Economic and financial impacts of natural disasters: An assessment

... The reported global cost of natural disasters has risen significantly, with a 15-fold increase between the 1950s and 1990s. During the 1990s, major natural catastrophes are reported to have resulted in economic losses averaging an estimated US$66bn per annum (in 2002 prices). Record losses of some U ...

... The reported global cost of natural disasters has risen significantly, with a 15-fold increase between the 1950s and 1990s. During the 1990s, major natural catastrophes are reported to have resulted in economic losses averaging an estimated US$66bn per annum (in 2002 prices). Record losses of some U ...

Form N-CSR Brookfield Mortgage Opportunity Income Fund Inc.

... Investment Risks: Investors in any bond fund should anticipate fluctuations in price. Bond prices and the value of bond funds decline as interest rates rise. Bonds with longer-term maturities generally are more vulnerable to interest rate risk, which is the risk that the issuer will not make interes ...

... Investment Risks: Investors in any bond fund should anticipate fluctuations in price. Bond prices and the value of bond funds decline as interest rates rise. Bonds with longer-term maturities generally are more vulnerable to interest rate risk, which is the risk that the issuer will not make interes ...

Basel III Leverage Ratio Framework and Disclosure Requirements

... sales of collateral when no other source of liquidity is available). ...

... sales of collateral when no other source of liquidity is available). ...

Prospectus SEB Alternative Investment

... an indirect wholly-owned subsidiary of The Bank of New York Mellon Corporation. This company is registered with the Luxembourg Trade and Companies’ Register under Corporate Identity Number B 67654 (the “Administrative Agent” or "Registrar and Transfer Agent"). In its capacity as Administrative Agent ...

... an indirect wholly-owned subsidiary of The Bank of New York Mellon Corporation. This company is registered with the Luxembourg Trade and Companies’ Register under Corporate Identity Number B 67654 (the “Administrative Agent” or "Registrar and Transfer Agent"). In its capacity as Administrative Agent ...

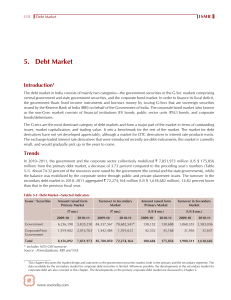

5. Debt Market

... Floating Rate Bonds: Floating rate bonds are securities that do not have a fixed coupon rate. The coupon is re-set at pre-announced intervals (say, every 6 months, or 1 year) by adding a spread over a base rate. In the case of most floating rate bonds issued by the Government of India so far, the base ...

... Floating Rate Bonds: Floating rate bonds are securities that do not have a fixed coupon rate. The coupon is re-set at pre-announced intervals (say, every 6 months, or 1 year) by adding a spread over a base rate. In the case of most floating rate bonds issued by the Government of India so far, the base ...

Market Consistent Embedded Value Report 2015

... The positive development in the shareholders’ economic value of the life in-force business was primarily based on the following factors: ‒ The overall more favorable economic conditions end of 2015 compared to end of 2014, including higher interest rates and lower credit spreads in Europe, as well a ...

... The positive development in the shareholders’ economic value of the life in-force business was primarily based on the following factors: ‒ The overall more favorable economic conditions end of 2015 compared to end of 2014, including higher interest rates and lower credit spreads in Europe, as well a ...

Alternatives jor Debt Management

... such debt in order to forestall a rise in interest costs on an important part of total debt. American experience shows that political pressures to monetize long-term debt can be even stronger - see the ratestructure pegging episode of the late 1940s. 3. Minimum Cost to the Treasury This would probab ...

... such debt in order to forestall a rise in interest costs on an important part of total debt. American experience shows that political pressures to monetize long-term debt can be even stronger - see the ratestructure pegging episode of the late 1940s. 3. Minimum Cost to the Treasury This would probab ...

Transition to IFRS and value relevance in a small but developed

... accounting quality, and any changes to this quality, before and after their adoption. Additionally, IFRS 1 (First-time adoption of International Financial Reporting Standards) requires reconciliation statements explaining how the transition from previous GAAP to IFRS affected companies’ financial st ...

... accounting quality, and any changes to this quality, before and after their adoption. Additionally, IFRS 1 (First-time adoption of International Financial Reporting Standards) requires reconciliation statements explaining how the transition from previous GAAP to IFRS affected companies’ financial st ...

Q2 2016 - PwC India

... Indian private equity did reasonably well in the second quarter of 2016, with overall investments worth 4.3 billion USD across 147 deals. Despite ecommerce/consumer Internet investments slowing down considerably owing to valuation and profitability concerns, the IT & ITeS sector continued its domina ...

... Indian private equity did reasonably well in the second quarter of 2016, with overall investments worth 4.3 billion USD across 147 deals. Despite ecommerce/consumer Internet investments slowing down considerably owing to valuation and profitability concerns, the IT & ITeS sector continued its domina ...

The Timing of Mergers along the Production Chain, Capital Structure

... develop real options models to analyse the terms and timing of takeovers when firms are unlevered. Lambrecht (2004) provides a comprehensive theoretical framework of a procyclical merger that is motivated by economies of scale. He explores horizontal mergers motivated by economies of scale. In cont ...

... develop real options models to analyse the terms and timing of takeovers when firms are unlevered. Lambrecht (2004) provides a comprehensive theoretical framework of a procyclical merger that is motivated by economies of scale. He explores horizontal mergers motivated by economies of scale. In cont ...

पीडीएफ फाइल जो नई विंडों में खुलती है।

... financing such as debentures (long term), preference share capital and equity share capital including reserves and surpluses. Financing the firm’s assets is a very crucial problem in every business and as a rule there should be a proper mix of debt and equity capital in financing the firm’s assets. ...

... financing such as debentures (long term), preference share capital and equity share capital including reserves and surpluses. Financing the firm’s assets is a very crucial problem in every business and as a rule there should be a proper mix of debt and equity capital in financing the firm’s assets. ...

Updating the Discount Rate Used for Benefit-Cost Analysis

... the present. Thus, a project with high initial costs but benefits only accruing in the distant future will look much less attractive when evaluated at a high discount rate than at a low one. Just the opposite is the case when there are significant short term benefits but costs are incurred later. Th ...

... the present. Thus, a project with high initial costs but benefits only accruing in the distant future will look much less attractive when evaluated at a high discount rate than at a low one. Just the opposite is the case when there are significant short term benefits but costs are incurred later. Th ...

Rural Microenterprise Finance Project in Philippines

... Project. The performance of the People’s Credit and Finance Corporation (PCFC) as the Executing Agency was highly satisfactory. The Project exceeded its target for the number of clients and women participants. However, the fundamental objective of reaching the ultra poor was not realized fully. Due ...

... Project. The performance of the People’s Credit and Finance Corporation (PCFC) as the Executing Agency was highly satisfactory. The Project exceeded its target for the number of clients and women participants. However, the fundamental objective of reaching the ultra poor was not realized fully. Due ...

investing for the future

... tackle. These include shortages of social housing and affordable homes; the difficulties that small and medium-sized enterprises (SMEs) face getting funding from commercial banks; regional inequalities in growth; encouraging the transition to a low-carbon economy; backing innovative start-ups; and i ...

... tackle. These include shortages of social housing and affordable homes; the difficulties that small and medium-sized enterprises (SMEs) face getting funding from commercial banks; regional inequalities in growth; encouraging the transition to a low-carbon economy; backing innovative start-ups; and i ...

CITIGROUP`S 2007 ANNUAL REPORT ON FORM 10-K

... As a worldwide business, Citigroup’s financial results are closely tied to the global economic environment. There is a risk of a U.S. and/or global downturn in 2008. A U.S-led economic downturn could negatively impact other markets and economies around the world and could restrict the Company’s grow ...

... As a worldwide business, Citigroup’s financial results are closely tied to the global economic environment. There is a risk of a U.S. and/or global downturn in 2008. A U.S-led economic downturn could negatively impact other markets and economies around the world and could restrict the Company’s grow ...

The Analysis of Formation Mechanism of Regional

... volume and structure are changing constantly, and state-owned commercial banks, non-state-owned commercial banks, and foreign-invested financial institutions also developed fast, and relative financial ratios, the credit support ratio of economic growth in all regions are on the rise. However, the e ...

... volume and structure are changing constantly, and state-owned commercial banks, non-state-owned commercial banks, and foreign-invested financial institutions also developed fast, and relative financial ratios, the credit support ratio of economic growth in all regions are on the rise. However, the e ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.