The impact of inflation and deflation on the case for gold

... The purpose of this study is to examine in detail gold‟s properties as an asset and its likely performance relative to other assets in a variety of different economic scenarios. By building on existing studies of the determinants of the gold price and combining this with our own quantitative analysi ...

... The purpose of this study is to examine in detail gold‟s properties as an asset and its likely performance relative to other assets in a variety of different economic scenarios. By building on existing studies of the determinants of the gold price and combining this with our own quantitative analysi ...

UNITED STATES SECURITIES AND EXCHANGE

... unconsolidated financial statements in accordance with the Swiss Code of Obligations. In this Annual Report: (i) ‘‘$,’’ ‘‘U.S. dollar’’ and ‘‘USD’’ refer to the lawful currency of the United States of America; (ii) ‘‘CHF’’ and ‘‘Swiss franc’’ refer to the lawful currency of Switzerland; (iii) ‘‘EUR’ ...

... unconsolidated financial statements in accordance with the Swiss Code of Obligations. In this Annual Report: (i) ‘‘$,’’ ‘‘U.S. dollar’’ and ‘‘USD’’ refer to the lawful currency of the United States of America; (ii) ‘‘CHF’’ and ‘‘Swiss franc’’ refer to the lawful currency of Switzerland; (iii) ‘‘EUR’ ...

Identifying Exchange Rate Common Factors

... What is the value-added of empirical factor identification? One is that it guides us toward an economic interpretation of the source of exchange rate co-movements (as opposed to the descriptive principal components analysis). Drawing on the stochastic discount factor (SDF) approach to the exchange r ...

... What is the value-added of empirical factor identification? One is that it guides us toward an economic interpretation of the source of exchange rate co-movements (as opposed to the descriptive principal components analysis). Drawing on the stochastic discount factor (SDF) approach to the exchange r ...

Risk Perceptions, Directional Goals and the Link between Risk and

... participants is assigned to consider a prospective investment in the firm’s stock (and thus do not have a directional goal). We also vary the observability of the inputs to a fair value estimate (i.e., Level 2 and Level 3 in the fair value hierarchy in ASC 820 [FASB 2014]). Level 3 estimates are th ...

... participants is assigned to consider a prospective investment in the firm’s stock (and thus do not have a directional goal). We also vary the observability of the inputs to a fair value estimate (i.e., Level 2 and Level 3 in the fair value hierarchy in ASC 820 [FASB 2014]). Level 3 estimates are th ...

Parameter Uncertainty and the Credit Risk of Collateralized Debt

... systems of correlated normal latent credit factors. Copula-based models have become popular over the last decade both because they are computationally tractable, and because they can be derived from the structural corporate debt valuation framework of Merton (1974). Today, normal copula models are u ...

... systems of correlated normal latent credit factors. Copula-based models have become popular over the last decade both because they are computationally tractable, and because they can be derived from the structural corporate debt valuation framework of Merton (1974). Today, normal copula models are u ...

When are consumer loans collateralized in emerging markets

... retail credit sector, joint stock commercial banks play an important role as they account for more than 50% of outstanding loan value. Nevertheless, consumer credit continues to encounter barriers to growth due to, for example, the unreliable credit rating systems and complicated application procedu ...

... retail credit sector, joint stock commercial banks play an important role as they account for more than 50% of outstanding loan value. Nevertheless, consumer credit continues to encounter barriers to growth due to, for example, the unreliable credit rating systems and complicated application procedu ...

13: Asset Valuation: Equity Investments

... non-cyclical industries with the lowest P/E ratios. an industry's prospects within the global business environment are a major determinant of how well individual firms in the industry perform. most valuation models recommend the use of industry-wide average required returns, rather than individual r ...

... non-cyclical industries with the lowest P/E ratios. an industry's prospects within the global business environment are a major determinant of how well individual firms in the industry perform. most valuation models recommend the use of industry-wide average required returns, rather than individual r ...

Quarterly Report Q2/2016

... The scope of our business activities and competitive positions as described in our Annual Report 2015 on page 57 did not change materially in the second quarter of 2016. In order to adapt our structures to our markets and customers, we spent 41 million euros on restructuring (previous year: 29 milli ...

... The scope of our business activities and competitive positions as described in our Annual Report 2015 on page 57 did not change materially in the second quarter of 2016. In order to adapt our structures to our markets and customers, we spent 41 million euros on restructuring (previous year: 29 milli ...

The Dollar Hegemony And The US-china Monetary Disputes

... bankruptcies and job losses in the U.S. manufacturing sector. However, the Chinese side does not agree that its currency is undervalued and deems exchange rate choice a sovereign action. It also refuses to admit that the results happening in the United States are mainly because of the Chinese monet ...

... bankruptcies and job losses in the U.S. manufacturing sector. However, the Chinese side does not agree that its currency is undervalued and deems exchange rate choice a sovereign action. It also refuses to admit that the results happening in the United States are mainly because of the Chinese monet ...

Governance Quality and Information Asymmetry

... and reduce its cost of capital. A recent empirical example of this is Armostrong et al. (2012) who suggest antitakeover laws as the means of reducing asymmetric information. Another example is Jiang et al. (2011) who demonstrate that voluntary disclosures significantly attenuate information asymmetr ...

... and reduce its cost of capital. A recent empirical example of this is Armostrong et al. (2012) who suggest antitakeover laws as the means of reducing asymmetric information. Another example is Jiang et al. (2011) who demonstrate that voluntary disclosures significantly attenuate information asymmetr ...

(2005). “Deposit insurance and financial crises: Investigation

... taking developing three hypotheses with respect to factors reducing market discipline and increasing risk-taking. The three factors are the extent of the government safety net, lack of financing by uninsured creditors, and lack of observability of banks' risk choices. Using data for 729 banks in 32 ...

... taking developing three hypotheses with respect to factors reducing market discipline and increasing risk-taking. The three factors are the extent of the government safety net, lack of financing by uninsured creditors, and lack of observability of banks' risk choices. Using data for 729 banks in 32 ...

OptionsIQ

... The theoretical or fair value of an option is the price one would expect to pay in order to just break even in the long run. Theoretical value can be thought of as the "production cost" of the option. The cost of purchasing an option in the marketplace is called the option premium. This amount is of ...

... The theoretical or fair value of an option is the price one would expect to pay in order to just break even in the long run. Theoretical value can be thought of as the "production cost" of the option. The cost of purchasing an option in the marketplace is called the option premium. This amount is of ...

1Q17 Results Presentation

... These negative impacts are offset by savings in the funding side and higher ALCO contribution (1) Bank of Spain’s public information as of Mar-17. ...

... These negative impacts are offset by savings in the funding side and higher ALCO contribution (1) Bank of Spain’s public information as of Mar-17. ...

e - Homework Minutes

... the firms in the emerging markets. The scores published by Governance Metrics International include the accountability of the board of directors, the disclosure of financial statements and internal controls, the rights of the shareholders, salary package, market and corporate behavior components. In ...

... the firms in the emerging markets. The scores published by Governance Metrics International include the accountability of the board of directors, the disclosure of financial statements and internal controls, the rights of the shareholders, salary package, market and corporate behavior components. In ...

household debt and unemployment

... decreasing bank equity decreases their screening. This implies that banks make more loans to bad households. Loans are thus riskier and interest rates are higher. As a result, there is more debt on household balance sheets; this exacerbates the household debt externality, moving the economy away fro ...

... decreasing bank equity decreases their screening. This implies that banks make more loans to bad households. Loans are thus riskier and interest rates are higher. As a result, there is more debt on household balance sheets; this exacerbates the household debt externality, moving the economy away fro ...

household debt and unemployment

... decreasing bank equity decreases their screening. This implies that banks make more loans to bad households. Loans are thus riskier and interest rates are higher. As a result, there is more debt on household balance sheets; this exacerbates the household debt externality, moving the economy away fro ...

... decreasing bank equity decreases their screening. This implies that banks make more loans to bad households. Loans are thus riskier and interest rates are higher. As a result, there is more debt on household balance sheets; this exacerbates the household debt externality, moving the economy away fro ...

words

... from our user-based research process and partnering with leading research organizations around the world. Steelcase is a global company, headquartered in Grand Rapids, Michigan, U.S.A., with approximately 10,400 employees. Steelcase was founded in 1912 and became publicly-traded in 1998, and our sto ...

... from our user-based research process and partnering with leading research organizations around the world. Steelcase is a global company, headquartered in Grand Rapids, Michigan, U.S.A., with approximately 10,400 employees. Steelcase was founded in 1912 and became publicly-traded in 1998, and our sto ...

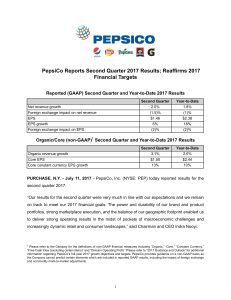

Reaffirms 2017 Financial Targets

... percent in the year and was positively impacted by items affecting comparability (8 percentage points) and negatively impacted by foreign exchange translation (1.5 percentage points). Core constant currency division operating profit (a non-GAAP measure) increased by 4 percent. Organic revenue, core ...

... percent in the year and was positively impacted by items affecting comparability (8 percentage points) and negatively impacted by foreign exchange translation (1.5 percentage points). Core constant currency division operating profit (a non-GAAP measure) increased by 4 percent. Organic revenue, core ...

the arab republic of egypt

... Annual information presented in this Prospectus is based upon 1 July to 30 June periods (which is the fiscal year of the Republic), unless otherwise indicated. Certain figures and percentages included in this Prospectus have been subject to rounding adjustments. Accordingly, figures shown in the sam ...

... Annual information presented in this Prospectus is based upon 1 July to 30 June periods (which is the fiscal year of the Republic), unless otherwise indicated. Certain figures and percentages included in this Prospectus have been subject to rounding adjustments. Accordingly, figures shown in the sam ...

united states securities and exchange commission ally

... or lower than the estimated residual value. Automotive manufacturers may elect as a marketing incentive to sponsor special financing programs for retail sales of their respective vehicles. The manufacturer can lower the financing rate paid by the customer on either a retail contract or a lease by pa ...

... or lower than the estimated residual value. Automotive manufacturers may elect as a marketing incentive to sponsor special financing programs for retail sales of their respective vehicles. The manufacturer can lower the financing rate paid by the customer on either a retail contract or a lease by pa ...

Rare events and investor risk aversion

... The main contribution of this paper is to provide evidence of significant and differential effects of infrequent financial and political events on risk aversion functions and pricing kernels, through the risk-neutral and historical densities. These are estimated from available options data on the We ...

... The main contribution of this paper is to provide evidence of significant and differential effects of infrequent financial and political events on risk aversion functions and pricing kernels, through the risk-neutral and historical densities. These are estimated from available options data on the We ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.