* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Prototype lab

Merchant account wikipedia , lookup

Mobile business intelligence wikipedia , lookup

Financialization wikipedia , lookup

Securitization wikipedia , lookup

Interest rate ceiling wikipedia , lookup

Business intelligence wikipedia , lookup

Credit score wikipedia , lookup

Credit rationing wikipedia , lookup

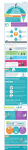

Supporting the development of inclusive financial markets in Kenya Using Alternative Data for Financial Decisions: Lending to Farmers Using Nontraditional Data Farmers needs are beyond agriculture operations financing Flexible financial instruments might be required to meet their needs REASONS WHY PEOPLE BORROW CREDIT PER LIVELIHOOD CATEGORY Employed Own business Dependent Casual ~34% access some form of credit. Largely informal OTH E R 7% 9% 4% 4% 6% 2% 3% 2% 3% 3% PAY OF F DE B T V E H ICL E 1% 2% 2% 1% 1% 9% 4% 9% 11% 39% FinAccess, 2015 H OU SE / L AN D EM E RGE N CY 12% 11% 11% 10% 19% 23% 35% 16% 18% 14% E DU CATION AGRICU LTU RE 19% 12% 7% 6% 8% 42% 6% 3% BU SIN E SS P U RP OSE S DAY- TO- DAY N E E DS 9% 10% 56% 50% 48% 74% 69% Agriculture ~ 3% of national bank credit portfolio goes to agriculture Informal sources are the main type of ag credit SOURCES OF CREDIT FOR ALL TYPES OF NEEDS IN AGRICULTURE LIVELIHOOD CATEGORY Informal Moneylender House/ Land Bank SOURCES OF AGRICULTURE CAPITAL ASCA / SACCO, 0.8% CHAMA/ ROSCA, 4.1% 0.1% or… 0.2% Buyer Credit Credit Card Government e.g. HELB, Youth… MFI Banks (savings, current accounts) CHAMA / ROSCA 0.2% Family / Friend / Neighbour, 11.3% 1.0% 1.2% 2.0% 2.5% 3.4% SACCO 3.4% Shopkeeper Own savings/ Last harvest’s surplus, 86.7% 5.0% Family / Friend / Neighbour ASCA Local shop goods credit Agro-dealers inputs credit , 0.30% Buyer Credit, 12.8% 3.0% Mobile banking Banks (savings, current accounts), 0.30% 5.7% 6.1% 10.7% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0%12.0% FinAccess, 2015 Challenges in agriculture credit scoring • Ag actors largely lack sufficient and reliable conventional data – The ag produce markets are largely informal – over 90% hence weak documentation • Weak financial transactions trail - much of the transaction are cash based, 97% of all national transactions • Weak methodologies for use of alternative data Emerging credit scoring data in the agriculture sector (general credit needs & ag capital) 1. Collateralisation of receivables 5. Machine learning and social media 2. Assets and performance score 3. Inputs purchase / character scoring / peer scoring 4. Airtime and mobile money transactions 6. Data mining 7. Credit reference bureau data + Collateralisation of receivables • Supply chains financing: mainly delivery invoices from blue chips buyers – Amount of credit is based on a % of delivered value and as per the tripartite agreement – The buyer undertakes to make remittances through the seller account held in the financial institutions. – Credit period averages 30 to 90 days – In events of prolonged payment delays, debts could be converted into short term loans – National movable assets registry underway – Example: http://mobipay.co.ke/ (IT platform, banks, milk processors, farmers) • Warehouse receipts – At infant stages. – Tested for wheat and maize – National regulation underway + Assets and performance score • Use of business assets and performance as a measure of credit worthiness – Platforms that digitise assets and business performance e.g. livestock details for use in credit, insurance and input financing decisions – Details include valuation of the animal, output records, geotagging, agronomic programmes e.g. vaccination tracking etc. – Example: http://www.agrilife.co.ke/ + Inputs purchase / character / peer scoring • Agro-dealer led credit scoring – Agro-dealer acts as first line credit score unit based on their client knowledge – Example: http://farmshop.co.ke/ testing an agro-dealer led credit through its franchisees. • Group based scoring by FSPs – Most common is group lending or guaranteed lending – Individual lending for groups members coming up (requires further innovations – mobile based systems emerging) • Mining group and individual financial profiles in ASCA / ROSCA / Chamas + Airtime and mobile money transactions • Algorithm using a combination of mobile money transactions, airtime usage and lock-in savings account details – Case study: http://fsdkenya.org/publication/how-m-shwariworks-the-story-so-far/ + Machine learning and social media • Machine learning aided algorithms: Mobile based Apps that use various data ranging from • • • • • Mpesa data (mobile money wallet) Social networks data – e.g. Facebook Calls, SMS and Mpesa logs - transactions messages on phone (accessed via App). Geotagging Handsets data – FSPs examples Tala https://tala.co.ke, branch https://branch.co, Pesazetu, • Data service providers examples https://farmdrive.co.ke – Datasets: individual, social, agronomic, environmental, economic, satellite data + Data mining (the gold within) • Much of the collected data during application and appraisal stage is hardly utilised by financial institutions in making lending decisions • Understanding correlated drivers to good or bad loan repayment using existing data (application forms, call reports, credit reference data, cashflows, appraisal, ROSCA & ASCA data) etc. – Digitisation of physical credit related data with high correlation to repayment behaviour – Identification of correlated repayment drivers – Developing scores based on the good predicators and segmentation Challenges in alternative data for credit scoring • Consumer protection • Data privacy and access – Consumer consent • Data availability and authentication • High cost of credit by emerging alternative credit providers (short tenure, high interest products) • Outside the regulation scope Michael Mbaka Senior Innovations Specialist FSD Kenya www.fsdkenya.org [email protected] +254 721 83 93 83