* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download printable PDF - Edison Investment Research

Discovery and development of beta-blockers wikipedia , lookup

Orphan drug wikipedia , lookup

Polysubstance dependence wikipedia , lookup

Compounding wikipedia , lookup

Pharmaceutical marketing wikipedia , lookup

Pharmacognosy wikipedia , lookup

NK1 receptor antagonist wikipedia , lookup

Pharmacogenomics wikipedia , lookup

Drug interaction wikipedia , lookup

Prescription drug prices in the United States wikipedia , lookup

Theralizumab wikipedia , lookup

Neuropsychopharmacology wikipedia , lookup

Neuropharmacology wikipedia , lookup

Pharmacokinetics wikipedia , lookup

Prescription costs wikipedia , lookup

Pharmaceutical industry wikipedia , lookup

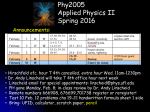

C4X Discovery Initiation of coverage Safer, better, faster Pharma & biotech 5 January 2016 C4X Discovery’s (C4XD) proprietary drug discovery platform allows the accurate measurement of molecular shapes in solution enabling improved and accelerated drug discovery. It has five programmes targeting validated clinical targets, with plans to add substantially to these in the next couple Price of years. The Orexin programme’s lead candidate, a selective OX1 antagonist, is in formal preclinical studies with clinical development anticipated by mid-2017. We suggest that the potential of this programme alone largely supports the current valuation, indicating that significant potential upside value is not yet ascribed. Net cash (£m) at 31 July 2015 Year end Revenue (£m) PBT* (£m) EPS* (p) DPS (p) P/E (x) Yield (%) 07/14 0.62 (1.3) N/A N/A N/A N/A 07/15 0.31 (3.8) (10.8) 0.0 N/A N/A 07/16e 0.47 (4.3) (14.0) 0.0 N/A N/A 07/17e 0.66 (5.2) (16.9) 0.0 N/A N/A Market cap £33m 7.5 Shares in issue 31.0m Free float 22% Code C4XD Primary exchange AIM Secondary exchange N/A Share price performance 120 100 Note: *PBT and EPS are normalised, excluding intangible amortisation, exceptional items. 80 60 Data-driven rational drug design 40 C4XD’s nuclear magnetic resonance-based technology platform can identify conformational features of drug molecules that are critical to target binding and can be optimised to improve drug potency and to reduce liability to off-target effects through enhanced selectivity. This should aid the selection of drug candidates with superior properties. Moreover, the speed at which the information is generated (days to weeks) could accelerate drug development with associated cost savings. 107.5p 20 0 Jan Mar May % Jul Sep 3m 12m Abs 39.6 59.3 20.8 Rel (local) 42.6 59.4 26.4 52-week high/low The potential time and cost-savings offered by C4XD’s platform is likely to appeal to Business description Transitioning to the clinic C4XD now has five drug programmes in the early stages of drug discovery and development. The lead programme is targeting the Orexin system (an important pathway in addiction and reward processes, and a critical regulator of sleep/wake states) for the treatment of addiction. Its lead candidate, a selective OX1 receptor antagonist, should enter Phase I by mid-2017. Other programmes are focused on clinically validated targets, such as GPR142 and NRF-2. C4XD is evaluating other targets, aiming to have 15-20 development programmes in a couple of years’ time. Modest £25.5m EV does not reflect upside potential The unique nature of C4XD’s discovery platform means that a fundamental DCFbased valuation is not appropriate at this stage. However, to illustrate that significant upside potential exists, an rNPV of £21m for the Orexin programme alone largely supports the current share price and EV. Our financial model suggests a current cash runway to end FY16 (end-FY15 cash £7.5m). Jan 1m Global industry appeal the global pharmaceutical industry, as it strives to improve R&D productivity, while also facing growing furore over rising drug prices. Existing collaborations (Evotec, AstraZeneca and Takeda), and the recently announced collaboration with the Structural Genomics Consortium, provide external endorsement of the technology. Nov 113.5p 67.5p C4X Discovery (C4XD) is a UK-based business using its proprietary NMR-based technology to solve the dynamic 3D structures of biomolecules in solution. The resulting information can then be used for rational drug design, ensuring safer and better drug candidate selection, with significant time and cost savings. Next events Proof-of-concept data from the inflammation and diabetes programmes H116 Orexin programme: filing of Clinical Trial Application to enable human studies H216 Analyst Christian Glennie +44 (0)20 3077 5727 [email protected] Edison profile page C4X Discovery is a research client of Edison Investment Research Limited Investment summary Company description: Rational drug discovery and design C4XD is a Manchester-based leader in NMR-based drug discovery and design. Established as Conformetrix as a spin-out from the University of Manchester in January 2008 by the founders, Dr Andrew Almond and Dr Charles Blundell, it was renamed C4X Discovery in 2013. The company employs 21 people. To date the company has raised £14.5m, including £11m gross proceeds from its IPO on AIM in October 2014 (at 100p/share). The company’s proprietary NMR-based technology can be used to solve the 3-D conformations of biomolecules in solution. C4XD believes that this will enable data-driven rational design of superior drug candidates, on a significantly faster timescale than conventional techniques, as observed in the selection of a lead candidate from the Orexin programme. C4XD aims to become a highly efficient and productive discovery R&D engine, targeting c. 15-20 new development programmes within two years. Dr Clive Dix became executive chairman in November 2015, with a proven track record in licensing and M&A activity. Valuation: £25.5m EV does not capture upside potential Assigning a fundamental valuation to C4XD necessitates consideration of the inherent value of the technology platform, pipeline candidates and potential future partnership deals. However, with a unique platform and multiple early-stage candidates, this is not appropriate at this stage. The experience with the candidate selection for the Orexin programme suggests the platform’s potential to significantly shorten the drug discovery stage, although this will require repetition against more than one target. Whether the technology will also lead to the selection of safer and more efficacious drugs for use in humans has yet to be proven. However, an illustrative valuation of the lead Orexin programme gives an rNPV of £21m, suggesting that this one programme alone largely supports the current share price, leaving significant room for upside when the earlier-stage programmes and the inherent value of the technology platform are considered. Sensitivities: Clinical validation required C4XD is subject to the usual risks associated with drug development, including clinical development delays or failures, IP protection, regulatory risks, competitor successes, partnering setbacks, and financing and commercial risks. The biggest near-term sensitivity is the successful transition of the Orexin programme from preclinical to clinical development, and its subsequent partnering; this will provide validation of the drug discovery platform, influencing C4XD’s negotiating position with future partners for this programme and others in development. Likewise, repetition of the time and cost savings for lead candidate selection in the other programmes will confirm the findings with the Orexin programme, validating the platform’s premise that it can substantially accelerate the drug discovery stage of drug development. C4XD’s current development pipeline is focused on targets that have previously been validated clinically, therefore reducing the risk profile to a certain extent. Financials: Funded through to end-FY16 C4XD raised gross proceeds of £11m when it listed In AIM in October 2014. We believe net cash of £7.5m at end-July 2015 should be sufficient to fund operations through to end-FY16. We forecast £3m of illustrative financing included nominally as long-term debt on the balance sheet in 2017 (as per our policy). We forecast that collaborations will continue to provide stable, but modest revenues in FY16e and FY17e. Costs will increase as the Orexin programme enters early-stage clinical trials, earlier-stage programmes progress into preclinical and clinical development and discovery work ramps up. We forecast R&D spend of £3.8m in FY16e and £4.8m in FY17e (FY15: £3.2m). For G&A we forecast spend of £0.95m in FY16e and £1m in FY17e (FY15: £0.9m). Consequently, we forecast net loss will increase to £4.3m in 2016e (from £3.1m in 2015). C4X Discovery | 5 January 2016 2 Outlook: Aiming to transform drug discovery Management believes that its proprietary nuclear magnetic resonance (NMR)-based technology enables improved and accelerated drug discovery based on conformational design of solution structures. This potentially disruptive technology could transform small molecule drug discovery. Better, safer, faster Management believes that its technology enables novel small molecule drug candidates to be generated on a significantly accelerated timeline. The company estimates that selection of the lead candidate for the Orexin programme was achieved in less than 50% of the time taken for traditional drug discovery techniques, with estimated overall cost-savings of up to 90% (c $10m). This databased empirical approach can be used in combination with existing techniques such as x-ray crystallography, and also for targets where the use of x-ray crystallography is limited (eg certain receptor types). The conformational information it provides should enable the selection and rational design of candidates with superior properties compared with current ‘best-in-class’ alternatives. For example, developing a lead candidate for the Orexin programme that is over 10x more selective for the OX1 receptor than other described OX1-antagonists, could equate to a more efficacious compound with reduced side-effects. It stands to reason that this improved candidate selection could increase the chance of clinical success, resulting in further time and cost savings. Potentially disruptive technology with global industry appeal The fact that C4XD’s data so far indicate that the technology is able to significantly accelerate the drug discovery phase, at a substantial cost saving, is likely to be of considerable appeal to the global pharmaceutical industry as it battles to improve R&D productivity. If the approach is also shown to lead to the selection of safer and better novel leads, with a consequent reduction in R&D attrition rates, the appeal would grow further. C4XD is already collaborating with a number of pharmaceutical companies, including AstraZeneca. Building up a pipeline of development programmes C4XD’s investment in its platform has paid off, and it now has a database of 3D bioactive structures that can be used to increase the efficiency with which it maps new drug conformations. Five drug development programmes are in the early stages of development (Exhibit 1). The lead programme is targeting the Orexin system for the treatment of stress-related addictive disorders (initially bingeeating disorder and smoking cessation). It is now in formal preclinical development, including safety and toxicology studies, with plans to file a clinical trial application by end-2016. C4XD plans to add to this pipeline, aiming for at least 15-20 development programmes in a few years’ time; these will either be out-licensed after early clinical studies or C4XD will continue development in house. Exhibit 1: Development pipeline Indication Addiction Stage Preclinical COPD Discovery (Inflammation) Diabetes – prog 1 Diabetes – prog 2 Inflammation/ autoimmune diseases Discovery Discovery Discovery Target OX1 inhibition Notes Lead candidate, a selective OX1 antagonist, is in preclinical development for the treatment of addictive disorders. It has >1000-fold selectivity for OX1 (vs 50-60-fold best literature profile). High selectivity for the OX1 receptor is required to avoid sedative side-effects via the OX2 receptor. Clinical development expected to commence by mid-2017. NRF-2 Impaired NRF2 function has been implicated in numerous diseases including COPD, multiple sclerosis (MS) and activation cancer. The NRF2 pathway is the target for the approved MS drug Tecfidera. C4XD believes that it has rationally designed selective, reversible NRF-2 activators that may offer improved safety and efficacy. GPR124 GPR142 receptor mediates enhanced glucose-stimulated insulin secretion. Novel lead molecules identified that activate activation GPR124, aiming to avoid the hypoglycaemia risk associated with many diabetes therapies. GLP-1 Current marketed GLP-1 receptor agonists, including Victoza, are all injectable. C4XD has developed orally available activation compounds, which it believes will be both efficacious and have reduced side-effects. IL-17 IL-17 is implicated in multiple inflammatory and autoimmune diseases. Most products in development are antibodies, inhibition which require injection. C4XD has identified small molecules that can selectively block IL-17’s interaction with its receptor with high potency, which would allow oral and/or topical delivery. Source: C4X Discovery, Edison Investment Research C4X Discovery | 5 January 2016 3 Rational, accelerated structural design Structure-based drug design (directed by the 3D structure of the drug target) is one tool used to improve the rate and success of drug development. Nuclear Magnetic Resonance (NMR) has been used to understand molecular structures for many years; data from the experiments can be used to provide 2D and some 3D structural information to aid rational drug design. C4XD has developed fundamentally new methods that exploit NMR data to determine not only the 3D shape of a drug molecule, but also the dynamic range of shapes that the molecule adopts in solution. Shape drives value The shape, or conformation, of a drug molecule is a determinant of if, and how, it binds to a target, and therefore whether it will have the desired biological effect. Where the gold-standard X-ray crystallography enables the bioactive (or bound) 3D structures of molecules to be determined, C4XD’s platform can be used to provide additional information regarding the conformation change of the drug upon binding – a determinant of the binding affinity. Further, it is able to do this under the same physiological conditions as the drug molecules encounter in the human body (such as 1 temperature and pH). This information can be used to design molecules with better affinity. This is important as drug molecules that are not highly optimised to bind to a particular target often interact with many different receptors or enzymes, which can give unpredictable side-effects and a narrow therapeutic window. Increasing the specificity, and so the affinity of a ligand for a particular target generally minimises off-target effects, so reducing side-effects and meaning that any toxicities only appear at doses well above the therapeutic level. Thus, an understanding of both the free and bound shapes of the drug molecule is vital to optimising the rational drug design. C4XD believes it provides the only empirical method that can accurately measure the free dynamic 3D-structures of drug molecules, offering a unique approach. As far as we are aware, C4XD is the only company able to generate this level of experimentally-derived conformational data, and can do so in a matter of days (X-ray crystallography takes 6-18 months to generate). This information can then be used in conjunction with existing rational design technologies, and importantly, when X-ray crystallography for the drug target is not routinely available (eg G-protein coupled receptors, such as the OX1/2 receptors, and ion channels). Potential to improve R&D productivity Drug development faces enormous challenges. It is time consuming, with developing a new medicine now taking on average 11 years, and high attrition rates mean that the probability of a Phase I product reaching the market is just 12% (and this does not even include the failure rate of 2 the discovery and preclinical stages). As a consequence, it is extremely expensive: when costs of failed programmes are accounted for, the cost to get a drug to market has been estimated to be as 2 high as $2.6bn. Thus, there is an obvious need, and desire, to improve R&D productivity. 3 R&D productivity can be considered to consist of two dimensions: efficiency and effectiveness. Using its technology in the lead Orexin programme, C4XD was able to improve R&D efficiency by significantly accelerating the ‘hit to lead’ and ‘lead optimisation’ stages of drug discovery, at a substantial cost saving (90% in the addiction programme). If this can be externally validated and repeated, it is likely to considerably interest the global pharmaceutical industry. However, if C4XD’s data-driven rational design leads to the selection of more selective, and therefore safer and better, 1 Blundell CD (2013). Quantification of free ligand conformational preferences by NMR and their relationship to bioactive conformation. Bioorg. Med. Chem. 21:4976-4987. 2 Tufts Center for the Study of Drug Development: Cost Study 2014. Available at: http://csdd.tufts.edu/files/uploads/Tufts_CSDD_briefing_on_RD_cost_study_-_Nov_18,_2014..pdf. Paul SM et al. (2010), How to improve R&D productivity: the pharmaceutical industry’s grand challenge. Nat Rev Drug Discov. 9:203-214. 3 C4X Discovery | 5 January 2016 4 novel leads, this could also improve R&D effectiveness by reducing attrition in both discovery and development stages, and the eventual approval of drugs with superior properties. Such a technology could potentially revolutionise drug discovery. Risk somewhat reduced compared to conventional approaches C4XD’s approach mainly involves pursuing existing, clinically validated, therapeutic targets. The technology can be used to solve the solution structures of the current best-in-class drug molecules for these targets, or other development-stage drug candidates, or indeed conduct more novel work on naturally occurring ‘endogenous’ ligands (such as peptide hormones), ie there are multiple potential starting points to develop safer and more effective compounds. This information is then used to design multiple molecules with better affinity and selectivity, from which a lead candidate, or indeed multiple candidates, can be selected. This approach results in the time savings, but is also de-risked compared to conventional drug discovery where the target may initially be unknown, and/or the clinical sequelae of acting on it are not apparent until clinical studies. The speed at which C4XD is able to deliver this capability means it has potential to become a sought-after R&D engine, producing multiple candidates against various targets, from which partners can then select for further development, all at a fraction of conventional costs. C4XD believes that selecting multiple candidates per target should enable the development of a portfolio of potentially complimentary therapies, as well as back-up options should the lead candidate falter. Building up a substantial drug discovery pipeline C4XD plans to continue to build on the momentum of the last 12 months by adding to its pipeline of drug discovery programmes. Key to this is the recently announced collaboration with the University of Oxford’s Structural Genomics Consortium (SGC-Oxford). SGC-Oxford is part of the Nuffield Department of Clinical Medicine and consists of c 100 scientists who collaborate widely with major pharmaceutical companies and the worldwide academic network, combining world-class expertise in therapeutic target validation, protein expression, assay development and protein structural information. As part of the collaboration, C4XD will be granted access to structural, biological and therapeutic information that SGC-Oxford holds in relation to various therapeutic targets and related assays, as well as initial ‘hit’ molecules that SGC-Oxford has identified against these targets. C4XD’s technology will be used in combination with SGC-Oxford’s expertise in conventional techniques to identify new and improved hit molecules against the SGC-Oxford targets. However, C4XD will retain ownership of any new compounds it independently identifies as part of the collaboration, thus forming the starting point for C4XD’s future drug discovery projects. C4XD is aiming to have 15-20 projects, with multiple candidates per project, in development in the next couple of years; some of which it will develop itself and others it will partner. Big pharma deals in place, but aiming for more strategic tie-ups Over the last three years, C4XD has forged fee-for-service collaborations with AstraZeneca, Takeda and Evotec; while this provides important external validation of the platform and a modest revenue stream, the longer-term goal is to seek more strategic collaborations with big pharma/biotech companies. Securing the right blend of partnerships to advance/fund certain programmes, while retaining and developing other projects in house, will be key toC4XD’s long-term success. Application throughout the product life cycle C4XD’s technology is also applicable throughout the life cycle of drugs. Polymorphism, the ability of a solid material to exist in more than one form, is important in the pharmaceutical industry for two reasons. Firstly, for IP reasons, it is important to identify all potential polymorphs of a drug. Secondly, although chemically identical, the different polymorphs can have significant differences in their physical properties, which may affect their pharmacological profile. In turn, this can affect development, manufacturing, product quality and product stability. C4XD’s technology can be used C4X Discovery | 5 January 2016 5 to predict and control the different polymorphs small molecules are able to adopt, information that is 4 essential throughout the product life cycle and to ensure sufficient IP protection. Transitioning to the clinic C4XD is developing novel small molecules to act on drug targets in areas of unmet clinical need. It believes its technology will enable the selection of candidates that have substantially safer and better properties compared with current ‘best-in-class’ alternatives. The most advanced programme is in stress-related addiction disorders; earlier programmes are directed at validated targets in inflammation, diabetes and autoimmune diseases. C4XD intends to advance the pipeline into early clinical trials, after which it will seek partnerships for development and commercialisation. Stress-related addiction – best-in-class potential C4XD is targeting the Orexin system for the treatment of stress-related addictive disorders. Orexins are neuropeptides produced in the lateral hypothalamus that regulate the sleep-wake cycle and appetite via the OX2 receptor. Belsomra (Merck & Co) is a dual OX1/OX2 antagonist approved for the treatment of insomnia. Via their action on the OX1 receptor, orexins also play a critical role in addiction and reward-related behaviours, making OX1 receptor a key target for the treatment of 5 addictive disorders. Indeed, in a large number of preclinical studies, OX1 antagonists have 6 effectively blocked addiction-related behaviours. However, a high degree of selectivity of the OX1 receptor is required. With the best reported literature selectivity for OX1 of 50-60-fold, off-target 2,7 activity at the OX2 receptor may result in sedative side-effects, which may limit use. The C4XD solution C4XD has used its technology to solve the structures of existing OX1 and OX2 inhibitors to identify the active groups required for OX1-selective inhibition. Once identified, multiple suitable cores were selected that work with the active groups, creating novel molecules with the desired conformation and selectivity. This has added IP benefits, whereby the ability to change cores enables C4XD to move outside of any existing patents. Exhibit 2: Potency of C4XD candidates at OX1 receptor vs three described OX1 antagonists Source: C4X Discovery 4 Bauer JF. (Autumn 2008). Polymorphism – a critical consideration in pharmaceutical development, manufacturing and stability. Journal of Validation Technology, 15-23. Mahler SV, et al. (2012) Multiple roles for orexin/hypocretin in addiction. Prog Brain Res. 198:79-121. 6 Yeoh, et al. (2014). Orexin antagonists for neuropsychiatric disease: progress and potential pitfalls. Front Neurosci.8:36. 7 Piccoli L, et al. (2012). Role of Orexin-1 receptor mechanisms on compulsive food consumption in a model of binge eating in female rats. Neuropsychopharmacology. 37:1999-2011. 5 C4X Discovery | 5 January 2016 6 C4XD has developed a number of distinct novel OX1 antagonists, which are over 1000-fold more selective for OX1 over OX2. Exhibit 2 illustrates how the C4XD candidate sits well within the target area (shaded in light green) of high OX1 potency and low OX2 potency, compared with three described OX1 antagonists. A lead candidate has been selected for clinical development. C4XD was able to achieve this in less than 50% of the time taken for the traditional drug discovery techniques (c three to five years); with estimated overall cost-savings of up to 90% (industry 3 standard $10-14m). The lead candidate is currently in formal preclinical studies, with plans to file the clinical trial application by the end of 2016, and begin clinical development by mid-2017. C4XD is also working with Evotec to identify and develop follow-up compounds, aiming to create a complementary portfolio of agents to treat addiction. This will also increase the attractiveness of the addiction portfolio to any pharmaceutical companies that may wish to license or acquire it in the future. Evotec is providing resource support on a fee-for-service basis, with C4XD retaining complete ownership of any identified orexin compounds. Addiction – a substantial market C4XD is targeting the smoking cessation and binge eating disorder (BED) markets initially, believing that the increased selectivity and potency of its candidate will prove more effective and tolerable than existing therapies. Other potential indications may include drug and alcohol addiction. Despite being largely genericised and losing market share to e-cigarettes, global sales of nicotinereplacement therapy (NRT) amounted to $2.4bn in 2013 (Bloomberg). Targeting OX1 would aim to modify addictive behaviour, and could potentially prove a more efficacious aid to cessation than NRT, providing an opportunity to make inroads into this market. BED is characterised by repeated episodes of binge eating in the absence of compensatory 8 behaviours to avoid weight gain; it is estimated to affect 1.5-2% of the general population. Vyvanse (Shire) became the first FDA-approved treatment for BED in January 2015. However, it carries a black-box warning due to cardiac and psychiatric risks; additionally it is a controlled substance due to the risk of addiction and abuse. OX1 receptor mechanisms have been shown to play a major role 7 in the control of BED episodes and could potentially avoid these restrictive side-effects. As far as we are aware, there are two other selective OX1 receptor antagonists in development, both preclinical. Sosei Group’s small molecule is also targeting BED and nicotine addiction; Eolas Therapeutics’ programme (partnered with AstraZeneca) is targeting smoking cessation. Earlier-stage pipeline C4XD has identified protein targets in the treatment of inflammation and diabetes, and is aiming to create best-in-class drugs in these blockbuster indications, where efficacy, safety and ease of use will be critical to obtaining significant market share. These are outlined in Exhibit 3. 8 Mcelroy SL, et al. (2003) Topiramate in the treatment of binge eating disorder associated with obesity: a randomised, placebo-controlled trial. AM J Psychiatry. 160:255-261. C4X Discovery | 5 January 2016 7 Exhibit 3: C4XD earlier stage pipeline Target (Indication) Keap1-NRF2 pathway (COPD and inflammation) GPR142 (Type 2 Diabetes) GLP-1 (Type 2 Diabetes) IL-17/IL-17R (Inflammatory and autoimmune diseases) Rationale Notes The Keap1/NRF2 pathway plays a major role in the protection of cells against oxidative stress. Impaired NRF2 function has been implicated in a number of diseases including pulmonary and cardiovascular diseases, cancer, aging-related and neurodegenerative diseases, making this an attractive therapeutic target. 9 Oxidative stress has been shown to play a central role in the progression of chronic obstructive pulmonary disease (COPD). Increasing evidence suggests that targeting NRF2 can be a novel therapy to mitigate inflammation, improve innate antibacterial defences and restore corticosteroid responses in COPD.9 In keeping with this C4XD has chosen to initially concentrate on COPD. In Type 2 diabetes the body develops resistance to insulin, or produces less insulin, resulting in high blood glucose levels. Many drug treatments aim to increase insulin production; however this is often done independent of the blood glucose levels, which can result in hypoglycaemia which is dangerous and sometimes fatal. GPR142 is a receptor predominantly expressed in pancreatic β-cells; it mediates enhancement of glucose-stimulated insulin secretion. Therefore, it is an exciting target for novel, safer, insulin secretagogues with reduced or no risk of hypoglycaemia. Over two-thirds of type 2 diabetics rely on injectable therapies, which are associated with side-effects and compliance issues. As a result many companies are working to develop oral versions of existing treatments. Victoza (Novo Nordisk) is the market leading injectable GLP-1 receptor agonist. It generated revenues of c $2bn in 2014. Interleukin 17 (IL-17) is a cytokine that plays a crucial role in in protecting the host from invasion by many types of pathogens, mediating its action via its receptor, IL-17R. Dysregulated IL-17 production can result in excessive pro-inflammatory cytokine expression and chronic inflammation, leading to tissue damage and autoimmunity. 11 As a result, it is a high value target for the treatment of multiple diseases, including psoriasis, ankylosing spondylitis, MS and rheumatoid arthritis. Tecfidera (BIIB) is approved for the treatment of relapsing forms of MS. It is thought to act by irreversibly modifying Keap-1, thereby increasing the expression of NRF2. 10 The inclusion of a warning on its label for the rare brain infection PML. Bardoxolone methyl (Reata Pharmaceuticals/ ABBV), also an activator of the NRF2 pathway, is in a Phase II study in pulmonary arterial hypertension. C4XD has designed its compounds to have significantly increased selectivity and potency compared to other NRF2 pathway activators, and also to reversibly bind to Keap-1. It believes this will result in both improved efficacy and safety profiles. C4XD has identified novel, orally available, lead molecules that activate GPR142. In 2014, the global prevalence of diabetes was estimated to be 9% among adults; 90-95% of cases of diabetes are Type 2 (WHO). By 2018, the drug market for diabetes is estimated to be $55bn (Bloomberg). Success in either of its diabetes programmes could constitute a significant market opportunity. C4XD has received grant funding from Innovate UK for these projects. C4XD used Victoza, along with other in-development GLP1 agonist candidates, to develop orally available compounds, which it believes will not only be efficacious but will also have reduced side-effects and will improve compliance. The majority of drugs targeting IL-17 are monoclonal antibodies reflecting the size and complexity of the IL-17/IL17R engagement, which makes targeting the IL-17 with small molecules difficult. Secukinumab (NOVN) is approved and ixekizumab (LLY) is in registration (both for psoriasis). Using its technology, C4XD has identified small molecules that can selectively block the IL-17/IL-17R interaction with high potency. These are conventional, drug-like compounds, for oral and/or topical use, which would offer benefits over IL-17 antibodies which require injection. C4XD aims to progress this programme towards optimisation and in vivo validation over the coming months. Source: C4X Discovery; Edison Investment Research. Notes: PML = progressive multifocal leukoencephalopathy Sensitivities C4XD is subject to the usual risks associated with drug development, including clinical development delays or failures, IP protection, regulatory risks, competitor successes, partnering setbacks, and financing and commercial risks. The biggest near-term sensitivity is the successful transition of the Orexin programme from preclinical to clinical development, and its subsequent partnering. In addition, as a novel technology, the platform requires validation. Although C4XD’s reported data to date has demonstrated the lead compound’s increased selectivity for the OX1 receptor, whether this will translate to a safe and efficacious drug in humans has yet to be established. C4XD’s current development pipeline is focused on targets that have previously been validated clinically, therefore reducing the risk profile to a certain extent. Progress of the Orexin programme will provide validation of the drug discovery platform; influencing C4XD’s negotiating position with future partners for this programme and others in development. Likewise, repetition of the time- and cost-savings for lead candidate selection in the other discovery programmes will confirm the findings with the Orexin programme, validating the platform’s premise that it can substantially accelerate the drug discovery stage of drug development. 9 Mercado N, et al. (2014). Activation of transcription factor NRF2 signalling by the sphingosine kinase inhibitor SKI-II is mediated by the formation of Keap1 dimers. PLoS ONE 9(29):e88168. 10 Jaramillo MC et al. (2013). The emerging role of the NRF-2-Keap1 signalling pathway in cancer. Genes & Dev. 27:2179-2191. 11 Jin W et al. (2013). IL-17 cytokines in immunity and inflammation. Emerging Microbes & Infections. 2:e60. C4X Discovery | 5 January 2016 8 C4XD is in the process of pursuing patents for its method to determine the 3D structures of dynamic molecules; a patent has been granted in Japan with others filed in the US, Canada and Europe. C4XD must also obtain IP protection for its development candidates. Further competitor barriers arise from the significant degree of know-how required for the set-up of the NMR experiments and the use of the software. Finally, C4XD’s stock is tightly held; poor liquidity can result in increased volatility. Valuation Assigning a fundamental valuation to C4XD necessitates consideration of the inherent value of the technology platform, pipeline candidates and potential future partnership deals. However, with a unique platform and multiple early-stage candidates, this is not appropriate at this stage. The experience with the candidate selection for the Orexin programme suggests the platform’s potential to significantly shorten the drug discovery stage, although this will require repetition against more than one target. Whether the technology will also lead to the selection of safer and more efficacious drugs for use in humans has yet to be proven. However, an illustrative valuation of the lead Orexin programme gives an rNPV of £21m, suggesting that this one programme alone largely supports the current share price, leaving significant room for upside when the earlier-stage programmes and the inherent value of the technology platform are considered. For illustrative purposes therefore, we applied a risk-adjusted NPV analysis of the Orexin programme. We arrive at an indicative rNPV of £21m based on a number of assumptions, including successful completion of Phase I trials in 2018, peak sales ($1.4bn), launch dates (2023), royalty rates (10%) and partnership deal metrics. Our indicative peak sales are based on the following assumptions: Prescription in speciality clinics for BED and on prescription for smoking cessation, therefore targeting a smaller market but at a premium price: $500/month (US); $375/month (Europe); For BED: 3.5% of patients with BED receive treatment at a speciality facility (c 0.5m patients per year in the US and Europe). Peak penetration of 20% in the US and 15% in Europe, achieved in 2029; constituting peak sales of c $530m (of note, Shire predicts peak sales of $200-300m for Vyvanse in BED in the US alone, also indicating that it could even exceed this); For smoking cessation: 8% of smokers will use pharmacological treatment to aid smoking cessation (c 11 million patients per year in the US and Europe) and a three-month treatment course. Conservative peak penetration of 7.5% in the US and 5% in Europe in 2029; constituting peak sales of c $825m. For comparison, Chantix (Pfizer) achieved peak sales of $883m in 2007; Chantix’s label includes a ‘black box’ warning due to its significant side-effects; and, 7.5% overall probability of success. However, given that the premise of the C4XD technology platform is an improved success rate, particularly in the transition from preclinical to clinical development, one could argue for a higher probability of success. Increasing this to 15% (in line with a Phase I product) would increase the rNPV to £39m (or 127p/share). Exhibit 4: Indicative rNPV valuation of the Orexin programme Product Indication Orexin programme BED and smoking cessation Launch 2023 Peak sales ($m) 1,400 Value (£m) 156 Probability 7.5% rNPV (£m) 21.0 NPV/share Assumptions* (p/share) 67.6 Peak sales in 2029. 10% royalty. Includes deal milestone estimates: $15m upfront in 2018; $12.5m on Phase II start in 2019; $17.5m on Phase III start in 2020; $30m on NDA filing/approval in 2022. These milestones are risk-adjusted. Source: Edison Investment Research. Note: *Deal estimates benchmarked against deal data from BioCentury. C4X Discovery | 5 January 2016 9 Exhibit 4 illustrates the Orexin programme’s indicative rNPV. This programme alone largely supports the current share price (107.5p) and enterprise value (£25.5m), suggesting significant room for upside when one considers the value of the earlier-stage pipeline and the technology platform. We note that in comparison to other drug discovery companies, C4XD appears comparatively undervalued, for instance Verseon (VSN), with a current market cap of £309m. Verseon’s small molecule drug discovery platform uses a computational modelling engine to design drug-like compounds. According to its website the platform allows for the systematic design, synthesis, and physical testing of multiple, high-quality drug candidates per programme, so ‘reducing the high failure rate that plagues the rest of the pharmaceutical industry’. Like C4XD, its pipeline has yet to enter clinical studies and therefore achieve clinical validation; it has with three preclinical programmes in development for anticoagulation, diabetic macular oedema, and solid tumours. Financials C4XD reported cash of £7.5m at end-July 2015. Our model suggests that this should be sufficient to fund operations through to the end of FY16. Revenues from collaborations amounted to £0.3m in 2015 (vs £0.6m in 2014). We forecast that collaborations will continue to provide stable, but modest revenues in FY16e (£0.5m) and FY17e (£0.7m). Although our valuation model includes riskadjusted milestones from a partner for the Orexin programme, our financial forecasts do not include any such income. Hence our forecasts include £3m of illustrative financing included as long-term debt on the balance sheet in 2017. Increased activity required to progress the discovery programme, along with the necessary rise in headcount following the IPO, resulted in R&D spend of £3.2m in 2015 (vs £1.2m in 2014). In keeping with this, we forecast £3.8m R&D spend in 2016 and £4.8m 2017, as the Orexin programme enters clinical development, and the earlier stage pipeline progresses. Beyond this, we assume that future R&D spend for the Orexin programme will be borne by a partner. G&A spend also increased (£0.9m in 2015 vs £0.6m in 2014), reflecting costs incurred following the IPO; we assume a gradual increase in the coming years. We forecast net loss of £4.3m in FY16 compared with £3.1m reported in 2015. C4X Discovery | 5 January 2016 10 Exhibit 5: Financial summary 2013 IFRS 2014 IFRS 2015 IFRS 2016e IFRS 2017e IFRS 736 (1) 735 0 (573) (583) (4) 0 0 (587) (89) (672) (676) 195 (477) (481) 619 (23) 596 (1,180) (1,207) (1,216) (4) 0 0 (1,220) (118) (1,334) (1,338) 220 (1,114) (1,118) 312 (112) 200 (3,159) (3,837) (3,858) (5) 0 0 (3,863) 49 (3,809) (3,814) 750 (3,059) (3,064) 468 (123) 345 (3,791) (4,358) (4,391) (5) 0 0 (4,395) 68 (4,323) (4,327) 0 (4,323) (4,327) 655 (136) 520 (4,755) (5,191) (5,227) (5) 0 0 (5,232) 0 (5,227) (5,232) 0 (5,227) (5,232) Average Number of Shares Outstanding (m) EPS - normalised (p) EPS - normalised and fully diluted (p) EPS - (reported) (p) Dividend per share (EUR) 19.9 N/A N/A N/A 0.0 20.0 N/A N/A N/A 0.0 28.5 (10.75) (10.75) (10.77) 0.0 31.0 (13.95) (13.95) (13.96) 0.0 31.0 (16.87) (16.87) (16.88) 0.0 Gross Margin (%) EBITDA Margin (%) Operating Margin (before GW and except.) (%) 99.9 N/A N/A 96.3 N/A N/A 64.1 N/A N/A 73.7 N/A N/A 79.3 N/A N/A 83 60 23 0 1,947 0 129 1,514 304 (127) (127) 0 (2,144) (2,144) 0 (241) 77 56 21 0 1,080 0 157 673 250 (270) (227) (43) (2,220) (2,220) 0 (1,333) 144 59 85 0 8,573 0 388 7,485 700 (749) (749) 0 0 0 0 7,968 124 62 62 0 4,599 0 582 3,317 700 (1,060) (1,060) 0 0 0 0 3,663 111 65 46 0 2,589 0 815 1,074 700 (1,247) (1,247) 0 (3,000) (3,000) 0 (1,547) (489) 89 (195) (14) 0 0 (89) 0 (698) (68) 0 0 630 (733) 119 (220) (7) 0 0 (119) 0 (960) 630 0 0 1,590 (2,425) 0 (750) (85) 0 10,080 2,255 0 9,075 1,590 0 0 (7,485) (4,407) 68 188 (9) 0 0 (8) 0 (4,168) (7,485) 0 0 (3,317) (5,215) 0 0 (20) 0 0 (8) 0 (5,243) (3,317) 0 0 1,926 July PROFIT & LOSS Revenue Cost of Sales Gross Profit Research and development EBITDA Operating Profit (before amort. and except.) Intangible Amortisation Exceptionals Other Operating Profit Net Interest Profit Before Tax (norm) Profit Before Tax (reported) Tax Profit After Tax (norm) Profit After Tax (reported) £'000s BALANCE SHEET Fixed Assets Intangible Assets Tangible Assets Investments Current Assets Stocks Debtors Cash Other Current Liabilities Creditors Short term borrowings Long Term Liabilities Long term borrowings Other long term liabilities Net Assets CASH FLOW Operating Cash Flow Net Interest Tax Capex Acquisitions/disposals Financing Other Dividends Net Cash Flow Opening net debt/(cash) HP finance leases initiated Other Closing net debt/(cash) Source: Company accounts; Edison Investment Research C4X Discovery | 5 January 2016 11 Contact details Revenue by geography C4X Discovery Holdings Manchester One Portland Street Manchester M1 3LD United Kingdom http://www.c4xdiscovery.com/ % 100% UK Management team Executive Chairman: Dr Clive Dix Chief Scientific Officer: Dr Craig Fox Dr Dix was appointed executive chairman in November 2015, having previously been non-executive chairman of the board. He has more than 30 years' experience in the pharmaceutical and biotechnology industries. He was CEO and co-founder of PowderMed, which was sold to Pfizer in 2006. Following postdoctoral roles and a period at Ciba-Geigy (now Novartis), Clive joined GlaxoWellcome, where he became UK research director. Other previous roles include senior VP of R&D at PowderJect Pharmaceuticals; chairman of the UK BioIndustry Association; CEO of Convergence Pharmaceuticals (acquired by Biogen); chairman of Crescendo Biologicals and chairman of Auralis (acquired by ViroPharma). Dr Dix is currently chairman of Touchlight Genetics and Calchan. Dr Fox is an experienced biologist, having worked on and managed many drug discovery and development projects during the last 18 years, from initial target selection right through to investigating clinical efficacy and safety in Phase II patient studies. Before joining C4XD, Dr Fox was director of respiratory research at Pulmagen Therapeutics, a clinical-stage company spun out of Argenta in 2010. Craig was part of the Etiologics team that merged with Argenta Discovery in 2004 and before this he worked for Bayer as a research scientist. He has a PhD from Birmingham University and a first class biochemistry degree from the University of Surrey. Head of Discovery: Dr Thorsten Nowak Chief Technical Officer: Dr Charles Blundell Dr Nowak is an experienced pharmaceutical researcher, having joined C4XD from AstraZeneca, where he worked for 16 years in drug design and project management. He has a PhD from the University of Cambridge and a first class chemistry degree from the University of Heidelberg, Germany and has worked across a range of therapeutic areas and drug targets. Dr Blundell is C4XD's co-founder and co-inventor of its core technology, having jointly led the spin-out from the University of Manchester in 2007. He has been awarded a number of grants from top UK research councils during his career and has had more than 20 publications in leading scientific journals. Dr Blundell has a Master’s degree and DPhil in biochemistry from the University of Oxford (Keble College); he graduated in the top five of his peer group. Principal shareholders (%) The Aquarius & related parties Founders (Andrew Almond and Charles Blundell) Aviva Andrew Black Baillie Gifford Board 36 19 10 8 7 7 Companies named in this report AstraZeneca (AZN); Takeda (4502); Evotec (EVT); Merck & Co (MRK); Shire (SHP); Sosei Group (4565); Biogen (BIIB); AbbVie (ABBV); Novo Nordisk (NOVO-B); Novartis (NOVN); Eli Lilly (LLY); Verseon (VSN). Edison, the investment intelligence firm, is the future of investor interaction with corporates. Our team of over 100 analysts and investment professionals work with leading companies, fund managers and investment banks worldwide to support their capital markets activity. We provide services to more than 400 retained corporate and investor clients from our offices in London, New York, Frankfurt, Sydney and Wellington. Edison is authorised and regulated by the Financial Conduct Authority (www.fsa.gov.uk/register/firmBasicDetails.do?sid=181584). Edison Investment Research (NZ) Limited (Edison NZ) is the New Zealand subsidiary of Edison. Edison NZ is registered on the New Zealand Financial Service Providers Register (FSP number 247505) and is registered to provide wholesale and/or generic financial adviser services only. Edison Investment Research Inc (Edison US) is the US subsidiary of Edison and is regulated by the Securities and Exchange Commission. Edison Investment Research Limited (Edison Aus) [46085869] is the Australian subsidiary of Edison and is not regulated by the Australian Securities and Investment Commission. Edison Germany is a branch entity of Edison Investment Research Limited [4794244]. www.edisongroup.com DISCLAIMER Copyright 2016 Edison Investment Research Limited. All rights reserved. This report has been commissioned by C4X Discovery and prepared and issued by Edison for publication globally. All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report. Opinions contained in this report represent those of the research department of Edison at the time of publication. The securities described in the Investment Research may not be eligible for sale in all jurisdictions or to certain categories of investors. This research is issued in Australia by Edison Aus and any access to it, is intended only for "wholesale clients" within the meaning of the Australian Corporations Act. The Investment Research is distributed in the United States by Edison US to major US institutional investors only. Edison US is registered as an investment adviser with the Securities and Exchange Commission. Edison US relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. As such, Edison does not offer or provide personalised advice. We publish information about companies in which we believe our readers may be interested and this information reflects our sincere opinions. The information that we provide or that is derived from our website is not intended to be, and should not be construed in any manner whatsoever as, personalised advice. Also, our website and the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. This document is provided for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research. Edison has a restrictive policy relating to personal dealing. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report. Edison or its affiliates may perform services or solicit business from any of the companies mentioned in this report. The value of securities mentioned in this report can fall as well as rise and are subject to large and sudden swings. In addition it may be difficult or not possible to buy, sell or obtain accurate information about the value of securities mentioned in this report. Past performance is not necessarily a guide to future performance. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (ie without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision. To the maximum extent permitted by law, Edison, its affiliates and contractors, and their respective directors, officers and employees will not be liable for any loss or damage arising as a result of reliance being placed on any of the information contained in this report and do not guarantee the returns on investments in the products discussed in this publication. FTSE International Limited (“FTSE”) © FTSE 2016. “FTSE®” is a trade mark of the London Stock Exchange Group companies and is used by FTSE International Limited under license. All rights in the FTSE indices and/or FTSE ratings vest in FTSE and/or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE indices and/or FTSE ratings or underlying data. No further distribution of FTSE Data is permitted without FTSE’s express written consent. Frankfurt +49 (0)69 78 8076 960 London +44 (0)20 3077 5700 Schumannstrasse 34b 2802016 High Holborn C4X Discovery | 5 January 60325 Frankfurt London, WC1V 7EE Germany United Kingdom New York +1 646 653 7026 245 Park Avenue, 39th Floor 10167, New York US Sydney +61 (0)2 9258 1161 Level 25, Aurora Place 88 Phillip St, Sydney NSW 2000, Australia Wellington +64 (0)48 948 555 Level 15, 171 Featherston St Wellington 6011 New Zealand 12