* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download ratios

Private equity secondary market wikipedia , lookup

Investment fund wikipedia , lookup

Systemic risk wikipedia , lookup

Business valuation wikipedia , lookup

Financial economics wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Securitization wikipedia , lookup

Investment management wikipedia , lookup

Global saving glut wikipedia , lookup

Household debt wikipedia , lookup

Pensions crisis wikipedia , lookup

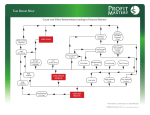

Analysis of financial statements Exercise 4 BASIC TOOLS AND TECHNIQUES OF FINANCIAL STATEMENT ANALYSIS Basic tools and techniques of financial statement analysis HORISONTAL ANALYSIS (__________ financial statements) VERTICAL ANALYSIS( __________ financial statements) RATIO ANALYSIS (_______ ratio, ratio ________, __________ of ratios and s_________ ratio) 2 PRINCIPAL TOOLS AND TECHNIQUES OF FINANCIAL STATEMENT ANALYSIS COMPARATIVE FINANCIAL STATEMENTS HORISONTAL ANALYSIS STRUCTURAL FINANCIAL STATEMENTS VERTICAL ANALYSIS RATIO ANALYSIS SINGLE RATIO RATIO BLOCKS SYSTEM OF RATIOS SINTETIC RATIOS 3 4 VERTICAL ANALYSIS( structural financial statements – common-size financial statements) balance sheet (items as a % total assets) income statement (items as a % of total income – net sales) Cash flow statements (items as a % of total inflows) Comparison with similar companies - financial results are often affected by industry and economy wide factors THE STRUCTURE OF ASSETS 5 20x1. 39% 61% Noncurrent assets Current assets 20x2. 43% 57% Noncurrent assets Current assets THE STRUCTURE OF SOURCES OF ASSETS 6 20X1. 39% 40% Equity and reserves Long term debt 21% Current liabilities 20X2. 34% 41% Equity and reserves Long term debt 25% Current liabilities THE STRUCTURE OF INCOME /EXPENSES 7 20X2. 20X1 0% 1% 0% 2% Operating revenues Operating revenues Financial revenues Financial revenues Extraordinary revenues 98% Extraordinary revenues 99% 20X1. 20X2. 6% 0% 7% 1% Operating expenses 94% Financial expenses Operating expenses Extraordinary expenses Financial expenses 92% Extraordinary expenses 8 HORISONTAL ANALYSIS (comparative financial statements) Information on a single company is compared over time For example, key measure of performance is the change in sales volume each year…. FINANCIAL RATIO ANALYSIS 9 Single ratio Ratio blocks System of ratio Synthetic ratios SINGLE RATIO 10 Express an mathematical relationship between one quantity and another For example (current assets/ current liabilities) Ratio must have be significant and measure a business position or/and performance For example, liquidity, profitability etc. RATIO BLOCKS 11 _______ ratios _______ ratios _______ ratios _______ ratios ________ ratios _________ ratios RATIO BLOCKS 12 Liquidity ratios Solvency ratios Activity ratios Economy ratios Profitability ratios Investment ratios FINANCIAL __________ (“SAFTEY” OF BUSINESS) FINANCIAL ____________ RATIO BLOCKS 13 Liquidity ratios Solvency ratios Activity ratios Economy ratios Profitability ratios Investment ratios FINANCIAL POSITION (“SAFTEY” OF BUSINESS) FINANCIAL PERFORMANCE LIQUIDTY RATIOS 14 CASH TO CURRENT LIABILITIES RATIO= CASH CURRENT LIABILITIES CASH + CASH EQUIVALENTS + ACCOUNTS RECEIVABLES ACID –TEST RATIO (QUICK RATIS) = CURRENT RATIO = FINANCIAL STABILITY RATIO = CURRENT LIABILITIES CURRENT ASSETS CURRENT LIABILITIES NONCURRENT ASSETS EQUITY + NONCURRENT LIABILITIES LIQUDITY RATIOS EQUITY NONCURRENT NONCURRENT ASSETS ASSETS FINANCIAL STABILITY RATIO <1 NONCURRENT NONCURRENT LIABILITIES LIABILITIES CURRENT CURRENT ASSETS ASSETS CURRENT CURRENT LIABILITIES LIABILITIES 15 CURRENT RATIO >2 WORKING CAPITAL WORKING CAPITAL = CA- CL E NCA “Golden rules of financing” NCL WORKING CAPITAL CA CL 16 Golden rules of financing 17 1. Long-term assets → long term sources 2. Short-term assets → short-term sources 3. One part of short-term assets → long-term sources (working capital) Assess the liquidity of the following companies? 18 COMPANY “A” COMPANY “B” Current assets 400.000 900.000 Current liabilities 200.000 700.000 200.000 200.000 Working capital Assess the liquidity of the following companies? 19 COMPANY “A” COMPANY “B” Current assets 400.000 900.000 Current liabilities 200.000 700.000 Working capital 200.000 200.000 2,00 1,28 CURRENT RATIO Assess the liquidity of the following company LIQUIDITY RATIOS Cash to current liabilities ratio Current ratio Financial stability ratio Working capital Does the company currently have the resources to pay short term debt? 20x1. 20x2. 20x3. 2,20 1,69 2,24 3,30 2,87 3,29 0,65 0,69 0,67 4.387.000 3.637.000 3.782.000 Analysing the impact of selected transactions on the current ratio For each of the following event, state whether the current ratio and working capital will increase or decrease. Assume the following transactions were completed 22 Declared but not pay dividendds of 50,000 euro. (CR decrease, WC decrease) Money borrowed from a bank (long term debt) in the amount od 11,000 euro. (CR increase , WC increase) Reclassified 30,000 euro of long term debt as short term liability. (CR decrease, WC decrease) CURRENT RATIO 23 CURRENT RATIO 1,08 2,56 This financial information pertains to the following companies: a) Manufacturing company b) Merchandising company (retail, wholesale) Task: Match each company with its financial information CURRENT RATIO 24 CURRENT RATIO MERCHANDISING COMPANY MANUFACTORING COMPANY 1,08 2,05 This financial information belongs to the following companies: a) Manufacturing company b) Merchandising company Task: Match each company with its financial information 25 Before calculating the current ratio, the accounts receivable turnover and total assets turnover should be computed (calculated). The higher the total assets turnover ratio and accounts receivable turnover ratio the company requires less working capital and lower current ratio. The longer the operating cycle company requires the higer the working capital level and current ratio. FEATURES THAT INFLUENCE LIQUIDITY RATIO _____________ TYPE ( bread manufacturing, ship manufacturing, technical equipment) THE ________ OF _________ (structure of current and the structure of total assets) THE STRUCTURE OF __________ (the structure of current and total liabilities) __________ RATIOS AND ___________ PERIOD( total assets turnover and accounts receivable turnover – days to collect receivables) 26 FEATURES THAT INFLUENCE LIQUIDITY RATIO INDUSTRY TYPE ( bread manufacturing, ship manufacturing, technical equipment) THE STRUCTURE OF ASSETS (structure of current and the structure of total assets) THE STRUCTURE OF LIABILITIES (the structure of current and total liabilities) TURNOVER RATIOS AND CONVERSION PERIOD( total assets turnover and accounts receivable turnover – days to collect receivables) 27 SOLVENCY (LEVERAGE) RATIOS LIABILITIES (DEBT) TO ASSETS RATIO EQUITY TO ASSETS RATIO = TIMES INTEREST EARNED = DEBT FACTOR = 28COVERAGE LEVEL II= = TOTAL LAIBILITIES (DEBT) TOTAL ASSETS EQUITY TOTAL ASSETS INCOME BEFORE TAX+ INTEREST INTEREST TOTAL LIABILITIES RETAINED EARNINGS + DEPRECIATION EQUITY+ NONCURRENT LIABILITIES NONCURRENT ASSETS Solvency (leverage) ratios 29 Balance sheet (indebtedness from balance sheet) _______________________ _______________________ Profit and loss account (indebtedness from profit and loss account) _______________________ _______________________ Coverage level II– liquidity vs solvency Solvency (leverage) ratios 30 Balance sheet (indebtedness from balance sheet) Liabilities (debt) to assets ratio Equity to assets ratio Profit and loss account (indebtedness from profit and loss account) Times interest earned Debt factor Coverage level II– liquidity vs solvency Solvency (leverage) ratios 31 Companies can finance their assets with equity and debt The higher the proportion of assets financed by debt the higher is debt/assets ratio The higher the proportion of assets financed by equity the lower the ratio An increasing ratio over time signals reliance on debt financing and more risk Debt financing is riskier then financing with equity because interest payments on debt must be made every period (they are legal obligation, whereas dividends on stock can be postponed) Give the implications and limitations of each financial ratio separately and then evaluate the collective influence that could be drawn from them about longterm debt position of this company. FINANCIAL RATIO Times interest earned Debt to assets ratio Equity to assets ratio 32 20x1. 20x2. 20x3. 5.5 6.0 8.2 40% 39% 40% ? ? ? Give the implications and limitations of each financial ratio separately and then evaluate the collective influence that could be drawn from them about longterm debt position of this company. FINANCIAL RATIO Times interest earned Debt to assets ratio Equity to assets ratio 33 20x1. 20x2. 20x3. 5.5. 6.0 8.2 40% 39% 40% 60% 61% 60% Times interest earned 34 A high time interested earned is viewed more favorably the a low one. This ratio shows the amount of profits generated for each unit of interest expense Analyst are interested in a company’s ability to meet its required interest payments because failure to do so can result in bankruptcy Assess the indebtedness of the company 35 FINANCIAL RATIO Times interest earned Debt to assets ratio Equity to assets ratio 20x1. 20x2. 20x3. 2.3 1.5 1.2 70% 71% 60% Assess the indebtedness of the company 36 FINANCIAL RATIO Times interest earned Debt to assets ratio Equity to assets ratio 20x1. 20x2. 20x3. 2.3 1.5 1.2 30% 29% 40% 70% 71% 60% 37 The company is financing its assets mostly through the debt. Times interest earned decreased materially over the time. Exercise Indicate the effect of each of the transactions on the ratios listed. Use + to indicate and increase, - to indicate a decrease and 0 to indicate no effect. Assume an initial times interest earned is more then 1 and debt ratio and debt/ equity ratio less than 1. Individual transactions have a significant impact on ratios RATIO TRANSACTION 1) Declaration of cash dividend 2) Declaration and payment of stock dividend 3) Increased profits by cutting cost of sales 4)Sale of common stock 5) Conversion of bonds to common stock TIMES INTEREST EARNED DEBT RATIO DEBT/ASSETS Individual transactions have a significant impact on ratios RATIO TRANSACTION 1) Declaration of cash dividend 2) Declaration and payment of stock dividend 3) Increased profits by cutting cost of sales 4)Sale of common stock 5) Conversion of bonds to common stock TIMES INTEREST EARNED DEBT RATIO DEBT/ASSETS No effect Increase No effect No effect Increase Decrease No effect Decrease Increase Decrease 41 “We tend to focus on assets and forget about debts. Financial security requires facing up to the big picture: assets minus debts”. ACTIVITY RATIOS 42 TOTAL ASSETS TURNOVER= SALES (TOTAL INCOME) TOTAL ASSETS CURRENT ASSETS TURNOVER = ACCOUNTS RECEIVABLE TURNOVER= DAYS TO COLLECT RECEIVABLES= SALES (TOTAL INCOME) CURRENT ASSETS SALES RECEIVABLES 365 ACCOUNTS RECEIVABLE TUROVER Question 43 What does the total asset turnover ratio measure in general? ACTIVITY RATIOS 44 How effective is management in generating sales from assets? Total asset turnover ratios measures the sales generated per one unit of assets (the most important activity ratio) A high ratio suggests that a company is managing its assets efficiently – a low asset turnover ration signifies less efficient management TOTAL ASSET TURNOVER RATIO (should be at least 1) Under the seasonal fluctuations Relaxing credit policies for new customers or Reducing collection efforts in accounts receivable may decrease these ratios ACTIVITY RATIOS 45 Accounts receivable turnover – measure how many times average trade receivables are recorded and collected during the period The higher the ratios the faster the collection of receivables Days to collect receivables – measures the average time it takes a customer to pay its accounts (depends on the industry) The lower the ratios the shorter is the collection of receivables, Can reduce borrowings and reduce interest expense Calculate and explain the total asset turnover ratio. How effective is management in generating sales from assets (resources)? 46 Total assets Total liabilities Total stockholders' equity Sales revenue Net income 20X1 41.000 20X2 53.000 20X3 60.000 6.000 11.000 14.000 35.000 42.000 46.000 130.000 147.000 156.000 25.000 40.000 51.000 Calculate total asset turnover ratio. What do these results suggest to you about this company? 47 FINANCIAL RATIOS 20X1. 20X2. 20X3. TOTAL ASSETS TURNOVER 3,17 2,77 2,6 48 Per one unit of assets company generated 3,17 units of sales (income, revenues). The total assets turnover ratio was very good, although it decrease material over the time. TOTAL ASSETS TURNOVER 49 COMPANY 1 TOTAL ASSETS TURNOVER 1,08 COMPANY 2 2,56 COMPANY 3 0,36 COMPANY 4 1,85 This financial information belongs to the following companies: a) Air line company (for example, Croatia Airlines, Southwest airlines), b) Motorcycle company (for, example, Honda, Harley Davidson, etc.) c) Beer company (for example, Bavaria, Boston Beer etc. ), d) Pizza company ( Papa John's,Pizza Hut, Taco Bell, KFC, etc.). Task: Match each company with its financial information TOTAL ASSETS TURNOVER 50 TOTAL ASSETS TURNOVER 1,08 2,56 0,36 1,85 ACCOUNTS RECEIVABLE TURNOVER 51 COMPANY 1 ACCOUNTS RECEIVABLE TURNOVER 3,042 COMPANY 2 6,083 COMPANY 3 12,16 COMPANY 4 18,25 Calculate days to collect receivables based on the accounts receivable turnover data. DAYS TO COLLECT RECEIVABLES 52 COMPANY 1 DAYS TO COLLECT RECEIVABLES cca 120 COMPANY 2 cca 60 COMPANY 3 cca 30 COMPANY 4 cca 20 DAYS TO COLLECT RECEIVABLES 53 COMPANY 1 DAYS TO COLLECT RECEIVABLES 120 COMPANY 2 60 COMPANY 3 30 This financial information pertains to the following companies: a) Airline company b) Drug company c) Travel agency d) Car manufactorer. Task: Match each company with its financial information COMPANY 4 20 DAYS TO COLLECT RECEIVABLES 54 COMPANY 1 Drug company DAYS TO COLLECT RECEIVABLES 120 COMPANY 2 Car manufacturer 60 COMPANY 3 Travel agency COMPANY 4 Airlines company 30 This financial information belongs to the following companies: a) Airlines company b) Drug company c) Travel agency d) Car manufactorer. Task: Match each company with its financial information 20 ECONOMY RATIOS 55 TOTAL ECONOMY RATIS = TOTAL INCOME TOTAL EXPENSE OPERATING ECONOMY RATIO= FINANCE ECONOMY RATIO OPERATING INCOME OPERATING EXPENSE = EXTRAORDINARY ECONOMY RATIO = FINANCIAL INCOME FINANCE EXPENSES EXTRAORDINARY INCOME EXTRAORDINARY EXPENSES ECONOMY RATIOS 56 Structure of income and expenses in income statement 57 Economy ratios 58 59 FINANCIAL RATIO TOTAL ECONOMY RATIO OPERATING ECONOMY RATIO 20x6. 60 FINANCIAL RATIO TOTAL ECONOMY RATIO OPERATING ECONOMY RATIO 20x6. 1,17 1,41 61 FINANCIAL RATIO TOTAL ECONOMY RATIO OPERATING ECONOMY RATIO 20x1. 20x2. 62 FINANCIAL RATIO TOTAL ECONOMY RATIO OPERATING ECONOMY RATIO 20x1. 20x2. 1,39 1,45 1,65 1,68 Pitalica 65 Total assets turnover of the Apple company is ?: A) less then 1 B) larger then 1 C) larger then 2 D) larger then 3 Total revenues 182.795 Cost of goods sold 112.258 Total assets 231.839 Epa 2014 =1,62 Calculate total assets turnover ratio? Total revenues 182.795 Cost of goods sold 112.258 Total assets 231.839 Epa 2014 =1,62 Calculate total assets turnover ratio? 0,78 68 69 Operating economy ratio 20x1= 1,496 70 “All good things which exist are the fruits of originality”. PROFITABILITY RATIOS NET PROFIT MARGIN = GROSS PROFIT MARGIN= NET INCOME+ INTEREST TOTAL INCOME GROSS PROFIT + INTEREST TOTAL INCOME NET INCOME+ INTEREST NET RETURN ON TOTAL ASSETS (ROA) = TOTAL ASSETS GROSS RETURN ON TOTAL ASSETS = 71RETURN ON EQUTY (ROE)= GROSS INCOME + INTERESE TOTAL ASSETS NET INCOME EQUITY NET PROFIT MARGIN (1) 72 Measured how much of every sales unit generated during the period is profit A rising net profit margin signals more efficient management of sales and expenses Differences among industries result form the nature of the products or services and the intensity of competition (example) Financial analyst expect well-un business to maintain or improve their net profit margin over time NET PROFIT MARGIN (2) 73 COMPANY 1 NET PROFIT MARGIN 3,3% COMPANY 2 8,3% COMPANY 3 18,0% COMPANY 4 30% This financial information pertains to the following companies: a) Motorcycle company ( Harley Davidson) b) Pizza company ( KFC). c) Retail company (Wal-Mart Stores) d) Jewelars (Tiffany and Co.) Task: Match each company with its financial information NET PROFIT MARGIN (3) 74 Poduzeće 1 NETO PROFIT MARGIN 3,3% Poduzeće 2 8,3% Poduzeće 3 18,0% Poduzeće 4 30% This financial information pertains to the following companies: a) Motorcycle company (for, example, Honda, Harley Davidson, etc.) b) Pizza company ( Papa John's, Pizza Hut, Taco Bell, KFC, etc.). c) Retail company (Wal- Mart Stores) d) Jewelars (Tiffany and Co.) Task: Match each company with its financial information PROFITABILITY RATIOS 75 How well has management used the stockholders‘ investments during the period? Return on equity (ROE) – measure how much firm earned for each unit of stockholders investment. the higher the ROE are expected to have higher stock prices How well has management used the assets provided by both the debt holders and stockholders? ROA (return on asstes) PROFITABILITY RATIOS 76 Financial leverage Net return on total assets (ROA) Return on equity (ROE) Technology Apple Google Microsoft ROE 20x4. Task: Match each company with its financial information a) 30,04% b) 24,58% c) 13,82% Technology ROE 2014 Apple Google Microsoft 30,04 % 13,82% 24,58% Task: Match each company with its financial information a) 30,04% b) 24,58% c) 13,82% 79 These companies had an outstanding profits in relation to the industry. Return on equity (ROE) Task: Match each company with its financial information a) 11,98% b) 15,48% c) 4,43% Return on equity (ROE) 11,98% Toyota 15,48% Daimler AG 4,43% Nissan Task: Match each company with its financial information a) 11,98% b) 15,48% c) 4,43% The concept of financial leverage 82 Firms can obtain funds from borrowing sources (bank loans) and invest those funds in assets. It pays to take out the loan, as long as the interest on the loan is less then return on assets ROE >ROA 83 FINANCIAL LEVERAGE Profitability ratios – VIP – telecommunication industry 84 PROFITABILITY RATIOS NET PROFIT MARGIN NET RETURN ON ASSETS RETURN ON EQUITY 20x1. 20x2. 20x3. 18,02% 15,66% 14,14% 22,84% 17,89% 13,84% 29,98% 27,29% 32,39% Does the financial leverage works in this case? Profitability ratios – VIP – telecommunication industry 85 PROFITABILITY RATIOS NET PROFIT MARGIN NET RETURN ON ASSETS RETURN ON EQUITY 20x1. 20x2. 20x3. 18,02% 15,66% 14,14% 22,84% 17,89% 13,84% 29,98% 27,29% 32,39% Does the financial leverage works in this case? Yes. The return on equity (ROE) is higher then net return on assets (ROA) 86 Determine the effect of financial leverage? Does the financial levarege work? Financial leverage is successful if the company earns more on the borrowed fund than it pays to use them. 87 It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” Warren Buffet INVESTMENT RATIOS NET INCOME EARNINGS PER SHARE (EPS)= DIVIDEND PER SHARE (DPS)= NUMBER OF SHARES DIVIDENDS PAID TO SHAREHOLDERS DIVIDEND PAYOUT RATIO (DPR)= PRICE-EARNINGS RATIO (P/E) = 88 NUMBER OF SHARES DIVIDEND PER SHARE (DPS) EARNINGS PER SHARE (EPS) SHARE MARKET PRICE (PPS) EARNING PER SHARE (MP) INVESTMENT RATIOS EARNINGS YIELD DIVIDEND YIELD 89 = = EARNINGS PER SHARE (EPS) SHARE MARKET PRICE (MP) DIVIDENDS PER SHARE (DPS) SHARE MARKET PRICE (MP) INVESTMENT RATIOS 90 The number of shares Market value of shares vs bookkeeping value of shares Dividend payout – retained earnings Decreasing earnings yield? Question In 20X1. in company “X” the earnings per share (EPS) is 9,50€ while the share market price is 228 €. In 20X2. earnings per share (EPS) increased by 13%. Under the assumption of ceteris paribus what is the share market price? Can you calculate the share market price? Explain. 92 “If a business does well, the stock eventually follows.” Warren Buffet The following information was in the annual report of Rover Company. 20x1 20x2 20x3 Earnings per share (EPS) 1,27 1,20 1,12 Cash dividends per share (common) (DPS) Market price per share (PPS) 0,82 0,85 0,90 16,30 14,00 12,80 Total common dividends 18.360.000 19.500.000 21.700.000 Shares outstanding, end of year Total assets 22.500.000 23.100.000 24.280.000 Total liabilities Nonredeemable preferred stock Preferred dividends 1.260.400.000 1.267.200.000 1.280.100.000 799.200.000 808.500.000 800.400.000 15.300.000 15.300.000 15.300.000 910.000 910.000 910.000 Based on these data calculate the following for the 2007., 2008. and 2009. percentage of earnings retained price/earnings ratio dividend payout dividend yield book value per share Discuss your results from the viewpoint of a potential investor 20x1. 1. percentage of earnings retained 2. price/earnings ratio 3. dividend payout 4. dividend yield 5. book value per share 20x2. 20x3. Discuss your results from the viewpoint of a potential investor EARNINGS PER SHARE (EPS)= NET INCOME NUMBER OF SHARES NET INCOME= EARNING PER SHARE X NUMBER OF SHARED FINANCIAL RATIO 20x1. NET INCOME 28.575.000 20x2. 20x3 27.720.000 27.193.600 Discuss your results from the viewpoint of a potential investor FINANCIAL RATIO FORMULA 20X1 20X2 20X3 1. percentage of earnings retained 0,36 0,30 0,20 12,83 11,67 11,43 0,64 0,70 0,80 0,05 0,061 0,07 2. price/earnings ratio (P/E) 3. dividend payout ratio (DPR) 4. dividend yield retained earnings net income share market price (PPS) earning per share (EPS) dividend per share (DPS) earnings per share (EPS) dividend per share (DPS) share market price (MP) 5. book value per share equity number of shares 20X1 Total assets Total liabilities Total equity Shares outstanding, end of year Book value per share 1.260.400.000 799.200.000 461.200.000 20X2 20X3 1.267.200.000 1.280.100.000 808.500.000 800.400.000 458.700.000 479.700.000 22.500.000 23.100.000 24.280.000 20,50 19,86 19,76 14,00 12,80 Market price per share (PPS) 16,30 Discuss your results from the viewpoint of a potential investor FINANCIAL RATIO FORMULA 1. percentage of earnings retained 2. price/earnings ratio (P/E) 3. dividend payout ratio (DPR) 4. dividend yield retained earnings net income share market price (PPS) earning per share (EPS) dividend per share (DPS) earnings per share (EPS) dividend per share (DPS) share market price (MP) 5. book value per share equity number of shares 20X1 20X2 20X3 0,36 0,30 0,20 12,83 11,67 11,43 0,64 0,70 0,80 0,05 0,061 0,07 20,50 19,86 19,76 DU PONT ANALYSIS RETURN ON ASSETS (EQUITY) NET PROFIT MARGIN NET INCOME + INTERESTS SALE - : INCOME TAX X NET SALE EXPENSE (WITHOUT INTERESTS) + SALLING, GENERAL AND ADMINISTRATIVE EXPENSE TOTAL ASSETS TURNOVER COST OF GOODS SOLD OTHER NET SALE : NONCURRENT ASSETS INVESTMENTS (SECURITIES) TOTAL ASSETS + CURRENT ASSETS + CASH INVESTMENTS (SECURITIES) + PLANT AND EQUIPMENT RECEIVABLES INVENTORIES PREPAID COSTS 100 DU PONT ANALYSIS RETURN ON ASSETS NET INCOME + INTEREST TOTAL ASSETS 101 = = NET PROFIT MARGIN NET INCOME + INTEREST TOTAL INCOME × × TOTAL ASSETS TURNOVER TOTAL INCOME TOTAL ASSETS 102 Match each company with its financial information 103 COMPANY NET PROFIT MARGIN TOTAL ASSETS TURNOVER ARTIO NET RETURN ON TOTAL ASSETS 9,82 % 1,495 14,68% 3,79 % 1,17 4,43% 18,90% 0,57 10,77% COMPANY NET PROFIT MARGIN TOTAL ASSETS TURNOVER ARTIO NET RETURN ON TOTAL ASSETS 9,82 % 1,495 14,68% 3,79 % 1,17 4,43% 18,90% 0,57 10,77% Exercise Whit this case the aim is made between two companies in different industries using net profit margin, total asset turnover and return on assets. JOHNSON&JOHNSON INC.* INCOME STATEMENT 01. 10. - 30. 09. 2008. (dollars in millions) Sales to costumers Cost of sales Gross profit Selling, general and administrative expenses Research expense Development expenses Interest income Interest expense Other income (expense) net Income before income taxes Income tax expense Net income 63,747 18,511 45,236 21,490 7,577 181 (361) 435 (1,015) 28,307 16,929 3,980 12,949 From balance sheet (average total assets 82,933) *Johnson & Johnson and their employees worldwide are engaged in the research and development, manufacture and sale a broad range of products in the health care field. BEST BUY CO INC.* INCOME STATEMENT 01. 10. - 30. 09. 2008. (dollars in millions) Sales to costumers Cost of sales Gross profit Selling, general and administrative expenses Goodwill Operating income Other income (expense) Interest expense Investment income Investment impairment Interest expense Income before income taxes Income tax expense Net income 45,015 34,017 10,998 9,062 66 1,870 35 (111) (94) 1,700 674 1,026 From balance sheet (average total assets 14,292) *Best Buy company is specialty retailer of consumer electronics, home office products, entertainment software, applied and related service. a) Compute the following ratios for Johnson &Johnson Inc. b) Compute the following ratios for Best Buy Co. Inc. net profit margin total asset turnover return on assets net profit margin total asset turnover return on assets c) Comment on the effect of the industry on these ratios. NET PROFIT MARGIN JOHNSON&JOHNSON BEST BUY CO. INC. TOTAL ASSET TURNOVER RETURN ON ASSETS NET PROFIT TOTAL ASSET MARGIN TURNOVER JOHNSON&JOHNSON 21,00% 0,77 BEST BUY CO. INC. 2,49% 3,15 RETURN ON ASSETS JOHNSON&JOHNSON BEST BUY CO. INC. NET PROFIT MARGIN 21,00% TOTAL ASSET TURNOVER 0,77 RETURN ON ASSETS 2,49% 3,15 7,84% 16,17% Match each company with its financial information 1. ““The Company offers a range of personal computing products, mobile communication devices, and portable digital music and video players, as well as variety of related software, services, network solution and various hardware and software products” 10-K 2. “We operate membership warehouse based on the concept on the concepts that offering our members low prices on a limited nationally branded and selected private-label products in a wide range of merchandise categories will produce high sales volumes and rapid inventory turnover “. -10 K 3. “Our Retail segment includes all of our merchandising operations, including our large-format general merchandise and food discount stores. We offers both everyday essential and fashionable, differentiated merchandise at exceptional prices.” – 10 K COMPANY NET PROFIT MARGIN TOTAL ASSET TURNOVER CURRENT RATIO COMPANY “A” 1.52% 3.35 1.11 COMPANY “B” 15.61% 0.78 1.88 COMPANY “C” 3.52% 1.42 1.66 COMPANY COSTCO COMPANY A WHOLESALE CORPORATION (2) APPLE (2009) COMPANY B (1) TARGET COMPANY C CORPORATION (3) NET PROFIT MARGIN 1.52% TOTAL ASSET TURNOVER 3.35 CURRENT RATIO 1.11 15.61% 0.78 1.88 3.52% 1.42 1.66 KEY WORDS COSTCO WHOLESALE CORPORATION (2) APPLE (20x1.) (1) •high sales volumes and NET PROFIT MARGIN 1.52% TOTAL ASSET TURNOVER 3.35 CURRENT RATIO 1.11 15.61% 0.78 1.88 3.52% 1.42 1.66 •rapid inventory turnover •offers a range of personal computing products, mobile devices •various hardware and software products TARGET CORPORATION (3) •fashionable •differentiated merchandise at exceptional prices EVALUATING COMPANY‘S PERFORMANCE Profit drivers – financial ratios __________________ It can be increased by: Increasing sales volume Increasing sales price Decreasing expenses ___________________ It can be increased by: Increasing sales volume Decreasing less productive assets FINANCIAL LEVERAGE Increasing borrowing Repurchasing outstanding stock EVALUATING COMPANY‘S PERFORMANCE Profit drivers – financial ratios Net profit margin It can be increased by: Increasing sales volume Increasing sales price Decreasing expenses Asset turnover (efficiancy) It can be increased by: Increasing sales volume Decreasing less productive assets FINANCIAL LEVERAGE Increasing borrowing Repurchasing outstanding stock Profit drivers and business strategy Business strategies – financial perspectives Product differentiation (high value) strategy Research and development – product promotion Superiority and distinctiveness of their products That allows company higher ________ and higher ________ _________ __________ Low cost strategy Relies on efficient management of account receivable, inventory and productive assets To produce high ___________ __________ _______ Profit drivers and business strategy Business strategies – financial perspectives Product differentiation (high value) strategy Research and development – product promotion Superiority and distinctiveness of their products That allows company higher prices and higher net profit margin Low cost strategy Relies on efficient management of account receivable, inventory and productive assets To produce high asset turnover 121 Quiz Quiz 1 122 A company’s accounts receivable turnover rate decreased from 7.3 to 4.3 over the last three years. What is the most likely cause for the decrease? a. An increase in the discount offered for early payment. b. A more liberal credit policy. c. A change in net payment due from 30 to 25 days. d. Increased cash sales. Quiz 1 123 A company’s accounts receivable turnover rate decreased from 7.3 to 4.3 over the last three years. What is the most likely cause for the decrease? a. An increase in the discount offered for early payment. b. A more liberal credit policy. c. A change in net payment due from 30 to 25 days. d. Increased cash sales. Quiz 2 124 An increasing inventory turnover ratio: A) indicates a longer time span between the ordering and receiving of inventory B) Indicated a shorter time span between the ordering and receiving of inventory C) Indicates a shorter time span between purchase and sale of inventory D) Indicates a longer time span between the purchase and sale of inventory. Quiz 2 125 An increasing inventory turnover ratio: A) indicates a longer time span between the ordering and receiving of inventory B) Indicated a shorter time span between the ordering and receiving of inventory C) Indicates a shorter time span between purchase and sale of inventory D) Indicates a longer time span between the purchase and sale of inventory. Quiz 3 126 Positive financial leverage indicates: A) positive cash flow from financing activities B) a debt-to-equty ratio of higher than 1 C) a rate of return on assets exceeding the interest rate on debt D) a profit margin in one year exceeding the previos year’s profit margin Quiz 3 127 Positive financial leverage indicates: A) positive cash flow from financing activities B) a debt-to-equty ratio of higher than 1 C) a rate of return on assets exceeding the interest rate on debt D) a profit margin in one year exceeding the previos year’s profit margin Quiz 4 128 In 20x1 in company “X” the earnings per share is 9,50€ while the share market price is 228 €. In 20x2. earnings per share increased by 13%. Under the assumption of ceteris paribus the share market price is: A) 257,64€ B) 9,50 € C) 228,00 € D) can not determine without additional information. Quiz 4 129 In 20x1 in company “X” the earnings per share is 9,50 € while the share market price is 228 €. In 20x2. earnings per share increased by 13%. Under the assumption of ceteris paribus the share market price is: A) 257,64€ B) 9,50 € C) 228,00 € D) can not determine without additional information. Quiz 5 If the company is successful in reducing selling and administrative costs while maintaining sales volume and the sales price of its product, what is the effect on the net profit margin ratio: A) the ratio will not change B) the ratio will increase C) the ratio will decrease D) either (a) or (c) Quiz 5 If the company is successful in reducing selling and administrative costs while maintaining sales volume and the sales price of its product, what is the effect on the net profit margin ratio: A) the ratio will not change B) the ratio will increase C) the ratio will decrease D) either (a) or (c) 132 WORKSHOP Find the best ratio (solution) for a company 133 Current ratio A) 0,5 B) 1 C) 2 D) 2,5 Financial stability ratio A) 0,5 B) 0,7 C) 1 D) 1,5 Debt to assets ratio A) 0,25 B)0,5 C) 0,75 D) 1 Times interest earned A) 1 B) 5 C) 10 D) 15 C) 5 D) 10 Debt factor A) 2 B) 3 Accounts receivables turnover ratio A) 2 B) 3 C) 5 D) 10 Days to collect receivables A) 10 B) 14 C) 50 D) 90 C) 15% D) 25% Return on equity A) 5% B) 10% Find the best ratio (solution) for a company 134 Current ratio A) 0,5 B) 1 C) 2 D) 2,5 Financial stability ratio A) 0,5 B) 0,7 C) 1 D) 1,5 Debt to assets ratio A) 0,25 B)0,5 C) 0,75 D) 1 Times interest earned A) 1 B) 5 C) 10 D) 15 C) 5 D) 10 Debt factor A) 2 B) 3 Accounts receivables turnover ratio A) 2 B) 3 C) 5 D) 10 Days to collect receivables A) 10 B) 14 C) 50 D) 90 C) 15% D) 25% Return on equity A) 5% B) 10% 135 Industry analysis Exercise 1. Using financial information to identify mystery companies This financial information belongs to the following companies: A) retail fur store, B) advertising agency, C) wholesale candy company, D) car manufacturer. Required: Match each company with its financial information COMPANIES 1 2 3 4 Balance sheet data (component percentage) Cash 3.5 4.7 8.2 11.7 Accounts receivable 16.9 28.9 16.8 51.9 Inventory 46.8 35.6 57.3 4.8 Property and equipment 18.3 21.7 7.6 8.7 Income statements data (component percentage) Gross profit 22.0 22.5 44.8 N/A* Profit before taxes 2.1 0.7 1.2 3.2 Current ratio 1.3 1.5 1.6 1.2 Inventory turnover ratio 3.6 9.8 1.5 N/A Debt to equity ratio 2.6 2.6 3.2 3.2 Selected ratios COMPANIES 1 2 3 4 CAR MANUFACTURING WHOLESALE CANDY COMPANY RETAIL FUR STORE ADVERTISING AGENCY Balance sheet data (component percentage) Cash 3.5 4.7 8.2 11.7 Accounts receivable 16.9 28.9 16.8 51.9 Inventory 46.8 35.6 57.3 4.8 Property and equipment 18.3 21.7 7.6 8.7 Income statements data (component percentage) Gross profit 22.0 22.5 44.8 N/A* Profit before taxes 2.1 0.7 1.2 3.2 Current ratio 1.3 1.5 1.6 1.2 Inventory turnover ratio 3.6 9.8 1.5 N/A Debt to equity ratio 2.6 2.6 3.2 3.2 Selected ratios Exercise 2. Using financial information to identify mystery companies This financial information belongs to the following companies: travel agency, hotel, meat packer, drug company. Required: Match each company with its financial information COMPANIES 1 2 3 4 7.3 21.6 6.1 11.3 Accounts receivable 28.2 39.7 3.2 22.9 Inventory 21.6 0.6 1.8 27.5 Property and equipment 32.1 18.0 74.6 25.1 Income statements data (component percentage) Gross profit 15.3 N/A* N/A 43.4 Profit before taxes 1.7 3.2 2.4 6.9 Current ratio 1.5 1.2 0.6 1.9 Inventory turnover ratio 27.4 N/A N/a 3.3 Debt to equity ratio 1.7 2.2 5.7 1.3 Balance sheet data (component percentage) Cash Selected ratios COMPANIES 1 2 3 4 MEAT PACKER TRAVEL AGENCY HOTEL DRUG COMPANY 7.3 21.6 6.1 11.3 Accounts receivable 28.2 39.7 3.2 22.9 Inventory 21.6 0.6 1.8 27.5 Property and equipment 32.1 18.0 74.6 25.1 Income statements data (component percentage) Gross profit 15.3 N/A* N/A 43.4 Profit before taxes 1.7 3.2 2.4 6.9 1.5 1.2 0.6 1.9 27.4 N/A N/a 3.3 1.7 2.2 5.7 1.3 Balance sheet data (component percentage) Cash Selected ratios Current ratio Inventory turnover ratio Debt to equity ratio Exercise 3. Using financial information to identify mystery companies This financial information belongs to the following companies: TV company, grocery store, accounting firm, retail jewellery store. Required: Match each company with its financial information COMPANIES 1 2 3 4 Balance sheet data (component percentage) Cash 5.1 8.8 6.3 10.4 Accounts receivable 13.1 41.5 13.8 4.9 Inventory 4.6 3.6 65.1 35.8 Property and equipment 53.1 23.0 8.8 35.7 Income statements data (component percentage) Gross profit N/A* N/A 45.2 22.5 0.3 16.0 3.9 1.5 Current ratio 0.7 2.2 1.9 1.4 Inventory turnover ratio N/A N/A 1.4 15.5 Debt to equity ratio 2.5 0.9 1.7 2.3 Profit before taxes Selected ratios COMPANIES 1 2 3 4 TV COMPANY ACCOUNTIN G FIRM RETAIL JEVERLY STORE GROCERY STORE Balance sheet data (component percentage) Cash 5.1 8.8 6.3 10.4 Accounts receivable 13.1 41.5 13.8 4.9 Inventory 4.6 3.6 65.1 35.8 Property and equipment 53.1 23.0 8.8 35.7 Income statements data (component percentage) Gross profit N/A* N/A 45.2 22.5 0.3 16.0 3.9 1.5 0.7 2.2 1.9 1.4 N/A N/A 1.4 15.5 2.5 0.9 1.7 2.3 Profit before taxes Selected ratios Current ratio Inventory turnover ratio Debt to equity ratio 145 “In terms of marketable securities or new offerings, we’ve never bought anything that’s been pitched to us by an investment banker or broker. We read hundreds and hundreds of annual reports every year.” Warren Buffet 146 THANK YOU FOR YOUR ATTENTION!