* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Leveraged Finance

Securitization wikipedia , lookup

Peer-to-peer lending wikipedia , lookup

United States housing bubble wikipedia , lookup

Financialization wikipedia , lookup

Private equity secondary market wikipedia , lookup

Stock selection criterion wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Financial economics wikipedia , lookup

Market (economics) wikipedia , lookup

Interbank lending market wikipedia , lookup

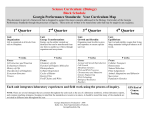

Q4 2015 Broader Market Volatility Disrupts Leveraged Finance Markets In This Report Underwriting standards tighten as lenders rethink risk appetites Leveraged Finance Interest rates jump in the fourth quarter but aren’t likely to follow last year’s post-January reversion High-yield market continues energy/ non-energy bifurcation Highlights from William Blair’s January 2016 leveraged finance survey FRONT LINE INSIGHTS Broader Market Volatility Disrupts Leveraged Finance Markets Syndicated loan activity slows dramatically and flex activity surges as arrangers struggle with unpredictable market conditions. Investor concerns about plummeting oil prices, China’s growth, and U.S. interest rates spilled over into debt markets in the fourth quarter. The widespread repricing of risk among lenders and arrangers resulted in higher pricing, lower liquidity, and tighter underwriting standards across leveraged finance markets. The market disruptions were particularly acute in the syndicated loan market. Based on increased investor concern about corporate earnings and the health of the global economy, CLO formation slowed considerably, creating a supply/demand imbalance. To capitalize on the resulting price dislocations in high-yield bonds, value-focused institutional investors migrated from second-lien loans toward the high-yield market. This, combined with a decreased willingness by arrangers to add risk to their balance sheets, caused syndicated loan activity to slow precipitously for much of the fourth quarter. Throughout the quarter, middlemarket activity was much steadier than the market for larger, rated deals. This was primarily due to the fact that middle-market lenders have more 1 stable funding sources and tend to focus more on maintaining relationships with financial sponsors when make lending decisions. In this quarter’s Leveraged Finance report, we look at the trends that shaped underwriting standards, interest rates, and the high-yield market in the fourth quarter. We also examine why, despite following a similar pattern to what was seen 12 months ago, 2016 could be shaping up to be a very different pricing environment than 2015. Underwriting Standards Tighten as Lenders Rethink Risk Appetites During the fourth quarter, there was a dramatic shift in sentiment among lenders and arrangers. Signaling a belief among credit market participants that the U.S. economy may be nearing the end of its current expansion phase, lenders and arrangers have displayed significantly lower risk appetites over the past several months. Lenders are still willing to do deals, but they are being much more prudent about the types of companies they are willing to underwrite and the amount of leverage they are willing to put on a company. Average leverage for LBOs in the fourth quarter was 5.3x, down from 5.7x for all of 2015 and 5.8x for 2014. The downturn in risk appetites has been particularly sharp in cyclical endmarkets. Not surprisingly, William Blair’s quarterly survey of leveraged finance market participants showed that the energy, building products, and automotive sectors saw the biggest 2014 vs. 2015: Similar Q4 Pattern, But Where Do We Go From Here? In both 2014 and 2015, interest rates for leveraged loans rose during the fourth quarter, and last year rates quickly reverted to their three-year averages after February. Technical challenges and a downturn in lenders’ and arrangers’ risk appetites, however, suggest that elevated rates may have staying power in 2016. 500 450 400 350 300 Jul Source: S&P LCD Aug Sep Oct Nov Dec 2014 Jan 2015 Feb Mar Apr May pullback by lenders during the fourth quarter. During the quarter, larger, higher-rated transactions increased as a percentage of new issuances. Debt rated BB- and higher represented 56% of fourth-quarter volume, up from 31% in 2014. As 2016 began, there was optimism that the institutional loan market would improve in January. But the technical challenges that hampered activity in the fourth quarter continued into January, and the steep equity selloff over the first several weeks of 2016 have put a further damper on risk appetites. While headlines will show that January 2016 LBO volume was up more than 60% from January 2015, this growth was driven by several large deals as investors migrate to stronger credits. The median first-lien term loan LBO facility size in January 2016 was $1.3 billion, compared with $325 million in January 2015. Further, the institutional second-lien market remains essentially shut down with only one second-lien facility getting done during January 2016, compared with nine in January 2015. Interest Rates Jump in Fourth Quarter, But Aren’t Likely to Follow Last Year’s Post-January Reversion Interest rates for B-rated loans rose in the fourth quarters of both 2014 and 2015. While rates quickly reverted to their three-year average after February 2015, it is too early to know what markets will look like in spring 2016. However, there are many reasons to believe that interest rates will not follow the path of early 2015. The recent supply/demand imbalance in the syndicated loan market, the change in lender sentiment, and the tightening of underwriting standards all suggest that this year’s period of elevated rates may have more staying power. In the syndicated loan market, interest rates rose throughout fourth quarter 2015 as arrangers often were forced to flex transactions significantly upward to clear the market. The degree of this flexing reflects the differences between the fourth quarters of both years. Given the unpredictability of the market over the past several months, the average increase in yield for B2 and B3 deals that flexed in fourth quarter 2015 was 75 basis points more than for deals that flexed in fourth quarter 2014. Throughout this period of volatility, rates in the middle market have been much more stable than larger deals. For many of the transactions involving smaller, unrated syndicated loans that William Blair has worked on recently, rates have risen 25 basis points to 50 basis points. Unitranche pricing has been more of a mixed bag. Unitranche providers that also buy institutional loans have increased rates due to relative value considerations; meanwhile, firms that focus exclusively on non-syndicated transactions have held rates steady. High-Yield Market Continues Energy/Non-Energy Bifurcation The precipitous drop in oil prices reverberated throughout the highyield market during the fourth quarter. The Federal Reserve’s longanticipated decision to begin raising interest rates and the closure of Third Avenue’s Focused Credit Fund also made headlines in December, although only the latter had a material impact on the high-yield market, according to Dan Hannis, managing director of William Blair’s high-yield bond trading group. In terms of performance, the highyield market continued its bifurcation into energy and non-energy assets. Energy bonds, on average, traded at 66 cents on the dollar as of December 31, while non-energy bonds closed the year at 93 cents. For all of 2015, the high-yield energy index was down 23.8%, compared to a -1.4% return for the broader index ex-energy. Two bright spots in the high-yield market were consumer staples and healthcare. Spreads for high-yield bonds in the consumer staples sector tightened by 10 basis points, as rising macroeconomic uncertainty provided support for these companies. Highyield bonds in the healthcare and pharmaceutical industries rebounded in late 2015, and spreads tightened 70 basis points in December. To learn more about these and other trends shaping leveraged finance markets, please do not hesitate to contact us. William Blair 2 MARKET UPDATE AND ANALYSIS Underwriting Tightens Amid Q4 Volatility Broader market volatility spilled over to leveraged finance markets in the fourth quarter, causing a marked downshift in leverage levels. The impact in the middle market was more muted than in the market for large corporate deals. LBO Leverage Multiples 7.0x 5.8x 5.4x 5.3x 5.3x 5.7x 5.2x 5.3x 6.0x 4.8x 4.5x 4.3x 5.0x 4.0x 3.0x 2.0x 1.0x 0.0x 2011 2012 2013 2014 2015 Middle Market Large Corporate 5.1x 5.2x 4Q15 Sources: S&P LCD Leveraged Loan Activity Slows in Q4 Leveraged Finance Market Analysis Each quarter we look behind the numbers to examine the market dynamics that are driving trends in pricing and volume in leveraged finance transactions. Driven largely by disruptions in the syndicated loan market, LBO loan volume dropped precipitously in the fourth quarter. There were long stretches during the quarter when no syndicated transactions were completed, and many of the deals that got done had to be placed through club arrangements. LBO Loan Volume ($ in billions) $189 $200 $150 $82 $100 $36 $50 $5 $35 $52 $85 $51 $68 $8 $0 2007 2008 2009 2010 2011 2012 data 2013 2014 2015 4Q15 Sources: S&P LCD High-Yield Issuance Falls as Oil Continues to Drop Falling oil prices and the closing of Third Avenue’s Focused Credit Fund dominated headlines in the high-yield market during the fourth quarter. The $36.3 billion of high-yield issuance in fourth quarter 2015 represents a 41% decrease from fourth quarter 2014. High-Yield Bond Volume ($ in billions) $400 $287 $300 $164 $200 $144 $68 $100 $345 $322 $310 $218 $262 $0 2007 Sources: S&P LCD 3 2008 2009 2010 2011 data 2012 2013 2014 2015 Highlights from William Blair’s January 2016 Leveraged Finance Survey Each quarter William Blair surveys midmarket leveraged finance professionals representing leading commercial banks, credit funds, BDCs, commercial finance companies, and other credit providers. This quarter’s survey comprised 10 questions (including the three shown below) to measure the current tone and direction of midmarket leveraged finance. Included in the survey is the Market Index Measure, which asks respondents to rate overall conditions in the leveraged finance market. On a scale of 1 to 5, with 5 being the most borrower-friendly conceivable, respondents rated conditions as 3.4, the least borrower-friendly reading since the survey began in 2014. To receive the results of the full January 2016 survey, please contact Mark Birkett at [email protected]. Pricing: For 2016, do you expect pricing for your primary debt offering to increase, decrease, or stay the same? 70% 49% 56% 40% 35% 23% 11% 6% Increase 3Q15 Decrease 4Q15 The percentage of respondents who expect pricing to increase over the next 6 to 12 months increased from 6% in July 2015 to 56% in January 2016. 9% Remain the Same 1Q16 46% 36% 23% 18% 13% 9% Leverage and Terms: For 2016, do you expect leverage and transaction terms to tighten, loosen, or remain the same? 68% 61% Increase 3Q15 Decrease 4Q15 26% Reflecting the broader resetting of risk appetites in the fourth quarter, the percentage of respondents who expect leverage and transactions terms to tighten over the next 6 to 12 months increased from 9% in July 2015 to 61% in January 2016. Remain the Same 1Q16 Sector focus: Are there any sectors or industries where your firm is proceeding more aggressively or cautiously today compared with six months ago? Not surprisingly, lenders have become much more cautious in energy and other commodity-driven, cyclical industries. At the other end of the spectrum, food and beverage, healthcare, and IT/software/hardware are three areas where lenders have become the most aggressive. Energy and Energy Services Building Products / Construction Automotive / Transportation Retail and Restaurant Chemicals Other Industrial / Manufacturing Education Financial Services / Specialty Finance Media Consumer Products / Services Professional Services Distribution Packaging IT /Software / Hardware Health Care Food and Beverage 69% 52% 49% 39% 31% 25% 24% 21% 20% 20% 19% 15% 13% 13% 12% 8% More Cautiously 4% 5% 8% 7% 11% 13% 12% 17% 20% 19% 15% 17% 17% 24% 29% 33% More Aggressively William Blair 4 WILLIAM BLAIR LEVERAGED FINANCE INVESTMENT BANKING William Blair by the Numbers 98 Drawing on our deep product expertise and the strength of our relationships, William Blair has built a leading leveraged finance franchise. Business owners turn to us for outstanding execution in support of their capital-raising objectives. completed transactions since 2008 Recent transactions include: arranged financing since 2012 $10.5bn+ 400+ lender and alternative credit provider relationships 5 William Blair’s Leveraged Finance team structures and arranges debt capital in support of acquisitions, recapitalizations, and growth through its well established relationships with debt capital providers globally. • $6.4 billion of completed/pending financing arranged since 2014 • Specialists who are experts in complex engagements, including those requiring insightful credit positioning and the arrangement of multiple layers of capital • Robust distribution capabilities providing a 360° view of the market; relationships with over 400 lenders and significant transaction experience with alternative credit providers • Real-time, proprietary view of the leveraged finance market from William Blair’s global M&A and debt advisory practices • Senior banker attention and unbiased, objective advice; senior bankers average more than 20 years of experience • Thoughtful, customized financing processes that produce outstanding outcomes Our Debt Capital Markets team provides clients with access to various debt capital markets, including high-yield and investment-grade notes, convertible bonds, syndicated term loans, preferred stock, and other debt securities purchased by institutional investors. • Debt underwriting, placement, and advisory services related to the public and private/144A markets • 40+ institutional sales and trading professionals based in Chicago and New York • Market maker in 500 high-yield bond and investment-grade issues; 400 preferred issues • National account coverage of 700+ Tier 1 institutional buyers and regional investors With more than 150 senior bankers around the world, William Blair has completed more than 2,000 advisory and financing transactions totaling more than $200 billion in value for our clients* Leveraged Finance Kelly Martin Managing Director +1 312 364 8832 [email protected] Michael Ward Managing Director +1 312 364 8529 [email protected] Mark Birkett Director +1 312 364 5483 [email protected] Matt Thomas Director +1 312 364 5261 [email protected] Jason Sutherland Vice President +1 312 364 8961 [email protected] Olivier Lopez Vice President +1 312 364 8460 [email protected] * In the past five years as of January 31, 2016 William Blair 6 Disclosure “William Blair” is a trade name for William Blair & Company, L.L.C., William Blair Investment Management, LLC and William Blair International, Ltd. William Blair & Company, L.L.C. and William Blair Investment Management, LLC are each a Delaware company and regulated by the Securities and Exchange Commission. William Blair & Company, L.L.C. is also regulated by The Financial Industry Regulatory Authority and other principal exchanges. William Blair International, Ltd is authorized and regulated by the Financial Conduct Authority (“FCA”) in the United Kingdom. William Blair only offers products and services where it is permitted to do so. Some of these products and services are only offered to persons or institutions situated in the United States and are not offered to persons or institutions outside the United States. This material has been approved for distribution in the United Kingdom by William Blair International, Ltd. Regulated by the Financial Conduct Authority (FCA), and is directed only at, and is only made available to, persons falling within COB 3.5 and 3.6 of the FCA Handbook (being “Eligible Counterparties” and Professional Clients). This Document is not to be distributed or passed on at any “Retail Clients.” No persons other than persons to whom this document is directed should rely on it or its contents or use it as the basis to make an investment decision. About William Blair Investment Banking William Blair’s investment banking group combines significant transaction experience, rich industry knowledge, and deep relationships to deliver successful advisory and financing solutions to our global base of corporate clients. We serve both publicly traded and privately held companies, executing mergers and acquisitions, growth financing, financial restructuring, and general advisory projects. This comprehensive suite of services allows us to be a long-term partner to our clients as they grow and evolve. From 2011-2015, the investment banking group completed more than 350 merger-andacquisition transactions worth $95 billion in value, involving parties in 26 countries and four continents, was an underwriter on more than 20% of all U.S. initial public offerings, and raised more than $120 billion in public and private financing.