* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Final Budget Outcome 2013-14

Present value wikipedia , lookup

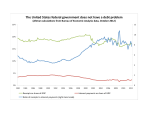

Expenditures in the United States federal budget wikipedia , lookup

Global financial system wikipedia , lookup

Balance of payments wikipedia , lookup

Conditional budgeting wikipedia , lookup

Securitization wikipedia , lookup

Financialization wikipedia , lookup