Security Scenarios And The Global Economy

... Crisis Impact on Defense Spending Global financial crisis and the subsequent recession in most European countries has created a new dynamic for defense spending • Even before the crisis punishing demands of operations on armed forces revealed shortfalls in capabilities • In addition the cost of new ...

... Crisis Impact on Defense Spending Global financial crisis and the subsequent recession in most European countries has created a new dynamic for defense spending • Even before the crisis punishing demands of operations on armed forces revealed shortfalls in capabilities • In addition the cost of new ...

Honduras_en.pdf

... rate appreciated by 0.9% in real terms over the course of 2009 compared with December 2008. In May 2009 the central bank revised its monetary policy for the second semester with a view to stabilizing the economy, resuming open market operations and setting a unified reserve requirement of 6.0%. In k ...

... rate appreciated by 0.9% in real terms over the course of 2009 compared with December 2008. In May 2009 the central bank revised its monetary policy for the second semester with a view to stabilizing the economy, resuming open market operations and setting a unified reserve requirement of 6.0%. In k ...

Real Money Rob Rikoon Good news for retirees: low

... world’s stock markets will at some point create inflation, this hasn’t happened yet. Interestingly, interest rates have moved up over the last month and this benefits savers, most notably retirees. For nearly 5 years now, the Federal Reserve Board has suppressed interest rates via its bond buying pr ...

... world’s stock markets will at some point create inflation, this hasn’t happened yet. Interestingly, interest rates have moved up over the last month and this benefits savers, most notably retirees. For nearly 5 years now, the Federal Reserve Board has suppressed interest rates via its bond buying pr ...

money

... hope and expect. Nearly every kind of investment involves some sort of risk. The price of rare coins or houses, for example, can go down as well as up. In general, there is a strong relationship between risk and reward. The higher the potential reward an investment offers, the higher the risk of ...

... hope and expect. Nearly every kind of investment involves some sort of risk. The price of rare coins or houses, for example, can go down as well as up. In general, there is a strong relationship between risk and reward. The higher the potential reward an investment offers, the higher the risk of ...

in GDP

... In order to improve external trade situation in BH it would be recommended to conduct a detailed micro analyze of goods that have the highest influence on BH import increase by identifying all main trading partners in foreign trade exchange, as well as, their price, quantity and type of imported g ...

... In order to improve external trade situation in BH it would be recommended to conduct a detailed micro analyze of goods that have the highest influence on BH import increase by identifying all main trading partners in foreign trade exchange, as well as, their price, quantity and type of imported g ...

Document

... surplus + Income of self-employed + imputed value of household production + property income (interest, dividend, royalties, rent, patents, rights) Value of services by financial institutions included in GDP. – Service charges – Difference between income received on loans and interest/claims paid o ...

... surplus + Income of self-employed + imputed value of household production + property income (interest, dividend, royalties, rent, patents, rights) Value of services by financial institutions included in GDP. – Service charges – Difference between income received on loans and interest/claims paid o ...

January 17, 2014 The Key Conclusions from this note: Fund Positioning

... The most powerful force that extended the disinflation-driven bull market of the 1990’s was the peace dividend followed by and, more importantly, the increase in computerization and the internet leading to a significant increase in labor productivity. None of these forces seem to be in force today. ...

... The most powerful force that extended the disinflation-driven bull market of the 1990’s was the peace dividend followed by and, more importantly, the increase in computerization and the internet leading to a significant increase in labor productivity. None of these forces seem to be in force today. ...

financial system

... consume or pay taxes, and if the government is not using all of its tax money for spending, and if CI is +, then we are left with money that becomes the source of national savings. Copyright © 2004 South-Western ...

... consume or pay taxes, and if the government is not using all of its tax money for spending, and if CI is +, then we are left with money that becomes the source of national savings. Copyright © 2004 South-Western ...

Mosler Levy Draft

... economy deteriorated causing the automatic stabilizers to aggressively kick in and increase the federal deficit to over 6% of GDP. • This seems to have been sufficient to stem the slide, perhaps around year end. • That means there is now less room for some of the proactive fiscal adjustments. • And ...

... economy deteriorated causing the automatic stabilizers to aggressively kick in and increase the federal deficit to over 6% of GDP. • This seems to have been sufficient to stem the slide, perhaps around year end. • That means there is now less room for some of the proactive fiscal adjustments. • And ...

Cash Flow IN Sources of Cash Flow in

... after subtracting CoGS Is the percentage of Sales that contributes to Fixed Expenses and Profit. ...

... after subtracting CoGS Is the percentage of Sales that contributes to Fixed Expenses and Profit. ...

833-2869-1-SP

... Source: IMF (2013, a), Global Financial Stability Report: Old Risk, New Challenges ...

... Source: IMF (2013, a), Global Financial Stability Report: Old Risk, New Challenges ...

200 kb PowerPoint presentation

... Firms that could roll over external debt were less cyclical Profit as a share of assets Percent ...

... Firms that could roll over external debt were less cyclical Profit as a share of assets Percent ...

May 10, 2007 - Lorain County

... Ron Nabakowski asked if the yield curve is affected by the global economy. Mr. Yacobozzi indicated that the yield curve is, indeed, affected by buyers of US Treasury debt, the interest rate environment, and the level of economic growth. The net effect of continued purchases of Treasury securities gl ...

... Ron Nabakowski asked if the yield curve is affected by the global economy. Mr. Yacobozzi indicated that the yield curve is, indeed, affected by buyers of US Treasury debt, the interest rate environment, and the level of economic growth. The net effect of continued purchases of Treasury securities gl ...

Written exam 2008 spring

... • This approach is designed for use for assets (firms) that derive their value from their capacity to generate cash flows in the future. It does make your job easier, if the company has a history that can be used in estimating future cash flows. It works best for investors who either – have a long t ...

... • This approach is designed for use for assets (firms) that derive their value from their capacity to generate cash flows in the future. It does make your job easier, if the company has a history that can be used in estimating future cash flows. It works best for investors who either – have a long t ...

Sovency Unit 1

... 4. Immediate Increase of 3% then level 5. Uniformly Decreasing over 10 years at 0.5% per year then level 6. Uniformly Decreasing over 5 years at 1% per year then increasing at 1% per year to original level 7. Immediate Decrease of 3% then level ...

... 4. Immediate Increase of 3% then level 5. Uniformly Decreasing over 10 years at 0.5% per year then level 6. Uniformly Decreasing over 5 years at 1% per year then increasing at 1% per year to original level 7. Immediate Decrease of 3% then level ...

TBC – Hay Speech

... 1 In per cent. The dashed lines show the consensus forecasts made at the end of the preceding year; the dots show forecasts for 2007 abd 2008 as of December 2007. Annual changes in real GDP and consumer prices. Average of countries available in Consensus Economics. ...

... 1 In per cent. The dashed lines show the consensus forecasts made at the end of the preceding year; the dots show forecasts for 2007 abd 2008 as of December 2007. Annual changes in real GDP and consumer prices. Average of countries available in Consensus Economics. ...

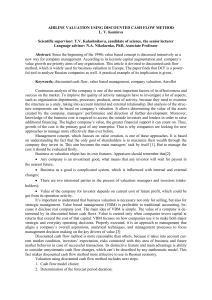

AIRLINE VALUATION USING DISCOUNTED CASH FLOW METHOD

... new way for company management. According to its keynote capital augmentation and company’s value growth are priority aims of any organization. This article is devoted to discounted cash flow method, which is widely used for business valuation in Europe. The paper finds that DCF is a powerful tool t ...

... new way for company management. According to its keynote capital augmentation and company’s value growth are priority aims of any organization. This article is devoted to discounted cash flow method, which is widely used for business valuation in Europe. The paper finds that DCF is a powerful tool t ...

International Trade and Balance of Payments

... - Net exports (Xn) decrease - The current account balance decreases and moves toward a deficit. 2. If the U.S. dollar depreciates relative to other countries does the balance of payments move toward a deficit or a surplus? - US exports are desirable - America exports more - Net exports (Xn) increase ...

... - Net exports (Xn) decrease - The current account balance decreases and moves toward a deficit. 2. If the U.S. dollar depreciates relative to other countries does the balance of payments move toward a deficit or a surplus? - US exports are desirable - America exports more - Net exports (Xn) increase ...

Weekly Advisor Analysis 06-24-13 PAA

... percent as the Chinese Central Bank refused to pump cash into the markets. China’s government has been attempting to curb potentially excessive and dangerous lending practices in an effort to shift economic growth away from fixed asset investment and more towards consumer spending. ...

... percent as the Chinese Central Bank refused to pump cash into the markets. China’s government has been attempting to curb potentially excessive and dangerous lending practices in an effort to shift economic growth away from fixed asset investment and more towards consumer spending. ...

No Slide Title

... Slovenia, Spain, Sweden, the Netherlands, United Kingdom Population: 460.1 million Total GDP: $11.7 trillion ...

... Slovenia, Spain, Sweden, the Netherlands, United Kingdom Population: 460.1 million Total GDP: $11.7 trillion ...