Not Just One Man - Barings I. How Leeson Broke Barings II. Lessons

... management of derivative activities. Barings collapsed because it could not meet the enormous trading obligations, which Leeson established in the name of the bank. When it went into receivership on February 27, 1995, Barings, via Leeson, had outstanding notional futures positions on Japanese equiti ...

... management of derivative activities. Barings collapsed because it could not meet the enormous trading obligations, which Leeson established in the name of the bank. When it went into receivership on February 27, 1995, Barings, via Leeson, had outstanding notional futures positions on Japanese equiti ...

A Market-led Revolution

... to small businesses and tea framers were simply not absorbing enough of the deposits available for onlending. In 2003, Equity introduced salary-based lending for low-income employees of both government institutions and private sector corporations. Initially Equity had some problems with these loans2 ...

... to small businesses and tea framers were simply not absorbing enough of the deposits available for onlending. In 2003, Equity introduced salary-based lending for low-income employees of both government institutions and private sector corporations. Initially Equity had some problems with these loans2 ...

CH2M HILL COMPANIES LTD (Form: 8-K, Received

... its discretion, as discussed below. By comparison, the year to date diluted weighted average number of shares of common stock as reflected in CH2M’s financial statements is 25,816,819. As discussed below, the Board of Directors has the discretion to review events and exclude nonrecurring or unusual ...

... its discretion, as discussed below. By comparison, the year to date diluted weighted average number of shares of common stock as reflected in CH2M’s financial statements is 25,816,819. As discussed below, the Board of Directors has the discretion to review events and exclude nonrecurring or unusual ...

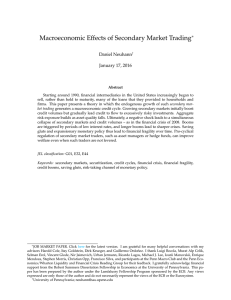

Macroeconomic Effects of Secondary Market

... subject to aggregate risk, there are no gains from trade among symmetric intermediaries – when one intermediary’s risk decreases, another’s increases. Yet Coval, Jurek, and Stafford (2009) show that the financial assets traded on secondary markets typically carry strong exposure to aggregate risk. ...

... subject to aggregate risk, there are no gains from trade among symmetric intermediaries – when one intermediary’s risk decreases, another’s increases. Yet Coval, Jurek, and Stafford (2009) show that the financial assets traded on secondary markets typically carry strong exposure to aggregate risk. ...

Shaping change in insurance - Analysts` conference 2017

... Run-off change of ultimate basic and major losses1 ...

... Run-off change of ultimate basic and major losses1 ...

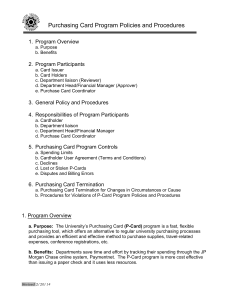

Purchasing Card Program Policies and Procedures

... Notify JP Morgan Chase immediately if the P-Card is lost or stolen (1-800-270-7760). Return the P-Card to the dept. liaison or directly to the Business Office upon terminating employment or transferring to another job. First, see that all outstanding Paymentnet charges are reviewed and reconciled wi ...

... Notify JP Morgan Chase immediately if the P-Card is lost or stolen (1-800-270-7760). Return the P-Card to the dept. liaison or directly to the Business Office upon terminating employment or transferring to another job. First, see that all outstanding Paymentnet charges are reviewed and reconciled wi ...

Pushing further in search of return: The new private equity model

... This requires them to generate more value from the asset to meet their return objectives, which takes longer – holding periods have increased – and demands more investment in efficiency, channel effectiveness and other forms of operational improvement. In this paper, we look at how funding, value ge ...

... This requires them to generate more value from the asset to meet their return objectives, which takes longer – holding periods have increased – and demands more investment in efficiency, channel effectiveness and other forms of operational improvement. In this paper, we look at how funding, value ge ...

public accounts and estimates committee

... These normally include the Treasurer’s speech and volumes on: strategy and outlook; service delivery; capital investment; and the estimated financial statements. The set also includes the annual financial report, published after the end of the budget period. ...

... These normally include the Treasurer’s speech and volumes on: strategy and outlook; service delivery; capital investment; and the estimated financial statements. The set also includes the annual financial report, published after the end of the budget period. ...

Wordly - corporate

... projected to grow 4.3% in 2017, with a majority of the increase allocated to the two largest areas of state general funding expenditures, PreK-12 education and Medicaid. While there is significant variation within individual states, forty-one states have enacted budgets for fiscal 2017 with higher ...

... projected to grow 4.3% in 2017, with a majority of the increase allocated to the two largest areas of state general funding expenditures, PreK-12 education and Medicaid. While there is significant variation within individual states, forty-one states have enacted budgets for fiscal 2017 with higher ...

Q1 Q2 Q3 Q4

... depends on the number of passengers boarding the bus, instead of traditional production contracts with fixed compensation models. At the same time, the clients vary in terms of experience and knowledge in tender processes. An ever increasing percentage of transport is currently being contracted in a ...

... depends on the number of passengers boarding the bus, instead of traditional production contracts with fixed compensation models. At the same time, the clients vary in terms of experience and knowledge in tender processes. An ever increasing percentage of transport is currently being contracted in a ...

Research Institute

... Source: Wood MacKenzie, BP Statistical Review of World Energy, Oxford Economics, ...

... Source: Wood MacKenzie, BP Statistical Review of World Energy, Oxford Economics, ...

Country risk, country risk indices, and valuation of FDI: A real options

... correct and whether the model is correct2. The bond may not be traded every day, so that an estimate for the price must be made. The valuation model on the right hand side of (1) depends on the unobservable recovery fraction N . Depending on the assumption about N , we will get different levels of S ...

... correct and whether the model is correct2. The bond may not be traded every day, so that an estimate for the price must be made. The valuation model on the right hand side of (1) depends on the unobservable recovery fraction N . Depending on the assumption about N , we will get different levels of S ...

re-prioritizing priority sector lending in india

... Directed lending raises costs by way of loan losses, defaults, and payment delays which results in an increase in commercial banks’ NPAs. An NPA is an asset that ceases to generate any income for the lending bank. In directed lending programs, banks wield little power in allocating credit, and must ...

... Directed lending raises costs by way of loan losses, defaults, and payment delays which results in an increase in commercial banks’ NPAs. An NPA is an asset that ceases to generate any income for the lending bank. In directed lending programs, banks wield little power in allocating credit, and must ...

Reserves Impact on Book Value Calculations

... expensed. – Capitalized costs create or increase the value of a property. They are recorded as a long term asset on the balance sheet. – Expensed costs maintain the value or cover the overhead costs of managing the property. They are charged against earnings in the current year. RSC Reserves Confere ...

... expensed. – Capitalized costs create or increase the value of a property. They are recorded as a long term asset on the balance sheet. – Expensed costs maintain the value or cover the overhead costs of managing the property. They are charged against earnings in the current year. RSC Reserves Confere ...

FORM 10-K - Morningstar Document Research

... eligible to file its annual reports pursuant to Section 13 of the 1934 Act on Form 20-F (in lieu of Form 10-K) and to file its interim reports on Form 6-K (in lieu of Forms 10-Q and 8-K). However, the Company elects to file its annual and interim reports on Forms 10-K, 10-Q and 8-K, including any in ...

... eligible to file its annual reports pursuant to Section 13 of the 1934 Act on Form 20-F (in lieu of Form 10-K) and to file its interim reports on Form 6-K (in lieu of Forms 10-Q and 8-K). However, the Company elects to file its annual and interim reports on Forms 10-K, 10-Q and 8-K, including any in ...

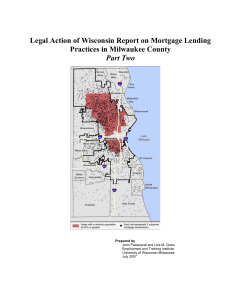

New Trends in Mortgage Fraud - National Crime Prevention Council

... Financial institutions sought to increase profits by adding features to their loans, including adjustable interest rates and prepayment penalties, which increased costs for borrowers. ...

... Financial institutions sought to increase profits by adding features to their loans, including adjustable interest rates and prepayment penalties, which increased costs for borrowers. ...

2016 Annual Report

... of Board members, once again dealt with it effectively through ongoing cost control, refinancing near-term debt into longer maturities, and buying back $1 billion of our outstanding bonds. We are continuing to focus on cost control, and plan to continue deploying part of our operating cash flow to r ...

... of Board members, once again dealt with it effectively through ongoing cost control, refinancing near-term debt into longer maturities, and buying back $1 billion of our outstanding bonds. We are continuing to focus on cost control, and plan to continue deploying part of our operating cash flow to r ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.