Herman J. Bierens - Personal.psu.edu

... absorbing boundaries for rating based corporate bond indices. Second, the rebalancing leads to changes in the index components and changes in the behavior of the index as well. The econometric model we propose is flexible enough to capture these special features of corporate bond indices. We assume ...

... absorbing boundaries for rating based corporate bond indices. Second, the rebalancing leads to changes in the index components and changes in the behavior of the index as well. The econometric model we propose is flexible enough to capture these special features of corporate bond indices. We assume ...

Supporting Credit Union Success

... to these challenges. The transformation of Credit Union Central of Canada (“CUCC”) into Canadian Credit Union Association (“CCUA”) and the reconfiguration of mandate, service offerings and future ownership to meet credit union needs is a confirmation that effective change is possible. Others have fa ...

... to these challenges. The transformation of Credit Union Central of Canada (“CUCC”) into Canadian Credit Union Association (“CCUA”) and the reconfiguration of mandate, service offerings and future ownership to meet credit union needs is a confirmation that effective change is possible. Others have fa ...

Interest Rates and Prices in an Inventory Model of Money with Credit

... credit for transactions is that it allows households to smooth consumption of not only goods bought with credit, but also goods bought with cash. Thus, consumption pro…les in the presence of credit are quite di¤erent from those obtained when transactions credit is unavailable. The relative smoothne ...

... credit for transactions is that it allows households to smooth consumption of not only goods bought with credit, but also goods bought with cash. Thus, consumption pro…les in the presence of credit are quite di¤erent from those obtained when transactions credit is unavailable. The relative smoothne ...

Credit Reporting at the Base of the Pyramid: Key Issues

... to the market potential that these 2.7 billion consumers represent. New players to this market segment, including commercial banks, credit card companies, consumer finance companies, and retailers, are offering credit products and other financial services to consumers with ever lower income levels. ...

... to the market potential that these 2.7 billion consumers represent. New players to this market segment, including commercial banks, credit card companies, consumer finance companies, and retailers, are offering credit products and other financial services to consumers with ever lower income levels. ...

Credit Scores, Reports, and Getting Ahead in

... Consumer credit reports and scores play a growing role in the ability of families to get ahead, now influencing prices for loans and insurance and efforts to get jobs and rent apartments. An analysis of a quarterly sample of 25 million anonymous consumer credit reports and scores for every U.S. coun ...

... Consumer credit reports and scores play a growing role in the ability of families to get ahead, now influencing prices for loans and insurance and efforts to get jobs and rent apartments. An analysis of a quarterly sample of 25 million anonymous consumer credit reports and scores for every U.S. coun ...

Chapter 5: Credit Management

... competitors, not inflation or interest rates The higher a firm’s contribution margin, the more likely the firm should be to offer discounts. A price cut is thought to have more impact than ...

... competitors, not inflation or interest rates The higher a firm’s contribution margin, the more likely the firm should be to offer discounts. A price cut is thought to have more impact than ...

Taking charge of your finances

... thing. It is okay to use credit if it will assist a person to make money. • Such as, receiving a home loan is good if a person can afford the monthly payments, tax benefits are received, an asset is received, and the value of the home increases. Therefore, the financial advantages of a home loan gre ...

... thing. It is okay to use credit if it will assist a person to make money. • Such as, receiving a home loan is good if a person can afford the monthly payments, tax benefits are received, an asset is received, and the value of the home increases. Therefore, the financial advantages of a home loan gre ...

Understanding FICO Credit Scores - DHS-Business

... The following information may be considered an illustration of the complexity used in credit analysis and not a "how-to" blue print for improving your scores. We understand from one source that, Fair Isaac divides various portions of your credit history from the big three credit bureaus into five la ...

... The following information may be considered an illustration of the complexity used in credit analysis and not a "how-to" blue print for improving your scores. We understand from one source that, Fair Isaac divides various portions of your credit history from the big three credit bureaus into five la ...

ConsumerMan Video for LifeSmarts 3: YOUR CREDIT REPORT

... interest rate. If your credit is bad, you could be denied a credit card or forced to make a big deposit when you sign up for cable TV. This lesson explores the basic facts about credit reports. Lesson Objective(s) Understand credit reporting agencies and the use of credit reports. Time 1 class perio ...

... interest rate. If your credit is bad, you could be denied a credit card or forced to make a big deposit when you sign up for cable TV. This lesson explores the basic facts about credit reports. Lesson Objective(s) Understand credit reporting agencies and the use of credit reports. Time 1 class perio ...

Shopaholic Credit Case Study - socialsciences dadeschools net

... 4) Obtain a retail credit card (Department store card) and pay it off 5) At college, pay utility bills and rent on time B. The function of a credit bureau is: 1) To provide creditors with your bill paying/credit record C. What are some of the consumer protection laws illustrated in the “To Your Cred ...

... 4) Obtain a retail credit card (Department store card) and pay it off 5) At college, pay utility bills and rent on time B. The function of a credit bureau is: 1) To provide creditors with your bill paying/credit record C. What are some of the consumer protection laws illustrated in the “To Your Cred ...

Prototype lab

... + Assets and performance score • Use of business assets and performance as a measure of credit worthiness – Platforms that digitise assets and business performance e.g. livestock details for use in credit, insurance and input financing ...

... + Assets and performance score • Use of business assets and performance as a measure of credit worthiness – Platforms that digitise assets and business performance e.g. livestock details for use in credit, insurance and input financing ...

Job Description

... Implement and align credit policies and procedures for Malaysia in consultation with Regional Credit Control Manager and GM. Liaise with Sales Managers on credit control/customer issues; as well as with Customer Services, Sales Operation and Accounts receivables. ...

... Implement and align credit policies and procedures for Malaysia in consultation with Regional Credit Control Manager and GM. Liaise with Sales Managers on credit control/customer issues; as well as with Customer Services, Sales Operation and Accounts receivables. ...

Credit Quiz Show

... 15% - Length of Credit history 10% - Pursuit of new credit 10% - Types of credit in use ...

... 15% - Length of Credit history 10% - Pursuit of new credit 10% - Types of credit in use ...

File

... an item for later purchase. Revolving debt: Debt owed on an account that the borrower can repeatedly use and pay back without having to reapply every time credit is used. Credit cards are the most common type of revolving account. ...

... an item for later purchase. Revolving debt: Debt owed on an account that the borrower can repeatedly use and pay back without having to reapply every time credit is used. Credit cards are the most common type of revolving account. ...

Law for Business

... Watch that grace period closely! Even one late payment hurts your credit score, especially when you have little history ...

... Watch that grace period closely! Even one late payment hurts your credit score, especially when you have little history ...

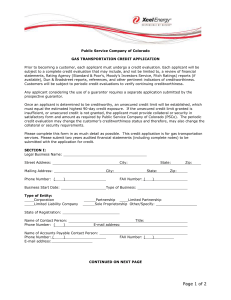

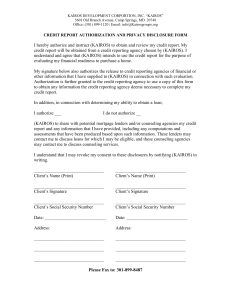

credit report authorization and privacy disclosure form

... Authorization is further granted to the credit reporting agency to use a copy of this form to obtain any information the credit reporting agency deems necessary to complete my credit report. In addition, in connection with determining my ability to obtain a loan; I authorize ___ ...

... Authorization is further granted to the credit reporting agency to use a copy of this form to obtain any information the credit reporting agency deems necessary to complete my credit report. In addition, in connection with determining my ability to obtain a loan; I authorize ___ ...

Buying or Leasing a Car and Your Credit Score

... may only require one inquiry from the leasing company, while a financed purchase could involve queries from multiple potential lenders." Mott said hard inquiries generally take place when you apply for a loan, credit card, mortgage or rent an apartment. When the lender checks your report, the result ...

... may only require one inquiry from the leasing company, while a financed purchase could involve queries from multiple potential lenders." Mott said hard inquiries generally take place when you apply for a loan, credit card, mortgage or rent an apartment. When the lender checks your report, the result ...

Chapter 29

... 1. Character--refers to honesty and willingness to pay back a debt; how you pay for future bills can be predicted by how you paid for past bills 2. Capacity--refers to the ability to pay a debt when it is due; size of income and current debt will be scrutinized 3. Capital--value of borrower’s posses ...

... 1. Character--refers to honesty and willingness to pay back a debt; how you pay for future bills can be predicted by how you paid for past bills 2. Capacity--refers to the ability to pay a debt when it is due; size of income and current debt will be scrutinized 3. Capital--value of borrower’s posses ...

Word Wall Words

... creditor- The business or organization that extends the credit. finance charge- The total cost of using credit, including interest and any fees. credit score- A numerical rating, based on credit report information, that represents a person’s level of creditworthiness. cosigner- A person with a stron ...

... creditor- The business or organization that extends the credit. finance charge- The total cost of using credit, including interest and any fees. credit score- A numerical rating, based on credit report information, that represents a person’s level of creditworthiness. cosigner- A person with a stron ...