* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Gold standard tutorial for Econ 105, test #3 Congratulations! You

Survey

Document related concepts

Transcript

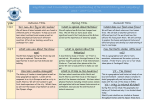

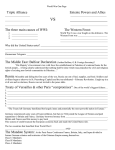

Gold standard tutorial for Econ 105, test #3 Congratulations! You are almost done studying. This topic will be less important than the material covered in the previous tutorials, but there will be enough questions on it on exam three that it is well worth knowing what the deal is. I put in bold the ideas that I think are most important to understand for beating this exam. So here are the main questions y’all will need to be able to answer: What is the fundamental difference between a gold standard and a system of flexible exchange rates? What happens when there is a trade imbalance, and how does this affect an economy under a gold standard? How does it affect an economy under a system of flexible exchange rates? What are the advantages and disadvantages of each type of system? We’ll just go through these one by one. So the fundamental difference between the two systems is how the money supply is controlled. Under a gold standard, the currency is ‘fixed’ to a certain amount of gold. In other words, the government says something like “$16 is equal in value to 1 oz. of gold.” The way the government (specifically the Treasury) actually makes this happen is by offering to exchange $16 dollars for an ounce of gold, and vice versa, meaning that you could show up and give the Treasury $16, and they would have to give you an ounce of gold. Well, to make this doable, the government has to make sure that it has enough gold on hand that if everyone showed up with their dollars and asked for gold, the Treasury would have enough to give to everyone. The main thing that you need to take away from this is that under a gold standard, the government can’t print any money unless there is gold to back it up. Another way to say this is that the money supply completely depends on the amount of gold the government has in reserve. This is different from the way things work now; today we live under a system of flexible exchange rates. Now, the supply of money can be whatever the government wants it to be, because it can print money without having to worry about gold at all. This is what makes monetary policy possible in today's world. So what do we mean by a trade imbalance? Let’s use the example from class (this tutorial assumes that you have at least some general notes on this). In class, we said that the U.S. was importing more than it was exporting, while Britain was exporting more than it was importing. This is a trade imbalance, because if it were balance imports would equal exports. So what happens under a gold standard if this trade balance occurs? Well, if the U.S. is importing tons of goods from Britain, then it needs to pay for them. But goods in Britain aren’t in dollars, they are in pounds. Since Britain is under a gold standard too (let’s say in Britain 1 pound=1 oz of gold), then someone in the U.S. who wants to buy British stuff will have to change their dollars to gold, and then their gold into pounds. It’s that simple. The important thing to notice here is that the gold standard is in effect fixing the exchange rate. If you take 16 dollars and exchange them for 1 oz of gold, and then take that gold and exchange it for 1 pound, then you are essentially trading 16 dollars for one pound. You’ll never see anyone trade 15 dollars for one pound, because they would be getting a worse deal than if they used gold to exchange their money. Another important thing to notice is that gold is leaving the U.S. and moving to Britain as people in the U.S. buy more stuff from Britain. So what’s the big deal? The deal is big because as gold leaves the U.S., we have to think about what that is going to do to the money supply. Remember that under a gold standard, the U.S. can’t have any dollars that aren’t backed by gold. Well, if the amount of gold in the U.S. decreases, then the supply of money decreases, which hurts the economy. Think about it this way; what does a decrease in the money supply remind you of? It sounds a lot like a tight money policy, except here the money supply is being decreased because the U.S. is losing gold, not because the Fed decided that it was a good idea to reduce the money supply. However, we’ll see the same effects in both cases: employment will fall, output will fall, and most importantly the price level will fall. The exact opposite is happening in Britain: output is increasing, employment in increasing, and most importantly the price level is increasing. So what does this mean? Well, the thing to see here is that because of this price change in both countries, the trade imbalance will reverse. This is because the now cheaper goods in the U.S are more attractive to buyers in Britain, and the now more expensive goods in Britain are less attractive to buyers in the U.S. The exact same thing will happen to Britain now that it is importing more than it is exporting: it's output will fall along with its price level. The main idea here is that the gold standard creates a cycle in which economies see big increases and decreases in employment and output. So we've seen how an economy under a gold standard deals with a trade imbalance, now let's take a look at what happens under a system of flexible exchange rates. Thankfully, it is much simpler! Instead of absolute prices changing (by this we mean the price levels in each country), relative prices change, and by this we mean the exchange rate. An exchange rate is just the price of buying a foreign currency. For example, right now you can buy 1 Euro for about $1.40. So let's go back to the beginning of our last example, where the U.S. was busy importing tons of stuff from Britain, only this time we'll be under a system of flexible exchange rates. What happens now is that because the U.S. needs lots of pounds to buy all of the stuff from Britain, the demand for pounds increases. I don't think you'll be tested on the graph shown on the next page, but this is how Ron explained it so it is worth looking at. So again, this just shows that as the demand for pounds increases (moving from Demand 1 to Demand 2), the price of pounds also increases. In other words, the exchange rate has changed in response to the trade imbalance. Cool! Well now that you know how each type of system works (if it's still a little fuzzy, come in to an SI session and I'll try explaining it a different way!), let's now take a look at the advantages and disadvantages of both types of systems. We'll start with the gold standard. The advantage to the gold standard is that it imposes discipline on the money supply. So what the heck does that mean? It means that the government can't get carried away with printing money, because by law they can't print more money unless they have more gold to back it up. Well then, why don't we use a gold standard? The reason is because of the disadvantage: under a gold standard trade imbalances will damage an economy (remember the employment falling?). This leads us to the advantage found in using the system of flexible exchange rates - trade imbalances don't have to damage the economy (at least not as much as they did under the gold standard). However, the disadvantage is that discipline is not imposed on the money supply - because governments don't have to worry about how much gold they have, they have to power to print money at will, possibly irresponsibly. Another disadvantage to flexible exchange rates is that they cause uncertainty in international markets. Because the exchange rate can change (the euro I mentioned before cost only $1.20 over the summer), it is hard to predict what it will be from day to day. This makes doing business with foreign companies somewhat dangerous - the exchange rate could move in a direction that really messes things up. That's all folks! Don't forget you can post to the message boards if you have questions for me.