* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download When are consumer loans collateralized in emerging markets

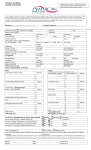

Survey

Document related concepts

History of the Federal Reserve System wikipedia , lookup

Financialization wikipedia , lookup

Payday loan wikipedia , lookup

Moral hazard wikipedia , lookup

Securitization wikipedia , lookup

Fractional-reserve banking wikipedia , lookup

Interbank lending market wikipedia , lookup

Interest rate ceiling wikipedia , lookup

History of pawnbroking wikipedia , lookup

Yield spread premium wikipedia , lookup

Credit rationing wikipedia , lookup

Peer-to-peer lending wikipedia , lookup

Student loan wikipedia , lookup

Transcript