2011 - Seaton Financial Advisors, LLC

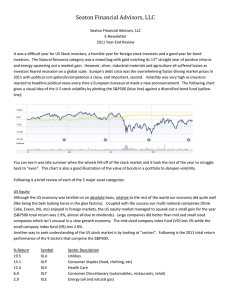

... opportunities after the dust has settled. For US equities, this means maintaining an allocation on the lower end of your strategic allocation range and favoring large companies with strong cash flows and a history of growing dividends. I continue to believe foreign equities remain too risky at least ...

... opportunities after the dust has settled. For US equities, this means maintaining an allocation on the lower end of your strategic allocation range and favoring large companies with strong cash flows and a history of growing dividends. I continue to believe foreign equities remain too risky at least ...

NEFE High School Financial Planning Program

... improved skills for tracking spending, and nearly half (45%) started saving or began saving more. Confidence of teens. Nearly two-fifths (38%) felt more confident about managing their money. Even more important, teens who studied the HSFPP maintained increases in personal finance knowledge and behav ...

... improved skills for tracking spending, and nearly half (45%) started saving or began saving more. Confidence of teens. Nearly two-fifths (38%) felt more confident about managing their money. Even more important, teens who studied the HSFPP maintained increases in personal finance knowledge and behav ...

The Post-2008 Economic Soft Depression and Your Portfolio

... • Global risk assets will grow more volatile as earnings shift lower in the US but accelerate overseas. Both Europe and Japan are primed for sizable gains at a time when US profits will slow, mainly due to a strong dollar; • We still think most emerging markets should be avoided; previous USD surges ...

... • Global risk assets will grow more volatile as earnings shift lower in the US but accelerate overseas. Both Europe and Japan are primed for sizable gains at a time when US profits will slow, mainly due to a strong dollar; • We still think most emerging markets should be avoided; previous USD surges ...

Economics - CIBC World Markets

... Benefit from our Economics Group’s long and well-earned reputation for being ahead of the curve. • The team produces analysis and timely forecasts of trends in the North American economy, the political environment and financial markets • Economists are recognized for their insights on critical marke ...

... Benefit from our Economics Group’s long and well-earned reputation for being ahead of the curve. • The team produces analysis and timely forecasts of trends in the North American economy, the political environment and financial markets • Economists are recognized for their insights on critical marke ...

Asia-Pacific developing economies to grow 7% this year by Kanaga

... precipitously bringing down asset prices and exchange rates. The report further notes that liquidity has been injected into the United States financial sector with the Federal Reserve purchases of mortgage-backed securities and other agency debt. The scale of such liquidity support is seen from the ...

... precipitously bringing down asset prices and exchange rates. The report further notes that liquidity has been injected into the United States financial sector with the Federal Reserve purchases of mortgage-backed securities and other agency debt. The scale of such liquidity support is seen from the ...

The current financial crisis began in the United States` subprime

... many structural imbalances that need adjustment that need to be made before an economic recovery can begin in earnest— among these are the still high levels of external debt (the real cost of servicing of which has increased exchange rates have moved against them), the ongoing need for households to ...

... many structural imbalances that need adjustment that need to be made before an economic recovery can begin in earnest— among these are the still high levels of external debt (the real cost of servicing of which has increased exchange rates have moved against them), the ongoing need for households to ...

Global environment - Financial Stability Report

... (b) Non-financial corporates consists of non-financial public and private sector firms and finance vehicles of industrial and utility firms. ...

... (b) Non-financial corporates consists of non-financial public and private sector firms and finance vehicles of industrial and utility firms. ...

Chapter 19

... the next short-term planning period • Primary tool in short-term financial planning • Helps determine when the firm should experience cash surpluses and when it will need to borrow to cover working-capital costs • Allows a company to plan ahead and begin the search for financing before the money is ...

... the next short-term planning period • Primary tool in short-term financial planning • Helps determine when the firm should experience cash surpluses and when it will need to borrow to cover working-capital costs • Allows a company to plan ahead and begin the search for financing before the money is ...

July 2016 – Gearing for a Stronger Half

... bonds increase amid incredibly low rates in Europe in Japan and less concern over Fed rate hikes. While we are also constructive on European investment grade credit, especially given the European Central Bank’s ongoing purchases of corporate bonds (~$20bn per month), low yields as a result of centra ...

... bonds increase amid incredibly low rates in Europe in Japan and less concern over Fed rate hikes. While we are also constructive on European investment grade credit, especially given the European Central Bank’s ongoing purchases of corporate bonds (~$20bn per month), low yields as a result of centra ...

Financial Planning

... Take financial planning courses (some are free) Watch the business and news channels Take micro-economics and macro-economics Use mock stock portfolios ...

... Take financial planning courses (some are free) Watch the business and news channels Take micro-economics and macro-economics Use mock stock portfolios ...

Financial Deepening and Economic

... The efficiency in allocation causes more increase in capital stock of the sectors that were more repressed before the liberalization started. It causes a reduction or a slower growth of capital stock in sectors that used to be subsidized before repression. Ultimately all sectors return to steady sta ...

... The efficiency in allocation causes more increase in capital stock of the sectors that were more repressed before the liberalization started. It causes a reduction or a slower growth of capital stock in sectors that used to be subsidized before repression. Ultimately all sectors return to steady sta ...

GLOBAL INSIGHT Model of the U

... the GI model to do policy analysis. In simulations, CDA analysts use the GI model to evaluate the effects of policy changes on not just disposable income and consumption in the short run but also the economy’s long-run potential. They can do so because the Global Insight model imposes the long-run s ...

... the GI model to do policy analysis. In simulations, CDA analysts use the GI model to evaluate the effects of policy changes on not just disposable income and consumption in the short run but also the economy’s long-run potential. They can do so because the Global Insight model imposes the long-run s ...

PDF

... institutions had relaxed credit standards, particularly for real estate and commercial and industrial lending. This included a general relaxing of the five C’s of credit for loan evaluation purposes. The five C’s are: 1) character, 2) capital, 3) capacity, 4) collateral, and 5) conditions (Gustafson ...

... institutions had relaxed credit standards, particularly for real estate and commercial and industrial lending. This included a general relaxing of the five C’s of credit for loan evaluation purposes. The five C’s are: 1) character, 2) capital, 3) capacity, 4) collateral, and 5) conditions (Gustafson ...

Global circumstances US, UK and Europe, Japan in

... *in this publication, HSBC Group offices are indicated by the following codes: ‘AU’ HSBC Bank plc – Sydney Branch and HSBC Bank Australia Limited; ‘GB’ HSBC Bank plc in London in the United Kingdom; ‘DE’ HSBC Trinkaus & Burkhardt KGaA in Dusseldorf, Germany; ‘FR’ HSBC CCF Securities (France) SA in P ...

... *in this publication, HSBC Group offices are indicated by the following codes: ‘AU’ HSBC Bank plc – Sydney Branch and HSBC Bank Australia Limited; ‘GB’ HSBC Bank plc in London in the United Kingdom; ‘DE’ HSBC Trinkaus & Burkhardt KGaA in Dusseldorf, Germany; ‘FR’ HSBC CCF Securities (France) SA in P ...

Bailouts Won`t Save a Global Economy That`s Breaking Apart

... insane bailout plan, printing money like mad and throwing it down the rathole. When that doesn’t work, Treasury and the Federal Reserve open the spigots even further, reminiscent of a gambling addict on a losing streak, betting it all that his luck will change. We expect this sort of behavior from W ...

... insane bailout plan, printing money like mad and throwing it down the rathole. When that doesn’t work, Treasury and the Federal Reserve open the spigots even further, reminiscent of a gambling addict on a losing streak, betting it all that his luck will change. We expect this sort of behavior from W ...

The Kiplinger Letter - April 15, 2016

... after a federal judge nixed the feds’ labeling of MetLife as “systemically important.” Financial institutions receive the designation if their failure would create a threat to the overall financial system. Systemically important firms must hold more capital and adhere to other regs set by the Federa ...

... after a federal judge nixed the feds’ labeling of MetLife as “systemically important.” Financial institutions receive the designation if their failure would create a threat to the overall financial system. Systemically important firms must hold more capital and adhere to other regs set by the Federa ...

Akyuz TD1.1

... Current Signals • Green shoots or yellow weeds? Positive signs in US, China, India and commodity pick-up; but more like an easing of the pace of decline rather than beginning of recovery. Property market correction incomplete and credit crunch far from over ...

... Current Signals • Green shoots or yellow weeds? Positive signs in US, China, India and commodity pick-up; but more like an easing of the pace of decline rather than beginning of recovery. Property market correction incomplete and credit crunch far from over ...

Answers to Problem Set 1

... A current account deficit or surplus is a situation that may be unsustainable in the long run. There are instances in which a deficit may be warranted, for example to borrow today to improve productive capacity in order to have a higher national income tomorrow. But for any period of current account ...

... A current account deficit or surplus is a situation that may be unsustainable in the long run. There are instances in which a deficit may be warranted, for example to borrow today to improve productive capacity in order to have a higher national income tomorrow. But for any period of current account ...

Slide 1

... EZ adopted by 17 countries as of 2013 Divergent wage trends led to growing imbalances after 2001 World financial crisis 2008 weakened public finances Eurozone crisis begins in Ireland, spreads to Greece, then to Italy According to Euroskeptics, the end of the Eurozone is nigh… ...

... EZ adopted by 17 countries as of 2013 Divergent wage trends led to growing imbalances after 2001 World financial crisis 2008 weakened public finances Eurozone crisis begins in Ireland, spreads to Greece, then to Italy According to Euroskeptics, the end of the Eurozone is nigh… ...