* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Material Fact - Approval of the Extraordinary General Meeting

Survey

Document related concepts

Transcript

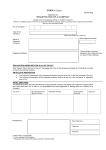

Unidas S.A.

Publicly-held Company

NIRE No. 35.300.186.281

CNPJ No. 04.437.534/0001-30

Rua Cincinato Braga No. 388, Bela Vista

CEP 01333-010 - São Paulo – State of São Paulo

MATERIAL FACT

Unidas S.A. (“Company”), in compliance with Brazilian Securities and Exchange Commission (“CVM”)

Instruction No. 358, dated January 3, 2002, as amended, communicates to the market in general that

its shareholders, in a special meeting held on this date, approved as follows:

a.

a tender offer for the primary and secondary distribution of common shares issued by the

Company (“Shares”), to be performed by the Company and certain shareholders ("Selling

Shareholders") in Brazil, in non-organized over-the-counter market, according to Brazilian

Securities and Exchange Commission (“CVM”) Instruction No. 400, dated December 29, 2003,

as amended (“CVM Instruction No. 400”), and with efforts for the placement of Shares abroad

(“Offer”), according to following characteristics:

The Shares to be issued by the Company in the scope of the primary part of the Offer

will be issued due to the increase of capital to be performed within the limit of its

authorized capital, according to the terms of Article 6 of Company’s Bylaws, excluded

the preemptive right of their current shareholders, according to the terms of Article 172,

item I of Law No. 6,404, dated December 15, 1976, as amended (“Corporation Law”)

and Paragraph 2 of Article 6 of Company’s Bylaws.

According to Article 24 of CVM Instruction No. 400, the number of Shares initially

offered (not including the Additional Shares) may be increased in up to 15%, in same

conditions and price as those of the initially offered Shares (“Supplementary Shares”),

according to the option to be granted to the intermediate institution that will be acting

as stabilizing agent within the scope of the Offer, in order to comply with any eventual

excess of demand that may be verified during the Offer.

According to Article 14, Paragraph 2 of CVM Instruction No. 400, the number of Shares

to be initially offered (not including the Additional Shares) may increase in up to 20%,

in same conditions and price as those of the initially offered Shares (“Additional

Shares”).

Within the context of the Offer, the price per Share (“Price per Share”) shall be

determined after the conclusion of the procedure for the collection of investment

intentions, to be performed by the Offer Coordinators, according to provisions set forth

in Article 23, Paragraph 1, and Article 44 of CVM Instruction nº 400 (“Bookbuilding

Procedure”). The selection of the criterion for determining the Price per Share is

justified, as the market price of Shares to be subscribed or acquired, as the case may

be, shall be calculated with the Bookbuilding Procedure, which reflects the value for

which the investors will present their firm orders of subscription or acquisition of

Shares, as the case may be, and therefore it will not promote unjustified dilution of

current shareholders of the Company, according to the terms of Article 170, Paragraph

1, item III of the Corporation Law.

b.

the adhesion by the Company and admission to trading of common shares issued by the

Company in the New Market, special segment of the stock market of BM&FBOVESPA S.A. –

Bolsa de Valores, Mercadorias e Futuros (“BM&FBOVESPA” and “New Market", respectively).

This notice is merely informative, and does not constitute an offer, invitation or request of offer for the

subscription or purchase of securities, including Shares, in Brazil or in any other jurisdiction and,

therefore, shall not be used as basis for any investment decision. In due course, it will be submitted to

the appreciation of (i) CVM a request of registration of Offer and (ii) BM&FBOVESPA a request of

adhesion by the Company and admission to trading of common shares issued by the Company in the

New Market, as well as a notice shall be published to the market in reference to the Offer and

containing information about (ii.i) other characteristics of the Offer, (ii.ii) the places for obtaining the

preliminary prospectus of Offer, (ii.iii) the estimated dates and places for the disclosure of the Offer;

and (ii.iv) conditions, procedure and period of reserve and period of Bookbuilding Procedure.

São Paulo, July 22, 2013.

_______________________________________

Gisomar Francisco de Bittencourt Marinho

Chief Financial and Investor Relations Officer