S0311856_en.pdf

... year. In 2003, the countries of the region have been able to access funds at an average cost of 9.6%, which is 300 basis points less than 12 months earlier. Nevertheless, foreign investment has been on the decline. Latin America and the Caribbean have received nearly US$ 22 billion in compensatory f ...

... year. In 2003, the countries of the region have been able to access funds at an average cost of 9.6%, which is 300 basis points less than 12 months earlier. Nevertheless, foreign investment has been on the decline. Latin America and the Caribbean have received nearly US$ 22 billion in compensatory f ...

Valuation: Part I Discounted Cash Flow Valuation

... Time horizon matters: Thus, the riskfree rates in valuation will depend upon when the cash flow is expected to occur and will vary across time. ...

... Time horizon matters: Thus, the riskfree rates in valuation will depend upon when the cash flow is expected to occur and will vary across time. ...

Review of Asset Values, Costs and Cost Allocation of Western

... of prices have not previously been subject to rigorous, cost-based regulation of prices. As a consequence, these businesses have not established the accounting systems (in particular the keeping of regulatory accounts) that are the norm in other utility industries where cost-based regulated has been ...

... of prices have not previously been subject to rigorous, cost-based regulation of prices. As a consequence, these businesses have not established the accounting systems (in particular the keeping of regulatory accounts) that are the norm in other utility industries where cost-based regulated has been ...

Title of presentation

... Risk/Reward for Direct Lending Proxies are attractive vs. Equities & Property • Better Sharpe ratio for US credit card assets and UK personal loans than for S&P • S&P and commercial property had negative returns of -37% and -23% in ...

... Risk/Reward for Direct Lending Proxies are attractive vs. Equities & Property • Better Sharpe ratio for US credit card assets and UK personal loans than for S&P • S&P and commercial property had negative returns of -37% and -23% in ...

Planet Fitness, Inc.

... The recapitalization transactions are considered transactions between entities under common control. As a result, the financial statements for periods prior to the IPO and the recapitalization transactions are the financial statements of Pla-Fit Holdings as the predecessor to the Company for account ...

... The recapitalization transactions are considered transactions between entities under common control. As a result, the financial statements for periods prior to the IPO and the recapitalization transactions are the financial statements of Pla-Fit Holdings as the predecessor to the Company for account ...

Joffe Open Source Credit Model Presentation to SEC

... This shortcoming of inadequate analysis is natural, indeed, in view of the size of the task. For instance, the 1937 industrial manual of Moody lists 5,032 companies on which statistical information has been gathered and prepared; 691 bond issues of these companies have been rated. The utility staff ...

... This shortcoming of inadequate analysis is natural, indeed, in view of the size of the task. For instance, the 1937 industrial manual of Moody lists 5,032 companies on which statistical information has been gathered and prepared; 691 bond issues of these companies have been rated. The utility staff ...

Estimating an Equilibrium Model of Limit Order Markets

... incorporates an insight by Baruch (2008), a paper subsumed by Back and Baruch (2012), that liquidity suppliers’ choice of supply schedules can be recursively characterized as a dynamic programming problem. This insight is key to my econometric procedure, allowing me to apply tools and methodologies ...

... incorporates an insight by Baruch (2008), a paper subsumed by Back and Baruch (2012), that liquidity suppliers’ choice of supply schedules can be recursively characterized as a dynamic programming problem. This insight is key to my econometric procedure, allowing me to apply tools and methodologies ...

Document

... • Buffett’s view: – Growth is a key determinant of value for any stock, so it is always a component of determining whether or not a stock is undervalued – Furthermore, so long as the market is undervaluing a stock, then he would categorize it as a “value” stock – Finally, he considers all investing ...

... • Buffett’s view: – Growth is a key determinant of value for any stock, so it is always a component of determining whether or not a stock is undervalued – Furthermore, so long as the market is undervaluing a stock, then he would categorize it as a “value” stock – Finally, he considers all investing ...

FLOWERS FOODS INC (Form: 10-K, Received: 02

... to differ materially from those projected. Certain factors that may cause actual results, performance, liquidity, and achievements to differ materially from those projected are discussed in this report and may include, but are not limited to: • unexpected changes in any of the following: (i) general ...

... to differ materially from those projected. Certain factors that may cause actual results, performance, liquidity, and achievements to differ materially from those projected are discussed in this report and may include, but are not limited to: • unexpected changes in any of the following: (i) general ...

DT - European Parliament

... The process of securitisation helps with the maturity transformation that financial institutions need to achieve. For banks securitisation has the potential advantage to reduce the (liquidity) risks of transforming short-term funds like savings deposits into long-term assets like loans and mortgages ...

... The process of securitisation helps with the maturity transformation that financial institutions need to achieve. For banks securitisation has the potential advantage to reduce the (liquidity) risks of transforming short-term funds like savings deposits into long-term assets like loans and mortgages ...

Quantifying Liquidity and Default Risks of Corporate Bonds over the

... our approach of jointly modeling default and liquidity risk over the business cycle is essential to capture the interactions between the two components. Such interactions give rise to the endogenous liquidity, which helps explain two general empirical patterns for the liquidity of corporate bonds: ...

... our approach of jointly modeling default and liquidity risk over the business cycle is essential to capture the interactions between the two components. Such interactions give rise to the endogenous liquidity, which helps explain two general empirical patterns for the liquidity of corporate bonds: ...

Salary Report 2014 Hong Kong

... Many of our client banks have been active in target areas. Risk and compliance remained buoyant, while vendor and change management have both been areas in which we have seen increased focus. ...

... Many of our client banks have been active in target areas. Risk and compliance remained buoyant, while vendor and change management have both been areas in which we have seen increased focus. ...

Blockholder Heterogeneity, Multiple Blocks, and the Dance Between

... In our view, a more complete characterization of blockholder presence is needed for mutiple reasons. First, an empirical description of the determinants of blockholder presence can inform future theories and thinking on the role that blockholders play in firms. At a minimum, a theory should be cons ...

... In our view, a more complete characterization of blockholder presence is needed for mutiple reasons. First, an empirical description of the determinants of blockholder presence can inform future theories and thinking on the role that blockholders play in firms. At a minimum, a theory should be cons ...

Commercial Mortgage-backed Securities: Prepayment and Default*

... structure (YLDCURVE), defined as the 10-year Treasury bond rate minus the 1-year Treasury bond rate. Figure 2 shows the changes in the yield curve over the sample period and clearly indicates an overall flattening of the yield curve during the latter 1990s. During the sample period, the mean value o ...

... structure (YLDCURVE), defined as the 10-year Treasury bond rate minus the 1-year Treasury bond rate. Figure 2 shows the changes in the yield curve over the sample period and clearly indicates an overall flattening of the yield curve during the latter 1990s. During the sample period, the mean value o ...

Twenty Years On - The UK and the Future of the Single Market

... There are a number of areas where we believe further action would be fruitful. The importance of further progress on opening up services markets is underlined by the scale of services sectors across all European economies. The Services Directive extended the Single Market to services but only to a l ...

... There are a number of areas where we believe further action would be fruitful. The importance of further progress on opening up services markets is underlined by the scale of services sectors across all European economies. The Services Directive extended the Single Market to services but only to a l ...

Sovereign CDS and Bond Pricing Dynamics in the Euro-area

... available in the short run. Nonetheless, cointegration analysis supports the long-run price accuracy of CDS relative to the underlying bond market, suggesting long-run equilibrium between the two credit prices. In the baseline VECM estimation with two lags, four out of six countries in the sample sh ...

... available in the short run. Nonetheless, cointegration analysis supports the long-run price accuracy of CDS relative to the underlying bond market, suggesting long-run equilibrium between the two credit prices. In the baseline VECM estimation with two lags, four out of six countries in the sample sh ...

Denmark - nationalbanken.dk

... for the 2nd quarter indicated further tightening of credit standards over the summer. Despite increased financial turmoil, tightening was in line with that seen in the 1st quarter. US borrowing conditions are generally more favourable, and in the 1st half of the year lending to households grew by ar ...

... for the 2nd quarter indicated further tightening of credit standards over the summer. Despite increased financial turmoil, tightening was in line with that seen in the 1st quarter. US borrowing conditions are generally more favourable, and in the 1st half of the year lending to households grew by ar ...

Treasury Inc.: How the Bailout Reshapes

... hierarch in this situation. The progressive corporate law model of corporate law is also considered in light of this dynamic, with the result that the accountability of government regulators and the disclosure rules underlying progressive corporate law are threatened by the presence of government ow ...

... hierarch in this situation. The progressive corporate law model of corporate law is also considered in light of this dynamic, with the result that the accountability of government regulators and the disclosure rules underlying progressive corporate law are threatened by the presence of government ow ...

The Global Insurance Protection Gap

... customer base (more often than not in distant rural areas), conveying the concept of insurance and building the necessary infrastructure to process claims, to name but a few. c. Public–private partnerships (PPPs) to address the protection gap There is no shortage of (re)insurance capital potentially ...

... customer base (more often than not in distant rural areas), conveying the concept of insurance and building the necessary infrastructure to process claims, to name but a few. c. Public–private partnerships (PPPs) to address the protection gap There is no shortage of (re)insurance capital potentially ...

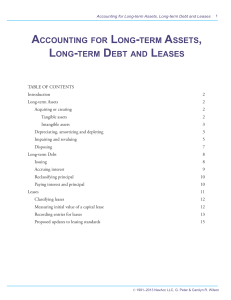

accounting for long-term assets, long

... PP&E. The resulting depreciation entry will be the one you have recorded often in earlier chapters: increase depreciation expense and increase accumulated depreciation. That is, all along we have been depreciating non-production-related assets. Recall our responses to the four questions: 1. Should ...

... PP&E. The resulting depreciation entry will be the one you have recorded often in earlier chapters: increase depreciation expense and increase accumulated depreciation. That is, all along we have been depreciating non-production-related assets. Recall our responses to the four questions: 1. Should ...

Pricing Crude Oil Calendar Spread Options

... significant increase in the demand for energy, in particular due to the spectacular economic growth of Asian economies such as India and China, has increased the prominence of energy trading and thus the number and complexity of transactions in energy markets. These circumstances have attracted mark ...

... significant increase in the demand for energy, in particular due to the spectacular economic growth of Asian economies such as India and China, has increased the prominence of energy trading and thus the number and complexity of transactions in energy markets. These circumstances have attracted mark ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.