* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Slide 1

Survey

Document related concepts

Transcript

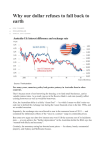

BT Monthly Markets Chart Pack – April 2009 An overview of movements in global financial markets Global share markets rallied for a second month in a row in April... Global share markets rallied further in April thanks to a series of better-than-expected first quarter earnings results on Wall Street and signs that investor optimism is beginning to improve. In the US, the benchmark S&P 500 Index gained an impressive 9.4% and this had a positive knock-on effect elsewhere, with indices in the UK (+8.1%), Europe (+14.7%) and Japan (+8.9%) also closing the month higher. The Australian share market made it back-to-back gains in April, with the S&P/ASX 200 Accumulation Index closing 5.6% higher thanks mainly to another firm lead from the US market. 2 …and continue to perform well over the long-term, despite some major market events Impact of major market events on global shares since 1987 6,200 Jul 01 Tech Wreck 5,700 5,200 4,200 Aug 97 Asian Currency Crisis 3,700 3,200 Nov 89 Fall of the Berlin Wall 2,700 2,200 1,700 Sep 01 Attack on Twin Towers Jul 98 Russian Bond Crisis 4,700 Oct 87 Wall Street crash Jun 07 US Sub-prime Crisis Feb 94 Bond Market Crash Mar 03 Troops enter Iraq Jan 91 Gulf War 1,200 700 Apr-87 Apr-89 Apr-91 Apr-93 Apr-95 Apr-97 Apr-99 Apr-01 Global shares measured by the MSCI World ex-Australia (net dividends) Index in A$. Source: BT Financial Group, MSCI 3 Apr-03 Apr-05 Apr-07 Apr-09 The Australian share market closed 5.6% higher in April S&P/ASX 200 Accumulation Index – year to 30 April 2009 39,000 37,000 35,000 33,000 31,000 29,000 27,000 25,000 23,000 21,000 30/04/2008 30/06/2008 30/08/2008 Source: BT Financial Group, Premium Data 4 30/10/2008 30/12/2008 28/02/2009 30/04/2009 Key Australian economic news – April The Reserve Bank of Australia left interest rates on hold at 3.00% following its early May meeting. The Bank acknowledged that the near-term outlook for the economy remains weak but expressed confidence that global markets, including China, are beginning to show signs of improvement. Australia’s trade balance was sharply higher in February, coming in at A$2.1 billion after a jump in exports offset a fall in imports. The Consumer Price Index (inflation) gained just 0.1% in the first quarter of 2009, below what the market had expected. The unemployment rate continued to trend higher in March, jumping 0.5% to a five-year high of 5.7% after the economy lost a further 34,700 jobs during the month. Newspaper advertisements were also lower, down 6.6%. The Westpac/Melbourne Institute’s consumer confidence survey showed an increase of 8.3% in February, taking the index to its highest level in 14 months. Source: BT Financial Group 5 The Australian dollar continued to rally against the US dollar in April The Australian dollar (A$) managed to post further gains against the US dollar in April thanks to a modest rise in commodity prices and improving investor sentiment. Given the current market environment, it’s difficult to imagine any sort of sustained recovery in the A$ until we see a similar recovery in the global economy, which means the local currency is likely to continue trading around current levels in the near-term At the end of April: A$1 bought Source: BT Financial Group 6 US$0.7251 +4.8% €0.5486 +5.1% ¥71.47 +4.5% The Australian dollar versus the US dollar… Currency markets – A$ per US dollar 0.9900 0.9600 0.9300 0.9000 0.8700 0.8400 0.8100 0.7800 0.7500 0.7200 0.6900 0.6600 0.6300 Apr-04 Oct-04 Apr-05 Oct-05 Apr-06 Source: BT Financial Group. Figures at 30 April 2009 7 Oct-06 Apr-07 Oct-07 Apr-08 Oct-08 Apr-09 the Euro… Currency markets – A$ per Euro 0.6550 0.6400 0.6250 0.6100 0.5950 0.5800 0.5650 0.5500 0.5350 0.5200 0.5050 0.4900 Apr-04 Oct-04 Apr-05 Oct-05 Apr-06 Source: BT Financial Group. Figures at 30 April 2009 8 Oct-06 Apr-07 Oct-07 Apr-08 Oct-08 Apr-09 and the Yen Currency markets – A$ per Yen 110 105 100 95 90 85 80 75 70 65 60 55 Apr-04 Oct-04 Apr-05 Oct-05 Apr-06 Source: BT Financial Group. Figures at 30 April 2009 9 Oct-06 Apr-07 Oct-07 Apr-08 Oct-08 Apr-09 Official world interest rate movements – April April was a relatively quiet month in terms of interest rate movements, with only the European Central Bank lowering its benchmark refi rate by a further 0.25%. Elsewhere, the Bank of England, the Bank of Japan and the US Federal Reserve all left their respective rates on hold. Here in Australia, the Reserve Bank decided to leave the official cash rate at just 3.00% following its early May meeting. Current rate Last moved Australia 3.00% Apr 2009 US 0% - 0.25% Dec 2008 Europe (ECB) 1.25% Apr 2009 Japan 0.10% Dec 2008 United Kingdom 0.50% Mar 2009 Source: BT Financial Group 10 Direction of last move Global share market returns 30 April 2009 1 year 3 years (pa) 5 years (pa) S&P 500 Index (US) -37.01% -12.67% -4.65% Nasdaq (US Tech.) -28.83% -9.57% -2.21% Nikkei 225 (Japan) -36.26% -19.47% -5.58% Hang Seng (Hong Kong) -39.74% -2.34% 5.38% DAX (Germany) -31.36% -7.42% 3.66% CAC (France) -36.76% -15.24% -2.97% FTSE 100 (UK) -30.29% -11.02% -1.12% S&P/ASX 200 Accum. Ind. -28.82% -6.35% 6.71% S&P/ASX Small Ordinaries -40.54% -10.40% -3.99% S&P/ASX 300 Listed Prop. -57.23% -24.20% -9.02% Global Australia Source: BT Financial Group 11 Short-term asset class performance 1-year rolling returns to 30 April 2009 (%) 2009 2008 2007 2006 2005 2004 2003 2002 Best performing asset class for the year 2001 2000 1999 1998 1997 1996 1995 1994 Australian cash 6.28 7.10 6.32 5.75 5.61 5.17 4.93 4.71 6.34 5.31 5.07 5.31 7.02 7.80 6.52 5.05 Australian bonds 12.76 3.59 5.01 4.50 7.44 2.64 9.12 4.84 10.30 1.86 6.94 13.99 12.65 12.81 4.73 3.26 Australian property -57.23 -23.56 33.20 18.04 21.29 11.73 13.25 18.53 11.49 6.70 1.92 29.88 19.11 3.19 6.39 12.89 Australian shares -28.99 -5.85 22.50 37.95 21.93 18.24 -6.44 4.29 10.46 7.14 16.06 15.44 12.05 17.11 3.84 23.43 International bonds 7.85 7.43 7.07 3.08 9.79 5.43 12.56 7.84 10.32 0.96 8.71 11.50 11.08 13.20 7.94 4.55 International shares -22.02 -14.08 6.30 27.70 1.71 12.06 -26.98 -18.30 -4.26 27.91 14.03 55.36 11.05 9.85 7.85 10.40 Source: S&P/ASX 300 Accumulation Index, MSCI World ex-Australia (net dividends) Index in A$, S&P/ASX 300 Property Index, UBS Composite 0+ years index, Barclays Capital Global Aggregate Bond Index hedged to $A , UBS Bank Bill 0+ years 12 Short-term asset class performance (cont’d) 1-year returns to 30 April 2009 (%) 30 April 2008 30 April 2009 3.6 Australian bonds Listed property Australian shares 12.8 -23.3 -57.2 -5.9 -29.0 7.4 7.9 Global bonds Global shares -14.1 -22.0 Source: S&P/ASX 300 Accumulation Index, MSCI World ex-Australia (net dividends) Index in A$, S&P/ASX 300 Property Index, UBS Composite 0+ years index, Barclays Capital Global Aggregate Bond Index hedged to $A 13 Long-term asset class performance 30 April 2009 $24,000 Australian shares $22,500 $21,000 $19,500 $18,000 Listed property $16,500 $15,000 Australian bonds Global shares $13,500 $12,000 $10,500 $9,000 $7,500 Cash $6,000 $4,500 $3,000 $1,500 $0 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 Note: Accumulated returns based on $1,000 invested in December 1984 Source: S&P/ASX 300 Accumulation Index, MSCI World ex-Australia (net dividends) Index in A$, S&P/ASX 300 Property Index, UBS Composite 0+ years index, UBS Bank Bill 0+ years 14 08 Oil prices moved higher again in April, up 4.1% thanks to stronger gains on Wall Street Oil prices – US$ per barrel $150 $135 $120 $105 $90 $75 $60 $45 $30 $15 $0 89 90 91 92 93 94 95 96 97 98 99 00 01 Source: BT Financial Group. West Texas Intermediate oil price at 30 April 2009 15 02 03 04 05 06 07 08 09 Summary At BT, we believe the Australian economy is currently in a moderate recession and we expect this will continue until late next year. Whilst economic data is expected to deteriorate in the near-term, we don’t see this as a reflection of financial markets. It’s likely we’ve seen the worst of the current downturn. There is growing confidence that share markets, including our own, have already seen the bottom. Regardless, share markets will remain volatile in the near-term. Shares are currently trading at historically low levels and we believe they represent good value for investors with a long-term investment horizon. With global growth likely to slow further and commodity prices likely to remain under pressure in the months ahead, it’s hard to see any sort of sustained recovery in the Australian dollar in the near-term. 16 This presentation has been prepared by BT Financial Group Limited (ABN 63 002 916 458) ‘BT’ and is for general information only. Every effort has been made to ensure that it is accurate, however it is not intended to be a complete description of the matters described. The presentation has been prepared without taking into account any personal objectives, financial situation or needs. It does not contain and is not to be taken as containing any securities advice or securities recommendation. Furthermore, it is not intended that it be relied on by recipients for the purpose of making investment decisions and is not a replacement of the requirement for individual research or professional tax advice. BT does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this presentation. Except insofar as liability under any statute cannot be excluded, BT and its directors, employees and consultants do not accept any liability for any error or omission in this presentation or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise noted, BT is the source of all charts; and all performance figures are calculated using exit to exit prices and assume reinvestment of income, take into account all fees and charges but exclude the entry fee. It is important to note that past performance is not a reliable indicator of future performance. This document was accompanied by an oral presentation, and is not a complete record of the discussion held. No part of this presentation should be used elsewhere without prior consent from the author. For more information, please call BT Customer Relations on 132 135 8:00am to 6:30pm (Sydney time) 17