* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Dr. Mitchell - people.vcu.edu

Futures exchange wikipedia , lookup

Stock exchange wikipedia , lookup

Financial crisis wikipedia , lookup

Kazakhstan Stock Exchange wikipedia , lookup

International monetary systems wikipedia , lookup

Reserve currency wikipedia , lookup

Bretton Woods system wikipedia , lookup

Purchasing power parity wikipedia , lookup

Foreign exchange market wikipedia , lookup

Foreign-exchange reserves wikipedia , lookup

Fixed exchange-rate system wikipedia , lookup

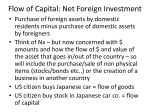

Dr. Mitchell/ECO 315/Spring 2002 1 Lecture9-BOP The Balance of Payments Accounts Double-entry bookkeeping 2 sides to each transaction the flow of goods & services, or assets the corresponding payments. Example: US importer buys UK cars for $1mil $1 mil debit (cars in) $1 mil credit (money out) “exports” are credits (+) “imports” are debits (-) 3 Major Accounts in BOP accounts Current Account Capital Account Official Settlements Account Notes: Balance on the 3 accounts must sum to zero. The total value of goods, services, and assets that come in must equal the value that flow out. Data problems lead to a statistical discrepancy. Oftentimes Official Settlements appear as a sub-account in the Capital Account. Dr. Mitchell/ECO 315/Spring 2002 2 Lecture9-BOP Current Account (Trade in Goods & Services) The entries in the current account represent the flow of actual goods, services, etc. The “trade balance” used to be defined as the balance on merchandise trade. Now it is defined as the combined balances on merchandise trade and trade in services. Interpreting the balance on the current account Current account surplus When the credits are more than the debits. The country is exporting more than it is importing. Current account deficit The opposite. Capital Account (International Borrowing & Lending & Exchange of Assets) Purchase of a foreign asset (such as stocks, bonds, real estate) or lending abroad Also called a capital outflow, because the money flows out. When this is extreme, it is called, “capital flight”. Capital flight occurs when residents are become nervous that domestic investment is risky. Sale of a domestic asset to a foreigner or borrowing from abroad Called a capital inflow. Interpreting the balance on the capital account Capital account surplus Means credits > debits. The country is a net seller of assets. Foreigners buy more of its assets than it buy of theirs. Capital account deficit They are net investors abroad. Dr. Mitchell/ECO 315/Spring 2002 3 Lecture9-BOP Official Settlements Account (All Official Transactions) This account keeps track of official holdings of foreign exchange reserves. Negative Balance If there is a negative balance, this means that the stock of foreign exchange reserves has increased (they have “imported” foreign exchange reserves). This means there are fewer units of foreign exchange, more units of the domestic currency in circulation. Interpretation in Flexible exchange rate environment: Central banks are trying to decrease the value of the domestic currency by selling it. Interpretation in Fixed exchange rate environment: At the current exchange rate, the quantity demanded of foreign exchange is less than the quantity supplied. (The value of the domestic currency is set below the equilibrium rate.) Positive Balance If there is a positive balance, this means that the official stock of foreign exchange reserves has decreased. There are more foreign currencies, fewer units of domestic currency in circulation. Interpretation in Flexible exchange rate environment: Central banks are trying to increase the value of the domestic currency by buying it up. Interpretation in Fixed exchange rate environment: At the current exchange rate, the quantity demanded of foreign exchange is greater than the quantity supplied. (The value of the domestic currency is above below the equilibrium rate.) Dr. Mitchell/ECO 315/Spring 2002 4 Lecture9-BOP “The” Balance of Payments CAB + KAB + OSB = 0 CAB + KAB = - OSB “The balance of payments” is often used in the vernacular to refer to the combined balances of the current and capital accounts. This is a correct usage. It is also often popularly confused with the balance on the current account and even the balance of trade. “The balance of payments” represents net official transactions, in other words, net intervention in the foreign exchange markets. Balance of payments deficit A surplus (positive balance) in the official settlements account. Net official sales of foreign exchange or net foreign official accumulation of dollars. The gov’t(s) is (are) trying to increase the value of this country’s currency. In the case of a fixed exchange rate, the market is placing downward pressure on the value of the domestic currency which the gov’t is forced to counteract. Note that in order to maintain this situation for long periods of time this country will need to have a reliable source of foreign exchange, such as export revenues, loans of hard currencies, international aid in hard currencies. Balance of payments surplus Opposite. The gov’t is trying to bring down the value of this country’s currency. Balance of payments = zero Expect this if the exchange rate is primarily set in the market (floating or lightly managed float). Expect this if a fixed exchange rate is set at about the right level, since the gov’t sales and purchases of foreign exchange will offset each other. Important note If BOP = 0, then the current account and capital account balances must be of equal size and opposite sign! Dr. Mitchell/ECO 315/Spring 2002 5 Lecture9-BOP Balance of Payments Crisis A balance of payments crisis occurs when a country runs out of foreign exchange reserves (or comes close). General description of a balance of payments crisis A fixed exchange rate is set pegging the currency to, say, the US dollar. There is a growing demand for dollars over time. (In a flexible exchange rate environment, the value of the local currency would be falling over time.) In order to maintain the fixed exchange rate, the local central bank is forced to buy more and more of the local currency, selling dollars in exchange. But what happens when the local central bank begins to run low on US dollars? Market response: Speculative Attack As international investors become aware that the central bank is running low on foreign exchange, they realize that there is a good chance the country won’t be able to “defend” its current exchange rate. They conclude that the value of the currency is likely to drop. Therefore they begin selling it off as fast as they can. The more they want to sell, the more pressure there is on the exchange rate, and the faster foreign exchange reserves fall, making the fears come true. Some actors may begin to bet against the local currency in other ways, such as by selling forward contracts on the local currency or taking out loans denominated in the local currency (do you see why?) Government Response: Floating Rates or Exchange controls These days, worldwide market forces are much larger than the resources of a typical country. The government may decide to let the currency float. It may decide to maintain the fixed rate but institute exchange controls that limit the amount of currency that can be traded (may need a permit). Another feature of exchange controls may be that any resident that earns hard currencies (say, through exporting goods) is obligated to trade the hard currency for the local currency. IMF Response: Loans or Guarantees The IMF has the option to give or lend US dollars to the country to use in its fight against the speculative attack. It can also guarantee the country that it will provide the amount needed. It is hoped that IMF action will help directly but also that it will convince people that the government can now defend its exchange rate, thereby lessening the demand for dollars and reducing the magnitude of the problem.