* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download State of the Markets

Survey

Document related concepts

Investment management wikipedia , lookup

Systemic risk wikipedia , lookup

United States housing bubble wikipedia , lookup

Household debt wikipedia , lookup

Syndicated loan wikipedia , lookup

Investment fund wikipedia , lookup

Business valuation wikipedia , lookup

Credit rationing wikipedia , lookup

Public finance wikipedia , lookup

Securitization wikipedia , lookup

Financialization wikipedia , lookup

Lattice model (finance) wikipedia , lookup

Financial economics wikipedia , lookup

Stock selection criterion wikipedia , lookup

Transcript

This is not research and is not intended as such. This has been prepared by individuals on the sales/trading desks of the Securities Division.

This material does not represent a formal or official view of Goldman Sachs as the views expressed herein are solely those of the authors,

which may differ from those of Global Investment Research.

PROPRIETARY AND CONFIDENTIAL

State of the Markets

Best Long and Short Risk Strategies

August 2009

Hedge Fund Strategies

Risk Factors – Please Read

CDS Risk Factors

No Claims on the Reference Entities. Participation in a Credit Default Swap does not constitute a purchase or other acquisition or assignment of any interest in any obligation of any

Reference Entity. The parties to the Credit Default Swap will not have any recourse against any Reference Entity and will have no rights to enforce directly compliance by any Reference

Entity with the terms of its obligations that are referred to in the Credit Default Swap, no rights of set-off against any Reference Entity, no voting rights with respect to any Reference

Entity and no security interest in any Reference Obligation.

Limited Provision of Information about Reference Obligations/Reference Entities. No information will be provided to prospective counterparties with respect to any Reference

Obligation or Reference Entity. Investors should conduct their own investigation and analysis with respect to the creditworthiness of each Reference Obligation and the likelihood of the

occurrence of an event triggering payments under the Credit Default Swap occurring with respect to each Reference Entity and Reference Obligation.

Concentration Risk/Structural Risk. The concentration of the Reference Obligations in the Index in one particular type of structured product security subjects the Credit Defaults Swap

to a greater degree of risk with respect to defaults within such type of structured product security. Prospective counterparties should review the list of Reference Obligations and conduct

their own investigation and analysis with regard to each Reference Obligation, including the credit, market, interest rate, structural and legal risks associated with each Reference

Obligation.

Evolving Nature of the Credit Default Swap Market. Credit default swaps (including credit default swaps on asset backed securities) are relatively new instruments in the market. While

ISDA has published and supplemented the ISDA Credit Derivatives Definitions in order to facilitate transactions and promote uniformity in the credit default swap market, the credit

default swap market is expected to change and the ISDA Credit Derivatives Definitions and terms applied to credit derivatives are subject to interpretation and further evolution. There

can be no assurance that changes to the ISDA Credit Derivatives Definitions and other terms applicable to credit derivatives generally will be predictable. Amendments or supplements to

the ISDA Credit Derivatives Definitions that are published by ISDA will only apply to the Credit Default Swap if the Credit Default Swap is amended. Therefore, in addition to the credit risk

of Reference Obligations, Reference Entities and the credit risk of their counterparty, persons who enter into Credit Default Swaps are also subject to the risk that the ISDA Credit

Derivatives Definitions could be interpreted in a manner that would be adverse to them or that the credit derivatives market generally may evolve in a manner that would be adverse to

them.

Credit Ratings. Credit ratings represent the rating agencies’ opinions regarding credit quality and are not a guarantee of quality. Rating agencies attempt to evaluate the safety of

principal and/or interest payments and do not evaluate the risks of fluctuations in market value. Accordingly, credit ratings may not fully reflect the true risks underlying any Credit Default

Swap. Also, rating agencies may fail to make timely changes in credit ratings in response to subsequent events, so that an issuer’s current financial condition may be better or worse than

a rating indicates.

Conflicts of Interest; No Reliance. Goldman Sachs does not provide investment, accounting, tax or legal advice in respect of the Credit Default Swaps and shall not have a fiduciary

relationship with any counterparty to a Credit Default Swap. In particular, Goldman Sachs does not make any representations as to (a) the suitability of any Credit Default Swap, (b) the

appropriate accounting treatment or possible tax consequences of any Credit Default Swap or (c) the future performance of any Credit Default Swap either in absolute terms or relative to

competing investments. Prospective counterparties should obtain their own independent accounting, tax and legal advice and should consult their own professional investment advisor to

ascertain the suitability of any Credit Default Swap, including such independent investigation and analysis regarding the risks, security arrangements and cash-flows associated with any

Credit Default Swap as they deem appropriate to evaluate the merits and risks of any Credit Default Swap

Goldman Sachs may, by virtue of its status as an underwriter, advisor or otherwise, possess or have access to non-publicly available information relating to the Reference Entities and/or

the obligations of the Reference Entities (including the Reference Obligations) and has not undertaken, and does not intend, to disclose, such status or nonpublic information in

connection with any Credit Default Swap. Accordingly, this presentation may not contain all information that would be material to the evaluation of the merits and risks of entering into any

Credit Default Swap.

Goldman Sachs does not make any representation, recommendation or warranty, express or implied, regarding the accuracy, adequacy, reasonableness or completeness of the

information contained herein or in any further information, notice or other document which may at any time be supplied in connection with a Credit Default Swap and accepts no

responsibility or liability therefore. Goldman Sachs may from time be an active participant on both sides of the market and have long or short positions in, or buy and sell, securities,

commodities, futures, options or other derivatives identical or related to those mentioned herein. Goldman Sachs may have potential conflicts of interest due to present or future

relationships between Goldman Sachs and any Reference Entity or any obligation of any Reference Entity.

2

Risk Factors – Please Read

Prospective Investors or Counterparties should read the final swap confirmation or Offering Circular, as the case may be, for a more complete description of risk factors

relevant to the particular investment. Entering into the Default Swaps or purchasing the Securities involves certain risks. Prospective swap counterparties or Investors should carefully

consider the following factors, as well as the risk factors included in the final swap confirmation or final Offering Circular, prior to entering into the Transaction. The following is not

intended to be an exhaustive list of the risks involved in the Transaction.

The final Offering Circular for any funded transaction will include more complete descriptions of the risks described below as well as additional risks. Any decision to invest in

the securities described herein should be made after reviewing the Offering Circular, conducting such investigations as the investor deems necessary and consulting the investor’s own

legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment in the securities

Risks Associated with Management Rights. The exercise of management rights by the Investor, particularly in the form of Subordination Trades, can potentially (a) increase the risk of

the investment by reducing the Credit Enhancement and hence increase the probability of suffering an actual “Incurred Loss” from a subsequent Credit Event (b) cause a rating

downgrade of the Portfolio Notes, i.e. if trading results in a reduction in Credit Enhancement such that the Rating Agencies determine that the tranche can no longer maintain its rating or

(c) increase the mark-to-market volatility of the Portfolio Notes.

Additional Credit Risks. In addition to the credit risk of the Reference Portfolio, the parties to the Default Swaps are exposed to the credit risk of receipt of payments from the other

party, and the Investors in the Securities are exposed to the credit risk of the issuer of the collateral securing the Securities for the full notional amount of their investment

Limited Liquidity of the Transaction. There is currently no market for the Default Swaps or Securities. The Default Swaps represent bilateral contracts that cannot be transferred or

terminated without the consent of the other party, which consent may be withheld or delayed for a number of reasons. Goldman Sachs may, but is not obligated to, unwind or terminate a

Default Swap under terms acceptable to it in its sole discretion. There can be no assurance that a secondary market for the Securities will develop or, if a secondary market does

develop, that it will provide the holder of the Securities with liquidity, or that it will continue for the life of the Securities. Moreover, the limited scope of information available to the swap

counterparties and/or Investors regarding the Reference Entities and the nature of any Credit Event, including uncertainty as to the extent of any reduction to be applied to the notional of

each class if a Credit Event has occurred but the amount of the relevant reduction in the notional amount has not been determined, may further affect the liquidity of the Default Swaps or

Securities, especially the subordinated classes. Consequently, any swap counterparty under the Default Swaps or Investor in the Securities must be prepared to hold such Default Swaps

or Securities for an indefinite period of time or until final maturity.

Mark-to-Market Risk. Investors and swap counterparties are exposed to considerable mark-to-market volatility following changes in any of the following: spreads of the credits in the

reference portfolio, comparable CDO spreads, ratings migration in the reference portfolio, ratings migration of the Default Swaps or Securities, and credit events in the reference portfolio

(and hence reduction of subordination). These will be reflected in mark-to-market valuations which are likely to be more volatile than an equivalently rated unleveraged investment

Additional Risk of Loss due to Definitions of Credit Events. The probability of occurrence of a Credit Event may be higher than the probability of what may be perceived as a “default”

(for example, what is tracked by rating agencies in their default studies) because of their broader definitions. This is particularly true with respect to the inclusion of “Restructuring” as a

Credit Event in all standard credit default swaps

Evolving Nature of the Credit Default Swap Market. Markets in different jurisdictions have also already adopted and may continue to adopt different practices with respect to the Credit

Derivative Definitions, particularly, but not limited to, the definition of “Restructuring”. Past events (e.g. Conseco restructuring and Railtrack bankruptcy) exemplify the fact that the Credit

Derivatives Definitions may contain ambiguous provisions that are subject to interpretation and may result in consequences that are adverse to the investor.

3

Risk Factors – Please Read

“Cheapest-to-Deliver” Risk. Given that Goldman Sachs, as buyer of protection, has discretion to choose the portfolio of valuation obligations used to calculate the severity of losses

following a Credit Event, it is likely that the portfolio of valuation obligations selected will be obligations of the Reference Entity with the lowest market value that are permitted to be

delivered pursuant to the relevant documentation. This could result in a lower recovery value and hence a larger loss amount

Credit Ratings. Credit ratings represent the rating agencies’ opinions regarding credit quality and are not a guarantee of quality. Rating agencies attempt to evaluate the safety of

principal and/or interest payments and do not evaluate the risks of fluctuations in market value. Accordingly, the credit ratings may not fully reflect the true risks of the Transaction. Also,

rating agencies may fail to make timely changes in credit ratings in response to subsequent events, so that an issuer’s current financial condition may be better or worse than a rating

indicates

Interest Rates. Changes in the market conditions such as the interest rate environment may impact the valuation of structured credit products

Conflicts of interest; No reliance. Goldman Sachs does not provide investment, accounting, tax or legal advice in respect of the Transaction and shall not have a fiduciary relationship

with any Default Swap counterparty or Investor. In particular, Goldman Sachs does not make any representations as to (a) the suitability of the Transaction, (b) the appropriate

accounting treatment or possible tax consequences of the Transaction or (c) the future performance of the Transaction either in absolute terms or relative to competing investments.

Prospective Default Swap counterparties and/or Investors should obtain their own independent accounting, tax and legal advice and should consult their own professional investment

advisor to ascertain the suitability of the Transaction, including such independent investigation and analysis regarding the risks, security arrangements and cash-flows associated with the

Transaction as they deem appropriate to evaluate the merits and risks of the Transaction

Goldman Sachs may, by virtue of its status as an underwriter, advisor or otherwise, possess or have access to non-publicly available information relating to the Collateral, the issuer(s)

thereof, the Reference Entities and/or the obligations of the Reference Entities and has not undertaken, and does not intend, to disclose, such status or non-public information in

connection with the Transaction. Accordingly, this presentation may not contain all information that would be material to the evaluation of the merits and risks of entering into the

Transaction

Markets Risk

Emerging Markets: Political and economic structures in countries with emerging economies or stock markets may be undergoing significant evolution and rapid development, and such

countries may lack the social, political and economic stability characteristics of more developed countries including a significant risk of currency value fluctuation. Such instability may

result from, among other things, authoritarian governments, or military involvement in political and economic decision-making, including changes or attempted changes in governments

through extra-constitutional means; popular unrest associated with demands for improved political, economic or social conditions; internal insurgencies; hostile relations with neighbouring

countries; and ethnic, religious and racial disaffections or conflict. Certain of such countries may have in the past failed to recognise private property rights and have at times nationalised

or expropriated the assets of private companies. As a result, the risks from investing in those countries, including the risks of nationalisation or expropriation of assets, may be

heightened.

Foreign Exchange: Foreign currency denominated Underlyers and Products are subject to fluctuations in exchange rates that could have an adverse effect on the value or price of, or

income derived from, the Products.

4

Risk Factors – Please Read

Risk Disclosure Regarding Equity Swaps or Similar Swap Transactions or Agreements

Prior to entering into an equity swap, contract for difference (CFD) or other similar swap transaction or agreement (hereinafter referred to as a "Swap Transaction"), Goldman Sachs

believes you should be aware of the following general risks associated with Swap Transactions: (i) Liquidity Risk: There is no public market for Swap Transactions and, therefore, it may

be difficult or impossible to liquidate an existing position on favorable terms; (ii) Transfer Restrictions: Swap Transactions entered into with Goldman Sachs cannot be assigned or

otherwise transferred without its prior written consent and, therefore, it may be impossible for you to transfer any Swap Transaction to a third party; (iii) Credit Risk: Because Goldman

Sachs, or one of its affiliates, may be obligated to make substantial payments to you during the term of a Swap Transaction, you must evaluate the credit risk of doing business with

Goldman Sachs or its affiliates; (iv) Pricing and Valuation: The price of each Swap Transaction is individually negotiated between Goldman Sachs and each counterparty and Goldman

Sachs does not represent of warrant that the prices for which it offers Swap Transactions are the best prices available, possibly making it difficult for you to establish what is a fair price

for a particular Swap Transaction; (v) Early Termination Payments: The provisions of the Swap Transaction may allow for early termination and, in such cases, either you or Goldman

Sachs may be required to make a potentially significant termination payment depending upon whether the Swap Transaction is in-the-money to Goldman Sachs or you at the time of

termination; (vi) Proprietary Trading: Goldman Sachs engages in proprietary trading for its own account and the accounts of its affiliates in the same or similar instruments underlying

Swap Transactions (including such trading as Goldman Sachs deems appropriate in its sole discretion to hedge its market risk in any Swap Transaction whether between Goldman

Sachs and you or with third parties) and such trading may affect the value of a Swap Transaction; and (vii) Indexes: Goldman Sachs does not warrant, and takes no responsibility for, the

structure, method of computation or publication of any currency exchange rates, interest rates, indexes of such rates, or equity indexes, unless Goldman Sachs specifically advises you

otherwise.

To understand clearly the terms and conditions of any Swap Transactions you may enter into, you should carefully review the Master Agreement, including any related schedules, credit

support documents, addenda and exhibits. You should not enter into Swap Transactions unless you understand the terms of the Swap Transaction you are entering into as well as the

nature and extent of your risk exposure. You should also be satisfied that the Swap Transaction is appropriate for you in light of your circumstances and financial condition.

You should not construe this risk disclosure statement as legal, business, or tax advice, and you should consult your attorney, business advisor, and tax advisor as to legal, business, tax,

and related matters concerning Swap Transactions.

Clients must be Eligible Contract Participants ("ECP") as defined in Section 1a(12) of the Commodity Exchange Act of 2000 in order to engage in swap transactions.

Generally, customers in either of the following categories are ECPs:

1. corporation, partnership, proprietorship, organization, trust, individual or other entity that has total assets exceeding $10mm.

2. ERISA plan, governmental employee benefit plan which has assets exceeding $5mm or has its investment decisions made by a CTA, financial institution or insurance

company.

5

Risk Factors – Please Read

Variance Swap Risk Disclosures

Selling variance swaps: Investors who sell a variance swap risk unlimited losses if the realized volatility of the underlyer exceeds the reference strike of the swap at expiration.

Buying variance swaps: Investors who buy a variance swap risk a maximum loss equal to the square of the variance strike times the variance notional (variance units * variance

strike2), if realized volatility goes to zero.

Prior to entering into a variance swap, dispersion swap or other similar swap transaction or agreement (hereinafter referred to as a "Swap Transaction"), Goldman Sachs believes you

should be aware of the following general risks associated with Swap Transactions: (i) Liquidity Risk: There is no public market for Swap Transactions and, therefore, it may be difficult or

impossible to liquidate an existing position on favorable terms; (ii) Transfer Restrictions: Swap Transactions entered into with Goldman Sachs cannot be assigned or otherwise

transferred without its prior written consent and, therefore, it may be impossible for you to transfer any Swap Transaction to a third party; (iii) Credit Risk: Because Goldman Sachs, or

one of its affiliates, may be obligated to make substantial payments to you during the term of a Swap Transaction, you must evaluate the credit risk of doing business with Goldman

Sachs or its affiliates; (iv) Pricing and Valuation: The price of each Swap Transaction is individually negotiated between Goldman Sachs and each counterparty and Goldman Sachs

does not represent of warrant that the prices for which it offers Swap Transactions are the best prices available, possibly making it difficult for you to establish what is a fair price for a

particular Swap Transaction; (v) Early Termination Payments: The provisions of the Swap Transaction may allow for early termination and, in such cases, either you or Goldman Sachs

may be required to make a potentially significant termination payment depending upon whether the Swap Transaction is in-the-money to Goldman Sachs or you at the time of

termination; (vi) Proprietary Trading: Goldman Sachs engages in proprietary trading for its own account and the accounts of its affiliates in the same or similar instruments underlying

Swap Transactions (including such trading as Goldman Sachs deems appropriate in its sole discretion to hedge its market risk in any Swap Transaction whether between Goldman

Sachs and you or with third parties) and such trading may affect the value of a Swap Transaction; and (vii) Indexes: Goldman Sachs does not warrant, and takes no responsibility for, the

structure, method of computation or publication of any currency exchange rates, interest rates, indexes of such rates, or equity indexes, unless Goldman Sachs specifically advises you

otherwise.

Returns on variance and dispersion swaps are not linear. To understand clearly the terms and conditions of any Swap Transactions you may enter into, you should carefully review

the Master Agreement, including any related schedules, credit support documents, addenda and exhibits. You should not enter into Swap Transactions unless you understand the terms

of the Swap Transaction you are entering into as well as the nature and extent of your risk exposure. You should also be satisfied that the Swap Transaction is appropriate for you in light

of your circumstances and financial condition. Clients must be Eligible Contract Participants ("ECP") as defined in Section 1a(12) of the Commodity Exchange Act of 2000 in order to

engage in swap transactions. Generally, customers in either of the following categories are ECPs:

1. Corporation, partnership, proprietorship, organization, trust, individual or other entity that has total assets exceeding $10mm or

2. ERISA plan, governmental employee benefit plan which has assets exceeding $5mm or has its investment decisions made by a CTA, financial institution or insurance company.

6

Risk Factors – Please Read

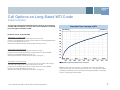

Risk Disclosure Regarding OTC Options

OTC options may trade at a value other than that which may be inferred from the current levels of interest rates, dividends and the underlyer due to other factors including, but not limited

to, expectations of future levels of interest rates, future levels of dividends and the volatility of the underlyer at any time prior to maturity.

Prior to entering into an OTC Option transaction you should be aware of the general risks associated with OTC Option transactions: Liquidity Risk: There is no public market for OTC

Option transactions and, therefore, it may be difficult or impossible to liquidate an existing position on favorable terms; Transfer Restrictions: OTC Option transactions entered into with

Goldman Sachs cannot be assigned or otherwise transferred without its prior written consent and, therefore, it may be impossible for you to transfer any OTC Option transaction to a third

party; Counterparty Credit Risk: Because Goldman Sachs, or one of its affiliates, may be obligated to make substantial payments to you as a condition of an OTC option transaction,

you must evaluate the credit risk of doing business with Goldman Sachs or its affiliates; Pricing and Valuation: The price of each OTC Option transaction is individually negotiated

between Goldman Sachs and each counterparty and Goldman Sachs does not represent or warrant that the prices for which it offers OTC Option transactions are the best prices

available, possibly making it difficult for you to establish what is a fair price for a particular OTC Option transaction; Proprietary Trading: Goldman Sachs engages in proprietary trading

for its own account and the accounts of its affiliates in the same or similar instruments underlying OTC Option transactions (including such trading as Goldman Sachs deems appropriate

in its sole discretion to hedge its market risk in any OTC Option transaction whether between Goldman Sachs and you or with third parties) and such trading may affect the value of an

OTC Option transaction.

Note: Options involve risk and are not suitable for all investors. Please ensure that you have read and understood the current options disclosure document before entering into any

standardized options transactions. United States listed options disclosure documents are available from our sales representatives or at http://theocc.com/publications/risks/riskstoc.pdf. A

secondary market may not be available for all options. Transaction costs may be a significant in option strategies calling for multiple purchases and sales of options, such as spreads.

When purchasing long options an investor may loose their entire investment and when selling uncovered options the risk is potentially unlimited. Supporting documentation for any

comparisons, recommendations, statistics, technical data, or other similar information will be supplied upon request.

To understand clearly the terms and conditions of any OTC Option transactions you may enter into, you should carefully review the Master Agreement, including any related schedules,

credit support documents, addenda and exhibits. You should not enter into OTC Option transactions unless you understand the terms of the OTC Option transaction you are entering into

as well as the nature and extent of your risk exposure. You should also be satisfied that the OTC Option transaction is appropriate for you in light of your circumstances and financial

condition. You may be requested to post margin or collateral to support written OTC options at levels consistent with the internal policies of Goldman Sachs.

7

Table of Contents

I.

State of the Markets

II.

Tradable Themes

I.

US Commercial Real Estate

II. Public Balance Sheet Conditions

III. Japan

IV. US Consumer and Retail

III.

Other Market Opportunities

I.

Commodity Opportunities

II. Event-Driven Market Neutral Investing

IV.

Appendix

V.

Legal Disclosures

8

State of the Markets Overview

Summary of Hedge Fund Strategies Group Views

If you believe this thesis, then…

Trading and Hedging Opportunities

Consumer

Debt

Repayment

Housing Bubble

- Short REIT Equities

- Buy AAA CMBS

Wealth

Destruction

Higher

Savings

Rate

Lower

Consumer

Spending

Prolonged

Elevated

Unemployment

Equity Market

Decline

- Buy FX Options on CommodityLinked Currencies

- Buy Equities of Non-US Commodity

Producers

- Sell Caps on the US Tax Index or

Receive the SIFMA Ratio

- Short JPY

- Buy Yen CMS Caps

- Short US Consumer and Retail

companies via equity or CDS

- Sell Aluminum Caps

Credit Crunch

Government

Intervention

Risk Shifting to Public

Balance Sheet

- Long Crude Oil vs Short Heating

Oil (Short the Crack Spread)

- Engage in Event-Driven Market

Neutral strategies

For Discussion Purposes Only.

9

State of the Markets

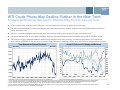

In 2009 Credit Spreads Have Tightened1,2

1Jan2008

9

Equity Prices Are Up From March ’09 Lows1

29Jul2009

8

6

5

7

6

4

5

3

4

3

2

2

1

2008

1

2009

Jan

Apr

Jul

Oct

Jan

Apr

Jul

CDX Index CDXHY Index (RHS) LCDX Index (RHS) iTraxx Europe iTraxx Asia

1.2

1.1

1

0.9

0.8

0.7

0.6

0.5

0.4

0.3

1Jan2008

2008

1Jan2008

29Jul2009

1.6

1.4

0.8

1.2

0.7

1

0.6

0.8

0.5

0.6

0.4

0.4

2008

Jan

Apr

Jul

CMBX AAA OTR ABX AAA OTR

0.2

2009

Oct

Jan

Apr

Jul

1 Source: Goldman Sachs. Data as of July 29, 2009. Past performance is not indicative of future results.

2 All credit indices shown are for 5y OTR contracts

Jul

In 2009 Commodities Markets Recovering1

0.9

0.3

2009

Jan

Apr

Jul

Oct

Jan

Apr

NASDAQ FTSE SX5E NIKKEI HANG SENG KOSPI BOVESPA

In 2009 Commercial Mortgages Up, Subprime Down1,2

1

29Jul2009

1Jan2008

2008

29Jul2009

2009

Jan

Apr

Jul

Oct

Jan

Apr

GS Agriculture GS Precious Metals GS Industrial Metals GS Petroleum

Jul

10

State of the Markets

“Green Shoots” Are Sprouting But Look Less Lively Compared To Nominal Values

US Production Could Be Bouncing2

Economic Data May Have Stopped Their Decline1

22Jul2009

80

600,000

100

70

500,000

80

400,000

60

300,000

40

200,000

20

2005

2006

2007

2008

2009

22Jul2009

50

40

30

20

2000 2001 2002 2003 2004 2005 2006 2007 2008

ISM's Purchasing Managers Index

ISM's CUSTOMERS' INVENTORIES INDEX ISM New Orders Index

Jan Jul Jan Jul Jan Jul Jan Jul Jan Jul

Initial Jobless Claims (LHS)

Consumer Confidence (RHS)

Industrial Production Is Down Despite Small Bounce3

2009

US Housing Starts Have Bounced But Are At All-Time Lows4

2,500

120

Germany

110

Japan

US

2,000

90

(Thousands)

100

"Green Shoots"

80

Japan Industrial Production

Back to 1984 Levels

70

US Industrial Production

Back to 1998 Levels

60

Germany Industrial Production

Back to 2000 Levels

Jan-09

Jan-08

Jan-07

Jan-06

Jan-05

Jan-04

Jan-03

Jan-02

Jan-01

Jan-00

Jan-99

Jan-98

Jan-97

Jan-96

Jan-95

Jan-94

Jan-93

Jan-92

Jan-91

1,500

1,000

"Green Shoots"

500

50

1

2

3

4

22Jul1999

60

Index

New Claims

22Jul2004

120

700,000

0

81 83 85

87 89

91 93

95 97 99

01 03

05 07 09

Source: Goldman Sachs. Data as of July 22, 2009. Past performance is not indicative of future results.

Source: Institute for Supply Management (ISM). Data as of July 22, 2009. Past performance is not indicative of future results.

Source: Haver Analytics, Japan Ministry of Economy, Trade & Industry; Statistisches Bundesamt. Data as of July 22, 2009. Past performance is not indicative of future returns

Source: US Department of Commerce, Bureau of the Census. Chart only shows data back to 1981 so that recent price movement will be recognizable. Full data history available upon request. Indicative Only.

Past performance is not indicative of future results. Data as of July 22, 2009

11

State of the Markets

China May Be Helping

China’s GDP growth has remained positive even through the financial crisis and Goldman Sachs Research projects that GDP growth

will return to 12% in 20101

Industrial Profit growth also points to a rapid recovery in the Chinese economy2

China Industrial Production and Real GDP1

China Sequential Industrial Profit Growth2

% YoY

20%

18%

GS

Proj.

16%

14%

12%

10%

8%

6%

4%

2%

China - Industrial Production (% chg yoy)

China - Real GDP (% chg yoy)

1

2

Jan-10

Jan-09

Jan-08

Jan-07

Jan-06

Jan-05

Jan-04

Jan-03

Jan-02

Jan-01

Jan-00

Jan-99

Jan-98

Jan-97

Jan-96

Jan-95

0%

Source: Goldman Sachs Research ERIWN Economic Database. https://360.gs.com/gs/portal/research/econ/erwin/erwinforecasts/ Past performance is not indicative of future results.

Source: Goldman Sachs Research: Asia Economic Data Flash. June 26, 2009. https://360.gs.com/gs/portal/?st=1&action=action.binary&d=7391688&fn=/document.pdf. Past performance is not indicative of

future results. Goldman Sachs provides no assurance or guarantee that future results will be consistent with the projected analysis.

12

State of the Markets

Government Intervention Has Been and May Continue To Be Substantial

Central Bank Lending Rates Have Plunged1

6%

21Jul2006

US Federal Debt Held by the Public (% of GDP)2

23Jul2009

5%

4%

3%

2%

1%

0%

2006

2007

2008

2009

Jan

Jul

Jan

Jul

Jan

US Fed Funds Target Rate US 3m T-Bill ECB Refinancing Tender

Jul

Bounce May Have Been Driven By Intervention3,4

Avg PMI

60

GDP Growth Impact (%)

4

55

50

45

40

35

30

Jan-07

Impact on US GDP From Spending May be Large3

Eased

Tightened

Jul-07

Jan-08

Jul-08

Jan-09

Jul-09

3

2

1

0

-1

-2

09Q1

09Q2

09Q3

09Q4

10Q1

10Q2

10Q3

10Q4

1 Source: Goldman Sachs Research. Global Economics Weekly. May 6, 2009. https://360.gs.com/gs/portal?action=action.doc&d=7122754. Past performance is not indicative of future results.

2 Source: Congressional Budget Office “The Long Term Budget Outlook” June 2009. http://www.cbo.gov/ftpdocs/102xx/doc10297/06-25-LTBO.pdf Goldman Sachs provides no assurance or guarantee that future results will be consistent with the

projected analysis.

3 Source: Goldman Sachs Research. “US Daily: Where We Stand on Fiscal Stimulus Implementation” May 6, 2009. https://360.gs.com/gs/portal/home/fdh/?st=1&d=7125758. Goldman Sachs provides no assurance or guarantee that future results

will be consistent with the projected analysis.

4 Data updated by GS Research on July 23, 2009. Eased are those whose FCIs have eased since 8/1/08, including India, China, UK, Australia, and Sweden. Tightened include Japan, Switzerland, US, and Euroland.

13

State of the Markets

Asset Bubbles May Still Be Deflating

Commercial and Residential Real Estate prices have declined from their peaks

Continued home foreclosures should add to the supply of houses up for sale

Housing And Commercial RE Prices

Projected To Fall1

190

4May2000

Large Housing Inventory Overhang2

22Jul2010

180

170

160

150

140

130

120

110

100

90

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Housing Prices (CS) Commercial RE Prices (NCREIF)

1

2

Source: Graph Data from Goldman Sachs. Data as of May 15, 2009. Past performance is not indicative of future results

Source: Goldman Sachs Research. Americas: Technology: IT Services. "Foreclosures at record level in April; pullback in LPS presents a buying opportunity". May 13, 2009. https://360.gs.com/gs/portal/home/?action=action.doc&d=7163957

14

State of the Markets

Impact On Balance Sheets Still Ahead

Asset Price Growth Æ Mortgage Growth Æ Bank Growth1

Total CRE & Resi Mortgages

Outstanding increased $5.2

trillion 2003-2007

15,000

13,000

4,000

Total CRE & Resi Mortgages

on Bank Balance Sheets

increased $1.6 trillion 20032007

11,000

9,000

3,000

7,000

2,000

5,000

1,000

3,000

Total CRE & Residential Mortgages (RHS)

Total CRE & Residential Mortgages ($ in bn)

5,000

6

17,000

19

95

19

96

19

97

19

98

19

99

20

00

20

01

20

02

20

03

20

04

20

05

20

06

20

07

20

08

Total Mortgage Debt on Bank Balance ($ in bn)

6,000

Projected Loan Losses on Bank Balance Sheet2

(in percent of total loans)

5

United States

Estimates

4

Europe

3

2

1

0

-1

1920

1930

1940

1950

1960

1970

1980

1990

2000

2010

Total Mortgage Debt on Bank Balance Sheet (LHS)

1 Source: Federal Reserve Flow of Funds Report. Past performance is not indicative of future results

2 Source: IMF Global Financial Stability Report, April 2009 http://www.imf.org/external/pubs/ft/gfsr/2009/01/index.htm. Figure 1.30. Past performance is not indicative of future results. Goldman Sachs provides no

assurance or guarantee that future results will be consistent with the projected analysis

15

State of the Markets

Credit Bubble Is Still Deflating

Banks Still Tightening Credit As Conditions Worsen1

Delinquencies (%)

10

Commercial Delinquencies (LHS)

Bank Lending Conditions (RHS)

8

6

10

80

Euro Area

8

60

40

20

4

0

2

-20

0

1991 Q1 1993 Q1 1995 Q1 1997 Q1 1999 Q1 2001 Q1 2003 Q1 2005 Q1 2007 Q1

12

-40

6

Chng (%)

12

100

Tightening (%)

14

Private Sector Credit Is Falling2

Projected Æ

4

United States

2

0

-2

-4

-6

Dec-05

Sep-06

Jun-07

Mar-08

Dec-08

Sep-09

Jun-10

1 Source: Federal Reserve Bank Lending Conditions; Commercial Default Data from Federal Reserve. Sourced through IHS Global Insight. Past performance is not indicative of future results

2 Source: IMF Global Financial Stability Report, April 2009 http://www.imf.org/external/pubs/ft/gfsr/2009/01/index.htm. Figure 1.5. Past performance is not indicative of future results. Goldman Sachs provides no

assurance or guarantee that future results will be consistent with the projected analysis.

16

State of the Markets

A “V” or “L” Shaped Recovery? The Key May Be the Bursting of the Consumer Bubble

Personal Savings Rate Is Projected to Return to

Historical Norms1

50

Savings Rate (RHS)

25

0

Excess Spending (left axis)

2008

Consumer Spending / GDP (right axis)

-1

1976

1984

1992

2000

2008

Upper Savings Rate Forecast

Lower Saving Rate Forecast

Retail Sales (LHS)

US Savings Rate (RHS)

1 Source: Goldman Sachs, U.S. Department of Commerce. Data as of July 23, 2009. Past performance is not indicative of future results.

2 Source: BEA, Goldman Sachs Analysis. Data as of December 11, 2008. Past performance is not indicative of future returns. Excess spending defined as the spending in excess of 62% Consumer Spending /

GDP, which is approximately the historical average of the Consumer Spending / GDP Ratio. Consumer credit may decrease 10-20% due to decline of assets and sources of credit.

17

Consumer Spending/GDP

60%

2006

1

-200

2002

2004

75

62%

2000

2

0

1998

3

Retail Sales (LHS)

100

64%

1994

1996

125

4

200

1992

5

150

66%

1990

6

175

400

1986

1988

7

200

US Savings Rate (%)

8

225

68%

1984

250

600

1980

1982

9

1978

10

70%

1976

Savings Rate Projections

800

1972

1974

11

1970

300

72%

1968

12

1000

1964

1966

325

275

Retail Sales

13

1962

25Jul2011

1960

23Jul1969

Excess Spending ($bil)

350

Nominal Private Consumption and GDP in the US2

State of the Markets

The Asset and Credit Bubble Led To A Wealth Bubble And…

Significant wealth has been accumulated due to housing prices, however, borrowing against these assets as a percentage of value has

grown since 2005 (from ~40% in 2005 to ~50% at the end of 2008)1

Net worth of the US consumer dropped from its peak in mid-2007 of $64 trillion to $51 trillion1,2

Decrease in value from home equity1

Decrease in value from capital gains from corporate equity, mutual funds, and pensions1

The Current Wealth Shock is Three Times Worse

Than Any Previous Post-War Recession3

Net Worth and Home Price Appreciation1,2

% GDP

70,000

Peak: $64 trillion

in net w orth

200

180

60,000

160

50,000

140

$51 trillion in net

w orth (Q408)

40,000

120

100

30,000

80

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

Net Worth ($ in bn) (LHS)

1

2

3

Case-Schiller National Composite Index (RHS)

Source: Federal Reserve Flow of Funds Report. Past performance is not indicative of future returns.

Source: Goldman Sachs Calculations. Assumptions: Home prices fall 15%, Stock prices fall additional 25% from Q3 2008 data. Past performance is not indicative of future returns.

Source: Goldman Sachs Research. Global Economics Weekly. April 1, 2009. https://360.gs.com/gs/portal?action=action.doc&d=6931401

18

State of the Markets

Home Equity Values Have Declined Following the Decline in Housing Prices

Approximately 32% of US homes are mortgage free1, implying that the Loan-To-Value ratio on the balance of US homes may be near

95% given a 9% drop in housing prices as implied by the S&P Case Shiller Home Price IndexSM 2

The decline in home equity may push savings rates higher and reduce consumer discretionary spending

US Residential Housing Breakdown1

$ Trillion

25

Residential Home Value

85%

20

68%

69%

70%

69%

68%

64%

63%

64%

65%

64%

62%

67%

76%

100%

80%

60%

15

28%

16%

0%

1%

2%

14%

21%

17%

6%

40%

21%

9%

20%

(11%)

10

0%

(20%)

(33%)

(43%)

5

(60%)

(40%)

(60%)

0

LTV & Return on Home Equity

120%

93%

(80%)

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

Value of Homes (no-mortgage)

Value of Home Equity (on Mortgaged Home Value)

Annual Return on Home Equity

Value of Homes Mortgaged

Loan-to-Value of Homes with Mortgages

1 Sources: Percentages of houses with mortgages from US Census. American Housing Survey 2007. (biannually released: 1995, 1997, 1999, 2001, 2003, 2005, 2007; interpolated between values). Table 3-15.

http://www.census.gov/hhes/www/housing/ahs/ahs07/ahs07.html. Home values from Source: Federal Reserve Flow of Funds Report, Table B.100. Calculations: Goldman Sachs. 2009 is Hedge Fund Strategies

estimate. Past performance is not indicative of future results. Goldman Sachs provides no assurance or guarantee that future results will be consistent with the projected analysis.

2 Source: S&P Case-Shiller Home Price Values Index. http://www2.standardandpoors.com/portal/site/sp/en/us/page.topic/indices_csmahp/0,0,0,0,0,0,0,0,0,1,1,0,0,0,0,0.html

19

State of the Markets

Low Savings Rates Were Enabled By The Growth Of The Credit Markets

Savings and Mortgage Equity Withdrawal (MEW) appear to be inversely linked1

Declining home prices and equity valuation might drive savings higher2

Relationship Between Saving and Mortgage Equity

Withdrawal1

ABS Issuance Has Come To A Halt1

1 Source: Goldman Sachs Research, US Economics Analyst. “Some Micro Evidence on Saving and MEW.” June 9, 2006. Past performance is not indicative of future results.

https://360.gs.com/gs/portal/home/?action=action.doc&d=2239993

2 Source: Board of Governors of The Federal Research, Flow of Funds Report <http://www.federalreserve.gov/releases/z1/Current/>

20

State of the Markets

Declining Wealth May Push Saving Rates Higher And Consumption Lower

The US consumer may realize that capital gains from real estate and equity are not permanent or persistent and that disposable

income may decrease in this recession

Thus, we expect savings rate to adjust upwards as the US consumer saves more money for his/her retirement and wealth, thus

reducing consumer spending

Wealth Ratio vs Savings Rate1

Net Worth Growth Decomposition1

1 Source: Goldman Sachs. Retail-Consumer 2009 Outlook. January 2009. https://360.gs.com/gs/portal?action=action.doc&d=6486350. Past performance is not indicative of future returns

21

State of the Markets

Baby Boomers May Need To Start Saving

The “Baby Boomer” generation (born 1945-1964) has generated higher earnings and created more economic growth than any

generation before them. The recent losses in housing, equity markets, and small business value have had a significant impact on their

wealth1

●

“approximately two-thirds of Early Boomer households, who are aged 54-63, are financially unprepared for retirement – that is, they

have not accumulated enough savings to maintain their lifestyle as they age.” – McKinsey Global Institute: “Talkin’ ‘Bout My

Generation: The economic impact of Aging US Baby Boomers

Entrance of a larger percentage of women in the workforce combined with higher education levels has contributed to this growth, but

has leveled out in the past 10 years1

The “Boomer Era” from 1980 to 20191

Boomers Have Not Saved as Much as Previous

Generations1

1 Source: McKinsey Global Institute: “Talkin’ ‘Bout My Generation: The economic impact of Aging US Baby Boomers". June 2008.

22

State of the Markets

Where Has The Reduction In US Consumer Spending Gone?

Reduction in US household consumption may have been redirected towards repayment of consumer debt and increased savings in

Bond funds/401K/IRA accounts.

Retail Flows From Money Markets Into Risk Assets2

(250)

(300)

change in T/E Bond Fund Assets

change in Taxable Bond Fund Assets

change in Money Market Asset

500

S&P 500 Value

650

600

15-Jul

Apr-08

Apr-06

Apr-04

Apr-02

Apr-00

Apr-98

Apr-96

Apr-94

Apr-92

Apr-90

Apr-88

Apr-86

Apr-84

Apr-82

Apr-80

Apr-78

Apr-76

Apr-74

Apr-72

1.0%

Apr-70

0

Cum

Cum

Cum

S&P

1-Jul

200

700

(200)

17-Jun

1.5%

750

(150)

3-Jun

400

800

(100)

20-May

2.0%

600

850

(50)

6-May

800

900

0

22-Apr

2.5%

1000

950

50

8-Apr

1200

100

25-Mar

1400

1000

11-Mar

3.0%

150

25-Feb

1600

Cumulative Change in MM & Fund Asset ($bn)

3.5%

11-Feb

S&P 500

Personal interest payments/Disposable Income (RHS)

1800

28-Jan

Consumers Continue To De-Lever1

14-Jan

1 Source: Bureau of Economic Analysis, Goldman Sachs. Data as of May 11, 2009. Past performance is not indicative of future results.

2 Source: AMG, Goldman Sachs. Data as of July 23, 2009. All data shown is for 2009. Past performance is not indicative of future results. Recent data shown rather than extended history to highlight recent trend.

23

State of the Markets

The Bursting of the Consumer Bubble Creates Headwinds

The US savings rate has been around 1.6% this past decade,

but it is projected to climb to 6-10% in the near future1,4

The increase in the US savings rate may be a structural

change rather than a cyclical change

●

●

●

Savings may need to increase to replace the $13 trillion

decline ($63 trillion to $50 trillion) in US wealth since mid20072,3

Savings may increase as baby boomers increase saving

rates as they age4

Savings may increase because the credit markets will

constrain consumers as they try to spend out of future and

current wealth4

Savings could be used to deleverages consumer balance

sheets

Savings Rate vs Consumer Credit1,3

140%

120%

Forecasted

deleveraging of the

consumer

14.0%

12.0%

10.0%

8.0%

100%

6.0%

80%

4.0%

60%

Forecasted

increase in savings

40%

2.0%

0.0%

19

60

19

63

19

66

19

69

19

72

19

75

19

78

19

81

19

84

19

87

19

90

19

93

19

96

19

99

20

02

20

05

20

08

Consumer Credit / Disposable Income (%) (LHS)

Personal Savings Rate (%) (Savings / Disposable Income) (RHS)

1

2

3

4

Source: BEA . Goldman Sachs provides no assurance or guarantee that future results will be consistent with the projected analysis. Past performance is not indicative of future returns

Source: GS Calculations. Assumptions: $10.6 trillion disposable income (2008). Savings rates increases from 1.8% to 10%. Home prices fall 15%; Stock prices fall additional 25% from Q3 2008 data

Source: Fed Flow of Funds. Goldman Sachs provides no assurance or guarantee that future results will be consistent with the projected analysis. Past performance is not indicative of future returns

Source: Goldman Sachs. "The Day After Tomorrow: The changing face of the consumer." October 1, 2008. https://360.gs.com/gs/portal/home/?action=action.doc&d=5955848

24

State of the Markets

US Equity Valuations Driven By The Consumer

Equity values might have downside

Peak earnings in the last cycle may be difficult to replicate given fundamental changes in the financial, energy, and, most importantly,

the consumer sectors

Combined, the financial and the consumer sectors accounted for over 50% of peak S&P income in mid-20072

S&P 500 Historical Earnings1

90

1May1954

S&P 500 Earnings in 2009 Dollars

S&P 500 Earnings Contribution by Sector2

28Jul2009

90

80

80

70

70

60

60

50

50

40

40

30

30

20

20

10

10

0

0

1963

1973

1983

S&P 500 Earnings in 2009 Dollars 10yr Rolling Average

US Recession

S&P 500 Earnings in 2009 Dollars

1993

2003

1 Source: Goldman Sachs. As of July 23, 2009. Past performance is not indicative of future returns

2 Source: Goldman Sachs Research. “Where We Stand Now: US Equity Market Outlook for Turbulent Times” November 10, 2008. p. 29. Data as of October 31, 2008. Past performance is not indicative of future

returns. https://360.gs.com/gs/portal/?st=1&action=action.binary&d=6194686&fn=/document.pdf The chart shows Net Income, defined as “earnings before extraordinary items available to common shareholders.”

Only positive data points are included.

25

State of the Markets Overview

Summary of Strategies To Implement These Views

If you believe this thesis, then…

US Real Estate

Section

Markets

Public Balance Sheet

Conditions

Capitalize on the

Strategy

Japan

US Retail and

Consumer

Commodities

Market Neutral

Opportunities

Economic fundamentals favor EM

divergence in CRE price

balance sheets as developed

estimates between REITs economies increase public debt

equity and CMBS markets

US faces high government

borrowing, unaddressed social

liabilities, and the potential long-term

erosion of the USD as the global

reserve currency

Position for a

weaker economy

with slowing

exports as well as

increasing

government debt

Position for lower

consumer spending

and a weaker

economic outlook

Position for stronger crude Capitalize on event-driven

oil demand, weaker USD

situations to generate

and inflation

attractive risk-adjusted

returns with low correlation to

At the same time,

broad market movements

capitalize on the slack in

refining capacity and high

implied volatility on

aluminum options

Short REIT Equity

Sell The Yen

Buy 5y or 7y CDS

Protection on Retail

and Consumer

Related CDS

Buy long-dated oil

Merger / Risk Arbitrage

Short the crack spread

Stubs/ Holding Companies

Sell calls on aluminum

Spin-offs

Long CMBS through

buying AAA CMBS or

selling protection on AAA

CMBX

Trade Ideas

Short debt-laden developed

economies/ long select emerging

economies

Buy CMS Caps

on JPY Rates

Buy USD, JPY or EUR Puts vs. Calls

on the currencies of commodityexporting countries (AUD, BRL, CAD,

NOK)

Buy 6m or 1y Put

Spreads on the S&P

Retail Select Index.

Consider selling a Call

to cheapen the option

Buy the equities of non-US

commodity producers

Dual Share Class

Capital Structure Arbitrage

Buy GS inflation Proxy Commodity

index

Sell Caps on the US Tax Index/

Receive the SIFMA ratio

Puts or put spreads may Buy FX currency forwards/FX options Sell the Yen

Description

be purchased on a REIT (to express a view on sovereign credit)

equity index or a basket of

Buy CDS protection on low beta

individual names in the

Retail and Office sectors developed countries/ Sell CDS

protection on select EM economies

Buy non-TALF eligible

CMBS AAA bonds of late Currency trades may be executed on

individual crosses, or as a basket

2006 or early 2007

Vintage A3/A4s

Sell protection on the

CMBX 5 AAA tranche

The US Tax Index tracks the US

Federal Marginal Income Tax Rate

The investor may

Buy Knock-in or Knock-out

choose to buy

Call options on oil to take a

protection on

long-term constructive view

individual names or on

Buy two contracts of

a broad basket

Crude Oil and Short one

contract each of Gasoline

Buy an OTM Call Puts, put spreads,

option on JPY 10y and put spread collars and Heating Oil to take a

rates struck at 3% may be purchased on bearish view on refining

or 4%

the S&P Retail Select margins

Index, a similar ETF,

or a custom basket of Sells call options on

aluminum

equities

outright, or buy

JPY puts / USD

calls or JPY puts /

KRW calls

For Discussion Purposes Only. All options mentioned are OTC options.

Please see the Risk Factors section of this presentation as well as each section’s trade summary page for important risks and considerations to these products and trades

Hedged purchases of

target company shares

Create synthetic positions

to benefit from price-to-netasset ratios

Exploit inefficiencies in

shares of newly listed entities

Relative value arbitrage of

share classes and capital

structure

26

Table of Contents

I.

State of the Markets

II.

Tradable Themes

I.

US Commercial Real Estate

II. Public Balance Sheet Conditions

III. Japan

IV. US Consumer and Retail

III.

Other Market Opportunities

I.

Commodity Opportunities

II. Event-Driven Market Neutral Investing

IV.

Appendix

V.

Legal Disclosures

27

US Commercial Real Estate Markets

Residential Housing Market Continues to Weaken

Agency Conforming Home Prices Appear to be Stabilizing

US Home Price Appreciation (YOY)1

60+ Day Delinquencies (%) 2

20%

50%

5.0%

60+ Delinquency Rate (OTS)

15%

10%

5%

0%

-5% 90

92

94

96

98

00

02

04

06

08

-10%

-15%

OFHEO Home Price Index

-20%

40%

4.0%

30%

3.0%

20%

2.0%

10%

1.0%

0%

0.0%

5/07

National S&P Case-Schiller Home Price Index

-25%

8/07

11/07

Subprime

Year Over Year HPI 1Q 20093

80%

ME

ND

OR

VT

NH

NY MA

CT

MN

SD

ID

WI

WY

MI

PA

IA

NE

NV

IL

UT

IN

WV

CO

KS

CA

AZ

OK

NM

VA

MO

KY

TX

RI

AR

11/08

Alt A

2/09

5/09

Prime ( R )

80%

1st Lien Loss Severity

70%

70%

60%

60%

50%

50%

40%

40%

DC

30%

30%

> 0%

20%

20%

(4)% – 0%

10%

SC

AL

8/08

NJ

DE

MD

NC

TN

MS

AK

OH

5/08

Option ARM

1st Lien Loss Severity2

WA

MT

2/08

GA

LA

FL

HI

1 Source: Office of Housing Enterprise Oversight (OFHEO), CSW

2 Source: LoanPerformance. Data shown for recent years to show recent trend.

3 Source: FHFA. http://www.fhfa.gov/Default.aspx?Page=87 Data accessed July 21, 2009

(8)% – (4)%

< (8)%

10%

0%

0%

5/07

8/07

11/07

Subprime

2/08

5/08

Option ARM

8/08

11/08

Alt A

2/09

5/09

Prime

29

Commercial Real Estate Beginning To Take Center Stage

Commercial Prices Are Falling And Trailing Residential 1

Historic And Expected Cap Rates Relative to CRE Values2

300.00

250.00

200.00

150.00

100.00

50.00

Commercial Real Estate (MIT)

Residential Real Estate (CS)

Vacancies Are Increasing (Retail Most Rapidly) 2

2009

2008

2007

2006

2005

2004

2003

2002

2001

2000

1999

1998

1997

1996

1995

1994

0.00

Cumulative life-time losses, by vintage (%)3

1 Source: Goldman Sachs, MIT Center for Real Estate, Moodys/REAL Commercial Property Price Index, S&P/Case-Shiller. Data as of July 28, 2009. Past performance is not indicative of future returns.

2 Source: Goldman Sachs Research. “Americas: Real Estate” May 11, 2009. https://360.gs.com/gs/portal/?st=1&action=action.binary&d=7147135&fn=/document.pdf

3 Source: Goldman Sachs Research. “Stress-testing losses for higher cap rates and financing costs” October 31, 2008. https://360.gs.com/gs/portal/?st=1&action=action.binary&d=6135768&fn=/document.pdf

30

CRE Historic Default Rates Shed Some Light…

From the period between 1978-1990, 10-yr default rates peaked as commercial real estate appreciation was at the lowest in eight

years

From the period between 1995-2006, historical and projected life defaults declined significantly as commercial real estate appreciated

in value

Default Rates and Property Values 1978 – 19901,2

4%

12%

2%

20%

0%

15%

-2%

10%

-4%

5%

0%

1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990

20%

18%

16%

10%

14%

12%

8%

10%

6%

8%

6%

4%

4%

-6%

2%

-8%

0%

2%

0%

1995

1996

1997

Vintage

Historical 10-Yr Defaults¹ (left)

CRE Annual Appreciation² (%)

14%

Default Rate¹ (%)

Historical 10-Yr Defaults¹ (%)

25%

6%

CRE Annual Appreciation² (%)

30%

All Property2,3

1998

1999

2000

2001

2002

2003

2004

2005

2006

Vintage

CRE Annual Appreciation² (right)

Historical Default¹ (left)

Projected 10-Yr Defaults¹ (left)

1 Source: Esaki et. al. Please note that this data is for the period 1978-1990 only. Past performance is not indicative of future results.

2 Source: National Council of Real Estate Investment Fiduciaries (NCREIF). Please note that this data is for the period. Past performance is not indicative of future results.

3 Source: Commercial Mortgage Securities Association

CRE 10-Yr Annual Appreciation² (right)

31

CRE Equity May Have Further to Fall…

Or May Be Completely Wiped Out…

CRE values are estimated to have declined approximately 26% from the peak1, and could potentially decline a further 20-30%2

according to S&P's rating stress for CMBS

A handful of recent transactions have sold in the market 60-65% down from peak February 2007 prices (e.g. Worldwide Plaza in New

York which sold on July 9, 2009 for $600mm after a previous sale of $1.74bn in February 2007)4

Secured financing markets remain closed and government programs seem to be doing little to help

Sources of Acquisition Financing3

As of March, 2009

1

2

3

4

CMBS Securitization Has Effectively Stopped3

As of April, 2009

Source: MIT Transactions-Based Index. http://web.mit.edu/cre/research/credl/tbi.html. Data as of July 12, 2009. Past performance is not indicative of future results

Standard and Poors "US CMBS Rating Methodology and Assumptions for Conduit/Fusion Pools". June 26, 2009.

Source: Goldman Sachs Research. “Americas: Real Estate” May 11, 2009. https://360.gs.com/gs/portal/?st=1&action=action.binary&d=7147135&fn=/document.pdf

Source: Wall Street Journal. “Deutsche Bank to Sell New York Skyscraper”. July 7, 2009. http://online.wsj.com/article/SB124692321690102803.html

32

Retail May Consolidate To Correct Accelerated Growth

Store Closings May Hurt Commercial Real Estate Property Owners

US REITS have raised $13bn YTD in capital1, however they may still need $40-60bn1 more, even without further reduction in values

Vacancy rates have begun to rise geometrically in specific CRE sectors, with Retail and Suburban Office nearing 17%2.

Goldman Sachs Research expects 15% obsolescence with roughly 200 regional malls closing in the next 5-10 years3

●

Retail square footage per capita has increased but retail sales have fallen

●

Regional Mall construction peaked from the late 60s – early 80s averaging almost 13% annual growth and retail stocks grew by

about 2% per year, while the population only grew by about 1% per year3

Retail Stock Square Footage Per Capita3

Retail Growth Has Outpaced Population Growth3

1 Source: Goldman Sachs Research. “Americas: Real Estate” May 11, 2009. https://360.gs.com/gs/portal/?st=1&action=action.binary&d=7147135&fn=/document.pdf

2 Source: Goldman Sachs Research. “Americas: Retail: Broadlines: Retail REITs: Final Four a Destination, but still a few rounds away”. July 14, 2009.

https://360.gs.com/gs/portal/?st=1&action=action.binary&d=7480830&fn=/document.pdf

3 Source: Goldman Sachs Research. “Americas: Real Estate” July 21, 2009. https://360.gs.com/gs/portal/?st=1&action=action.binary&d=7508032&fn=/document.pdf Paste performance is not indicative of future

returns

33

REIT Equity Prices Have Risen…

…But Property Values Have Continued to Fall

REITs as a broad Index (DJUSRE Index GP <GO>) have rallied nearly 50% since the lows in early March1, despite negative

Commercial Real Estate price discovery

The trend downward in Commercial Real Estate price indices does not show signs of abating2

A continued trend downward could imply a ~40% decline in REIT equity prices from current levels3. In addition, there is a potential for

further dilution should REITS encounter capital markets resistance to refinancing debt coming due in the next several years.

The Hedge Fund Strategies Group estimates that there is a divergence in CRE price estimates between equity and CMBS

markets close to 25%

US REIT Equity / CMBX AAA Prices1

350

105

All Price

110

100

300

100

95

250

90

90

200

80

85

70

80

60

75

50

70

40

65

30

60

20

2007

Jan

Apr

2008

Jul

Oct

Jan

Apr

Oct

Jan

Apr

CMBX AAA On-The-Run (RHS)

Dow Jones Real Estate Index (DJUSRE) (LHS: Jan 1 2007 = 100)

Jul

Industrial

Office

Retail

100

50

2009

2008

2007

2006

2005

2004

2003

2002

2001

2000

1999

1998

1997

1994

0

CMBS Implied Losses4

55

2009

Jul

Apt

150

1996

21Jul2009

1995

1Jan2007

Price

Index Level

120

All Property Price Index Level2

Tranche

Name

CMBX 1 AAA

Avg Attch Avg Exhst

Markit

Price** Spread**

WAL*

Point*

Point*

PV01***

29.76%

100.00%

89.25

211

5.34

6.01

CMBX 5 AAA

29.76%

100.00%

1 Source: Goldman Sachs. Data as of July 20, 2009. Past performance is not indicative of future results

2 Source: MIT Transactions-Based Index. http://web.mit.edu/cre/research/credl/tbi.html . Data as of July 12, 2009. Past performance is not indicative of future results

3 Source: Goldman Sachs Analysis. As of July 10, 2009

4 Source: * = Intex; ** = GS; *** = Markit

75.50

433

6.15

7.99

AAA Implied

Loss**

12.38%

Collat Implied

Loss**

26.65%

30.21%

45.97%

34

REIT Equities and CMBS May Imply Different CRE Losses

There May Be A 25% Mis-pricing In Loss Expectations For CRE

Real Estate Structures ( February 2007) 1

REIT

CRE Loan

Debt

40%

Commercial

Property

(Asset)

Commercial

Property

(Asset)

Equity

60%

Market Prices and Implied Losses (Current) 2

CMBS

Debt

70%

CRE Loan

Pool

(Debt)

REIT

Implied

Market

Price Chg Pricing

AAA

70%

Debt

40%

Market

Change

- 38%

-65%

Impact of CRE Price Decline On REIT Equity and AAA CMBS3

Current Value vs. February 2007

AAA CMBS

-20%

-40%

-60%

-80%

-100%

0%

-10%

-20%

-30%

-40%

-50%

-60%

-120%

CRE Implied Loss

-70%

-80%

Debt

Recovery

53%

Market

Change

- 62%

-32%

-90%

CMBS

CRE Loan

Pool

(Debt)

CMBS

AAA

75.5

-30%

Market

Change

- 47%

-17%

-27%

-3%

Structure As Implied By Market Prices2

0%

REIT Equity

Commercial

Property

(Asset)

Equity

Mezz

27%

3%

Equity

30%

Commercial

Property

(Asset)

CRE Loan

-100%

REIT Equity Performance: -64%

Orig. Debt Value

40,000,000

Orig. Equity Value

60,000,000

CMBS AAA Price: 75.5

CRE Debt Orig. Value

70,000,000

CRE Equity Orig. Value

30,000,000

Debt Value

Equity Value

40,000,000

21,620,000

Loss on CMBS

Equity Loss

Debt Loss

Debt Recovery

38,380,000

0

100.0%

CRE Debt Loss

CRE Debt Value

Equity Value

CRE Property

Original CRE Value

100,000,000

Current CRE Value

61,620,000

Change in CRE Value

-38%

CRE Property

Original CRE Value

Current CRE Value

Change in CRE Value

47%

33,005,000

36,995,000

0

100,000,000

36,995,000

-63%

Structures are hypothetical and used for illustrative purposes only. All levels (prices) are indicative and there is no representation that any transaction can or could have been effected at such level (price). Goldman Sachs provides no assurance or

guarantee that future results will be consistent with the projected analysis.

1

Source: Goldman Sachs. REIT Structure based on average LTV of 75 REITs as of February 2, 2007. CRE / CMBS structure illustrative assuming 70% LTV and 30% Subordination for CMBS.

2

Source: Goldman Sachs. Data as of July 20, 2009. Equity REIT performance based on US REIT Index performance 2/2/2007 – 7/20/2009. CMBS performance based on price of 75.5 for CMBS 07-2 AAA

3

Source: Goldman Sachs as of July 20, 2009. Assumptions: REIT LTV 40%, CRE Loan LTV 70%, AAA Subordination 30%

35

US Commercial Real Estate Market

Implementation

If you believe this thesis, then:

Description

Puts can be purchased on a REIT equity index or on a basket of individual names in

S

H

O Buy 1-2yr Puts or Put

R Spreads on REITs

T

the Retail and Office sectors

Buy a put outright or cheapen the cost by selling a further out of the money put to

create a put spread

Loss is limited to premium paid

Risk: The Investor stands to lost the entire option premium if REIT equities

decline less than anticipated

Buy non-TALF eligible CMBS AAA Bonds of late 2006 or early 2007 Vintage A3/A4s

Collect a regular stream of cash flows and potentially benefit from price appreciation

Buy AAA CMBS

L

O

N

G

Goldman Sachs trading desks maintain an inventory of bonds

Risk: the underlying loans may cease to pay their mortgage payments which

could impair the value of the bond price and impact cash flows

Sell protection on the CMBX 5 AAA tranche

Sell Protection on

AAA CMBX

Note: For discussion purposes only.

Risk: CMBX spreads may widen exposing the investor to a loss

36

Public Balance Sheet Conditions

Currencies And Sovereign CDS May Present Unusual

Opportunities…

Foreign Exchange markets may be driven by a number of factors, including:

Interest rates, terms of trade, labor productivity, perceived safety of the country/currency

●

Foreign Exchange spot markets are sensitive to short term catalysts while forwards and implied volatility project slower moving trends

Developed economies credit spreads may suffer relative to emerging countries

Currency, Credit, and Commodity Production Road Map1

70%

Commod Exports % GDP

1.35

Norway

60%

Size of bubble = GDP

14Jul2005

Sweden

Return

to

trend?

1.3

1.2

USD Gradual

Decline

1.15

40%

Canada

Australia

1.1

France

1.05

South Korea

Italy

30%

Russia

New Zealand

Japan

20%

United States

1

Mexico

0.95

China

10%

United Kingdom

Brazil

Turkey

Indonesia

Argentina

(CDS = 2,233bp)

0%

0

14Jul2009

1.25

Germany

50%

USD Generally Trending Weaker?2

100bp

200bp

Credit Spread

300bp

400bp

0.9

0.85

2005

2006

2007

2008

Jan

Jul

Jan

Jul

Jan

EURUSD USD Index Commodity Currency Basket vs USD

Financial

Crisis 2009

Jul

Jan

1 Sources: Sovereign Credit Spreads from Goldman Sachs as of July 13, 2009. Commodity Exports from the UN (http://comtrade.un.org/db/default.aspx), GDP data from CIA world factbook (www.cia.gov). Chart

represents countries in the G20 for which Goldman Sachs trades and tracks sovereign CDS levels and the country’s currency. In addition to G20, the chart also includes New Zealand, and Norway which are not

in the G20 but which are in the Commodity Currency basket highlighted in this presentation.

2 Source: Goldman Sachs. Data as of July 13, 2009. Past performance is not indicative of future returns. Goldman Sachs provides no assurance or guarantee that future results will be consistent with the projected

analysis.

Jul

38

Global GDP Growth Attributable to Current Accounts

The Balance Is Shifting

The current account balance summarizes the flow of goods, services, income and transfer payments into and out of a country

Persistent current account deficits may lead to a natural depreciation of a currency, as importing, and making income and transfer payments usually

reflect that one’s currency is leaving the country to make payments in a foreign currency

Significant GDP growth has been attributed to the increasing imbalance in US account deficits

Cumulative Current Account Balance (1980- 2008)1

1 Source: IMF: World Economics Outlook Database, data shown in USD billions.

Note that some countries do not report its data to the IMF or have not reported such data from 1980

39

Trade Resulted In Skewed Current Account Balances

Driving Tremendous Growth in World GDP

Current Account positions as a percent of GDP have shifted more in Asia versus developed economies

Aggregation of International Reserves have outpaced current account shifts in emerging economies

Real GDP Growth (% Chg YoY)1

Contribution to Total GDP Growth (PPP Basis, %, 3y Avg)1

10

Other Developing

China

United States

Other Advanced

6

8

5

6

4

4

3

2

2

2009

Current Account Positions (% of GDP)1

25

Latin America

Emerging Europe

Middle East

2008

2006

2004

2002

2000

1998

1996

1994

1992

1990

1988

1986

1984

1982

1980

1978

-1

1976

-6

1974

0

Advanced economies

Emerging and developing economies

1972

2006