* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Introduction to Business

Derivative (finance) wikipedia , lookup

Currency intervention wikipedia , lookup

Stock market wikipedia , lookup

Financial crisis wikipedia , lookup

Futures exchange wikipedia , lookup

Stock exchange wikipedia , lookup

Stock selection criterion wikipedia , lookup

Early history of private equity wikipedia , lookup

Hedge (finance) wikipedia , lookup

Bridgewater Associates wikipedia , lookup

Private money investing wikipedia , lookup

Investment fund wikipedia , lookup

Securities fraud wikipedia , lookup

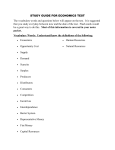

Click here to advance to the next slide. Chapter 32 Real Estate and Other Investments Section 32.2 Other Investment Options Read to Learn Describe how precious metals, precious gems, and other commodities as well as collectibles can impact an investment plan. Discuss the advantages and disadvantages of buying and selling collectibles online. The Main Idea Investment plans should include a variety of investments. Aside from real estate, stocks, and bonds, a diversified portfolio might include commodities, such as precious metals and precious gems, as well as collectibles. Key Concepts Diversifying Your Investment Plan Investing in Collectibles Key Terms diversify to vary investments in order to spread risk or to expand precious metals valuable ores such as silver, gold, and platinum Key Terms precious gems rough mineral deposits (usually crystals) that are dug from the earth by miners and then cut and shaped into brilliant jewels Key Terms commodities exchange an exchange through which investors can buy contracts for quantities of a given commodity for delivery at a future date Key Terms collectibles items that appeal to collectors and investors fraud the crime of obtaining money or some other benefit by deliberate deception Diversifying Your Investment Plan There are many types of investments from which to choose, allowing people to diversify their plan. diversify to vary investments in order to spread risk or to expand Graphic Organizer Stocks Real Estate Bonds Collectibles Diversifying Options Commodities Gems Precious Metals Investing in Precious Metals Many people invest their money in precious metals as a hedge against inflation. precious metals valuable ores such as silver, gold, and platinum Investing in Precious Metals Precious metals are usually valued by the ounce. The price of gold can fluctuate with war, political unrest, or inflation. Investing in Precious Gems Precious gems include diamonds, sapphires, rubies, and emeralds. precious gems rough mineral deposits (usually crystals) that are dug from the earth by miners and then cut and shaped into brilliant jewels Investing in Precious Gems Precious gems appeal to investors for the following reasons: Small size Durability Beauty Protection against inflation Ease of storage Graphic Organizer Risks Associated with Precious Gems Precious gems are not easily converted to cash. Beginning investors may have trouble determining quality. Political unrest in gem-producing countries can affect supply and prices. You will likely have to buy your gems at higher retail prices and sell them at lower wholesale prices. Metals and gems can fluctuate greatly in value. Investing in Other Commodities Some people like to “play the market” on the commodities exchange. commodities exchange an exchange through which investors can buy contracts for quantities of a given commodity at a future date Investing in Other Commodities Most investors want to sell their commodities contract at a profit before the delivery date. An expected event can spell the difference between rags and riches when investing in commodities. Commodities Exchanges Commodities are the raw materials that producers use to create goods and food. There are about 50 different commodities handled on more than a dozen exchanges in the United States and Europe alone. Investing in Collectibles Collectibles can include rare coins and books, works of art, antiques, and stamps. collectibles items that appeal to collectors and investors Investing in Collectibles The Internet has made buying and selling collectibles efficient and convenient. eBay is the biggest online auction site. Graphic Organizer The Pros of Online Collection Online collecting is easy. Sellers can reach buyers around the world. Comparison shopping is easy. Most Web sites do not charge a commission. Graphic Organizer The Cons of Online Collection Prices are not necessarily lower. Collectibles do not offer interest or dividends. Finding a buyer on short notice is difficult. You will have to purchase insurance. As a buyer, you don’t know the seller. Fraud is an ever-present danger. Staying Aware of Fraud Buyers of collectibles should be aware of the danger of fraud. fraud the crime of obtaining money or some other benefit by deliberate deception Staying Aware of Fraud The best way to avoid fraud is to learn everything you can about the items you collect. You should buy and sell collectibles only with reputable dealers. 1. How can precious metals, precious gems, and other commodities as well as collectibles impact an investment plan? as hedges against inflation and possible sources of profit 2. Describe the function of a commodities exchange. They allow investors to buy contracts for quantities of a given commodity for delivery at a future date. 3. What are some pros and cons of online investing? pros: convenience, ability to trade worldwide; cons: possibility of fraud, inability to see items End of Chapter 32 Real Estate and Other Investments Section 32.2 Other Investment Options