I. INTERNATIONAL DEVELOPMENTS

... expected to continue for an extended period mainly because of, predictions that emerging economies will maintain their rapid growth performance, and the relatively low weight of developing country assets in the portfolios of institutional investors (Chart I.15). Chart I.14. Flow of Funds Towards Eme ...

... expected to continue for an extended period mainly because of, predictions that emerging economies will maintain their rapid growth performance, and the relatively low weight of developing country assets in the portfolios of institutional investors (Chart I.15). Chart I.14. Flow of Funds Towards Eme ...

Recent Development and Outlook: ASEAN+3 Economies Reza Siregar Group Head/Lead Economist

... With the reduction in global tail risks , there could be upward pressure on government bond yields as investors move into higher yielding, riskier assets. Sudden surge and sharp reversal of risk appetite towards Asia would undermine regional financial stability. ...

... With the reduction in global tail risks , there could be upward pressure on government bond yields as investors move into higher yielding, riskier assets. Sudden surge and sharp reversal of risk appetite towards Asia would undermine regional financial stability. ...

In Greek mythology, Cassandra was a princess of Troy, the

... on its domestic market rather than basing its growth on exports, in particular through a policy of competitive exchange rate policy, its economy would have been less vulnerable to external shocks. All these policies might not have been sufficient, by themselves, to ward the crisis, but they certain ...

... on its domestic market rather than basing its growth on exports, in particular through a policy of competitive exchange rate policy, its economy would have been less vulnerable to external shocks. All these policies might not have been sufficient, by themselves, to ward the crisis, but they certain ...

Are We in a Recession? What Will It Look Like If We Have One?

... The Federal Reserve—stuck between a rock and a hard place Doesn't want to lose its price-stability credibility by cutting interest rates too far too fast and igniting inflation both through a misjudgment of domestic demand and because cutting interest rates means a weaker dollar, higher dollar price ...

... The Federal Reserve—stuck between a rock and a hard place Doesn't want to lose its price-stability credibility by cutting interest rates too far too fast and igniting inflation both through a misjudgment of domestic demand and because cutting interest rates means a weaker dollar, higher dollar price ...

Chapter 8

... Work through the sequence of changes in excess reserves, the interest rate, loan making, the money supply, total spending, and economic activity for an increase and a decrease in excess reserves. ...

... Work through the sequence of changes in excess reserves, the interest rate, loan making, the money supply, total spending, and economic activity for an increase and a decrease in excess reserves. ...

Balance of Payments Accounts

... The flow of financial capital is a two-way street. Financial investors in the U.S. are sending money to Japan because interest rates might be higher, but Japanese investors are sending money to the U.S. stock market because they believe the U.S. economy has a brighter ...

... The flow of financial capital is a two-way street. Financial investors in the U.S. are sending money to Japan because interest rates might be higher, but Japanese investors are sending money to the U.S. stock market because they believe the U.S. economy has a brighter ...

Overview Investment performance for 2013 proved to be very strong

... result, when the Federal Reserve announced on December 18 that they would begin reducing bond purchases from $85 Billion/month to $75 Billion/month, the markets moved up sharply. Central bank monetary initiatives were not limited to the U.S. Since the 2008 financial crisis, the global marketplace ha ...

... result, when the Federal Reserve announced on December 18 that they would begin reducing bond purchases from $85 Billion/month to $75 Billion/month, the markets moved up sharply. Central bank monetary initiatives were not limited to the U.S. Since the 2008 financial crisis, the global marketplace ha ...

Corporate Earnings Hit by Rising Pension Liabilities

... The recent broad decline in interest rates, a reaction to market turmoil in August, has put pressure on corporate pension obligations. That’s because the current value of such liabilities is determined using a discount rate based on long-term interest rates. When that rate falls, the liability rises ...

... The recent broad decline in interest rates, a reaction to market turmoil in August, has put pressure on corporate pension obligations. That’s because the current value of such liabilities is determined using a discount rate based on long-term interest rates. When that rate falls, the liability rises ...

Compensating Balances

... COMMERCIAL PAPER 4. Non-bank lending : Commercial Paper a. Definition: short-term unsecured promissory note generally sold by large MNCs on a discount basis. b. Standard maturities c. Bank fees charged for: ...

... COMMERCIAL PAPER 4. Non-bank lending : Commercial Paper a. Definition: short-term unsecured promissory note generally sold by large MNCs on a discount basis. b. Standard maturities c. Bank fees charged for: ...

HOMs Conference on Central Asia

... Competition (contd.) Unlikely that there will be consensus in decision making circles in Government and Parliament for privatisation to proceed at the rate suggested in the table on page 209-210 of the Report, which is by 2011. ...

... Competition (contd.) Unlikely that there will be consensus in decision making circles in Government and Parliament for privatisation to proceed at the rate suggested in the table on page 209-210 of the Report, which is by 2011. ...

FIN 3000 Chapter 1 Principles of Finance

... There is no separation between the partnership and the owners ...

... There is no separation between the partnership and the owners ...

Read More - Financial Partners Capital Management

... process for obtaining them? Should you rent or buy a home? How do you find good healthcare providers, and what are your options for obtaining health insurance? What are your options for life, home, auto and liability protection? Are your current financial resources easily accessible to you from the ...

... process for obtaining them? Should you rent or buy a home? How do you find good healthcare providers, and what are your options for obtaining health insurance? What are your options for life, home, auto and liability protection? Are your current financial resources easily accessible to you from the ...

Balance of Payments

... - Net exports (Xn) decrease - The current account balance decreases and moves toward a deficit. 2. If the U.S. dollar depreciates relative to other countries does the balance of trade move toward a deficit or a surplus? - US exports are desirable - America exports more - Net exports (Xn) increase - ...

... - Net exports (Xn) decrease - The current account balance decreases and moves toward a deficit. 2. If the U.S. dollar depreciates relative to other countries does the balance of trade move toward a deficit or a surplus? - US exports are desirable - America exports more - Net exports (Xn) increase - ...

Slide 1

... Marginal productivity of capital has fallen over time, from 16% in early 1990s to under 13% in 2004, suggesting that efficiency of investment is declining (IMF 2005a). Suggests scope for intermediating savings more efficiently. ...

... Marginal productivity of capital has fallen over time, from 16% in early 1990s to under 13% in 2004, suggesting that efficiency of investment is declining (IMF 2005a). Suggests scope for intermediating savings more efficiently. ...

Download: Turkey's Economy and the Global Economic Crisis (pdf)

... Also, significantly weaker short-run exchange rate pass-through supported the disinflation process in this period. As a result, declining trend in the inflation rate continued and inflation fell to 5.3 percent in August. Distinguished Guests, It is obvious that in this highly integrated global envir ...

... Also, significantly weaker short-run exchange rate pass-through supported the disinflation process in this period. As a result, declining trend in the inflation rate continued and inflation fell to 5.3 percent in August. Distinguished Guests, It is obvious that in this highly integrated global envir ...

COPY FOR “DECCAN HERALD” OF NOVEMBER 1 2008

... I. T. B.P.O., hotels, restaurants, airlines, etc, the financial sector, durable consumer products from automobiles to television sets and entertainment electronics. Governments must devise safety nets especially for the unemployed poor, encourage banks not to squeeze borrowers who are slow to repay, ...

... I. T. B.P.O., hotels, restaurants, airlines, etc, the financial sector, durable consumer products from automobiles to television sets and entertainment electronics. Governments must devise safety nets especially for the unemployed poor, encourage banks not to squeeze borrowers who are slow to repay, ...

Strategies for Reinvigorating Global Economic Growth

... Reforming International Monetary System (IMS) ...

... Reforming International Monetary System (IMS) ...

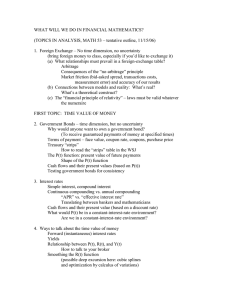

TopicsInAnalysis

... (b) Connections between models and reality: What’s real? What’s a theoretical construct? (c) The “financial principle of relativity” – laws must be valid whatever the numeraire FIRST TOPIC: TIME VALUE OF MONEY 2. Government Bonds – time dimension, but no uncertainty Why would anyone want to own a go ...

... (b) Connections between models and reality: What’s real? What’s a theoretical construct? (c) The “financial principle of relativity” – laws must be valid whatever the numeraire FIRST TOPIC: TIME VALUE OF MONEY 2. Government Bonds – time dimension, but no uncertainty Why would anyone want to own a go ...

Future Rate Hikes and Market Volatility

... believe this rate hike will occur in December believing that the Fed does not want to be a part of the election dialogue, but this is just speculation. One thing is for certain, we will continue to see market volatility and uncertainty between now and the end of the year. As I mentioned before, we h ...

... believe this rate hike will occur in December believing that the Fed does not want to be a part of the election dialogue, but this is just speculation. One thing is for certain, we will continue to see market volatility and uncertainty between now and the end of the year. As I mentioned before, we h ...

Inside the Black Box: The Credit Channel of Monetary Policy

... Based on the theoretical prediction that the external finance premium facing a borrower should depend on borrower’s financial position. The greater is the borrower’s net worth, the lower the external finance premium should be. Since borrower’s financial position affect the external finance premium, ...

... Based on the theoretical prediction that the external finance premium facing a borrower should depend on borrower’s financial position. The greater is the borrower’s net worth, the lower the external finance premium should be. Since borrower’s financial position affect the external finance premium, ...

Presentation to the Financial Women’s Association San Francisco, CA

... to delinquencies and foreclosures on subprime and other mortgages. Foreclosures are extremely painful for homeowners and create negative spillovers for neighbors and afflicted communities. As you may know, some of the earliest and sharpest price declines nationwide occurred in parts of California an ...

... to delinquencies and foreclosures on subprime and other mortgages. Foreclosures are extremely painful for homeowners and create negative spillovers for neighbors and afflicted communities. As you may know, some of the earliest and sharpest price declines nationwide occurred in parts of California an ...