* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Domestic credit to private sector - E

Survey

Document related concepts

Transcript

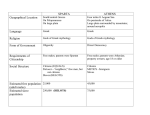

Student no.1 Student no.2 Student no.3 Student no.4 To begin with, economic crisis is a situation in which the economy of a country experiences a sudden downturn. An economy dealing with an economic crisis will most likely experience a falling Gross domestic product (GDP), a drying up of liquidity and a sudden rise of prices. There are three main types of economic crisis; banking crisis (When a bank suffers a sudden rush of withdraws by depositors), Speculative bubbles and crashes (A speculative bubble exists in the event of large, sustained overpricing of some class of assets) and Wider economic crisis (A coexistence of different financial aspects). There are also a variety of causes that can create an economic crisis including growth of the housing bubble, easy credit conditions, subprime lending, collapse of the shadow banking system, imbalances in international trades and malfunction fiscal policy. Generally speaking, economic crisis is not something unprecedented in the world. As matter of fact, back in 1920, shortly after the end of World War 1, United States experience a big Depression which lasted almost two years. In the last few years, global community deals with an intense economic crisis, which, once again, initially took place in United States and then spread almost in all over the world. Economic crisis was created by the inability of banks to pay the large number of mortgage loans in United States and then expanded rapidly in developed countries. Soon after that the whole world suffers from the biggest economic crisis in years. Immediately countries react and start taking measures to tackle the crisis. All measures had the same goal, to improve liquidity and to leverage investment in order to boost the economy and retain the unemployment in a low percentage. Greece also tried to take measures, but in vain because, in contrast to the rest European countries, the economy in Greece is weak since it depends on areas as tourism, shipping and construction which affected out of crisis very intensity. Not to mention the fact that banks, which constitute the most powerful part of Greek capital and work at an unprecedented rate of credit expansion both domestically and abroad, are exposed to international crisis by taking high risks since countries which Greek banks trades with, are included in the countries who most severely affected by the crisis. Furthermore, banks in Greece due to crisis lost their confidence and became less competitive among the other countries (Chart 1). In addition, there was something weird about the austerity bill that the Greek parliament chooses to follow. Although the package includes measures such as government layoffs that seem logical, there are also measures such as private-sector wage cuts that not only will make the unemployment rate increase but also it will imperil revenue by reducing people’s incomes. Results of crisis in Greek private sector were pretty severe, making lowproductivity businesses to close and others with insufficient funds/raw materials businesses tend to minimize leading to future closure. Not to mention that the rise of unemployment was more than 25% over the first 12 months reaching high 40%->50% during the current period. It’s important to mention that the crisis has not emerged from the private sector of the economy, but by the public and especially by the difficultly of the banks to fund the domestic economy. Naturally the private sector should avoid tremendous changes, but the crisis affect the Greek economy in a particularly strange way by making private sector shrink over the years. The fact of that change appears in the analog of the two sectors in the composition of the GDP of the Greek economy. This change does not happen instantly; in contrast this is the result of a process and financing options that made the risk of founding a new private business to increase. That made the people to tend to work in the public sector and as result he private sector had less and less labor force and became much smaller. So private sector in Greek economy has undoubtedly the most serious consequences. Crisis combined with the immobilization of the banking system and high taxation made little private businesses close or shrink in a way that people can not handle. As an example, in the private sector the rate of unemployment rapidly rise to 23% and about 400.000 young people lost their jobs in about a month. On the other hand, economic crisis had positive effects on some private businesses because they become more useful and their productivity increased swiftly. For instance, a private business of bailiffs had their income increased for almost 30% in a month. Also due to economic crisis and the decrease of the minimum wage from 740 to 585 businesses tent to hire people easier and employees work harder and increased their productivity duo to the convenience of the employer at hiring someone else instead. In addition, people with lots o qualifications and skills who could not find a job duo to high remunerations can easier find a job since the labor market become more competitive and the employers ask for more skills. To the best of my knowledge, Greece can overcome crisis with the minimum of damage by trying to make private sector more competitive to public sector and letting it occupy a bigger part of GDP; making GDP increase rapidly and overcoming crisis in a smaller period of time and more gently. To do so Greek government should increase their state subsidies for private businesses, as well as provide better interest rates for them. In addition, state should interfere to the credit system to ensure liquidity since the biggest problem of private sector nowadays is their inability to access funding. Also state should start liquidating the major debt (charts 2,3,4) to the private sector boosting economy of households and as result state revenues. Concluding, private sector was shrinked during economic crisis and the closure of private businesses lead to further damage for Greece. Funding private businesses is a good was to overcome crisis without making the people abandon this country and making Greece les competitive among the other countries. Domestic credit to private sector For our information and charts we visited: http:// data.worldbank.org/ country/ greece, http://www.thelancet.com/journals/lancet/article/PIIS0140-6736(11)61556-0/fulltext, http://www.sciencedirect.com/science/article/pii/S0176268010000534, http://onlinelibrary.wiley.com/doi/10.1111/j.1468-5965.2010.02139.x/full, http://www.relooney.info/0_New_6572.pdf, http://ec.europa.eu/eurostat, http://www.tradingeconomics.com/ , http://www.greekcrisis.net/, http://www.inews.gr/263/katotatos-misthos-giati-prepei-na-afxithei-sta-640-evro-apo-586simera-diavaste-to.htm, http://www.newmoney.gr/article/7582/kleinoyn-hiliadesepiheiriseis-stin-kypro-logo-desmeysis-ton-trehoymenon-logariasmon, http://dspace.lib.uom.gr/dspace/bitstream/2159/15261/3/AndreadouMariaMsc2012.pdf , http://www.bankofgreece.gr/BoGDocuments/20-5_lioukas.pdf, http://folders.skai.gr/main/theme?locale=el&id=127, http://www.spiegel.de/international/business/bad-for-business-euro-crisis-has-decimatedgreek-private-sector-a-770190.html, http://www.businessdictionary.com/definition/economic-crisis.html, http://www.hardouvelis.gr/GET.asp?id=SPEE, http://www.protothema.gr/news-inenglish/article/?aid=188251