PDF Download

... The periphery countries therefore now have to devalue to make their consumers and firms switch from imports to domestic goods, thereby reducing their imbalances. Ireland is the only country to have achieved this to date by cutting wages, contributing to a fall in its price level relative to the core ...

... The periphery countries therefore now have to devalue to make their consumers and firms switch from imports to domestic goods, thereby reducing their imbalances. Ireland is the only country to have achieved this to date by cutting wages, contributing to a fall in its price level relative to the core ...

Financing Infrastructure Through Capital Market

... Started in response to government appeal to private sector Structured as intermediary between infrastructure providers and capital markets Listed and rated bonds on market Created two subsidiaries:non profit capacity building fund and distressed bond company ...

... Started in response to government appeal to private sector Structured as intermediary between infrastructure providers and capital markets Listed and rated bonds on market Created two subsidiaries:non profit capacity building fund and distressed bond company ...

Globalisation: Opportunity or threat?

... – Required a truly global response to avoid turning into a re-run of the 1930s ...

... – Required a truly global response to avoid turning into a re-run of the 1930s ...

budget deficits into modest surpluses a la 1998-2001

... • Government Savings = Budget Surplus • So, it is easy to conclude that a reduction in the budget surplus (i.e. a larger budget deficit) reduces national savings and, hence, leads to larger CA deficits. ...

... • Government Savings = Budget Surplus • So, it is easy to conclude that a reduction in the budget surplus (i.e. a larger budget deficit) reduces national savings and, hence, leads to larger CA deficits. ...

Mexico

... • Because of an upcoming presidential election on August 21, 1994, political developments caused an increase in Mexico’s risk premium () due to increases in default risk and exchange rate risk: These events put downward pressure on the value of the peso, Mexico’s central bank had promised to mainta ...

... • Because of an upcoming presidential election on August 21, 1994, political developments caused an increase in Mexico’s risk premium () due to increases in default risk and exchange rate risk: These events put downward pressure on the value of the peso, Mexico’s central bank had promised to mainta ...

The New Partnership for Africa’s Development (NEPAD) and

... Financial Integration and Trade • Volatility in quantity and prices (exchange rates and interest rates) have adverse effects on the real sector • Excessive volatility can constrain ability of governments and private sector operators to enter into new binding commitments • It is difficult for develo ...

... Financial Integration and Trade • Volatility in quantity and prices (exchange rates and interest rates) have adverse effects on the real sector • Excessive volatility can constrain ability of governments and private sector operators to enter into new binding commitments • It is difficult for develo ...

Strategijsko pozicioniranje

... factors (i.e. income tax reducing the income to spend…plus more saving, and buying preference –domestic vs. imported products/services), thus reducing the income of domestic firms… • This creates leakages (withdrawal) from the circular flow of income (explaining business revenue fluctuation) • Part ...

... factors (i.e. income tax reducing the income to spend…plus more saving, and buying preference –domestic vs. imported products/services), thus reducing the income of domestic firms… • This creates leakages (withdrawal) from the circular flow of income (explaining business revenue fluctuation) • Part ...

II. Domestic Economic Outlook 2

... current account deficit in the upcoming period. Although financial and non-financial sectors had no trouble in borrowing from abroad, during the period from May to July, Turkey posted a capital outflow of approximately USD 10 billion. However, with the postponement of the expectations over Fed taper ...

... current account deficit in the upcoming period. Although financial and non-financial sectors had no trouble in borrowing from abroad, during the period from May to July, Turkey posted a capital outflow of approximately USD 10 billion. However, with the postponement of the expectations over Fed taper ...

SYLLABUS COURSE TITLE Managerial Finance Faculty/Institute

... Students are acquainted with: fundamental concepts in Financial Management, (dis-) advantages of forms of business organization, linkage between stock price and intrinsic value, capital structure and dividend policy, investing in long-term assets. PREREQUISITES Basic accounting The student ...

... Students are acquainted with: fundamental concepts in Financial Management, (dis-) advantages of forms of business organization, linkage between stock price and intrinsic value, capital structure and dividend policy, investing in long-term assets. PREREQUISITES Basic accounting The student ...

Conventional theories of saving

... best choice for him; otherwise, this choice would not have been defined as the default. 5 The use of mental accounting means, in part, that people think about funds differently, depending on their source. For example, regular wage and salary income may be defined as funds for consumption, while irre ...

... best choice for him; otherwise, this choice would not have been defined as the default. 5 The use of mental accounting means, in part, that people think about funds differently, depending on their source. For example, regular wage and salary income may be defined as funds for consumption, while irre ...

Monetary Policy Monetary Policy Money Supply How Banks Make

... o Bond yields are used to set long-term rates for mortgages and business lending. As yields decrease so to should interest rates on these instruments. o If the banks want to make money, they need to search out other investments o The hope is that the banks will then start lending more money to busin ...

... o Bond yields are used to set long-term rates for mortgages and business lending. As yields decrease so to should interest rates on these instruments. o If the banks want to make money, they need to search out other investments o The hope is that the banks will then start lending more money to busin ...

history of the cash flow statement

... However, cash flow statements, in some form or another, have a long history in the United States. In 1863, Northern Central Railroad issued a summary of its financial transactions that included an outline of its cash receipts and cash disbursements for the year. Because current assets can be thought ...

... However, cash flow statements, in some form or another, have a long history in the United States. In 1863, Northern Central Railroad issued a summary of its financial transactions that included an outline of its cash receipts and cash disbursements for the year. Because current assets can be thought ...

India's Experience with Capital Flow Management

... NRI deposits - interest rate ceiling linked to LIBOR/SWAP In sum, gradual and calibrated liberalization - sequencing 13 ...

... NRI deposits - interest rate ceiling linked to LIBOR/SWAP In sum, gradual and calibrated liberalization - sequencing 13 ...

Subscribe About/Contact Advertise Français All articles

... Understanding causalities is a pre-condition for good policymaking, since bubbles and crises will occur again if the sources are not addressed directly. There is wide agreement that markets need more effective monitoring and regulation, and stronger corporate governance. After all, from Wall Street ...

... Understanding causalities is a pre-condition for good policymaking, since bubbles and crises will occur again if the sources are not addressed directly. There is wide agreement that markets need more effective monitoring and regulation, and stronger corporate governance. After all, from Wall Street ...

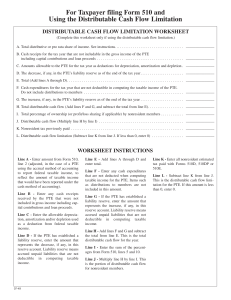

For Taxpayer filing Form 510 and Using the Distributable Cash Flow

... B. Cash receipts for the tax year that are not includable in the gross income of the PTE including capital contributions and loan proceeds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _______________ C. Amounts allowable to the PTE for the tax year as d ...

... B. Cash receipts for the tax year that are not includable in the gross income of the PTE including capital contributions and loan proceeds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _______________ C. Amounts allowable to the PTE for the tax year as d ...

Last quarter, we cautioned that conditions were right for a

... the long term have great potential, in near term, their economies particularly those with export susceptible to profit taking. Counter to the stance of many global investors who bet that quantitative driven economies are growing at a slower rate. We are monitoring these economies closely. easing was ...

... the long term have great potential, in near term, their economies particularly those with export susceptible to profit taking. Counter to the stance of many global investors who bet that quantitative driven economies are growing at a slower rate. We are monitoring these economies closely. easing was ...

Houston Paper - First International

... upgraded to a level whereby they could be bought by financial institutions such as pension funds and life insurance companies which have a huge and growing appetite for investment. The problem is that this credit insurance also became a traded chip in the Capital Casino as demand for credit insuranc ...

... upgraded to a level whereby they could be bought by financial institutions such as pension funds and life insurance companies which have a huge and growing appetite for investment. The problem is that this credit insurance also became a traded chip in the Capital Casino as demand for credit insuranc ...