* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Compared to U.S. Treasury investors, should U.S. Agency MBS

Beta (finance) wikipedia , lookup

Land banking wikipedia , lookup

Systemic risk wikipedia , lookup

Securitization wikipedia , lookup

Federal takeover of Fannie Mae and Freddie Mac wikipedia , lookup

Moral hazard wikipedia , lookup

United States housing bubble wikipedia , lookup

Financial economics wikipedia , lookup

Global saving glut wikipedia , lookup

Investment fund wikipedia , lookup

Financialization wikipedia , lookup

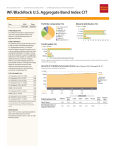

February 2017 Compared to U.S. Treasury investors, should U.S. Agency MBS investors be worried about their portfolios in a rising rate environment? By John Sprow The short answer is no. U.S. Mortgages generally outperform similar risk U.S. Treasuries across a variety of rate scenarios over longer periods of time. To demonstrate this we parsed over 30 years of Bloomberg Barclays U.S. Aggregate return data into periods of positive and negative returns to analyze the relative performance. The general return advantage of U.S. Agency Mortgages is clear and is shown below. Compound Twelve Month Return 14% 12.04% 10.98% 12% 10% 8% 6% Date Percentage Event 10/31/2008 -1.93% Global Financial Crisis 5/30/2003 -1.47% Iraq war 2/29/2008 -1.31% Global Financial Crisis 9/30/2002 -1.21% U.S. Stock market crash/Corporate fraud 9/30/1998 -1.21% Russia Default/Long term Capital meltdown 4/30/2008 1.76% Global Financial Crisis 1/30/2009 1.66% Global Financial Crisis 4/30/2009 1.39% Global Financial Crisis 1/29/1988 1.28% Early mortgage market volatility 6/30/1988 1.22% Early mortgage market volatility Negative 6.33% 5.45% 4% 2% It is helpful to understand relative performance outliers. The largest monthly excess relative performance “outliers” from the 30 years of data are shown below: 1.07% 0.88% 0.54% 0% -2% -4% -6% -5.66% -5.12% -8% Full range (1/1987 12/2016) Bloomberg Barclays U.S. Bloomberg Barclays U.S. Aggregate Index Up Aggregate Index Down months months Positive Interestingly, half of the large excess relative returns (positive and negative) were observed during the 2008-2009 global financial Sources: Amundi SB calculations, based on data from Bloomberg Indices. crisis. Although U.S. Agency Mortgages suffered no credit or liquidity issues, all spread assets dramatically underperformed U.S. However, excess returns are not free. This performance advantage Treasuries due to the massive flight to quality into U.S. Treasury is not certain and does vary especially over short periods of time. securities. The other specific events are characterized by less dramatic but similar market moving events in the financial There are a few reasons for these divergences. In the United markets. States, a mortgage borrower can refinance into a new loan (without penalty) if mortgage rates fall. This is similar to many In summary the data support our a priori expectation (and corporate bonds. In addition U.S. Agency Mortgages have spread experience) that U.S. Agency Mortgages generally outperform risk versus U.S. Treasuries, as they are not the same instrument comparable duration Treasuries except in large or unexpected and relative performance will diverge in certain scenarios. For rate moves or flight to quality events. We are happy to discuss this both of these reasons relative performance can vary. further. Bloomberg Barclays Treasury Bloomberg Barclays MBS Difference John Sprow is an Executive Vice President and Senior Investment Specialist at Amundi Smith Breeden. Mr. Sprow is a 30 year investment professional and draws on his deep investment experience to help clients develop investment solutions. During his career Mr. Sprow has served as the Chief Risk Officer, co-head of the Investment Management Group, Senior Portfolio Manager, and leader of the firm’s credit department. Mr. Sprow has been the lead portfolio manager for nearly all of the investment strategies offered by Amundi Smith Breeden. He joined the firm in 1987. Contributions from Yue Teng, Paul Younes, Kevin Monds, and Greg Brown. For more information on this topic or to inquire about working with Amundi Smith Breeden, please contact us at 919.967.7221 or email [email protected]. This is our current assessment of the market and is subject to change. All information is provided for informational purposes only and should not be considered a recommendation to buy or sell securities. Past results are not necessarily indicative of future performance. This information is taken, in part, from sources that we believe to be reliable, but no warranty is made as to accuracy. No part of this presentation may be reproduced in any form, or referred to in any other written materials, without the written permission of Amundi Smith Breeden LLC.