* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Investment Advisor RFP Sample

Private equity secondary market wikipedia , lookup

Internal rate of return wikipedia , lookup

Negative gearing wikipedia , lookup

Investor-state dispute settlement wikipedia , lookup

Fund governance wikipedia , lookup

Early history of private equity wikipedia , lookup

Land banking wikipedia , lookup

International investment agreement wikipedia , lookup

Investment banking wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

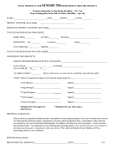

Request For Proposals for Investment Advisor/Manager

Organizational Background

SAMPLE ORGANIZATION is the nation’s leading resource on the earliest years of a child’s

development. Founded in 1977 by top experts from the fields of pediatrics, research science,

mental health, child development and other disciplines, SAMPLE ORGANIZATION is

governed by a multi-disciplinary, internationally renowned Board of Directors consisting of 30

members.

SAMPLE ORGANIZATION’s mission is to promote the healthy development of our nation's

infants and toddlers by supporting and strengthening families, communities, and those who work

on their behalf. We have built an outstanding track record and reputation for translating and

disseminating cutting-edge knowledge on how to promote the healthy development of infants,

toddlers, and their families. Through publications, trainings, and direct technical assistance, we

educate those working with infants, young children, and their families on a range of issues

related to early childhood development and effective interventions. Our work strengthens and

supports parents, programs, professionals, policy-makers, and all those working to support

families in our society.

We help parents move to a deeper understanding of their young child that leads to increased

awareness, sensitivity, and devotion, and the secure attachments that lay the foundation for

healthy social, emotional, and intellectual development

We work with infant/family programs to achieve quality and excellence by focusing on

“behind the scenes” issues of staff training, management, and leadership that directly affect

the quality of services provided to children and their families.

For professionals, we unite passion and knowledge, presenting the latest findings from

clinical research, providing forums for the exchange of ideas across academic disciplines,

and promoting national leadership on behalf of young children.

We guide policy makers in making the important decisions, large and small, that directly

impact a family, community, and country.

SAMPLE ORGANIZATION is a stable, yet growing nonprofit organization, with an annual

budget of $10 million, and a skilled and highly experienced staff of 65 that bring expertise in

early childhood development, child abuse prevention and treatment, social work, evaluation,

disabilities, law, marketing, and public relations to the organization.

Request For Proposal

The Investment Committee of the Board of Directors is now seeking proposals from selected

investment advisors to advise, manage, and administer approximately $1-3 million in balanced

portfolios. We seek an overall investment strategy structured to meet the goals and objectives of

two separate pools of funds—an endowment fund and an operating fund.

SAMPLE ORGANIZATION currently maintains an endowment fund with approximately $1

million, expected to grow to $3 million within two years through a $1 million fundraising

campaign and a $1 million match. We require an investment policy and strategy for the

endowment fund that will provide current income as well as an opportunity for long-term growth

of capital. Attached is our current investment policy for your reference.

We also require an investment strategy for an operating fund with approximately $1.8 million in

assets that mesh with the operating needs of the organization. Approximately $900,000 of the

operating fund would need to be accessible for monthly operations, but invested in funds that

provide higher yielding returns than overnight money market accounts. Approximately $900,000

of the operating fund could be invested in funds that ensure a continued high level of income.

The selected investment advisor would be expected to develop, and implement, an investment

strategy for each of these funds that employs both equity and fixed income investment

capabilities and to work with our staff to establish appropriate guidelines for both funds.

Please submit your written proposal to advise, manage, and administer these funds for SAMPLE

ORGANIZATION to Director of Finance and Corporate Affairs, SAMPLE

ORGANIZATION, 123 Main Street, NW, Suite 2000, Washington, DC 20036 no later than

{10 days after the proposal is emailed out}. If selected as a finalist, your organization will be

scheduled for an oral presentation in September in Washington, D.C. Each presenter will have

approximately 45 minutes to provide an overview of their proposal and to answer questions.

Your written proposal should include the following information:

Company Background

Provide a detailed background of your organization. Be sure to include any relationships

your company has with any other organizations such as insurance companies, brokerage

firms, investment banking firms, or mutual fund companies.

Provide information about whether your firm is a registered investment advisor under the

Investment Advisor’s Act of 1940. Include Part 2 of your most recent From ADV.

Describe in detail any litigation/regulatory action against your firm as it relates to

management of client portfolios.

Provide a representative client list as well as contact information for three client references.

Please specify nonprofit clients.

Provide biographical information on key investment professionals at the firm, including the

team you would assign to the management of SAMPLE ORGANIZATION’s assets.

Relationship Management

Based upon the background provided by SAMPLE ORGANIZATION, please provide an

overview of how your firm would work with our Board committee and staff to develop and

implement an investment strategy. Make specific reference to individuals/groups at your firm

that would be involved in that process.

Provide a brief description of your approach to managing balanced portfolios. Include

various assets that you would recommend to the committee for investment.

2

Investment Management

Briefly describe your firm’s investment management philosophy.

Describe what you believe to be the best benchmark for your investment approach and why.

Describe the primary strategies employed by your firm for adding value to portfolios (e.g.

market timing, credit research, stock selection, etc.)

Describe your asset allocation optimization process and how it is used to meet the investment

objectives of your clients. Describe how often you re-balance accounts.

Provide information about whether your firm establishes optimal investment strategies for

each client independently.

Describe what role, if any, our finance staff would have as part of your investment

process/strategy.

Describe how you would assist a client in the development of their investment policy.

Provide the minimum and maximum asset size of the accounts that you service. Provide the

average asset size of the accounts that you currently service.

Provide information on recommended third-party custody of securities.

Reporting and Fees

Describe your reporting procedures including frequency for various forms of communication.

What items will be reviewed in performing the regular investment performance

evaluation?

How does your investment report identify risk or volatility in comparison to a

benchmark?

How does your investment report ensure compliance with the target asset allocation?

Who specifically would perform the investment evaluation and what are their

credentials?

Include sample report copies.

Investment Fees:

Indicate the schedule and billing process for the investment consultant services (include

disclosure of any and all sources of compensation, including finder’s fees, “soft dollars,”

and similar arrangements).

Indicate the approximate fee of the investment vehicles or third party managers typically

recommended for similarly situated portfolios.

Indicate the fee schedule for the recommended third party investment custodian.

3

Indicate any additional fees to which the Association or portfolio may be subject.

Other

Provide any additional information or comments that you believe would distinguish your

organization from others, or that would be relevant for us to know as we consider your

response for the investment advisor, manager, and administrator of our funds.

4