* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Preliminary Considerations for Questionnaire

Survey

Document related concepts

Transcript

RESEARCH METHODS IN BUSINESS

STUDY MATERIAL SUPPLIED FOR THE COURSE BM 512 OF MASTER OF BUSINESS ADMINISTRATION

UNDER THE SCHOOL OF MANAGEMENT SCIENCES , TEZPUR UNIVERSITY, and prepared by

MRINMOY K SARMA. It should be noted that the material is supplied as a part of the course curriculum and is in

no way exhaustive.

Business Research has been used as an instrument for reducing managerial errors in decision

making. Some of the researches conducted in the actual business field are routine, while some are

commissioned for a specific one-time purpose. However, it may not be taken for granted that research

will always provide with the right answer to a particular problem. In fact, it is reported that almost 70% of

the researches conducted all over the world either offers inaccurate information or misleads the

decision maker. When Xerox initially wanted to launch the copier machine, out of three market

researches commissioned, two advised the company against the proposed launch. The remaining

agency predicted a turnover of only 8000 machines within the next 6 years. Xerox launched the product

and sold more than 80000 (eighty thousand) pieces within the next 3 years. New Coke, Ford Edsel are

few of the classic examples of the victims of market research. There are many reasons for which a

research may lead to inaccurate results. Errors may creep in at every stage of the research process.

For example, sometimes a wrong approach might be taken, while in some other cases a wrong

instrument may be adopted. Therefore, adherence to the correct method of conducting a research is

the prerequisite of success.

The Research Process:

The following is the flow of research process. However, minor variations are found in different

books.

Establish the need for information

Specify research objectives and information needs

Determine research design and source of data

Develop the data collection procedures

Design the sample

Collect the data

Process the data

Analyse the data

Present research results

We will be discussing here the highlighted portions of the process.

Designing the Sample:

This includes the following jobs:

01.

Decide about the method of sampling to be employed

02.

Decide about the sample size

03.

Select a sample

Research Methods in Business

Class Notes: Tezpur University MBA Programme

2

© Mrinmoy K Sarma

Before proceeding let us have a look at the cases where sample drawing is necessary. In many

a situations it is not possible to make a census (100% enumeration of the total elements), like in case of

measuring the attitude of the target customers on a new packaging or on a new advertising campaign.

For that matter, in case of Opinion Poll on the results of a general election it is just next to impossible to

contact all eligible voters and to know their preferences. The cost involves in doing so would be too

much (in fact, as much as the cost of the general election itself) which would negate the usefulness of

the Opinion Poll. Thus, we do take recourse to sampling methods for the following reasons:

Economy in Money and time,

Not to destroy or contaminate the population, and

Sometimes for more accuracy. (explanation will be offered in the class)

At this juncture the meaning of the following frequently used terms are explained.

Elements:

About which information is sought; may be human, Product, Stores, Company

etc.

Population (or Universe): Aggregate of all the elements defined prior to selection of the

samples. Population must be defined in terms of

Elements :

…as defined above

Sampling Units: The element(s) which are available for selection at some stage(s) of

the sampling process, like Chemical Engineers may be sampled from

a business organisation whose turnover is more than Rs.5 crore in the

last financial year.

For example, if we are to select samples from among the males aged

over 50 years form households from blocks of the cities having more

than 5 lac of population we have the following multistage Sampling

Units:

Primary S.U.: Cities above 5 lac of population

Secondary S.U.: City Blocks

Tertiary S.U.: Households

Final S.U.: Males aged over 50 years. this is the element

Extent:

Coverage in respect of geographical area of the elements or sampling

units.

Time:

The time period within which samples are drawn.

Sampling Frame

In case we are interested in drawing samples through probabilistic methods (which are

explained later in this material), a sampling frame is necessary. A sampling frame is the means of

representing the elements of the population. This may be a Telephone Directory, Employee Register or

a Voter’s list. Though in many social science research problems the sampling frame often difficult to

define, proper car must be taken to find and establish a sampling frame before proceeding further with

the research process. Maps also serve frequently as sampling frames. This is useful in case of area

sampling.

A perfect sampling frame is one in which every element of the population is

represented once and only once. Examples of perfect frames are rare, however, specially when we are

interested in sampling from any appreciable segment of a human population.

Errors in the sampling frame may be exclusion or multi inclusion of elements in the

frame. These are known as frame errors.

Research Methods in Business

Class Notes: Tezpur University MBA Programme

3

© Mrinmoy K Sarma

However, one does not need a sampling frame to take a non-probability sample.

Sampling Unit

A sampling unit is the basic unit containing the elements of the population to be

sampled. It may be the element itself or a unit in which the element is contained.

For example, if we want to sample males of 21 years of age, it might be possible to

meet each sample directly. In this case, the sampling unit would be identical with the element. However,

if we were interested in sampling children below the age of 10, it would be easier to meet them in their

residence in presence of their parents. In this case, the sampling unit is the household and the element

is the child below 10 years of age.

In any case of interview, further specification of the sampling unit is required like should

we interview the person who answers the doorbell first, if he/she is an element of our study population.

Interviewing whoever remains present at home, may sometime lead to overrepresentation of women

and elderly persons in the sample. Therefore, for surveys, where random samples of an adult

population is desired, a random selection must be made from the adult residents of each household

(sampling unit in this case). The ‘next birthday’ method (where the birthdays of adults are taken and the

person whose birthday falls first is interviewed) is the simplest method to use in such a situation. Many

innovative methods can also be used, which might be the result of creativity of the researcher.

We can select sampling units in different stages. Suppose we are interested in

selecting samples which are residents of a town having a population of 1 lac or more, having residing

near a main street, and female more than 30 years of age, we will have to take up sampling units as

follows:

Primary s.u

:

Cities with more than 1 lac population.

Secondary s.u :

Main streets.

Tartiary s.u

:

Households.

Final s.u

:

Females of more than 30 years of age.

Statistic:

These are the characteristics of a sample.

Parameter:

These are the characteristics of a population.

Symbols:

for

Population

for

Samples

Size:

N

n

Mean:

x

S.D.:

s

Research Methods in Business

Class Notes: Tezpur University MBA Programme

4

© Mrinmoy K Sarma

Steps in Selecting a Sample:

Define the population in terms of

1. Elements

2. Units

3. Extent and

4. Time

Identify the sampling frame

Determine the sample size

Select a sampling procedure

These two steps can also be

performed simultaneously

Select the sample

We have already discussed about the first two steps. The third step would be discussed later,

along with various methods of drawing sample.

There are many different sampling procedures by which researchers may select their samples.

But one fundamental concept must be dealt with at the outset - the distinction between probability and

non-probability sampling.

In probability sampling each element of the population has a known chance of being selected

as a sample. The sampling is done by mathematical decision rules that leave no discretion to the

researchers. It is to be noted that there is a difference between known chance and equal chance. Equal

chance probability sampling is only a special case, which is called simple random sampling. Probability

sampling gives us a distinct advantage over non-probabilistic sampling; that is, this allows to calculate

the likely extent to which the sample value differs from the population value of interest. This difference

is called sampling error.

In non-probability sampling, the selection is based on some part of judgment of the

researchers. There is no known chance of any particular element in the population being selected.

Therefore, it is not possible to calculate the sampling error.

The different available fundamental sampling procedures are,

1.

2.

3.

Probability Sampling

Non-probability sampling

Simple random Sampling

Stratified Sampling

Cluster Sampling

a.

Systematic Sampling

b.

Area Sampling

1.

2.

3.

Convenience Sampling

Judgment Sampling

Quota Sampling

Convenience Sampling:

This is based on the convenience of the researchers. Therefore, it is unclear about the actual

population. One such example would be people-on-the-street interview by a television interviewer.

Research Methods in Business

Class Notes: Tezpur University MBA Programme

5

© Mrinmoy K Sarma

In this case, the difference between the population value of interest and the sample value is

unknown, in terms of both size and direction. And we can not measure the sampling error. And clearly

therefore, we can not make any definite conclusive statement about the result of such sampling. Thus,

this type of sampling is appropriate at the exploratory stage of the research.

Judgment Sampling (or Purposive Sampling):

Here the basis is expert opinion on the usefulness of selecting a particular element as the

sample. For example, in test marketing, a judgment is made as to which cities would constitute the best

ones for a particular product targeted to a particular group of customer. Or the decision about

interviewing a particular dealer regarding a new incentive scheme would definitely call for expert opinion

or past experience of the researchers.

Here also, the degree and direction of error is unknown, and definite statement regarding

findings of the survey is not meaningful. However, if the expert’s judgment was valid, then such result

would be more representative than that of a convenience sampling.

Quota Sampling:

This is a special type of purposive sample. Here the researcher takes explicit steps to obtain a

sample that is similar to the population on some “pre-specified” controlled characteristics. e.g., a

interviewer may be instructed to select half of the interviewees from people 30 years of age and older

and the other half under the age of 30. Here the control characteristic is age of the respondents. In real

life the interviewer may have to face more control characteristics like age, educational background,

place of residence

(urban or rural), etc. In such a situation the researcher will have to use his

discretion to obtain samples from each of the categories equally, as far as possible.

This method is the most widely used among all non-probabilistic methods of sampling. Almost

47% of the American firms use it frequently and almost 39% use this method “sometimes”.

In the above example, if the age is divided in four categories ( under 15, 16 to 25, 26 to 50 , and

51 and above) place of residence into two categories, educational level into four categories ( under

HSLC, Graduates, Post Graduates and Professional degree holders) and add another variable ,income

level ,with five categories ( income per month below (Rs.) 5000/-, 5001/- to 7500/-, 7501/- to 10000/and 10001/- and above) we will have 4 x 2 x 4 x 5 = 160 sampling cells. In this case we may have

equal number of representation from each of the 160 cells. The number of representation can be

derived by the following method.

Multiply the population size by desired proportion from each cell

Disadvantages of quota sampling are - the proportion of respondents assigned to each cell

must be accurate and up-to-date. This is often difficult and impossible. The “proper” control

characteristics must the selected . It is also not possible to include more variables due to practical

difficulty. Even these problems are solved, interviewers may not be able to select actual respondents for

interviews.

This method is useful in preliminary stage of the research , if done with care, they can provide

more definite answers. However, such results are less valid than a probability sampling.

Simple Random Sampling:

This is the most frequently used method of sampling. In such sampling we select the sample

randomly. But for this method to be successful two preliminary conditions must be fulfilled:

1.

Each element must get an equal chance of being selected

Research Methods in Business

Class Notes: Tezpur University MBA Programme

2.

6

© Mrinmoy K Sarma

Each combination of the n sampling elements has an equal chance of being selected.

The first condition says that every element must be equally likely top be selected, like a

blindfolded man taking out a ball from a bag full of balls of different colours and of equal size and

weight.

The second condition says that if we are to select 4 samples from a population of 16 elements,

than every combination (there would be 16C4 nos. of combinations) would have equal chance of being

selected.

For simple random sampling we use Random Number Table (supplied in the class).

For calculation of population parameter following formulae are used.

=

X

2=

x

N

=

OR

N

and

fX

f

S.D.=

2

for drawn samples:

Sample mean x

x

n

(X)2

(

Sample Variance s = X 2

)/ df

_

n

df = n- ( no. of statistic calculated, generally 1)

S.D. of the sampling distribution (the Standard Error)

Sx=

s

n

The Classical Theory of Statistics:

This theory would help the students in understanding the properties of normal distribution which

is very important in understanding the behaviour of sampling distribution and useful in grasping the

hypothesis testing fundamentals.

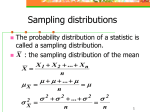

The sampling distribution of mean and statistical inferences:

In any population there are many possible sample groups. The classical statistical inference is

based on what happens when one repeatedly selects different sample groups from the population.

If we repeat calculation of mean of the sample twice, thrice, and n times we find that the sample

mean closer in value to the population mean , would tend to repeat more frequently than others. If, now,

we plot this mean value in a graph we would find a bell shaped curve. This is normal distribution curve.

Research Methods in Business

Class Notes: Tezpur University MBA Programme

7

© Mrinmoy K Sarma

This distribution is known as sample mean distribution or sample distribution . It is important in two

ways:

1.

The sample mean in this distribution is distributed around the population mean in known way,

2.

Using this distribution, we can determine how closely the sample statistics are distributed

around the population parameter.

FOR FORMALISATION OF THE NATURE OF SAMPLING DISTRIBUTION OF THE MEAN we

consider the Central Limit Theorem of Statistics:

1.

If a population distribution of a measure is normal the sampling distribution of the mean is also

normal.

2.

If the population distribution is non-normal the sampling distribution of the mean approaches

normal as the sample size increases.

3.

The mean of sampling distribution of the mean is population mean. In the type of situation in

which the expected value of the mean of the sampling distribution for the statistics is the parameter or

population value the statistic is said to be unbiased.

4.

The S.D. of the sampling distribution of the mean is the population S.D. divided by the square

root of the sample size. This value is often called the standard error of the mean.

As in practice we do not know or so we estimate them with X and s

68%

95%

99.7%

There is an important aspect about the normal curve.

1. 68% of the cases will be within + 1 standard deviation of the mean

2. 95% of the cases will be within + 2 standard deviation of the mean

3. 99.7% will be within + 3 standard deviation of the mean.

The above diagram depicts a normal curve with area under +1,+2, +3 standard deviation of the

mean.

Other characteristics of the normal curve:

a.

b.

c.

d.

The curve is of a single peak; it has the bell shape.

The mean ( ) lies at the centre of the normal curve

Median and mode are also at the centre, i.e., mean = mode = median

Two tails never meet the horizontal axis.

CERTAIN FREQUENTLY USED TERMS IN RANDOM SAMPLING:

Confidence interval:

Let us assume the followings for ease of our calculation and understanding:

s = 2.88 and n = 5 as found in particular sampling statistics calculation.

Research Methods in Business

Class Notes: Tezpur University MBA Programme

8

© Mrinmoy K Sarma

and mean of the sampling distribution is 22.6. ( already calculated)

Then the standard error or the (s.d. of the sampling distribution)2 is

Sx

2.88

5

1.3

Now let us calculate the size of the intervals at + 1 standard deviation from the mean, +2 s.d.,

and + 3 s.d. from the mean. At +1 s.d. the inteval is

22.6+ 1.3 = range 21.3 and 23.9

We know that 68% of the means from our sampling distribution are contained in this interval if

our calculated sample mean X is truly the mean of the sampling distribution. Thus at the + 2 s.d. the

interval is

22.6 + 2 ( 1.3) = 22.6 + 2.6 = range 20.0 and 25.2

Again we know that 95% of the means from our sampling distribution are contained in this

interval if our calculated sample mean X is truly the mean of the sampling distribution.

These intervals are known as Confidence intervals. The first interval was 68%, the second one

was 95% confidence interval.

Sampling fraction =

n

N

The sampling fraction can be used to estimate the total population usage of product or services

from the total sample usage. Suppose that a sample of 5 students out of the population of 50 ) used a

total of 35 liters of petrol per week . Then the estimated total population usage of petrol would be,

Total sample usage

Sampling fraction

= 35/ (5/50) = 35/.1 = 350 liters.

Determining the sample size:

After understanding of sampling error and non-sampling error, let us have a look at the sample

size determination.

In simple random sampling for a known sample size , we calculated the confidence interval of

our estimate at a given level of confidence. To do this for a continuous measure we have the following

information:

1.

An estimate of the mean, x

2

An estimate of the standard deviation, s

3

A sample size

4

A level of confidence

5

Using items two and three, we calculated the standard error, s x. We then calculated the relevant

confidence interval. The equation to do this at 95% confidence level was

Research Methods in Business

Class Notes: Tezpur University MBA Programme

Confidence interval =

x 2

9

© Mrinmoy K Sarma

s

n

We have calculated the x and s, and we know n, so we can solve this equation for the

confidence interval. Or, we could calculate the precision we obtained using part of the above equation

as follows,

Precision =

s

n

Now, suppose we want to reach a level of given precision. If we have a value for s, we can

solve this equation for the required sample size.

Let us illustrate this. Suppose at the 99.7 % level of confidence we wish to obtain an estimate of

the mean age of a target segment for a new magazine that is within + 1.5 years of the true mean age.

In addition , we will assume that we have an estimate of s= 6.0. The required sample size is obtained by

solving the following equation for n:

Precision =

+ 1.5 years

=+3

1.5

=

s

n

6

n

18

n

1.5n

n

=

=

18

12

n

=

144

this 3 comes from the equation of

determining the area under the

normal curve at.99.7% confidence

level.

Thus, with a sample size of 144 will give us a precision of + 1.5 years, if s= 6.

Here we have used absolute precision. If we express the precision level in terms of percentage

we call it relative precision. In this situation the formula would be

b.

x

=+

s

n

b = percentage of precision level

x = the estimate of mean

s

Here also the

should be multiplied by the coefficient at desired level of coefficient.

n

Research Methods in Business

Class Notes: Tezpur University MBA Programme

10

© Mrinmoy K Sarma

The most disturbing thing in our calculation of sample size is that we need to know the value of

s for absolute precision and a value of

s

in case of relative precision.

x

If we have these values, in all likelihood, we already know what we intend to know. Also, for

absolute precision the required sample size varies (a) inversely with the size of the precision desired,

(b) directly with s, and (c) directly with the size of the confidence level desired. In most studies we want

to measure many variables. To the extent that they differ in terms of precision desired , s, or confidence

level, the required sample size will differ. There is no one-sample size that is statistically optimal for any

study. The only way to assure the required precision would be to select the largest sample.

However, if a researcher has experience with the problem at hand , then very accurate estimate

of s are likely to be available at the time the sample size is being planned.

No one should accept the sample size generated by the statistical formula blindly. One reason

for not doing so is the existence of non-sampling errors. Non-sampling errors increase as the sample

size increases. Therefore, a carefully done study of 200 samples might give, sometimes (but not

always), better result than that from a sample size of 2000.

Sample size and other factors:

In any kind of business research one is always to find out a compromise between technical

elegance and practical constrains. These constrains are definitely effect the decision regarding the

sample size . Some of them are 1. Study objectives

2. Time constrain

3. Cost constrain

4. Audience acceptability

5. Data analysis procedure

The sample size determination procedure becomes complicated with more number of variables

are taken for analysis.

Other methods of Sample size determination:

1. Unaided judgement

2. All-you-can-afford

3. Average size in similar studies

4. Required size per cell in case of quota sampling

5. Traditional statistical methods ( as discussed above)

Stratified Sampling:

Stratified sampling calls for division of the total population into some sub groups and then

collect samples from each such group. The underlying objective of this method is to reduce the

standard error of the estimator. Thus the confidence interval we calculate will be smaller.

The method:

1.

2.

Divide the total population into mutually exclusive and collectively exhaustive

groups or strata.

Perform an independent simple random sample in each stratum.

Let us have the following notations:

Research Methods in Business

Class Notes: Tezpur University MBA Programme

Nst.1

Nst.2

nst.1

nst.2

Xst.1

Xst.2

s2st.1

s2st.2

11

© Mrinmoy K Sarma

= population in the stratum 1

= population in the stratum 2

= sample size in stratum 1

= sample size in stratum 2

= sample mean of the stratum 1

= Sample mean of the stratum 2

=sample variance of the stratum 1

= sample variance of the stratum 2

Disproportionate Stratified Sampling:

The overall sample size n be allocated to strata on a disproportionate basis with the population

sizes of the strata. Normally, we can reduce the standard error by sampling heavily in strata with higher

variability. Therefore, to reduce standard error we should draw heavy sample from strata whose

population is more variable in nature. Past experience and earlier studies can give us data regarding

variability in strata. Therefore, in such situation the samples from each strata differs in number and this

is known as disproportionate stratified sampling.

Cluster Sampling:

In cluster sampling a cluster or a group of elements are randomly selected at one time unlike

the other methods, where individual elements were picked up one by one. Therefore, the population

here also, should be divided into mutually exclusive and collectively exhaustive groups. We can select

randomly any of these groups. If we select groups thus, and use all the elements in the selected groups

as samples, it is known as one-stage cluster sampling. Or if we had selected a random sample

elements from within the selected groups this is known as two-stage cluster sampling.

In cluster sampling we try to form groups as heterogeneous as in the population (this is just

opposite to the stratified sampling, where, we try to formulate strata as homogeneous as possible), so

that selected samples from any of the groups would be representative of the total population as a

whole. If the groups are less heterogeneous than that of the population, then the standard error from

such sampling will be more than that of the simple random sampling.

Systematic Sampling:

In systematic sampling the researcher select every Kth element in the sampling frame , after a

random start somewhere within the first k elements. Suppose we want to select a systematic sample of

n=5 from a population size of 50 then the K will be

k= N/n = 50/5 = 10

The steps will be,

1. Obtain a random number between 1 and 10, This element will be picked up first.

2. Add 10 to this random number. This element will be the second element of the sample. Then add

another 10 and pick up that sample and so on.

Systematic sampling is easy and cheap to use. This is a close substitute of the simple random

sampling. Here, we do not need the complete sampling frame unlike in the simple random sampling.

However, the problem of periodicity might occur without the knowledge of the interviewer.

Area Sampling:

In each of the above sampling procedure a complete accurate listing of the elements of the

population is required . Unfortunately , for a great many business research applications such lists are

Research Methods in Business

Class Notes: Tezpur University MBA Programme

12

© Mrinmoy K Sarma

impossible to find. Therefore, in area sampling the area where the sample reside is taken into

consideration and samples are selected accordingly. Frequently used version of are sampling is Multi

Stage Area Sampling. The steps involved in MSAS are described below. Here a hypothetical case of

MSAS is described.

Stage 1:

Divide India in 5 zones. North, East, South, West and Northeast.

Stage 2:

A listing is made of the states fall within each of the zones:

Thus in the northeast seven states namely, Assam, A.P., Mizoram, Manipur, Nagaland,,Tripura

and Meghalaya. This type of listing is done for every zones.

Then a state from the selected zone in stage 1 is selected.

Stage3:

Another list of major cities is to be prepared of the selected state. Thus if Assam was selected

randomly the major cities will be, Guwahati, Tezpur, Jorhat, Tinsukia, Nagaon, Nalbari , Silchar,

Dibrugarh, Mangaldai ( or may be all district Hqs). Then a particular city is selected

Stage 4:

Then a ward of that particular city is selected .

Stage 5:

Then a street of that particular ward

Stage 6:

Then a house from the selected street.

Research Methods in Business

Class Notes: Tezpur University MBA Programme

13

© Mrinmoy K Sarma

Concepts of Measurement and Scaling

Once a research problem is defined and a particular plan of action is chosen to solve the

problem, three main components needed to be decided. Designing questionnaire, determining sample

size, and sampling technique including finalisation of field procedures. In many cases of practical

interest -- new product concept testing, corporate image measurement, advertisement effectiveness

measurement, and the like the researcher will seek information of various nature -- even of

psychological dimensions. If useful data are to be obtained from the field the researcher will have to

exercise cautions in deciding what is to be measured and how to make the measurement. This is to be

decided before preparing the questionnaire and starting field operations. Thus measurement of a

business phenomenon is fundamental to providing any meaningful information for decision making. The

objective of measurement is to transform the characteristics of objects into a form that can be analysed

later. Therefore, the object under study must be defined so that this can be measured. Many

researchers (specially the student researchers) blunder here and try to measure the object without pre

defining the objects under study.

Definitions in Research: An important part of practice of research entails construction, use, and

modification of definitions of objects. ”Attitude", "aggressiveness" "leadership capabilities" "job

satisfaction" can not be measured as it is, since these things can not be described objectively. Vague

definitions can not be measured, and therefore, cannot be used for further decision making.

Definitions can be distinguished into two classes --Constitutive definition and operational

definition. Constitutive definition is roughly similar to a dictionary definition. An operational definition

establishes the meaning of an object through specifying what is to be observed and how the

observation is to be made. Measurements and operational definition go together. That means the

researcher will have to get an operational definition of the object under investigation. Let us take the

example of "job satisfaction". Operational definition would suggest the individual components to be

measured to collectively arrived at a decision regarding "job satisfaction" of a particular group of

workers.

In business research measurement process involves using numbers to represent the business

phenomena under investigation. Stated formally, the empirical system includes marketing phenomena,

such as buyer reaction to products or advertisement, while the abstract system includes the numbers

used to represent the business phenomena.

The Measurement Process

Empirical system

Physical Sciences

Measurement

Social Sciences

Abstract System

Number System

Measurement Defined: It is the assignment of numbers to characteristics of objects or events

according to rules. Effective measurement is possible when the relationship existing among the objects

or events in the empirical system directly correspond to the rules of the number system. If this

correspondent is misrepresented, measurement error occurs.

Types of Scales:

Scales have been classified in terms of the four characteristics of the number system. These

scales of measurement are nominal, ordinal, interval and ratio. The following chart compares the four

scales of measurement. The understanding of the types of scales of measurement is necessary

because analytical procedure differs according to the type of the scale.

Research Methods in Business

Class Notes: Tezpur University MBA Programme

14

© Mrinmoy K Sarma

Characteristics of Measurement Scales

Scale

1.

Nominal

2.

Ordinal

3.

Interval

4.

Ratio

Number system

Unique definition of numerals

( 0, 1,….,9)

Order of numerals

1<2, 2<3, 5>4 etc.

Equality of difference

3-2=8-7

Equality of ratios

2/4 = 4/8

Characteristics

No origin, no order and no

equality of differences

No origin, no equality of

difference. But with order

No origin. But with order and

equality of difference

With origin, equality of ratios,

and order

Questionnaire

A questionnaire is a formalised schedule for data collection. The basic job of questionnaire is to

measure the variables under study. This is the most widely used primary data collection techniques,

and used throughout the world for social science researches.

Questionnaire is one of the methods through which the empirical system definition (operational

definition of the variable) is converted into abstract system of the number system, which measures the

variables under consideration. If something goes wrong in this process measurement error occurs.

The next paragraphs are used to discuss the principles of perfect questionnaire construction,

which can reduce this error to the minimum.

There are 5 basic components of the questionnaire. They are (1) Identification Data, (2)

Request for Cooperation, (3) Instruction, (4) Information Sought, (5) Classification Data.

Identification Data contain the respondent’s name, address and other relevant information,

which might be used at a later date to identify the

respondent from the questionnaire. Often these information

First Page of Questionnaire

are collected from some secondary sources like the sampling

Identification

Data

frame before selection of sample and therefore, as one of the

first steps of data collection. Normally, this information is

written in a separate sheet of paper, which is not shown to

Request for Cooperation

the respondents. Many researchers put a code mark in the

beginning of the questionnaire, which may indicate the

identification of the respondent. The code mark is put in a

prominent place in the first page of the questionnaire, like in

the right-hand-top corner of the page. The code may be of

any nature – alfa or numeric or both. However, care should

be taken to see that these codes can be entered into the data

sheet of the SPSS or any other software package, which will

eventually be used for data processing and analysis. In this

code itself the time, date and place of the interview may also

be recorded. However, separate code may be used for this

purpose, or otherwise this may directly be written at in a pre specified prominent place of the first page

of the form.

Request for Cooperation: A request is made to the prospective respondents for their help and

cooperation by the researcher. In this components the researcher should spell out very briefly the

objectives of the research, how this is going to help him or an organisation and why and how the

respondent is selected for the interview. However, sometimes for the sake of extracting unbiased

responses, the identity of the sponsors may not be revealed anywhere in the questionnaire. Many

researcher use creative ideas here to motivate the subject (subject is a world frequently used in place of

respondent in areas like psychology and medicine, where the subjects are monitored for physical or

psychological responses after a particular experiment etc.) to ensure willing and accurate responses

Research Methods in Business

Class Notes: Tezpur University MBA Programme

15

© Mrinmoy K Sarma

from them. The mention of tentative time required to fill up the questionnaire just after the request is of

utmost importance. The required time may be gathered during the pilot survey itself. The average time

taken to fill up the questionnaire during the pilot survey may be used as the tentative time required.

However, if there are many changed after the pilot survey, a new average may be gathered through

another pilot survey.

Instructions are the comments and hints about the questionnaire itself or about individual

questions there in. The instructions help the respondents or the interviewers in fully understanding the

questionnaire and the individual questions and thus help in having accurate measurements of the

variable under study. The instructions common for all questions may be put in the beginning of the

questionnaire just after the request for cooperation. However, the hints regarding a particular question

may be put just after the question in different distinguishable letter font and within brackets. The letter

fonts must be same for all kinds of instructions throughout the questionnaire, and must not be more eye

catching than the letter fonts used for writing the questions itself. Many researcher use italics and one

size smaller (than the size used for the questions) of the same letter font as in the questions. The

instructions should be precise and easily understood by the respondents, and as such this is no place to

show the researcher’s proficiency or knowledge (of word stock) in English. The sentences should be

short and preferably without any idioms.

Information sought is the most important part of the questionnaire, which deals with the

questions itself. This problem is taken up below under the headline Questionnaire Design.

Lastly, classification data are used to classify the respondents on the basis of some predefined

criteria. Income level, age, sex, educational background, profession etc. of the respondents may consist

the classification data. The questions regarding these should normally be asked towards the end of the

questionnaire.

Questionnaire Design

According to Kinnear and Taylor, two well-known authorities in marketing research,

questionnaire design is more of an art than a science. No amount of steps and procedures will ensure

an effective and efficient questionnaire. The skill through which researchers make effective

questionnaire can be acquired only through experience and hard work. The only way to begin is to

develop as many questionnaires as possible and then analyse them for weaknesses and pitfalls.

As mentioned earlier, the measurement of the variables is the very preliminary step towards

writing a questionnaire. Likewise Research Design, Sources of Data, Target Respondents etc. are to be

considered initially before starting the formal process of questionnaire design. These are known as

previous decisions. It must be mentioned here that more heterogeneous the target group more

difficult is the job of preparation of a single questionnaire for the entire group. A perfect link between

the information need and the data to be collected must be established before proceeding. The data

to be collected must have absolute link with the information need. Otherwise the data collected would

not be able to meet the requirement of the research objectives and thus all efforts will be invalid. To

ensure a perfect link, the research objective must be divided into certain sub-objectives beforehand.

The sub objectives then should be tested for the needed information, how the information are to be

collected, what kind of sources of data are to be adopted etc. If primary data were decided to be

collected, the target group of information providers should also be identified. Then the researcher must

decide about the variables those are to be measured to achieve the required sub-objective(s). The

variables are then measured as mentioned earlier.

Research Methods in Business

Class Notes: Tezpur University MBA Programme

16

© Mrinmoy K Sarma

Preliminary Considerations for Questionnaire Preparation

RESEARCH OBJECTIVE (S)

INFORMATION NEEDS

INFORMATION NEEDS

VARIABLES TO BE MEASURED

SOURCES OF DATA

METHODS OF ANALYSIS TO BE USED

TARGET GROUP OF RESPONDENTS

SCALES OF MEASUREMENT

QUESTIONNAIRE

The Scale of Measurement of each variable is to be determined ahead of the beginning of

questionnaire writing. The diagram titled Preliminary Considerations for Questionnaire Preparation

explains the process of arriving at preliminary considerations. [The diagram will be discussed in the

class with examples.]

In the following paragraphs a six-step process of questionnaire preparation is discussed. The

process is depicted in the following diagram.

Steps in Questionnaire Design

Question contents

Response format

Question wording

Question sequence

Physical characteristics

Pilot survey, revise and finalise

Decision about Question Contents

Decision concerning question content centre on the general nature of the question and the

information it is designed to produce according to the preliminary considerations. Five major issues and

problem areas are involved with question contents.

1.

The need for the data asked for by the question: In general, every

question in the questionnaire must be able to make contribution to the problem at hand. Here decision

is to be taken on how the researcher is going to use the data generated by the question? If a

satisfactory answer cannot be provided, the question should not be retained in the questionnaire. A

Research Methods in Business

Class Notes: Tezpur University MBA Programme

17

© Mrinmoy K Sarma

question must be asked if and only if it helps in measuring a particular predetermined variable(s).

However, in case of certain situations an irrelevant question may be asked if the researcher thinks it as

suitable in creating easiness in answering few questions that follows. Or for involvement of the

respondents and creating a rapport before asking a sensitive question. Like if the intention of the

researcher is to ask for TV watching habit of the respondents, he can ask a question whether the

respondent enjoy watching TV.

2.

Ability of the Question in Producing Relevant Data: Once it is assumed

that the question is necessary, the researcher must make sure that the question is sufficient to produce

the required data. Sometimes, a single question may not be enough to measure a particular variable.

Like determining the level of disposable income of the respondent. In this case the researcher may ask

for many indirect or cross-questions at different places of the questionnaire so as to ascertain the level

of the respondent’s spending during a particular period of time, if in the opinion of the researcher a

direct question is not going to give a accurate result. Actually, the researcher may decide about this

while deriving the sub variables for measurement.

3.

Ability of the Respondent to Answer Accurately: Once it is decided that

the question is necessary and sufficient, next task in front of the researcher is to ensure that the subject

knows the accurate answer of the question. Inability in the part of the respondent to answer a question

accurately may be resulted from three situations.

The respondent may have never been exposed to the answer. It is found that the

respondents tend to answer a question even if he/she does not know the answer. This often leads to

serious measurement errors. To avoid this error the researcher may take a two pronged strategy: a)

eliminate such respondents (whom the researcher thinks may not have an accurate answer) in the

sampling frame itself; and b) more realistically, encourage the respondents to leave the questions blank

when they do not know the accurate answer. [Can you find out some tactics for implementing the second strategy?

Also can you visualise what kind of errors might arise if we implement the first strategy wrongly? If you have the answers, offer

them in the class].

The second situation arises when the respondent is forgetful. People are asked

questions, answer to which they once knew but now forgotten. Like the date on which they bought their

TV set or the Microwave oven? Researches have found out that people tend to forget the information

rapidly just after being exposed to them, and then they continuously do so over the passage of time. It is

a well-known fact that the probability of forgetting an event is related to the importance the subject has

attached to the event and the frequency of occurrence of the event. Like if you ask a 50-year-old about

the amount of his first pay cheque, in all probability he will remember it accurately. (Now, whether he will

be willing to share that information with you is another matter.) There are few dangers for the

researcher from the forgetful respondent. Researches have also found out that there might be omission

(simple forgetfulness), telescoping; i.e., the respondent is remembering an event as occurred recently,

while actually it happened long back; and creation, which occurs when the respondent tries to create an

imaginary event.

When the researcher is interested in finding out the facts about an infrequent or

unimportant event the questionnaire designing becomes difficult. (Is not it difficult to define what is

“important” or “unimportant” in the lives of so many respondents you have not met yet). Aided Recall

can be used as one of the solutions, where respondents are given some probable solutions (like in the

multiple-choice questions) of the question. However, in aided recall method, there is a high chance of

occurrence of creation error, which may be reduced by using some bogus or wrong choices in the

solution panel.

The third situation arises when the respondents are able to answer accurately but not

willing to give the accurate answer. There might be two situations again. a) The respondent refuses

to answer. In this case apart from having a high non-response rate, no other error occurs. b) The

respondent willingly offers incorrect answer. There might be many reasons because of which the

respondents may not be willing to cooperate. He may think that the situation is not conducive to offer

the right answer, or disclosure of the data will be embarrassing, or the disclosure might be a potential

threat to the respondent’s prestige or normative view.

Research Methods in Business

Class Notes: Tezpur University MBA Programme

18

© Mrinmoy K Sarma

Here the researcher's job is to motivate the respondents to offer the accurate

response. Financial incentives are widely used to achieve this. However, some other measures like

designing the questionnaire in innocent manner, which assures that the answers are not going to be

used against the respondents may also be used.

One interesting technique, though with some limitations in analysis, is randomised

response technique. This may be used to address the problem of non-response to an embarrassing

question. In this method the researcher presents the respondents with two questions, separately from

the other questions in the questionnaire. One of the two questions will be the intended question, while

the other will be irrelevant for the research and will be very general, like the month of birth of the

respondent, or that of his/her spouse, which the respondent will find very easy to answer. Then a

random procedure, like tossing a coin will be used to select the question to be answered. The question

will be selected by the respondent and the researcher will not know about the selection. Essentially, the

response format should be same for both the questions. And the respondent will tell the interviewer only

the answer, like yes or no. Since the respondents are assured that the interviewer will not know the

question he/she is answering, it is expected that the respondent will behave reasonably and offer the

accurate answer to whatever question the random procedure selects. After completion of the data

collection procedure the researcher use the help of some secondary data to find out the proportion of

the respondents said yes or no (or whatever the response format was) to the question under

consideration.(Let us play a game in the Class)

An example of Randomised response Technique: Suppose you are interested in finding

out the percentage of college going students who drink. If you ask a teenager directly about whether

he/she drinks chances of getting a biased (incorrect) answer are very high. To overcome this you may

club this question with a very easy question like the month of his/her birth. You must be careful in

selection of the second question as this should meet the following two criteria:

The question should be very easy to answer

And the answer to the question should be available from a secondary source.

Now consider the following example of a randomised response questionnaire:

TOSS THE COIN THE INTERVIEWR IS GIVING YOU.

IF YOU GET HEAD, ANSEWR QUESTION NO.1 BELOW.

IF TAIL APPEARS ANSWER TO QUESTION NO. 2.

DO NOT TELL OR SHOW THE INTERVIWER ANYTHING.

THUS INTERVIWER WILL NOT BE KNOWING TO WHICH QUESTION YOU ARE ANSWERING.

AND YOUR PRIVACY WILL REMAIN INTACT

1.

YOU WERE BORN IN THE MONTH OF DECEMBER.

2.

YOU HAVE NEVER STOLEN ANY MONEY FROM YOUR FATHER’S PURSE.

ANSWER:

YES

NO

Answer to the first question will be known from the data collection by the census

authority (do you know the name of the office which conduct census in India?). Even from intuition the

answer can be guessed to be around

1

. Now the percentage of respondents which answers “No” to

12

the second question could be calculated by the following formula.

P( No) P(insensitiv e _ question) * P(" No" to _ insensitiv e _ question)

P( sensitive _ question)

See Thomas C Kinnear and James R Taylor ,“Marketing Research”, 5 th international edition, McGraw-Hill for

more detail.

Research Methods in Business

Class Notes: Tezpur University MBA Programme

19

© Mrinmoy K Sarma

Where,

P (No) is proportion of respondents who answered "No"

P (insensitive_question) is the probability of answering 'No" to the insensitive question (in this

case it is 0.5)

P ("No" to_insensitive_question) is proportion of people born NOT in December (from census

data)

P (sensitive_question) is the probability of answering 'No" to the sensitive question (in this case

it is 0.5)

Decision About Response Format

This is one of the more creative areas of questionnaire preparation. Normally there are two

types of response format. 1. Open ended question, and 2. Close ended questions. There are various

advantages and disadvantages of both the types of questions.

To make the questionnaire attractive multiple choice questions may be used in many ways.

Interesting pictures, cartoons etc. may provided in lieu of normal words. Like smiley faces might be

used for expressing satisfaction level. The following example will give an idea.

Question: Are you satisfied with the after sales service of the product XYZ?

Choices:

Very

Satisfied

Somewhat

Satisfied

Indifferent

(cannot say)

Not

Satisfied

Not

Satisfied at all

These choices

can graphically

be depicted as :

Decision on Question Wording:

The heart of the questionnaire consists of the questions - the link between the data and

information needs of the study. It is critical that the researcher and the respondents assign same

meaning to the questions asked. Otherwise serious measurement errors will occur. Therefore, the

discussion under this sub-head will revolve around how to write questions, which carry the same

meaning for both researcher and the respondent. There are certain general guidelines regarding

designing the wordings of the question.

1.

Use simple words

2.

Use clear words: In finding out clarity of words used in a questionnaire,

answer the following questions.

a) Does this word mean what is intended?

b) Does it have any other meaning?

c) If so, does the context make the intended meaning clear?

d) Does this word have more than one pronunciation? (for Telephonic interview this is

most important)

e) Is there any word with similar pronunciation that might be confused with this word?

f) Is there a still simpler word or phrase that might be used?

1.

Avoid leading questions: A leading question is one in which the respondent is

given a cue as to what should be the answer of the question. Leading question often

reflects the researcher's or the organisation’s view point on a particular variable under

study. This type of question causes constant measurement error throughout the survey.

An example of leading question would be to ask a respondent: Today is very hot. Is not

it?

Research Methods in Business

Class Notes: Tezpur University MBA Programme

2.

20

© Mrinmoy K Sarma

Avoid biasing questions: A biasing question includes word or phrases those

are emotionally coloured and suggest a feeling of approval or disapproval. Often it

includes certain references, which might effect the answer of a question. An example

might be Do not you agree with the view of Bill gates that new century will be an era of

Information Technology? And who would, in earth, like to answer such kind of an

question? Those who like Bill will say yes and those who do not know gates will say no.

And now your job is to find out which one is the honest response!

An example of loaded question will be Is General Motors doing everything

possible in reducing automobile pollution? The answer is obvious no or obvious yes,

because General Motors is doing, and also not doing everything possible to reduce

automobile pollution. Even if the intention of the researcher was different the use of the

two words made the question vulnerable to measurement error.

3.

Avoid implicit alternatives: Researcher should not offer only partial

alternatives in case of close ended questions. If your job is to find out the brand name

of the Toothpaste used by the respondent, then you must include all available brands in

the market so that while responding the sample does not feel difficulty in finding out a

place to tick. If it is not possible to include all the alternatives or if your job is not to find

out the exact brand of the toothpaste, you are allowed to use the word others so that

any measurement error does not occur. That means the choices should be collectively

exhaustive.

4.

Implicit assumption: Consider the two questions: Do you favour a ban on

commercials in movie theatres? And just add the following part to the question. …even

if it means a rise in $.5 per show? The proportion of samples that said ‘yes’ to the first

part of the question is 22%, and the same for the whole question is 11%. Often it is

found that measurement error galore for the failure of the researchers in stating

essential assumptions. Therefore, the researcher must not think that the respondents

know the virtual assumptions related to a question.

5.

Avoid estimates : Question should not be such that the respondent has to

rely on estimates. Therefore, distant recall question should not be asked. If estimate is

encouraged the respondents might give inaccurate information.

6.

Avoid double barreled questions: The questions should be simple and

should contain only one answer. However, it is often seen that one question actually

includes two questions and thus two answers. Consider, What is comment on LML

Vespa's after sales service and economy standard? The answer to these two questions

may be different, and the respondent is not sure to which question you are asking

answer!

7.

Consider the frame of reference: This refers to the respondent's view point

from which he/she is answering the questions. Consider the two questions: Are

automobile manufacturers are making satisfactory progress in controlling automobile

emission? And Are you satisfied with the progress automobile manufacturers are

making in controlling emissions?

The wording for each question should be as simple as possible. It should be consistent to the

vocabulary level of the respondents.

Decide on Question Sequence: once the wordings are finalised, the questions should be put in

sequence. The following guidelines may be followed for this purpose.

Use simple and interesting opening question

Ask general questions first

Place uninteresting question later in the sequence.

S. Hume and M. Magiera, "What do Moviegoers Think of Ads?" Advertising Age ( April 1990)

Research Methods in Business

Class Notes: Tezpur University MBA Programme

21

© Mrinmoy K Sarma

Arrange questions in logical order.

Physical get up of the questionnaire should be eye-catching, gorgeous and should be full of

blank spaces. The letters should be easily legible to all members of the sample.

Pilot Survey: The basic job of a pilot survey is to find out the difficulties that might be faced

during the field operations of the survey with the questionnaire so that necessary actions and

modifications can be initiated to remove these difficulties in the time of actual field operation. Specially

the understanding of the questions by the respondents are tested. The following issues are taken up in

this stage:

In terms of physical appearance:

a)

Will the questionnaire appeal to respondents and motivate them to cooperate? Is

your questionnaire "sensuous"?

b)

Does the questionnaire include brief and precise instructions? Are the

instructions are enough to explain the respondents what is wanted from them?

Are they confusing in any respect?

c)

Is your format conducive to your chosen method of data entry? (like keying,

scanning and hand tabulation etc?

In terms of content:

a)

Does each question ask for one bit of information?

b)

Does the question presuppose a certain state of affairs? If so, if the assumption

is justified?

c)

Does the question wording bias response?

d)

Are any of the questions words emotionally loaded, vaguely defined, or overly

general?

e)

Do any of the question's words have a double meaning, which may confuse

respondents?

f)

Does the question use abbreviations, or jargon, which may be unfamiliar?

g)

Are the question's responses mutually exclusive and sufficient to cover each

conceivable answer?

Research Methods in Business

Class Notes: Tezpur University MBA Programme

22

© Mrinmoy K Sarma

SURVEY METHOD

There are three widely used methods of primary data collection, especially through survey method.

These are,

mail,

telephone interview, and

in-person interview

There remain inherent merits and demerits of all these methods. The methods are evaluated

on the basis of the following criteria

Versatility of use

Cost associated

Time taken

Possibility of Sample Control

Quality of information

Quantify of information

Response rate (or non response rate)

Mail surveys are the most common examples of self-reported data collection. One of the

reasons is that such surveys can be relatively low in cost. This does not mean, however, they are

necessarily easy to carry out. Planning the questionnaires for mail surveys is often more difficult than for

surveys those use interviewers (in-person interview or telephonic interviews). For example, care is

needed to anticipate the physical and psychological conditions of the respondents in advance – in many

cases without knowing the ground realities of the environment the respondent is facing.

Using the mail (post) can be particularly effective in business surveys. Mail surveys also work

well when they are directed toward specific groups -- such as, subscribers to a specialized magazine or

members of a professional organization. The manner in which self-reported data are obtained has

begun to move away from the traditional mail-out/mail-back approach. The use of fax machines -- and

now the Internet -- is on the rise. Fax numbers and e-mail addresses are being added to specialized

membership and other lists. As a by-product, they can be used, along with more conventional items like

names and mailing addresses, in building potential sampling frames.

There are still other methods of obtaining self-reported data like the one used for obtaining

continuous information about the same elements over a period of time. Panels are such examples.

However, technology has helped reducing the cost, time and effort in collecting such routine

information. For example, computer network can be used to put in necessary information into the

principal server by the remote respondents. However, for the immediate future, this type of automation

will probably be restricted largely to business or institutional surveys in which the same information is

collected at periodic intervals -- monthly, quarterly, etc. Do you think TRP surveys can use this

technique?

How to Conduct an Interview

Interview surveys -- whether face-to-face (in-person) or by telephone -- offer distinct

advantages over self-reported data collection. The "presence" of an interviewer can increase

cooperation rates and make it possible for respondents to get immediate clarifications. One of the main

requirements for good interviewers is the ability to approach strangers in person or on the telephone

and persuade them to participate in the survey. Once a respondent's cooperation is acquired, the

interviewers must maintain it, while collecting the needed data, which should be obtained in exact

accordance with laid down instructions.

For ensuring quality of the collected data, interviewers should be carefully trained through

classroom instruction, self-study, or both. Good interviewer techniques such as -- how to make initial

contacts, how to conduct interviews in a professional manner, and how to avoid influencing or biasing

responses. Training generally involves practice interviews to familiarize the interviewers with the variety

of situations they are likely to encounter. However, for different interviews, the interviewers should be

Research Methods in Business

Class Notes: Tezpur University MBA Programme

23

© Mrinmoy K Sarma

trained separately so that a question by question understanding is achieved to make them qualified to

deal with any misunderstanding that might arise at the time of the interview. Also, the interviewers may

be made clear about the purpose, definitions and procedures of conducting a particular survey

separately. In most reputable survey organizations, the interviewers are also required to take a strict

oath of confidentiality before beginning the work. Interviewers should also be trained on the way the

samples are to be selected, if needed. If they are to visit the pre-selected samples, adequate guiding

materials such as addresses, maps, pictures etc. should be made available to them (after imparting

training on how to read them), so that they make no mistake in finding the right samples.

It is advisable to send an advance letter to the sample respondents, explaining the purpose of

the survey and that an interviewer will be calling soon. Many reputed survey organisations offer

information to the respondents on how the information will be used and the level of confidentiality of the

data.

Visits to sample units should be scheduled with attention to considerations like the best time of

day to call or visit, which might be gathered from the pre-selected samples through advance call or mail.

Computers and Survey:

Few years back more than 95% of the 165 members of the Council of American Survey

Research Organisation offered internet based data collection, wherein they used internet as their data

collection tool rather than typical meet-the-respondent fill-up-the-questionnaire technique. They reported

many advantages of such a method of data collection. Speed is one of the main advantages. One

market research organisation completed 1000 questionnaire for a customer satisfaction survey within

only 2 hours! This is incredible compared to the time (sometimes months) required in traditional

method. Networked research also offers the ability to target hard-to-reach population. One of the

traditional difficulties in segmentation research is to identify and access respondents who fit a particular

lifestyles or reside in a remote area. Now-a-days many internet portals offer segmentation statistics at a

price and thus the researchers can reach such population without much difficulties. You might have

noticed while using internet how the promotional mails are sent (most of the cases unsolicited). The

same method can be used with a bit of refinement and modification. Web based data collectors can use

the opportunity for multi-media presentation to make their points. With the advent of high-speed

network connection (in giga-bites) this would be more practical and user friendly. And remember this

can be made at the disposal of the respondents without any movement of the interviewers. However,

despite all these unparalleled advantages such research may be infected with the traditional errors of

data collection. More so because of the fact that the Internet addresses are impossible to verify to

ascertain whether the sampling frame is the correct one.

However a blending of traditional method and computer method can reduce these errors to the

minimum, while keeping the distinctive advantages of the networked survey.

Computer Assisted Telephone Interview (CATI): The use of computers in survey

interviewing is increasing day by day. American Statistical Association reports that in the United States,

most of the large-scale telephone surveys are now conducted using computers. In CATI, the

interviewers use a computer either in a network or stand alone to conduct the telephonic interview. The

questions in order of preference appear in the screen and the responses are inserted directly into the

computer. Then the same are analysed readily using the required statistical software.

The CATI interviewer's screen is programmed to show questions in a planned order, so that

interviewers cannot inadvertently omit questions or ask them out of sequence. Specially, if some

questions require “branching” (i.e., answers to prior questions determine which other questions are to

be asked. Like, if the answer to a question is “yes”, then a different set of questions are asked, while for

“no” as an answer still different questions are asked) CATI can be programmed to do the correct

branching automatically. In ordinary telephone interviewing, incorrect branching has sometimes been an

important source of errors, especially omissions. CATI can also be used to make automatic crosschecking of responses. If certain inconsistency occurs, the software itself will pop in certain question on

the screen for the respondent to clarify (to correct or confirm) earlier responses.

Research Methods in Business

Class Notes: Tezpur University MBA Programme

24

© Mrinmoy K Sarma

Other advantages of this method of telephonic interview are quality and speed. CATI can

produce statistical results quicker than traditional methods of data collection. For example, it eliminates

the need for a separate data processing and data entry. This method is more useful when a daily or

periodic summary of results is required.

However, limitations of CATI include the type of questions – obviously only close ended

questions with multiple choices can be managed through such methods. Any insertion, which requires

longer time, may distract the respondent, as the waiting time for the next question will be long.

Moreover, CATI can cost more for small, non-repeated surveys, due to programming the questionnaire.

CATI's cost per interview decreases as sample size increases -- so in large and/or repeated surveys, it

is cost competitive with conventional telephone methods.

Computer Assisted Personal Interview (CAPI): This method has direct linkage to the high

level of use of lap top computers or other portable computer systems, which can be taken into the field,

and either the interviewer or the respondent can directly enter data in response to questions. Data

collection carried out in this way is referred to as CAPI. The CAPI laptops may not be in a network at

the time of administration of the questionnaire. Nonetheless, most CATI quality and speed advantages

also occur with CAPI.

Although only a few organizations currently employ CAPI methods, their use is expected to

expand in the next few years. Clearly, the periodic interviews like that of a panel study (for example to

determine TRP {do you know by this time what is it? If not, find out NOW} indexes) may be greatly

benefited by the use of CAPI.

However, the question remains as to what extent the traditional paper and pencil method will

remain as the prime tool of conducting interviews! Who can predict!!

Shortcuts to Avoid during a Survey:

A credible survey must be carefully planned and controlled (during execution). This needs lots of

determination, consistency in the approach and perseverance. Amateur researchers are often inclined

to adopt shortcuts, as they feel such measures would not jeopardize with the quality of the findings.

However, contrary to their belief, taking shortcuts can invalidate the results and badly mislead the

sponsor and other users. Here three most commonly used shortcuts are mentioned.

Pretesting of field procedures (pilot survey) is avoided

non-respondents are not followed up sufficiently

Sloppy fieldwork and inadequate quality controls

Therefore, efforts should be made not to take these shortcuts for the sake of collecting good

quality data. When non-response occurs, efforts must be made to re-contact the sample again and

again. Every organisation might have some policy as to how the non-responses are taken care of, or

how many times a non-respondent will be tried to be contacted. However, if non-response is occurring

for reasons other than non availability of the sample at the time of the visit of the interviewers or a

returned mail due to non availability of the addressee, non-response can be prevented to a great extent

by proper planning and pretesting of the questionnaire. A pretest of the questionnaire and field

procedures is the only way of finding out if everything “works”— especially if a survey employs new

techniques or a new set of questions. We will discuss about Pretesting, which is also known as pilot

survey is a later part of this material. Sloppy execution of a survey in the field can seriously damage

results, Controlling the quality of the fieldwork is done in several ways, most often through observation

or redoing a small sample of interviews by supervisory or senior personnel. There should be at least

some questionnaire-by-questionnaire checking, while the survey is being carried out; this is essential if

omissions or other obvious mistakes in the data are to be uncovered before it is too late to fix them. In

other words, to assure that the proper execution of a survey corresponds to its design, every facet of a

survey must be looked at during implementation. For example... re-examining the sample selection …

redoing some of the interviews. Without proper checking, errors may go undetected. With good

procedures, on the other hand, they might even have been prevented. As W. Edwards Deming

recommends, a complete systems approach should be developed to be sure that each step fits into

the previous and subsequent steps. Murphy’s Law applies here, as elsewhere in life. The corollary to

Research Methods in Business

Class Notes: Tezpur University MBA Programme

25

© Mrinmoy K Sarma

keep in mind is that not only it is true that “If anything can go wrong it will… but, “If you didn’t check on

it, it did.”

How to Plan a Survey:

To begin with every researcher must ask the following questions repeatedly:

1.

2.

3.

Whether the required information can be collected through a survey?

Or may be these cannot be?

Is the information available in some indirect sources?

When the researcher is satisfied with the answers and convinced that there is a need for survey

for the required information, he/she can take further steps in planning a survey. The following stages of

activities are generally followed while planning a survey.

A.

B.

C.

D.

E.

F.

G.

H.

LAY DOWN THE OBJECTIVES OF THE INVESTIGATION: This is generally is

the function of the sponsor of the survey. However, it is the duty of the

researcher to finalise the objectives which are achievable (means, not

unrealistic) with the consultation of the sponsor. The objectives of the survey

should be as specific, clear cut and unambiguous as possible.

SPECIFY THE DATA COLLECTION PROCEDURE: The mode of data

collection must be decided upon before proceeding further. The decision will

have to be made whether the mail (conventional or electronic), telephone or inperson method will be applied. The steps those follow this will be heavily

dependent upon this decision of the researcher.

PLANNING OF THE DATA COLLECTION FORM: If the researcher is willing to

employ the mail in and mail out method of data collection, the form of data

collection, which is known as the questionnaire, in this case will have to be

carefully planed and implemented (please see the topic questionnaire, which s

included in the material.). However, if the electronic method is used proper

care has to be taken to see that enough responses are received with out any

distortion of the objectives. Like if the researcher is administering the

questionnaire through e-mail, the planning will be different than if the data are