U.S. Monetary Policy Forum, February 29, 2008

... Interbank Offered Rate (LIBOR) – generally around 6 percentage points over the six-month LIBOR. The reductions in the federal funds rate, as well as the reduction in the spread of LIBOR over the federal funds target after the introduction of the Federal Reserve’s Term Auction Facility, have signific ...

... Interbank Offered Rate (LIBOR) – generally around 6 percentage points over the six-month LIBOR. The reductions in the federal funds rate, as well as the reduction in the spread of LIBOR over the federal funds target after the introduction of the Federal Reserve’s Term Auction Facility, have signific ...

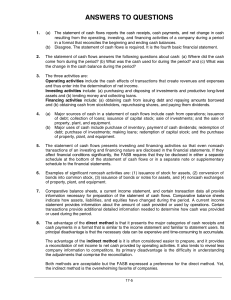

Post-Closing Trial Balance

... c. The last day of the current month 2) List all accounts in numerical order with their account numbers 3) List all account balances in the “Trial Balance” section of the worksheet. (Draw a single Rule under the last account and all the way across the page.) 4) Add the debit column and the credit co ...

... c. The last day of the current month 2) List all accounts in numerical order with their account numbers 3) List all account balances in the “Trial Balance” section of the worksheet. (Draw a single Rule under the last account and all the way across the page.) 4) Add the debit column and the credit co ...

To view this press release as a Word document

... times the average of the past decade. Half of the contribution was derived from the asset management of the portfolios of currencies included in the numeraire (Dollar, Euro and British Pound)—primarily the investment in spread assets, which are not included in the benchmark and which yielded excess ...

... times the average of the past decade. Half of the contribution was derived from the asset management of the portfolios of currencies included in the numeraire (Dollar, Euro and British Pound)—primarily the investment in spread assets, which are not included in the benchmark and which yielded excess ...

FRBSF E L CONOMIC ETTER

... Once other investors saw how quickly and unpredictably such markets could cease to function well, those who used similar complex instruments likely grew concerned about how quickly and unpredictably their own exposures might change for the worse, leading them to pull back, too. One might say that th ...

... Once other investors saw how quickly and unpredictably such markets could cease to function well, those who used similar complex instruments likely grew concerned about how quickly and unpredictably their own exposures might change for the worse, leading them to pull back, too. One might say that th ...

Fund Facts

... should not be relied upon as such. Opinions expressed herein are subject to change without notice. The services described are provided by CCLA Fund Managers Limited (CCLA), a firm authorised and regulated by the Financial Conduct Authority. This document is issued for information purposes only and i ...

... should not be relied upon as such. Opinions expressed herein are subject to change without notice. The services described are provided by CCLA Fund Managers Limited (CCLA), a firm authorised and regulated by the Financial Conduct Authority. This document is issued for information purposes only and i ...

doc

... difference in productivity between rich and poor countries; the inputs to production (land, natural resources, capital) increase worker productivity, but the amount of land and the endowment of natural resources are fixed – thus, only physical capital can be increased to increase per worker output a ...

... difference in productivity between rich and poor countries; the inputs to production (land, natural resources, capital) increase worker productivity, but the amount of land and the endowment of natural resources are fixed – thus, only physical capital can be increased to increase per worker output a ...

Advanced Financial Analysis: Intro and Firm Objectives

... (1) Cash raised from investors (2) Cash invested in firm (3) Cash generated by operations (4a) Cash reinvested (4b) Cash returned to investors P.V. Viswanath ...

... (1) Cash raised from investors (2) Cash invested in firm (3) Cash generated by operations (4a) Cash reinvested (4b) Cash returned to investors P.V. Viswanath ...

Global Tensions and Economic Security -

... • Today world economy is characterized by divergence • While growth was centered in the advanced world in the 1970s, 1980s, and 1990s, more recently it has moved to emerging economies • According to the International Monetary Fund of the eight countries expected to contribute most to global economic ...

... • Today world economy is characterized by divergence • While growth was centered in the advanced world in the 1970s, 1980s, and 1990s, more recently it has moved to emerging economies • According to the International Monetary Fund of the eight countries expected to contribute most to global economic ...

CC Marsico Global Fund APIR CHN0002AU

... show revenue growth contributions from market share gains, rather than dependence on the macroeconomic environment. In a slow global growth environment, these stocks should outperform as investors seek out secular growth companies that can grow revenues. We tend to invest in companies that have stro ...

... show revenue growth contributions from market share gains, rather than dependence on the macroeconomic environment. In a slow global growth environment, these stocks should outperform as investors seek out secular growth companies that can grow revenues. We tend to invest in companies that have stro ...

Read More - FPA of Minnesota

... 2016, perhaps to 1.25%. Any such increases likely will make it more expensive to borrow money (through a bank loan) or carry credit card debt. Borrowing money: The potential silver lining to higher interest rates is that they may encourage banks to more readily loan money to consumers through mortga ...

... 2016, perhaps to 1.25%. Any such increases likely will make it more expensive to borrow money (through a bank loan) or carry credit card debt. Borrowing money: The potential silver lining to higher interest rates is that they may encourage banks to more readily loan money to consumers through mortga ...

What a Week on Wall Street

... Yes—everyone acknowledges by now that Wall Street’s capacity to innovate and turn out more and more sophisticated financial instruments had run far ahead of government’s regulatory capability, not because government was not capable of regulating but because the dominant neoliberal, laissez-faire att ...

... Yes—everyone acknowledges by now that Wall Street’s capacity to innovate and turn out more and more sophisticated financial instruments had run far ahead of government’s regulatory capability, not because government was not capable of regulating but because the dominant neoliberal, laissez-faire att ...

Balance of Payments Statistics: A European Perspective

... Data in public data warehouse http://sdw.ecb.europa.eu/ ...

... Data in public data warehouse http://sdw.ecb.europa.eu/ ...

Robert T. Parry President and Chief Executive Officer

... there is a one-to-one relationship between the increase in trend productivity growth and the increase in the equilibrium real interest rate. Of course, things are not usually this simple. For example, in the U.S. economy today, two developments have tended to mitigate the increase in equilibrium rat ...

... there is a one-to-one relationship between the increase in trend productivity growth and the increase in the equilibrium real interest rate. Of course, things are not usually this simple. For example, in the U.S. economy today, two developments have tended to mitigate the increase in equilibrium rat ...

2017 Market Outlook: 15 Experts On What To Watch

... businesses and can no longer count on successes based purely on outsourcing and other related activities. Clients are demanding much more including digital, cloud and security services — all crucial capabilities that Fortune 1000 companies need to successfully adapt their business models. The inform ...

... businesses and can no longer count on successes based purely on outsourcing and other related activities. Clients are demanding much more including digital, cloud and security services — all crucial capabilities that Fortune 1000 companies need to successfully adapt their business models. The inform ...

ITEM 9 Treasury Management Annual Report 2011_12

... Economic Review The Eurozone debt crisis dominated the year’s economic news. The apparent inability of leaders to either agree on remedial policies or implement fiscal consolidation measures prompted frequent bouts of market volatility, as investors positioned themselves for potential government def ...

... Economic Review The Eurozone debt crisis dominated the year’s economic news. The apparent inability of leaders to either agree on remedial policies or implement fiscal consolidation measures prompted frequent bouts of market volatility, as investors positioned themselves for potential government def ...

Misdirected and ineffective: Regional financial cooperation in Asia

... Some features of the crisis period The region as whole characterised by savings surpluses, though there were individual countries that recorded savings deficits. The savings surpluses were being invested in dollar denominated assets, and deficit countries were increasingly dependent on capital flow ...

... Some features of the crisis period The region as whole characterised by savings surpluses, though there were individual countries that recorded savings deficits. The savings surpluses were being invested in dollar denominated assets, and deficit countries were increasingly dependent on capital flow ...

How Higher Interest Rates Affect the Economy

... By the second quarter of 1995, the delayed impact of seven consecutive rate hikes slowed economic growth to less than one percent on an annual basis. Per capita income actually shrank. By March of this year, the Fed raised its benchmark interest rate to the same level as its 1995 peak. If the centr ...

... By the second quarter of 1995, the delayed impact of seven consecutive rate hikes slowed economic growth to less than one percent on an annual basis. Per capita income actually shrank. By March of this year, the Fed raised its benchmark interest rate to the same level as its 1995 peak. If the centr ...

Chapter 15

... The present value of the cash flows minus the present value of the cash outflows Appropriate discount rate is the riskadjusted required rate of return In the previous example the after-tax cash flows are equity cash flows thus the appropriate discount rate is the required equity yield ...

... The present value of the cash flows minus the present value of the cash outflows Appropriate discount rate is the riskadjusted required rate of return In the previous example the after-tax cash flows are equity cash flows thus the appropriate discount rate is the required equity yield ...

Nov. 30, 2015 - Centre Funds

... for the average company in the S&P 500 Index while net profit margins are plateauing, which may be a sign of financial engineering, e.g., stock buybacks, as well as the strong influence from low borrowing costs. Unlike in 2000, stock prices are not inflated relative to earnings; rather, earnings are ...

... for the average company in the S&P 500 Index while net profit margins are plateauing, which may be a sign of financial engineering, e.g., stock buybacks, as well as the strong influence from low borrowing costs. Unlike in 2000, stock prices are not inflated relative to earnings; rather, earnings are ...

Modest growth in investor confidence amid continued volatility

... overcome rising energy costs and a slowdown in European economic growth. Growing business optimism, based on improving sales and profits, may give business leaders the confidence to take on staff more quickly. Home prices are a key component of consumer wealth. Housing starts in the United States we ...

... overcome rising energy costs and a slowdown in European economic growth. Growing business optimism, based on improving sales and profits, may give business leaders the confidence to take on staff more quickly. Home prices are a key component of consumer wealth. Housing starts in the United States we ...

10-1 Reasons for Saving and Investing

... A long-term, planned approach to making investments is called a. systematic investing b. contingency fund planning c. political risk d. hedging ...

... A long-term, planned approach to making investments is called a. systematic investing b. contingency fund planning c. political risk d. hedging ...