* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

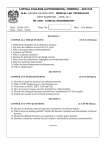

Download CIS September 2011 Exam Diet Examination Paper 2.1:

Internal rate of return wikipedia , lookup

Systemic risk wikipedia , lookup

Modified Dietz method wikipedia , lookup

Financial literacy wikipedia , lookup

Business valuation wikipedia , lookup

Present value wikipedia , lookup

Pensions crisis wikipedia , lookup

Interest rate ceiling wikipedia , lookup

Balance of payments wikipedia , lookup

Global financial system wikipedia , lookup

Financial economics wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Global saving glut wikipedia , lookup

Financial crisis wikipedia , lookup

CIS September 2011 Exam Diet Examination Paper 2.1: Financial Accounting and Financial Statement Analysis Economics and Financial Markets Quantitative Analysis and Statistics Level 2 Financial Accounting and Financial Statement Analysis (1 – 18) 1. Which of the following statements is incorrect about bonus issue? A. A bonus issue has no effect on EPS. B. A bonus issue has no effect on the earning capacity of a business. C. A bonus issue is simply capitalization of reserves. D. All of the above. 2. A financial asset connotes the following, except: A. A contractual obligation to exchange financial instruments with another enterprise under conditions which are potentially unfavourable. B. Cash. C. A contractual right to exchange financial instruments with another company under conditions that are potentially favourable. D. A contractual right to receive cash or another financial instrument from another enterprise. 3. During periods of inflation, the use of FIFO (rather than LIFO) as the method of accounting for inventories causes which of the following? A. Higher inventory turnover. B. Higher incomes taxes. C. Lower ending inventory. D. Higher reported sales. 4. In the last financial year ABC Limited issued an invoice for N28,900 for the sale of a fixed asset with a net book value of N27,600. What was the effect of this transaction on the company's assets, liabilities and capital and reserves? Assets Liabilities A. unchanged reduced increased B. increased unchanged increased C. increased reduced increased unchanged reduced D. reduced 5. Capital and reserves Which of the following statements is/are correct? I. Both realized and recognized gains are reported in the profit and loss account. II. Both realized and recognized gains are reflected in the balance sheet. III. Only realized gains are reported in the profit and loss account. A. B. C. D. 6. III only I and II II and III I, II and III In the year to 31 May 2010, Fantastic Plc acquired 75% of the share capital of SSH Limited for N360,000. At the date of the acquisition, SSH Limited had 500,000 shares of 50k each in issue and retained profits of N150,000. What is the value of goodwill arising on the acquisition? A. N40,000 B. N60,000 C. N127,500 D. N290,000 7. According to IFRS, which of the following statements is correct about the treatment of research and development costs? A. All research and development costs must be recognized as expenses when incurred. B. Costs incurred in the research phase which meet the recognition criteria for an intangible asset, should be capitalized. C. Costs incurred in the development phase which meet the recognition criteria for an intangible asset, should be capitalized. D. None of the above statements is correct. 8. At 30 April 2010, the net book value of the fixed assets of Bako Limited was N80,000 greater than the tax written down value, and the balance brought forward on the deferred tax account was N24,800. The company accountant calculated that the corporation tax charge on the reported profit for the year to 30 April 2010 would be N53,960, based on the tax rate of 35%. What is the total charge for taxation in the profit and loss account for the year to 30 April 2010? A. N48,360 B. N57,160 C. N73,160 D. N78,760 9. You observe that the asset turnover ratio (sales/average net fixed assets) of a company exceeds the industry average. Which of the following statements best explains this? A. The firm expanded plant and equipment in the past few years. B. The firm makes less efficient use of assets than competing firms. C. The firm has a substantial amount of old plant and equipment. D. The firm uses straight-line depreciation. 10. On 7 November 2009, there was a fire in the storeroom of Chichi Limited, in which stock valued at N120,000 was destroyed. This represented 30% of the company's stock. Due to a clause in the insurance contract, the insurance company has stated that it will only pay out the first N30,000 of the claim. How should this be reported in the financial statements for the year to 31 October 2009? A. Nothing needs to be reported in the financial statements for the year to 31 October 2004. B. No charge in the profit and loss account and a note disclosing a loss of N90,000 C. No charge in the profit and loss account and a note disclosing a loss of N30,000 D. Charge of N90,000 to the profit and loss account. 11. Which one of the following is best described as ‘a reduction in the monetary value of economic benefits which the entity has received in the last accounting period’? A. An asset. B. A liability. C. A gain. D. A loss. 12. A firm's current ratio is above industry average; however, the firm's quick ratio is below industry average. These ratios suggest which of the following? A. The firm has relatively more total current assets and even more inventory than other firms in the industry. B. The firm is very efficient at managing inventories. C. The firm has liquidity that is superior to the average firm in the industry. D. The firm is near technical insolvency. 13. You have been given the assignment of translating the financial statement of a foreign entity in which your group of companies has substantial interest, using the current rate method. What is the correct approach for translating the revenue and expenses of the entity? A. At the spot exchange rate as on the date of transaction or a periodic average rate. B. At the closing date rate. C. At the higher of spot exchange rate as on the date of transaction or the closing date rate. D. At the lower of spot exchange rate as on the date of transaction or the closing date rate. 14. Which of the following is one of the problems usually encountered when comparing financial ratios prepared by different reporting agencies? A. Some agencies receive financial information later than others. B. Agencies vary in their policies as to what is included in specific calculations. C. Some agencies are careless in their reporting. D. Some firms are more conservative in their accounting practices. 15. Which of the following is/are true? I. II. III. IV. Depreciation charges increase profit. Reduction in provision for bad debt increases profit. Undervaluation of stock increases profit. Increase in provision for bad debt increases profit. A. B. C. D. II only II and III only IV only III only 16. Which accounting concept supports the assertion that economic reality should takes precedence over legal issues? A. Realisation concept. B. Conservatism. C. Substance over form. D. Measurement concept. 17. Creativity Limited has a number of intangible assets. The directors have asked for your advice on how to treat them in the financial statements. Which of the following items should not be capitalized? A. Internally generated goodwill. B. Positive purchased goodwill. C. A patent purchased separately from the business. D. All of the above. 18. A firm has a (net profit/pretax profit) ratio of 0.6, a leverage ratio of 2, a (pretax profit/EBIT) of 0.6, an asset turnover ratio of 2.5, a current ratio of 1.5, and a return on sales ratio of 4%. What is the firm’s ROE? A. 4.2% B. 5.2% C. 6.2% D. 7.2% Economics and Financial Markets (19 – 31) 19. The exchange rate is said to ‘over shoot’ when: A. Its long run response to a disturbance is greater than its immediate response. B. Its immediate response to a disturbance is greater than its long-run response. C. Its immediate response to a disturbance is equal to its long-run response. D. It responds ahead of a disturbance. 20. Under what situation does Marshall-Learner condition hold? A. When net exports rise when the domestic currency depreciates. B. When net exports fall when the domestic currency depreciates. C. When net export does not respond to domestic currency depreciation. D. When net exports rise when the domestic currency appreciates. 21. If exchange rates float freely, the exchange rate for any currency is determined by the: A. Demand for and the supply of it. B. Demand for it. C. Supply of it. D. Official reserves that back it. 22. Net A. B. C. D. Domestic Product (NDP) is: Indirect business taxes + depreciation. Indirect business taxes – depreciation. Always larger than GDP and is therefore preferred measure of living standard. GDP less depreciation. 23. The liquidity trap occurs when demand for money: A. Is perfectly interest elastic. B. Is perfectly interest inelastic. C. Means that an increase in money supply leads to a fall in the interest rate. D. Means that an increase in the money supply leads to an increase in the interest rate. 24. Reducing involuntary unemployment: A. Helps the economy move on to the Production Possibility Frontier. B. Helps shift the economy's Production Possibility Frontier outwards. C. Helps the economy move along its Production Possibility Frontier. D. Helps the economy move inside the Production Possibility Frontier. 25. Investment is: A. An injection that increases aggregate demand. B. A withdrawal that increases aggregate demand. C. An injection that decreases aggregate demand. D. A withdrawal that decreases aggregate demand. 26. What is the implication of a negative elasticity of demand? A. Demand is price elastic. B. Demand is price inelastic. C. The demand curve is downward sloping. D. An increase in income will reduce the quantity demanded. 27. A contraction in supply occurs when: A. Demand shifts outwards. B. The supply curve shifts inwards. C. The quantity supplied falls when the price falls. D. The supply curve shifts outwards. 28. The average variable cost curve: A. Is derived from the average fixed costs. B. Converges with the average cost as output increases. C. Equals the total costs divided by the output. D. Equals revenue minus profits. 29. In A. B. C. D. a monopoly, which of the following is not true? Products are differentiated. There is freedom of entry and exit into the industry in the long run. The firm is a price taker. There is one main seller. 30. In A. B. C. D. a recession, a government: Is likely to want to increase demand in the economy. Is likely to want to decrease demand in the economy. Is likely to want to stabilise demand in the economy. Is likely to want to increase supply in the economy. 31. To A. B. C. D. anticipate what the economy is going to do next, the government will look at: Lagging indicators. Flashing indicators. Coincidental indicators. Leading indicators. Quantitative Analysis and Statistics (32 – 40) 32. Which of the following statements least accurately interprets the NPV rule? A. Holding all else constant, the further out the cash flow of an investment, the lower the NPV will be. B. Holding all else constant, if a project has nothing but positive future cash flows, then its NPV will be positive as well. C. Holding all else constant, the NPV will increase as the discount rate decreases. D. Holding all else constant, the NPV will increase as the cost of the investment decreases. 33. A sum of N500,000 was invested by two partners in a business which yielded a profit of N900,000: If the profit was shared in the ratio 4:5, the difference between the amounts received by the partners is: A. N100,000 B. N150,000 C. N250,000 D. N400,000 34. Which of the following statements least accurately describes the interpretation of an F-statistic? A. The F-statistic will increase as the sample size increases. B. The F-statistic may be used to determine if the regression coefficients are significant. C. The F-statistic may be found as the ratio of the variance of the regression to the variance that is accounted for by the error terms. D. The F-statistic may be found using the components of an ANOVA. 35. Two matrices A and B are said to be conformable for multiplication if: A. The numbers of rows of A is equal to the number of rows of B. B. The number of columns of A is equal to the number of rows of B C. The number of columns of A is equal to the numbers of columns of B D. A and B are symmetric matrices. 36. The economics department of the securities firm that you work for just released three possible growth rates for the economy: -3.4%, 2.3% and 5.3%. In addition, it indicated that the probability of each possibility occurring is 32%, 46% and 22%, respectively. Which of the following measures is accurate with respect to this situation? A. Variance equals zero. B. Standard deviation equals 3.32%. C. Standard deviation equals 11.01. D. The mean equals 1.4%. 37. Your colleague has formulated a linear programming problem as below: Maximise subject to 3x1 + 4x2 4x1 + 2x2 4x1 + 6x2 ≤ ≤ 100 180 (objective function) (machine hours) (labour hours) Which of the following statements is incorrect? A. This is a maximization problem. B. Machine hours are a constraint in this problem. C. Labour hours are not a constraint in this problem. D. This problem can be solved using graphical method. 38. Which of the following hypothesis statements would not entail a one-tailed test? A. The average dividend payout ratio in the automotive industry is 4.2% B. The variance of P/E ratios is greater than 22% C. The average stock returns in a population exceed 7.2% D. The variance of the regression exceeds the variance of the error terms. 39. A firm’s total cost and demand functions are given by TC=Q2 + 50Q +10 and P =200 - 4Q respectively. What is the level of output required to maximize the firm’s profit? A. 10 units B. 15 units C. 25 units D. 50 units 40. Consider the following series of year-end cash flows: Year Year Year Year 1 2 3 4 N -15,000 6,000 10,000 1,000 Which of the following best represents the internal rate of return of the cash flows? A. 5.77% B. 6.77% C. 7.67% D. 8.67% Total = 40 marks Question 2 - Financial Accounting and Financial Statement Analysis When Schemers Limited started facing problems it was, among other things, “recording revenue in advance of the sale of the goods”. How does such an accounting practice affect the following? 2(a) Reported earnings. (11/2 marks) 2(b) Reported cash flows. (11/2 marks) Question 3 - Economics and Financial Markets With appropriate graph, illustrate what would happen to the demand for a ‘normal good’ when consumer incomes rise. (3 marks) Question 4 - Quantitative Analysis and Statistics Most statistical enquiry involves a study of a sample of the relevant population. Identify four possible reasons why a sample survey is preferable to a population survey. (4 marks) Question 5 - Financial Accounting and Financial Statement Analysis Group Red is a group composed of several companies. In fact, Red Limited acquired: 70% of the shares of Blue Limited at N3,500,000 on 1st January 2010; 30% of the shares of Pink Limited at N1,350,000 on 31st December 2009. Moreover, Blue Limited acquired 80% of the shares of Green Limited at N1,000,000 on 1st January 2010. Furthermore, Green Limited owns 10% of the shares of Orange Limited. None of these companies is a joint venture. 5(a) As the consultant to the Chief Financial Officer, you have been asked which method has to be applied to recognize these investments in the consolidated financial statements of Red Limited. Name the applicable consolidation methods and give reasons for your choice. (Assuming that Red Limited prepares its consolidated financial statements in conformity with IFRS and that, for this question, control is assumed to have been achieved only if the investor owns more than 50% of the shares). Fill the table below. (7 marks) Method Explanation Blue Limited Pink Limited Green Limited Orange Limited 5(b) Furthermore, you have been asked how investments in equity instruments in the financial statement that give neither control nor a significant influence must be accounted for in the consolidated balance sheet of Red Limited. (2 marks) 5(c) Calculate the goodwill for Red Limited arising from the acquisition of Blue Limited. (ignoring deferred taxes). Explain how positive goodwill is treated in general over its lifetime (i.e. on the date of acquisition and in the following years). Additional information: - 5(d) Total Equity on 1st January 2010 at book value: Blue Limited 3,000,000 Unrealized gains (fair value - book value) in the balance sheet on 1st January (5 marks) 2010 of Blue Limited: N500,000. The consolidated balance sheet of Group Red Limited has been prepared as shown below. You are required to identify the mistakes in this consolidated balance sheet, providing explanations for your answers. (N’ OOO) Assets Fixed Assets Negative Goodwill Trade Receivables Intercompany d Receivables 10,000 - 5,000 5,000 3,000 (N’ OOO) Liabilities and Trade Payables Provisions Alpha's share of consolidated equity Minority interests Blue's capital 13,000 2,500 500 6,000 1,000 3,000 13,000 (3 marks) 5(e) Suppose that the goodwill resulting from consolidation was N26,000,000. Its allocation to the cash-generating units of Red was (N’ 000): Unit A 15,000 Unit B 7,000 Unit C 4,000 26,000 Goodwill Other assets allocated to the units Unit A 15,000 Unit B 7,000 Unit C 4,000 Total 26,000 2,027 1,892 1,081 5,000 On 31st December 2010, the value in use and the fair value less costs to sell of these cash generating units are (N’ 000): Fair value less costs to sell Value in use Unit A 18,000 15,000 Unit B 1,000 1,092 Unit C 4,000 5,050 Calculate the recoverable amount of each cash generating unit. Which of them must be impaired? For cash generating units that must be impaired, allocate the impairment loss to the corresponding assets. (5 marks) (Hint: Use the following table. All cells are not necessarily needed). Unit A Unit B Unit C Recoverable amount Carrying amount Impairment loss Correspondence assets and allocated amount Question 6 - Economics and Financial Markets As the economies of the world slid into recession in 2008, central banks became more and more worried that the traditional instrument of monetary policy – controlling interest rates – was insufficient to ward off a slump in demand. So, central banks resulted to increasing money supply directly, in a process known as quantitative easing. This is an aggressive version of open market operations. The effect is to pump large amounts of additional cash into the economy in the hope of stimulating demand and through the process of credit creation, to boost broad money too. Required 6(a) What are the indicators that an economy is in a recession? (3 marks) 6(b) Briefly discuss open market operations as a monetary policy tool. (3 marks) 6(c) Using the IS-LM model and appropriate graphs, analyze the impact of quantitative easing policy on an economy. (7 marks) 6(d) Assume that, instead of using monetary policy, government decides to use expansionary fiscal policy to stimulate the economy. What does this entail? (4 marks) Question 7 - Quantitative Analysis and Statistics A company has a fleet of vehicles and is trying to predict the annual maintenance costs per vehicle. The following data have been supplied for a sample of vehicles: Vehicle number 1 2 3 4 5 6 7 8 9 10 Ages in years Maintenance cost per annum x y 2 8 6 8 10 4 4 2 6 10 60 132 100 120 150 84 90 68 104 140 Using the information above, an analyst in the Finance department came up with the following summarized information: ∑x = 60 ; ∑y = 1048 ; ∑xy = 7092 ; ∑x2 = 440 Required: 7(a) Using the least squares technique, calculate the values of a and b in the equation y = a + bx, to allow managers to predict the likely maintenance cost, knowing the age of the vehicle. You can assume that the analyst’s figures are accurate. 7(b) (3 marks) Prepare a table of maintenance costs covering vehicles from 1 to 4 years of age, based on your calculations in 7(a) above. (3 marks) 7(c) Estimate the maintenance costs of a 12 year-old vehicle and comment on the validity of making such an estimate. (5 marks)