Justification for the decision on the buffer rate

... based on the additional credit-to-GDP gap has been selected as the CCB guide. Overall, the decline in credit-to-GDP ratio, which had been observed since the end of 2010, has stopped in 2016. However, the credit-to-GDO gap remains deeply negative. Since the beginning of 2016, explicit positive develo ...

... based on the additional credit-to-GDP gap has been selected as the CCB guide. Overall, the decline in credit-to-GDP ratio, which had been observed since the end of 2010, has stopped in 2016. However, the credit-to-GDO gap remains deeply negative. Since the beginning of 2016, explicit positive develo ...

Finding Value in Global Bond Markets

... and other high quality, high yield sovereigns offer value far in excess of German Bunds and Japanese Government Bonds where nominal yields are lower. In this current environment of low nominal growth and low inflation, US Treasurys are likely to act as a deflation hedge, as well as help offset volat ...

... and other high quality, high yield sovereigns offer value far in excess of German Bunds and Japanese Government Bonds where nominal yields are lower. In this current environment of low nominal growth and low inflation, US Treasurys are likely to act as a deflation hedge, as well as help offset volat ...

Investment Outlook

... on the taxi squad for Notre Dame, in the movies. Coach even told the other team to sort of give me a wide berth to the hoop to keep the streak alive. Thirty seconds to go, I got the ball, my great looking legs now covered up by modern day shorts to the knee; lacking any youthful bounce that as a tee ...

... on the taxi squad for Notre Dame, in the movies. Coach even told the other team to sort of give me a wide berth to the hoop to keep the streak alive. Thirty seconds to go, I got the ball, my great looking legs now covered up by modern day shorts to the knee; lacking any youthful bounce that as a tee ...

the influence of the financial factors on cash flow, as determining

... Also, another financial factor, which has an influence on investment decisions adopted by the firm, is the leverage; more clearly, the higher leverage firms’ investments can be more sensitive to the cash flow than lower leverage firms’ investments. The cash flow is the only source of financing for t ...

... Also, another financial factor, which has an influence on investment decisions adopted by the firm, is the leverage; more clearly, the higher leverage firms’ investments can be more sensitive to the cash flow than lower leverage firms’ investments. The cash flow is the only source of financing for t ...

CAPITAL MOBILITY

... It is not a surprising evidence that capital account liberalisation boosts growth in high income countries, but slots it in low income countries.. Still there’s a movement towards more liberalisation.. ...

... It is not a surprising evidence that capital account liberalisation boosts growth in high income countries, but slots it in low income countries.. Still there’s a movement towards more liberalisation.. ...

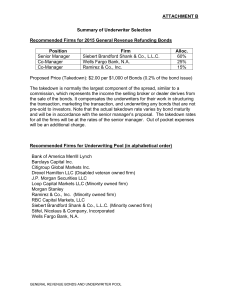

Attachment B

... evaluating the capabilities of a firm was the demonstrated commitment of a firm in bidding on our recent competitive bond issues. The RFP also included questions about providing specific suggestions for the structuring of the 2015 GRRBs and our debt program, in general. The selection committee made ...

... evaluating the capabilities of a firm was the demonstrated commitment of a firm in bidding on our recent competitive bond issues. The RFP also included questions about providing specific suggestions for the structuring of the 2015 GRRBs and our debt program, in general. The selection committee made ...

Speech by Mr. Ivan Iskrov, Governor of the BNB, at the spring

... Balance of Payments current account. This view was based on the general assumption that these economies need a strong inflow of capital, in order to cover the deficit on the current account, and in times of crisis the access to capital would be difficult. The above does not take into account the fac ...

... Balance of Payments current account. This view was based on the general assumption that these economies need a strong inflow of capital, in order to cover the deficit on the current account, and in times of crisis the access to capital would be difficult. The above does not take into account the fac ...

BUAD 611 – Managerial Finance

... 4 – You manage a real estate investment company. One year ago the company purchased 10 parcels of land distributed throughout the community for $1 million each. A recent appraisal of the properties indicates that five of the parcels are now worth $600,000 each. While the other five are worth $1.5 mi ...

... 4 – You manage a real estate investment company. One year ago the company purchased 10 parcels of land distributed throughout the community for $1 million each. A recent appraisal of the properties indicates that five of the parcels are now worth $600,000 each. While the other five are worth $1.5 mi ...

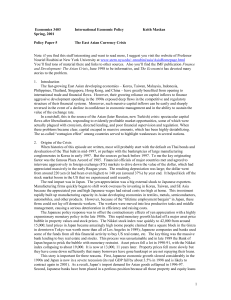

Economics 3403 - University of Colorado Boulder

... went bad. Estimates now are that non-performing loans exceed $1 trillion, or over 30% of Japanese GDP. These banks have called in other loans in an attempt to recapitalize themselves, which has resulted in a general credit decline (a “credit crunch” in the colorful phrase). Essentially no one is bo ...

... went bad. Estimates now are that non-performing loans exceed $1 trillion, or over 30% of Japanese GDP. These banks have called in other loans in an attempt to recapitalize themselves, which has resulted in a general credit decline (a “credit crunch” in the colorful phrase). Essentially no one is bo ...

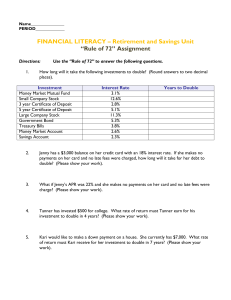

Rule of 72 Assignment

... Jenny has a $3,000 balance on her credit card with an 18% interest rate. If she makes no payments on her card and no late fees were charged, how long will it take for her debt to double? (Please show your work). ...

... Jenny has a $3,000 balance on her credit card with an 18% interest rate. If she makes no payments on her card and no late fees were charged, how long will it take for her debt to double? (Please show your work). ...

High-level Regional Policy Dialogue on

... There is a debate in India on the instruments needed for controlling inflation. According to some, Monetary policy may not be the right one. Fiscal policy and supply side are important. Due to monetary tightening, investment demand got affected although consumption demand is less affected. It has ad ...

... There is a debate in India on the instruments needed for controlling inflation. According to some, Monetary policy may not be the right one. Fiscal policy and supply side are important. Due to monetary tightening, investment demand got affected although consumption demand is less affected. It has ad ...

Document

... debt ratios than the slower (or negative ) GDP growth and banking crisis. Therefore any policy that seeks to reduce public debt should avoid curbing GDP growth; without growth, any fiscal consolidation is highly unlikely to succeed . These findings challenge the influential “Lawson Doctrine”, that f ...

... debt ratios than the slower (or negative ) GDP growth and banking crisis. Therefore any policy that seeks to reduce public debt should avoid curbing GDP growth; without growth, any fiscal consolidation is highly unlikely to succeed . These findings challenge the influential “Lawson Doctrine”, that f ...

Test Bank for Quiz-2 FINA252 Financial Management

... A firm’s financial statement, that summarizes its sources and uses of cash over a specified period, is known as a(n): A. profit and loss statement B. accounting standard C. statement of cash flows D. balance sheet ...

... A firm’s financial statement, that summarizes its sources and uses of cash over a specified period, is known as a(n): A. profit and loss statement B. accounting standard C. statement of cash flows D. balance sheet ...

Firms must adapt to survive turbulence

... change management pro grammes, some firms create op portunities from factors such as technology. For others, they ig nore the proverbial writing on ...

... change management pro grammes, some firms create op portunities from factors such as technology. For others, they ig nore the proverbial writing on ...

December 2015 - Allianz Global Investors

... divergence begins As more central banks reduced interest rates to the bone and moved into QE mode, monetary policy around the world continued converging in 2015. Yet 2016 will see the first major divergence of monetary policy if, as expected, the US Federal Reserve raises interest rates. As a result, ...

... divergence begins As more central banks reduced interest rates to the bone and moved into QE mode, monetary policy around the world continued converging in 2015. Yet 2016 will see the first major divergence of monetary policy if, as expected, the US Federal Reserve raises interest rates. As a result, ...

Second Quarter 2015 Financial Market Commentary Slower and

... July 5th Greek referendum. It’s up to the Greek government and people to step back from the brink and stay in the EU. The key date is July 20th when a 3.5 billion euro payment is due to the ECB by Greece. This date will likely force the ECB to make a permanent decision on supporting Greek banks via ...

... July 5th Greek referendum. It’s up to the Greek government and people to step back from the brink and stay in the EU. The key date is July 20th when a 3.5 billion euro payment is due to the ECB by Greece. This date will likely force the ECB to make a permanent decision on supporting Greek banks via ...

Origins and Initial Years of The Global Economic Crisis

... Crisis Impact on Defense Spending Global financial crisis and the subsequent recession in most European countries has created a new dynamic for defense spending • Even before the crisis punishing demands of operations on armed forces revealed shortfalls in capabilities • In addition the cost of new ...

... Crisis Impact on Defense Spending Global financial crisis and the subsequent recession in most European countries has created a new dynamic for defense spending • Even before the crisis punishing demands of operations on armed forces revealed shortfalls in capabilities • In addition the cost of new ...