CHAPTER 6 ANSWERS TO "DO YOU UNDERSTAND?" TEXT

... 2. How does the yield spread between Treasury bonds and risky corporate bonds vary over the business cycle? Can you provide a logical explanation for the cyclical behavior of the spread? Answer: The spread contracts when the economy expands and widens when the economy slows down. Probability of defa ...

... 2. How does the yield spread between Treasury bonds and risky corporate bonds vary over the business cycle? Can you provide a logical explanation for the cyclical behavior of the spread? Answer: The spread contracts when the economy expands and widens when the economy slows down. Probability of defa ...

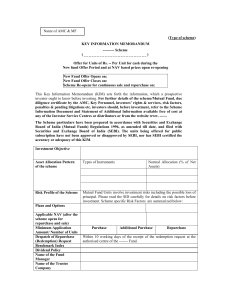

KEY INFORMATION MEMORANDUM

... investor ought to know before investing. For further details of the scheme/Mutual Fund, due diligence certificate by the AMC, Key Personnel, investors’ rights & services, risk factors, penalties & pending litigations etc. investors should, before investment, refer to the Scheme Information Document ...

... investor ought to know before investing. For further details of the scheme/Mutual Fund, due diligence certificate by the AMC, Key Personnel, investors’ rights & services, risk factors, penalties & pending litigations etc. investors should, before investment, refer to the Scheme Information Document ...

Collapse. The story of the international financial crisis, its causes

... substantially in the wake of this decision (Chomsisengphet and Pennington-Cross, 2006). Other factors, such as the long economic upswing of the nineties and the stable macroeconomic environment since the mid-eighties as well as political and social pressures, contributed to a dramatic expansion of ...

... substantially in the wake of this decision (Chomsisengphet and Pennington-Cross, 2006). Other factors, such as the long economic upswing of the nineties and the stable macroeconomic environment since the mid-eighties as well as political and social pressures, contributed to a dramatic expansion of ...

what have we learned from recent financial crises and policy

... First, measures to strengthen the system must be comprehensive and must cover each of the main pillars of the international financial system: institutions, markets and infrastructure. Second, policymakers and regulators must rely increasingly on market-led processes to provide the discipline require ...

... First, measures to strengthen the system must be comprehensive and must cover each of the main pillars of the international financial system: institutions, markets and infrastructure. Second, policymakers and regulators must rely increasingly on market-led processes to provide the discipline require ...

Valuation Methods and Banks` Takeover Premium: an

... However, the metrics commonly used to value banks are not able to fairly weight return and risk. In facts, the standard valuation metrics can hardly be adjusted to the business of banks since they work by a different business model which doesn’t allow to consider banks as industrial firms. In this p ...

... However, the metrics commonly used to value banks are not able to fairly weight return and risk. In facts, the standard valuation metrics can hardly be adjusted to the business of banks since they work by a different business model which doesn’t allow to consider banks as industrial firms. In this p ...

Smyrna Soccer Club Financial Aid Application Page 1 of 3

... It is the policy of SSC to attempt to provide financial aid to those players who might not otherwise be able to participate with the Smyrna Soccer Club. This program assists players with a portion of annual dues. It does not over the cost of uniforms, travel or tournament fees. Because SSC financial ...

... It is the policy of SSC to attempt to provide financial aid to those players who might not otherwise be able to participate with the Smyrna Soccer Club. This program assists players with a portion of annual dues. It does not over the cost of uniforms, travel or tournament fees. Because SSC financial ...

SUPERVISION in the EU - European Commission

... DGS – Key provisions • Member States have to ensure one or more officially recognised DGS • All deposit-taking credit institutions must join DGS – No exception – Only alternative: equivalent institutional protection scheme (mutual guarantee scheme) recognized under national law ...

... DGS – Key provisions • Member States have to ensure one or more officially recognised DGS • All deposit-taking credit institutions must join DGS – No exception – Only alternative: equivalent institutional protection scheme (mutual guarantee scheme) recognized under national law ...

Sovereign Default: The Role of Expectations.

... • This paper 1. Shows Arellano (2008) exhibits multiplicity studied in Calvo (1988). Characterize equilibria (in a two-period model). 2. Evaluates the effect of policy by an agent with deep pockets (IMF or ECB?). 3. Shows (in an infinite period model) how a sunspot can be used to replicate behavior ...

... • This paper 1. Shows Arellano (2008) exhibits multiplicity studied in Calvo (1988). Characterize equilibria (in a two-period model). 2. Evaluates the effect of policy by an agent with deep pockets (IMF or ECB?). 3. Shows (in an infinite period model) how a sunspot can be used to replicate behavior ...

Page 1 Important information This information has been provided by

... intense scrutiny throughout the recent financial crisis. In his article - The do's and don'ts of portfolio construction, John Owen, Senior Investment Specialist for Australian shares and global property provides some insights on how NOT to make the same mistakes. Page 5 ...

... intense scrutiny throughout the recent financial crisis. In his article - The do's and don'ts of portfolio construction, John Owen, Senior Investment Specialist for Australian shares and global property provides some insights on how NOT to make the same mistakes. Page 5 ...

Chapter 11

... • What are the characteristics of bonds as financial assets? • What are the different types of bonds? • What are characteristics of other major financial assets? ...

... • What are the characteristics of bonds as financial assets? • What are the different types of bonds? • What are characteristics of other major financial assets? ...

PDF

... The relatively high MR2A curve intersects MR1 at point a and the price control line at b. Thus, the effect of the control is to reduce the amount of Q1 to that at b, and to create a shortage equal to the difference between the quantity of Q1 at c and b. Meanwhile, the quantity of Q2 expands from th ...

... The relatively high MR2A curve intersects MR1 at point a and the price control line at b. Thus, the effect of the control is to reduce the amount of Q1 to that at b, and to create a shortage equal to the difference between the quantity of Q1 at c and b. Meanwhile, the quantity of Q2 expands from th ...

OUTLOOK

... why we are at the end of a monetary super-cycle. Monetary policy has been used to stabilise the economy when an external shock occurs since the 1980s. Policy makers have succeeded in restricting the economic and financial harm caused by a recession by easing monetary policy and triggering a new pri ...

... why we are at the end of a monetary super-cycle. Monetary policy has been used to stabilise the economy when an external shock occurs since the 1980s. Policy makers have succeeded in restricting the economic and financial harm caused by a recession by easing monetary policy and triggering a new pri ...

Capital Structure

... rs = r0 + (B / SL) (r0 - rB) rB is the interest rate (cost of debt) rs is the return on (levered) equity (cost of equity) r0 is the return on unlevered equity (cost of capital) B is the value of debt SL is the value of levered equity ...

... rs = r0 + (B / SL) (r0 - rB) rB is the interest rate (cost of debt) rs is the return on (levered) equity (cost of equity) r0 is the return on unlevered equity (cost of capital) B is the value of debt SL is the value of levered equity ...

Solutions to Chapter 1

... then used to produce goods and services, which makes it a real asset. 12. The responsibilities of the treasurer include the following: supervises cash management, raising capital, and banking relationships. The controller’s responsibilities include: supervises accounting, preparation of financial st ...

... then used to produce goods and services, which makes it a real asset. 12. The responsibilities of the treasurer include the following: supervises cash management, raising capital, and banking relationships. The controller’s responsibilities include: supervises accounting, preparation of financial st ...

Revisiting the Role of Insurance Company ALM

... Against this backdrop, insurers were faced with the difficult task of raising capital when conditions were most difficult. Adding to the challenge, liquidity needs were increasing as product sales were falling and concerns were growing about the possibility of increased policy surrenders and withdra ...

... Against this backdrop, insurers were faced with the difficult task of raising capital when conditions were most difficult. Adding to the challenge, liquidity needs were increasing as product sales were falling and concerns were growing about the possibility of increased policy surrenders and withdra ...

market access insight: commercial considerations

... In a recent example, a company hoped to license a new drug. With a more favorable side effect profile, the product was poised to compare favorably to the market’s current treatment, but the developer had concerns about under-valuing the product’s potential. The developer undertook a market access st ...

... In a recent example, a company hoped to license a new drug. With a more favorable side effect profile, the product was poised to compare favorably to the market’s current treatment, but the developer had concerns about under-valuing the product’s potential. The developer undertook a market access st ...

Corporate finance 2 (Stocks)

... 4. Smaller or newer companies usually sell their shares on the over-the-counter ………….……. markets. ...

... 4. Smaller or newer companies usually sell their shares on the over-the-counter ………….……. markets. ...

SAS Risk Analysis Environment

... primary line of business need to measure the value and risk associated with the portfolios they hold for regulatory, strategic, and tactical reasons. These financial institutions group individual portfolios by asset type or structured to meet a particular business need. Tools exist for calculating t ...

... primary line of business need to measure the value and risk associated with the portfolios they hold for regulatory, strategic, and tactical reasons. These financial institutions group individual portfolios by asset type or structured to meet a particular business need. Tools exist for calculating t ...

paper

... Eliciting preferences for non-market goods has traditionally been done by help of stated preference methods, which could be seen as a group of direct methods in comparison to those indirect methods usually denoted revealed preference methods. The direct valuation methods include variants like contin ...

... Eliciting preferences for non-market goods has traditionally been done by help of stated preference methods, which could be seen as a group of direct methods in comparison to those indirect methods usually denoted revealed preference methods. The direct valuation methods include variants like contin ...

Volatility of an Impossible Object Risk, Fear, and Safety in Games of

... monetary mechanism. Is the reflexivity of flowing fiat currency the solution or the very source of the paradox? We don’t know. Likewise how certain are we that the elevated two-dimensional prices of risk assets and low spot volatility have anything to do with fundamental three-dimensional reality? I ...

... monetary mechanism. Is the reflexivity of flowing fiat currency the solution or the very source of the paradox? We don’t know. Likewise how certain are we that the elevated two-dimensional prices of risk assets and low spot volatility have anything to do with fundamental three-dimensional reality? I ...