Solutions to Questions and Problems

... If it has too much cash it can simply pay a dividend, or, more likely in the current financial environment, buy back stock. It can also reduce debt. If it has insufficient cash, then it must either borrow, sell stock, or improve profitability. ...

... If it has too much cash it can simply pay a dividend, or, more likely in the current financial environment, buy back stock. It can also reduce debt. If it has insufficient cash, then it must either borrow, sell stock, or improve profitability. ...

PDF Download

... emerging markets engaged in debt management policies that have reduced the level of public debt, cut the share of debt denominated in foreign currency, decreased the share of variable interest rate debt, and, particularly, helped to extend the maturity of external debt (Arslanalp and Tsuda, 2014; Fi ...

... emerging markets engaged in debt management policies that have reduced the level of public debt, cut the share of debt denominated in foreign currency, decreased the share of variable interest rate debt, and, particularly, helped to extend the maturity of external debt (Arslanalp and Tsuda, 2014; Fi ...

Chapter 9 Put and Call Options

... So who sold you the option? A counter-party, who may have also been a small trader like you, wrote (offered to sell) this option at this price by posting a limit order to sell any number of contracts (it may have been more than one) for $5.35 per contract and that became Best Ask.6 To be clear, when ...

... So who sold you the option? A counter-party, who may have also been a small trader like you, wrote (offered to sell) this option at this price by posting a limit order to sell any number of contracts (it may have been more than one) for $5.35 per contract and that became Best Ask.6 To be clear, when ...

Capital Flows to Asia and Latin America, 1950-2007

... We first construct time series of these wedges using an estimated version of the model together with panel data that is constructed using country-specific, historical sources. We then conduct a variety of experiments in changing the values of specific wedges, and their stochastic processes, to corre ...

... We first construct time series of these wedges using an estimated version of the model together with panel data that is constructed using country-specific, historical sources. We then conduct a variety of experiments in changing the values of specific wedges, and their stochastic processes, to corre ...

aecom

... when market value is not readily available. Transaction costs associated with business acquisitions are expensed as they are incurred. On October 17, 2014, the Company completed the acquisition of the U.S. headquartered URS Corporation (URS), an international provider of engineering, construction, a ...

... when market value is not readily available. Transaction costs associated with business acquisitions are expensed as they are incurred. On October 17, 2014, the Company completed the acquisition of the U.S. headquartered URS Corporation (URS), an international provider of engineering, construction, a ...

MOBILIZING CLIMATE FINANCE A ROADMAP TO FINANCE A LOW

... and proposes to the President of the French Republic paths of action to mobilize increased public and private funding in the fight against climate change. It also forwards proposals on how the French government could advance the ‘innovative climate finance agenda’ in the various international forums ...

... and proposes to the President of the French Republic paths of action to mobilize increased public and private funding in the fight against climate change. It also forwards proposals on how the French government could advance the ‘innovative climate finance agenda’ in the various international forums ...

Banks, Government Bonds, and Default: What do the Data Say?

... Our paper is related to the literature studying the costs of public defaults. Quantitative models like Arellano (2008) find that, when calibrated to match the data, exclusion from financial markets is too short to account for the observed low frequency of defaults. In line with her findings, recent ...

... Our paper is related to the literature studying the costs of public defaults. Quantitative models like Arellano (2008) find that, when calibrated to match the data, exclusion from financial markets is too short to account for the observed low frequency of defaults. In line with her findings, recent ...

Unlocking funding for European investment and growth

... It examines the obstacles which currently prevent the wholesale markets from supporting growth and investment in Europe, and offers recommendations on how these may be addressed. Growth and financing of real economy assets in Europe face structural challenges. Whilst some funding channels are curren ...

... It examines the obstacles which currently prevent the wholesale markets from supporting growth and investment in Europe, and offers recommendations on how these may be addressed. Growth and financing of real economy assets in Europe face structural challenges. Whilst some funding channels are curren ...

Entrepreneurial Valuation Techniques

... Source: Venture Economics’ US Private Equity Performance Index (PEPI) 12/31/2004 Venture Economics’ Private Equity Performance Index is calculated quarterly from Venture Economics’ Private Equity Performance Database (PEPD). The PEPD tracks the performance of over 1,400 US venture capital and buyout ...

... Source: Venture Economics’ US Private Equity Performance Index (PEPI) 12/31/2004 Venture Economics’ Private Equity Performance Index is calculated quarterly from Venture Economics’ Private Equity Performance Database (PEPD). The PEPD tracks the performance of over 1,400 US venture capital and buyout ...

Discussion Paper

... economies with export structures highly concentrated around a small number of commodities, given that it would provide them with an opportunity to hedge against fluctuations in export earnings. There have been frequent advocates for this kind of issuance in commodity-dependent countries.2 The mid 19 ...

... economies with export structures highly concentrated around a small number of commodities, given that it would provide them with an opportunity to hedge against fluctuations in export earnings. There have been frequent advocates for this kind of issuance in commodity-dependent countries.2 The mid 19 ...

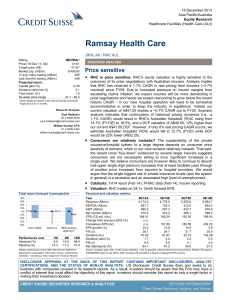

Ramsay Health Care 2013 12 18 - Price sensitive

... ■ Consumers are relatively inelastic? The sustainability of the private insurance/hospital system to a large degree depends on consumer price elasticity of demand, which in our view remains relatively inelastic. That said, the recent cover "buy-down" evidenced by several larger insurers suggests con ...

... ■ Consumers are relatively inelastic? The sustainability of the private insurance/hospital system to a large degree depends on consumer price elasticity of demand, which in our view remains relatively inelastic. That said, the recent cover "buy-down" evidenced by several larger insurers suggests con ...

ESLA1994-1995_en.pdf

... 1. The economy of Latin America and the Caribbean in 1994 Overall, in 1994, the economies of Latin America and the Caribbean turned in a stronger performance than in previous years. The growth rate of gross domestic product for the region progressed from an annual average of 3.3% for the three-year ...

... 1. The economy of Latin America and the Caribbean in 1994 Overall, in 1994, the economies of Latin America and the Caribbean turned in a stronger performance than in previous years. The growth rate of gross domestic product for the region progressed from an annual average of 3.3% for the three-year ...

The Financial Development Report 2012 - WEF

... degree of humility that we put forth our findings, given some of the inherent limitations and occasional inconsistencies of these data, the rapidly changing environment, and the unique circumstances of some of the economies covered. Yet, through its attempt to establish a comprehensive framework and ...

... degree of humility that we put forth our findings, given some of the inherent limitations and occasional inconsistencies of these data, the rapidly changing environment, and the unique circumstances of some of the economies covered. Yet, through its attempt to establish a comprehensive framework and ...

“MURABAHA”

... countries particularly in Pakistan, because interest is not permissible in Islamic Shariah. Interest in known as second major sin after shirk. What should a Muslim community needs to do to avoid interest? Answering this question we find solution of Islamic mode of financing, which is done both by Is ...

... countries particularly in Pakistan, because interest is not permissible in Islamic Shariah. Interest in known as second major sin after shirk. What should a Muslim community needs to do to avoid interest? Answering this question we find solution of Islamic mode of financing, which is done both by Is ...

Tick Size and Institutional Trading Costs: Evidence from Mutual Funds

... examines alternative explanations for our findings. Section IV offers concluding remarks. ...

... examines alternative explanations for our findings. Section IV offers concluding remarks. ...

ZEBRA TECHNOLOGIES CORP (Form: 10-K, Received

... 1995 and are highly dependent upon a variety of important factors, which could cause actual results to differ materially from those expressed or implied in such forward-looking statements. When used in this document and documents referenced, the words “anticipate,” “believe,” “intend,” “estimate,” “ ...

... 1995 and are highly dependent upon a variety of important factors, which could cause actual results to differ materially from those expressed or implied in such forward-looking statements. When used in this document and documents referenced, the words “anticipate,” “believe,” “intend,” “estimate,” “ ...

S0311856_en.pdf

... year. In 2003, the countries of the region have been able to access funds at an average cost of 9.6%, which is 300 basis points less than 12 months earlier. Nevertheless, foreign investment has been on the decline. Latin America and the Caribbean have received nearly US$ 22 billion in compensatory f ...

... year. In 2003, the countries of the region have been able to access funds at an average cost of 9.6%, which is 300 basis points less than 12 months earlier. Nevertheless, foreign investment has been on the decline. Latin America and the Caribbean have received nearly US$ 22 billion in compensatory f ...

Title of presentation

... Risk/Reward for Direct Lending Proxies are attractive vs. Equities & Property • Better Sharpe ratio for US credit card assets and UK personal loans than for S&P • S&P and commercial property had negative returns of -37% and -23% in ...

... Risk/Reward for Direct Lending Proxies are attractive vs. Equities & Property • Better Sharpe ratio for US credit card assets and UK personal loans than for S&P • S&P and commercial property had negative returns of -37% and -23% in ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.