dividend policy, signal information for the capital market

... Enouncement of rational arguments in terms of business practices on dividend policy raised over time many questions and caused a permanent concern in this respect. Financial theory considers the dividend policy as an interesting field of study due to problematic incitements which they provide to sci ...

... Enouncement of rational arguments in terms of business practices on dividend policy raised over time many questions and caused a permanent concern in this respect. Financial theory considers the dividend policy as an interesting field of study due to problematic incitements which they provide to sci ...

CAPITAL MARKET DEVELOPMENT AND FOREIGN PORTFOLIO INVESTMENT IN THE BAHAMAS May, 2000

... including The Bahamas during the last two decades. The new emphasis on equity markets was driven by the failure of past non-market based strategies and the realization of the potential role that private imitative and capital markets can play. The ensuing development of local equity markets created c ...

... including The Bahamas during the last two decades. The new emphasis on equity markets was driven by the failure of past non-market based strategies and the realization of the potential role that private imitative and capital markets can play. The ensuing development of local equity markets created c ...

Park Your Cash in a Safe Neighborhood

... Given that inflation may be staging a comeback, despite the Fed's efforts, Treasury Inflation Protected Securities -- commonly called TIPS -- could make sense, as would the similar, private-sector issuance of Corporate Inflation Protected Securities. Structured products Money market accounts are ano ...

... Given that inflation may be staging a comeback, despite the Fed's efforts, Treasury Inflation Protected Securities -- commonly called TIPS -- could make sense, as would the similar, private-sector issuance of Corporate Inflation Protected Securities. Structured products Money market accounts are ano ...

Uncle Sam Can`t Touch These `Tax-Free Dividends`

... And companies have responded. Just look at the chart below to see how companies have been paying shareholders since 1982, especially since 2005 (hint: it hasn't been just with traditional dividends)... ...

... And companies have responded. Just look at the chart below to see how companies have been paying shareholders since 1982, especially since 2005 (hint: it hasn't been just with traditional dividends)... ...

The Aggregate Demand Schedule

... A = M/P + (P B /P)B , but Ricardian Equivalence (Barro: government bonds are not net wealth) would suggest just including real money balances. The Pigou effect is also known as the real balance effect. I How does the Pigou effect operate? I A reduction in the price level raises consumers’ net real w ...

... A = M/P + (P B /P)B , but Ricardian Equivalence (Barro: government bonds are not net wealth) would suggest just including real money balances. The Pigou effect is also known as the real balance effect. I How does the Pigou effect operate? I A reduction in the price level raises consumers’ net real w ...

press release

... and we noted in TFG’s Q3 2012 performance report that we would continue to monitor closely over the course of Q4 2012 whether these reductions were sustained, before considering a reduction in applicable discount rates. In Q4 2012 observable data has confirmed the re-rating of CLO risk, albeit the t ...

... and we noted in TFG’s Q3 2012 performance report that we would continue to monitor closely over the course of Q4 2012 whether these reductions were sustained, before considering a reduction in applicable discount rates. In Q4 2012 observable data has confirmed the re-rating of CLO risk, albeit the t ...

Financial systém and financial market

... subjects through computer network or telephone lines. The price of these short term money is derivate from referential interest rate IBID (Interbank Bid Rate) and IBOR (Interbank Offered Rate). On the money market are at most trading institutional investors and this market is also know as a “whole ...

... subjects through computer network or telephone lines. The price of these short term money is derivate from referential interest rate IBID (Interbank Bid Rate) and IBOR (Interbank Offered Rate). On the money market are at most trading institutional investors and this market is also know as a “whole ...

Reducing Systemic Risk: Canada`s New Central

... CDCC was selected by the industry to develop central clearing services for Canadian fixed-income markets. CDCS clears all derivatives contracts traded on the Montréal Exchange, as well as some over-the-counter equity options. Since the introduction of the new CCP service in February 2012, CDCS also ...

... CDCC was selected by the industry to develop central clearing services for Canadian fixed-income markets. CDCS clears all derivatives contracts traded on the Montréal Exchange, as well as some over-the-counter equity options. Since the introduction of the new CCP service in February 2012, CDCS also ...

JPM Cazenove Conference Title Slide “Building the New Economy

... credit. Short-term credit is best provided by banks… but when longer-dated investment is required, banks have to engage in maturity and sometimes credit transformation – these are inherently unstable activities. So the longterm is best left to institutions which can match long term assets to long-te ...

... credit. Short-term credit is best provided by banks… but when longer-dated investment is required, banks have to engage in maturity and sometimes credit transformation – these are inherently unstable activities. So the longterm is best left to institutions which can match long term assets to long-te ...

EY ITEM Club Outlook for financial services Summer 2016

... Since our last financial services forecast six months ago, which highlighted the emerging bright spots for UK banks, the horizon has clouded somewhat. These clouds largely come from downward pressures on demand by consumers and businesses rather than any weakness in banks’ ability to lend. Falling c ...

... Since our last financial services forecast six months ago, which highlighted the emerging bright spots for UK banks, the horizon has clouded somewhat. These clouds largely come from downward pressures on demand by consumers and businesses rather than any weakness in banks’ ability to lend. Falling c ...

WASATCH LARGE CAP VALUE PORTFOLIO

... ^Total strategy assets across all vehicles and composites. Composite returns for the Large Cap Value Composite have been provided. The Wasatch Large Cap Value Composite contains fully discretionary equity accounts following the Wasatch Large Cap Value style. The composite primarily invests in equiti ...

... ^Total strategy assets across all vehicles and composites. Composite returns for the Large Cap Value Composite have been provided. The Wasatch Large Cap Value Composite contains fully discretionary equity accounts following the Wasatch Large Cap Value style. The composite primarily invests in equiti ...

Equity Research: Fundamental and Technical Analysis

... Prices of the securities in the stock exchange keep on fluctuating. The investors and other operators are always interested in buying the shares at lower prices and selling them at higher prices to make profit. To achieve this objective, they estimate the share price. Fundamental Analysis is the pro ...

... Prices of the securities in the stock exchange keep on fluctuating. The investors and other operators are always interested in buying the shares at lower prices and selling them at higher prices to make profit. To achieve this objective, they estimate the share price. Fundamental Analysis is the pro ...

Alternative Investment Fund Managers Directive (AIFMD) investor

... denominated in currencies other than Sterling. Changes in exchange rates may adversely affect the value of any investment, which will have a related effect on the price of shares. Investing in private and unquoted securities An investment trust may have the ability to invest a proportion of its port ...

... denominated in currencies other than Sterling. Changes in exchange rates may adversely affect the value of any investment, which will have a related effect on the price of shares. Investing in private and unquoted securities An investment trust may have the ability to invest a proportion of its port ...

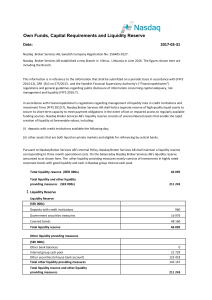

Own Funds, Capital Requirements and Liquidity Reserve

... investment firms (FFFS 2010:7), Nasdaq Broker Services AB shall hold a separate reserve of high-quality liquid assets to secure its short-term capacity to meet payment obligations in the event of lost or impaired access to regularly available funding sources. Nasdaq Broker Services AB’s liquidity re ...

... investment firms (FFFS 2010:7), Nasdaq Broker Services AB shall hold a separate reserve of high-quality liquid assets to secure its short-term capacity to meet payment obligations in the event of lost or impaired access to regularly available funding sources. Nasdaq Broker Services AB’s liquidity re ...

Extended Hours Trading Disclosure

... generally means the time between 9:30 a.m. and 4:00 p.m. Eastern Standard Time. ...

... generally means the time between 9:30 a.m. and 4:00 p.m. Eastern Standard Time. ...

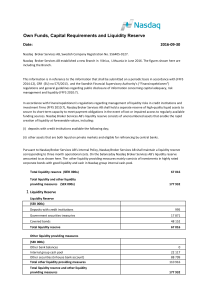

Own Funds, Capital Requirements and Liquidity Reserve

... investment firms (FFFS 2010:7), Nasdaq Broker Services AB shall hold a separate reserve of high-quality liquid assets to secure its short-term capacity to meet payment obligations in the event of lost or impaired access to regularly available funding sources. Nasdaq Broker Services AB’s liquidity re ...

... investment firms (FFFS 2010:7), Nasdaq Broker Services AB shall hold a separate reserve of high-quality liquid assets to secure its short-term capacity to meet payment obligations in the event of lost or impaired access to regularly available funding sources. Nasdaq Broker Services AB’s liquidity re ...

OUTER LIMITS As Funds Leverage Up, Fears of Reckoning Rise

... Federated Investors Inc. have launched funds that rely heavily on derivatives. Gardenproducts maker Scotts Miracle-Gro Co. and other public companies have loaded up on debt to improve returns. This leveraging binge has regulators and others worried. In the first place, no one knows how much leverage ...

... Federated Investors Inc. have launched funds that rely heavily on derivatives. Gardenproducts maker Scotts Miracle-Gro Co. and other public companies have loaded up on debt to improve returns. This leveraging binge has regulators and others worried. In the first place, no one knows how much leverage ...