Macro2003 Free Response

... As U.S. interest rates go down relative to other countries’ interest rates, U.S. citizens would “save money” in other countries, thus increasing the supply of dollars in the foreign exchange market causing ...

... As U.S. interest rates go down relative to other countries’ interest rates, U.S. citizens would “save money” in other countries, thus increasing the supply of dollars in the foreign exchange market causing ...

Review Questions Chapter 16

... price level next year if the Fed keeps the money supply constant? c. What money supply should the Fed set next year if it wants to keep the price level stable? d. What money supply should the Fed set next year if it wants inflation of ...

... price level next year if the Fed keeps the money supply constant? c. What money supply should the Fed set next year if it wants to keep the price level stable? d. What money supply should the Fed set next year if it wants inflation of ...

Euro Region Debt Crisis and Exchange Rate Dynamics in EU Accession Countries

... The purpose of our analysis is to estimate a simple reduced form real exchange rate model to highlight the relationship between the real exchange rates, long-run fundamentals, and short- run monetary variables, with a special emphasis on the impact of government budget deficits. The theoretical fram ...

... The purpose of our analysis is to estimate a simple reduced form real exchange rate model to highlight the relationship between the real exchange rates, long-run fundamentals, and short- run monetary variables, with a special emphasis on the impact of government budget deficits. The theoretical fram ...

Tenge Real Effective Exchange Rate Index (REER)

... The selection of the partner countries is made annually on the basis of the data of the Committee on Statistics of the Ministry of National Economy of the Republic of Kazakhstan. The calculation uses the data of exports and imports for 3 years. The main trading partners are countries, the share of ...

... The selection of the partner countries is made annually on the basis of the data of the Committee on Statistics of the Ministry of National Economy of the Republic of Kazakhstan. The calculation uses the data of exports and imports for 3 years. The main trading partners are countries, the share of ...

International Monetary System

... • These fixed rates against the ECU determined a fixed cross rates between all 12 currencies • Each cross rate was allowed to fluctuate within a band of 2.25% around the central rate Lessons learnt from EMS: • Differences in countries macroeconomic policies can put severe pressure on the central rat ...

... • These fixed rates against the ECU determined a fixed cross rates between all 12 currencies • Each cross rate was allowed to fluctuate within a band of 2.25% around the central rate Lessons learnt from EMS: • Differences in countries macroeconomic policies can put severe pressure on the central rat ...

PDF Download

... area countries’ effective exchange rates; from January 1999, based on weighted averages of bilateral euro exchange rates. Weights are based on 1990 manufactured goods trade with the trading partners United States, Japan, Switzerland, United Kingdom, Sweden, Denmark, Greece, Norway, Canada, Australia ...

... area countries’ effective exchange rates; from January 1999, based on weighted averages of bilateral euro exchange rates. Weights are based on 1990 manufactured goods trade with the trading partners United States, Japan, Switzerland, United Kingdom, Sweden, Denmark, Greece, Norway, Canada, Australia ...

The Open Economy Terminology

... The assumption that financial investors will hold only the bonds with the highest expected rate of return is obviously too strong, for two reasons: ...

... The assumption that financial investors will hold only the bonds with the highest expected rate of return is obviously too strong, for two reasons: ...

single global currency

... the risks of fluctuations in currency values. A substantial part of the trading is not driven by exports or imports of goods or services, but by speculators gambling on the future values of currencies. The transaction costs of these daily trades are as high as hundreds of billions of dollars a year. ...

... the risks of fluctuations in currency values. A substantial part of the trading is not driven by exports or imports of goods or services, but by speculators gambling on the future values of currencies. The transaction costs of these daily trades are as high as hundreds of billions of dollars a year. ...

7.1

... Barter is an exchange of goods or services without the use of money. Barter expresses value and is a medium of exchange. Barter is difficult to tax. Barter usually takes place domestically. ...

... Barter is an exchange of goods or services without the use of money. Barter expresses value and is a medium of exchange. Barter is difficult to tax. Barter usually takes place domestically. ...

Lecture 3: Int`l Finance

... currency to another • Foreign exchange is the currency of another country that is needed to carry out international transactions • The market where currencies are exchanged is called the foreign exchange market, or FOREX market ...

... currency to another • Foreign exchange is the currency of another country that is needed to carry out international transactions • The market where currencies are exchanged is called the foreign exchange market, or FOREX market ...

ECN 104 sec003 Notes Foreign Exchange Market –A market in

... Foreign Exchange Market –A market in which the money (currency) of one nation can be used to purchase (can be exchanged for) the money of another nation. Why do we need a foreign exchange market? As we discussed before, Polish currency will not buy goods or services in downtown Toronto. If you want ...

... Foreign Exchange Market –A market in which the money (currency) of one nation can be used to purchase (can be exchanged for) the money of another nation. Why do we need a foreign exchange market? As we discussed before, Polish currency will not buy goods or services in downtown Toronto. If you want ...

Set 4 The foreign exchange market

... Question 4. In reality there is a small spread between bid and ask rates. Suppose that the exchange rates between euro, U.S. dollar and the yen are given in the table below. Explore the possibility of three-point arbitrage between these currencies once you have $1,000,000. ...

... Question 4. In reality there is a small spread between bid and ask rates. Suppose that the exchange rates between euro, U.S. dollar and the yen are given in the table below. Explore the possibility of three-point arbitrage between these currencies once you have $1,000,000. ...

The main qualities of an orthodox currency board are

... rate like a central bank. The peg with the foreign currency tends to keep interest rates and inflation very closely aligned to those in the country against whose currency the peg is fixed. ...

... rate like a central bank. The peg with the foreign currency tends to keep interest rates and inflation very closely aligned to those in the country against whose currency the peg is fixed. ...

Forecasting Exchange Rates

... relative prices levels between countries. – Countries with relatively high rates of inflation will show currency depreciation – Countries with relatively low rates of inflation will experience currency appreciation ...

... relative prices levels between countries. – Countries with relatively high rates of inflation will show currency depreciation – Countries with relatively low rates of inflation will experience currency appreciation ...

CHAPTER 14 FIGURES

... Source: U.S. Bureau of Economic Analysis, U.S. International Transactions Accounts Data, table 1, with rearrangements and simplifications by authors. *Also includes the net value of financial derivatives (financial instruments whose values are linkedto an underlying asset, interest rate, or index, s ...

... Source: U.S. Bureau of Economic Analysis, U.S. International Transactions Accounts Data, table 1, with rearrangements and simplifications by authors. *Also includes the net value of financial derivatives (financial instruments whose values are linkedto an underlying asset, interest rate, or index, s ...

National Currency of the Republic of Belarus

... After the presidential election in 1994 the government established a programme, the main purpose of which was to reduce the inflation and create the conditions for future economic growth in the country mainly with a help of fixed exchange rate. Government interventions in the functioning of financia ...

... After the presidential election in 1994 the government established a programme, the main purpose of which was to reduce the inflation and create the conditions for future economic growth in the country mainly with a help of fixed exchange rate. Government interventions in the functioning of financia ...

Temas Públicos

... productive inputs would be mobilized from one sector to another. Given that the exports basket is quite diverse, tradable sectors of natural resources are not affected the same way those that are more intense in the use of labour force. ...

... productive inputs would be mobilized from one sector to another. Given that the exports basket is quite diverse, tradable sectors of natural resources are not affected the same way those that are more intense in the use of labour force. ...

Monetary Policy - Economics of Agricultural Development

... Exchange rates in developing countries often set by government and “pegged” to currency of a major developed country ...

... Exchange rates in developing countries often set by government and “pegged” to currency of a major developed country ...

Economics focus

... (they fondly hope) faster economic growth. In theory, the question is not if, but when, these countries will join the euro: unlike Britain and Denmark, which are in the EU but not the single currency, they have no Maastricht treaty “optout”. They are supposed to meet the same entry conditions as tho ...

... (they fondly hope) faster economic growth. In theory, the question is not if, but when, these countries will join the euro: unlike Britain and Denmark, which are in the EU but not the single currency, they have no Maastricht treaty “optout”. They are supposed to meet the same entry conditions as tho ...

GCSE Business Studies The External Business Environment Revision

... Problems with Government intervention • Taxes imposed in one country but not another may simply encourage firms to switch production to a country that does not have the tax. • It might be considered “unethical” for developing nations such as China to take costly measures to reduce pollution that ha ...

... Problems with Government intervention • Taxes imposed in one country but not another may simply encourage firms to switch production to a country that does not have the tax. • It might be considered “unethical” for developing nations such as China to take costly measures to reduce pollution that ha ...

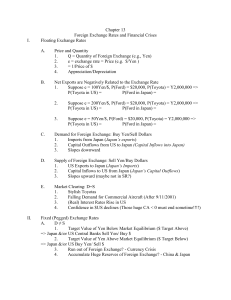

Chapter 13 - Montana State University

... Countries hit with currency/financial crisis (Asia, 1997): IMF c. Generally, if a country uses monetary policy to defend exchange rate, it can’t use it for domestic stabilization Market rates rise with risk of default ...

... Countries hit with currency/financial crisis (Asia, 1997): IMF c. Generally, if a country uses monetary policy to defend exchange rate, it can’t use it for domestic stabilization Market rates rise with risk of default ...

Currency Wars - Western Asset

... political and economic pressures put on governments to raise trade barriers. This is not the time to succumb to these pressures… trade frictions seem to be increasing at a time of continuous economic difficulties. These tensions are reflected… through decisions affecting foreign investment.” (Annual ...

... political and economic pressures put on governments to raise trade barriers. This is not the time to succumb to these pressures… trade frictions seem to be increasing at a time of continuous economic difficulties. These tensions are reflected… through decisions affecting foreign investment.” (Annual ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.