* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download exchange rates

International status and usage of the euro wikipedia , lookup

Foreign-exchange reserves wikipedia , lookup

Bretton Woods system wikipedia , lookup

Currency War of 2009–11 wikipedia , lookup

Reserve currency wikipedia , lookup

Currency war wikipedia , lookup

International monetary systems wikipedia , lookup

Foreign exchange market wikipedia , lookup

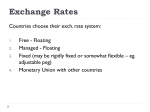

Fixed exchange-rate system wikipedia , lookup

EXCHANGE RATES UNIT 26 DISCUSSION You probably have at least one banknote in your pocket, wallet or purse. How much is it worth in other currencies? How do you know? How is the value (the exchange rate) of the money in your pocket determined? If you keep a banknote (e.g. a dollar) in your pocket, you know that it might be worth less after a few months. Why? If you deposit it in a bank, of course, it will be worth a little more. Why? Why do companies, institutions and people buy and sell currencies? Has the value of your currency increased or decreased in the past few weeks or months? Why? EXCHANGE RATES – VOCABULARY – MATCH THE WORDS FROM COLUMNS A AND B. FIXED OVERVALUED UNDERVALUED GOLD FLOATING FOREIGN MARKET SUPPLY & PURCHASING POWER EXCHANGE CONVERTIBLE SINGLE CURRENCY FUTURES COMMON DEMAND FLUCTUATIONS PARITY CURRENCY CONTRACTS CONVERTIBILITY FORCES ECXHANGE RATES EXCHANGE RATES - VOCABULARY VERBS ●Guarantee ●Fluctuate ●Intervene ●Peg against ●Determine ●Adjust ●Speculate ●Revalue ●Devalue ●Settle ●Appreciate ●Hedge against ●Convert ●Depreciate ●Establish ●Exchange ●Manage READING – EXCHANGE RATES – MK, pp. 128 & 129 I Read the text and decide which paragraphs could be given the following headings: A Counteracting speculation B Gold convertibility C Market forces D Market interventions E Parity and speculation READING – EXCHANGE RATES – MK, pp. 128 & 129 II MK, p. 129 – Write questions to which these could be the answers, according to the text. III VOCABULARY – Find words in the text that match the definitions in MK, p. 129. SPEAKING – EXCHANGE RATES – MK, pp. 128 & 129 GROUP A GOLD CONVERTIBILITY Between end of WWII and 1971 – exchange rates – fixed against – the US dollar – pegged against – gold Fixed exchange rates – adjusted (revalued and devalued) – International Monetary Fund Gold convertibility – ended in 1971 – inflation in the USA – the Federal Reserve – not enough gold – guarantee currency GROUP B MARKET FORCES Gold convertibility – replaced – floating exchange rates Floating exchange rate – supply and demand – foreign exhange markets Buyers and sellers of currency – its price – rise – fall Milton Freedman – exchange rates – settle at stable rates – economic realities – calculations of central banks – underestimated – speculation SPEAKING – EXCHANGE RATES – MK, pp. 128 & 129 GROUP C PARITY AND SPECULATIO Purchasing power parity – cost of goods and services – different countries – inflation – currency depreciates Financial institutions, companies and rich individuals – interest rates – short-term capital gains – currency appreciates International trade and foreign travel – 5% of the world currency transactions – 95% purely speculative GROUP D COUNTERACTING SPECULATION Exchange rate changes – problems for industry Futures contracts – hedge against currency fluctuations Forward planning difficult – price of imported raw materials and exported products – rise and fall – establishment of the euro, the common currency in much of Europe SPEAKING – EXCHANGE RATES – MK, pp. 128 & 129 GROUP E MARKET INTERVENTIONS Governments and central banks – change the value of currency – intervene – exchange markets – foreign currency reseves – buy and sell their own currency – ‘manage’ floating exchange rate 1992 – the Bank of England – protect the pound sterling – lost over £3 billion in a day – speculators – impossible to influence the floating exchange rate EXCHANGE RATES - SUMMARY CHOOSE THE CORRECT OPTION. The value of a country’s A) money B) currency C) exchange rate is extremely important to all businesses engaged in international A) commerce B) stock market C) trade – imports and exports. For over a quarter of a century after the Second World War, most currencies were A) pegged B) measured C) exchanged against the US dollar, which in turn was fixed A) according to B) against C) in comparison to the gold. Since the early 1970s, there has been a system of A) floating B) flotation C) flotating exchange rates, largely A) fixed B) determined C) caused by supply and demand, which in theory reflect a country’s balance of A) accounts B) finance C) payments and a rate of A) devaluation B) depreciation C) inflation. EXCHANGE RATES - SUMMARY In fact many currency movements seem to be influenced by A) investments B) speculation C) banks rather than underlying economic activity. Currency speculation in Europe was greatly reduced by the adoption of a A) usual B) common C) unique currency, the Euro, by twelve countries in 2002. Many economists defend the floating rate system and the necessity for a common European A) currency B) exchange rate C) bank. HOMEWORK – CASE STUDY – MK, pp. 130 & 131 Case study: A currrency transaction tax + Writing (a brief summary of your decisions)