Growth, De-Regulation and Rent-Seeking in Post

... The Friedman approach in defence of the inherent justice of the market outcome assumes that contribution should be measured in terms of wages and prices that would obtain in a free market, bypassing the thorny normative idea of the moral merit of contributions. Prices reflect valuations at the margi ...

... The Friedman approach in defence of the inherent justice of the market outcome assumes that contribution should be measured in terms of wages and prices that would obtain in a free market, bypassing the thorny normative idea of the moral merit of contributions. Prices reflect valuations at the margi ...

IFI_Ch14

... – If the firm has additional sources of capital outside the domestic (illiquid or small) capital market, the marginal cost of capital shifts right to MCCF – This is because foreign markets can provide long-term funds at times when the domestic market is saturated because of heavy use by other borrow ...

... – If the firm has additional sources of capital outside the domestic (illiquid or small) capital market, the marginal cost of capital shifts right to MCCF – This is because foreign markets can provide long-term funds at times when the domestic market is saturated because of heavy use by other borrow ...

FACTSHEET – 05.07.2017 Solactive Panthera World Market

... This info service is offered exclusively by Solactive AG, Guiollettstr. 54, D-60325 Frankfurt am Main, E-Mail [email protected] | Disclaimer: The financial instrument is not sponsored, promoted, sold or supported in any other manner by Solactive AG nor does Solactive AG offer any express or imp ...

... This info service is offered exclusively by Solactive AG, Guiollettstr. 54, D-60325 Frankfurt am Main, E-Mail [email protected] | Disclaimer: The financial instrument is not sponsored, promoted, sold or supported in any other manner by Solactive AG nor does Solactive AG offer any express or imp ...

Financial Algebra - Elgin Local Schools

... salespeople. They are paid a percent of the profit the dealership makes on the car, not on the selling price of the car. If the profit is under $750, the commission rate is 20%. If the profit is at least $750 and less than or equal to $1,000, the commission rate is 22% of the profit. If the profit i ...

... salespeople. They are paid a percent of the profit the dealership makes on the car, not on the selling price of the car. If the profit is under $750, the commission rate is 20%. If the profit is at least $750 and less than or equal to $1,000, the commission rate is 22% of the profit. If the profit i ...

RBC Dain Rauscher Inc

... Resale and Repurchase Transactions—Securities sold under repurchase agreements or purchased under agreements to resell (resale agreements) are accounted for as collateralized financing transactions. The Company records these agreements at the contract amount at which the securities will subsequently ...

... Resale and Repurchase Transactions—Securities sold under repurchase agreements or purchased under agreements to resell (resale agreements) are accounted for as collateralized financing transactions. The Company records these agreements at the contract amount at which the securities will subsequently ...

Fixed Income Portfolio Management Interest rate sensitivity

... portfolio maturity to generate capital gains, whereas an investor who believes rates will rise should switch to shorter maturity instruments to reduce potential capital losses ...

... portfolio maturity to generate capital gains, whereas an investor who believes rates will rise should switch to shorter maturity instruments to reduce potential capital losses ...

Bubbles, Financial Crises, and Systemic Risk

... highlights the role of financial innovation, in this case in the form of bills of exchange that facilitated leverage. During the 19th century, the U.S. suffered a multitude of banking crises. Before the creation of a national banking system in 1863-65, major banking crises occurred in the U.S. in 18 ...

... highlights the role of financial innovation, in this case in the form of bills of exchange that facilitated leverage. During the 19th century, the U.S. suffered a multitude of banking crises. Before the creation of a national banking system in 1863-65, major banking crises occurred in the U.S. in 18 ...

Claire Donnelly

... Minimize displacement of low-income residents Preserve project viability ...

... Minimize displacement of low-income residents Preserve project viability ...

Financial crisis and economic downturn: Where did they come from

... be able or willing to extend credit to the normal extent • In countries in which fiscal space is limited, especially important to focus fiscal stimulus actions on measures having the largest effect on aggregate demand (expenditures or targeted transfers), although political considerations may requir ...

... be able or willing to extend credit to the normal extent • In countries in which fiscal space is limited, especially important to focus fiscal stimulus actions on measures having the largest effect on aggregate demand (expenditures or targeted transfers), although political considerations may requir ...

FACTORS INFLUENCING THE PATRONAGE OF STOCKS ON THE

... The theory of price-efficient capital markets relates to a financial asset market where prices quickly mirror all accessible information. This implies that all publically accessible information is already factored into the price of an asset, so investors can only make or expect a return equal to the ...

... The theory of price-efficient capital markets relates to a financial asset market where prices quickly mirror all accessible information. This implies that all publically accessible information is already factored into the price of an asset, so investors can only make or expect a return equal to the ...

NEER THE OF ThE MARKET

... 1884 price. They also find problems in the Cowles cumulative returns series. They do not find problems with the data used in this paper. '6To check this, I carried out a simple simulation. I generated data assuming stock prices followed a geometric random walk at daily frequency with an innovation s ...

... 1884 price. They also find problems in the Cowles cumulative returns series. They do not find problems with the data used in this paper. '6To check this, I carried out a simple simulation. I generated data assuming stock prices followed a geometric random walk at daily frequency with an innovation s ...

The Role of a Corporate Bond Market in an Economy

... what is known as private placements. Investors in such instruments are usually referred to as relationship investors because they must monitor the company’s performance themselves and are therefore typically provided special access to the company and its activities (see e. g. Emerick and White 1992) ...

... what is known as private placements. Investors in such instruments are usually referred to as relationship investors because they must monitor the company’s performance themselves and are therefore typically provided special access to the company and its activities (see e. g. Emerick and White 1992) ...

Lesson 10 - La Passerelle

... • The best way to « feel » the relationship between two RV is to look at their scattergram (or their joint distribution) • We « fit » an oval shape (with the appropriate technique which we won’t study) through the scattergram • The most important fact is whether there is an angle between the axes of ...

... • The best way to « feel » the relationship between two RV is to look at their scattergram (or their joint distribution) • We « fit » an oval shape (with the appropriate technique which we won’t study) through the scattergram • The most important fact is whether there is an angle between the axes of ...

Review Questions

... Depository institutions are financial intermediaries that issue checkable deposits. They are the most familiar and the largest type of financial intermediary. Checkable deposits are deposits that are subject to withdrawal by writing a check to a third par ty. Such deposits are money per se since the ...

... Depository institutions are financial intermediaries that issue checkable deposits. They are the most familiar and the largest type of financial intermediary. Checkable deposits are deposits that are subject to withdrawal by writing a check to a third par ty. Such deposits are money per se since the ...

NBER WORKING PAPER SERIES BUBBLES, FINANCIAL CRISES, AND SYSTEMIC RISK Martin Oehmke

... may be based on the “this-time-is-different” rationale. While the asset price boom observed may be out of line with historical data, agents may choose to ignore this by arguing that something fundamental is different this time around, such that cautionary signals from history do not apply. The ideal ...

... may be based on the “this-time-is-different” rationale. While the asset price boom observed may be out of line with historical data, agents may choose to ignore this by arguing that something fundamental is different this time around, such that cautionary signals from history do not apply. The ideal ...

Interest Rates and the Dollar Taking Center Stage

... sustainable over the long-term. As you move through each stage of retirement it is wise to make sure that you plan and monitor your investments and financial situation. One thing we know is that the only constant is change! ...

... sustainable over the long-term. As you move through each stage of retirement it is wise to make sure that you plan and monitor your investments and financial situation. One thing we know is that the only constant is change! ...

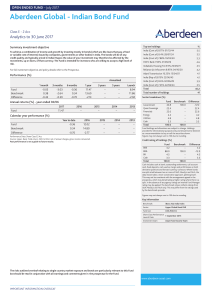

Aberdeen Global - Indian Bond Fund

... Variable (a “SICAV”). The information contained in this marketing document is intended to be of general interest only and should not be considered as an offer, or solicitation, to deal in the shares of any securities or financial instruments. Aberdeen Global has been authorized for public sale in ce ...

... Variable (a “SICAV”). The information contained in this marketing document is intended to be of general interest only and should not be considered as an offer, or solicitation, to deal in the shares of any securities or financial instruments. Aberdeen Global has been authorized for public sale in ce ...

CHAPTER 6 ANSWERS TO "DO YOU UNDERSTAND?" TEXT

... 2. How does the yield spread between Treasury bonds and risky corporate bonds vary over the business cycle? Can you provide a logical explanation for the cyclical behavior of the spread? Answer: The spread contracts when the economy expands and widens when the economy slows down. Probability of defa ...

... 2. How does the yield spread between Treasury bonds and risky corporate bonds vary over the business cycle? Can you provide a logical explanation for the cyclical behavior of the spread? Answer: The spread contracts when the economy expands and widens when the economy slows down. Probability of defa ...