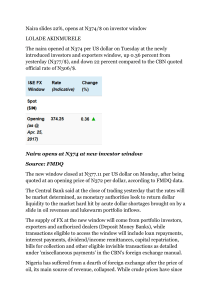

Naira opens at N374 at new investor window Source

... The new window closed at N377.11 per US dollar on Monday, after being quoted at an opening price of N372 per dollar, according to FMDQ data. The Central Bank said at the close of trading yesterday that the rates will be market determined, as monetary authorities look to return dollar liquidity to th ...

... The new window closed at N377.11 per US dollar on Monday, after being quoted at an opening price of N372 per dollar, according to FMDQ data. The Central Bank said at the close of trading yesterday that the rates will be market determined, as monetary authorities look to return dollar liquidity to th ...

Peru_en.pdf

... measures to rein in fiscal spending, including a cap on 2010 spending growth set at 3% of the 2009 nominal expenditure total, a curb on implementation of public investment projects and limitations on the use of funds from the contingency reserve. Despite all this, fiscal policy maintained an expansi ...

... measures to rein in fiscal spending, including a cap on 2010 spending growth set at 3% of the 2009 nominal expenditure total, a curb on implementation of public investment projects and limitations on the use of funds from the contingency reserve. Despite all this, fiscal policy maintained an expansi ...

Long-Run Determinants of Exchange Rate Regimes: A Simple

... purchasing power parity, from the World Bank’s World Development Indicator (WDI) ...

... purchasing power parity, from the World Bank’s World Development Indicator (WDI) ...

exchange rate

... currency (interventions) on the foreign exchange market in return for the currency to which it is pegged (more vulnerable) In order to maintain the rate, the central bank must keep a high level of foreign reserves. This is a reserved amount of foreign currency held by the central bank that it can us ...

... currency (interventions) on the foreign exchange market in return for the currency to which it is pegged (more vulnerable) In order to maintain the rate, the central bank must keep a high level of foreign reserves. This is a reserved amount of foreign currency held by the central bank that it can us ...

FIN MRKTS 1 NO VEMBER 2012 SOL UTIONS FINAL CO PY

... trying to earn unusually high returns on their funds but rather they use the money market as an interim investment that provides a higher return than holding cash at bank. They feel that market conditions are not right to warrant the purchase of additional stock, or they may expect interest rates to ...

... trying to earn unusually high returns on their funds but rather they use the money market as an interim investment that provides a higher return than holding cash at bank. They feel that market conditions are not right to warrant the purchase of additional stock, or they may expect interest rates to ...

Open-Economy Macroeconomics

... rates. Purchasing-power parity is a theory of exchange rates whereby a unit of any given currency should be able to buy the same quantity of goods in all countries. According to the purchasing-power parity theory, a unit of any given currency should be able to buy the same quantity of goods in a ...

... rates. Purchasing-power parity is a theory of exchange rates whereby a unit of any given currency should be able to buy the same quantity of goods in all countries. According to the purchasing-power parity theory, a unit of any given currency should be able to buy the same quantity of goods in a ...

Due Date: Thursday, September 8th (at the beginning of class)

... economy under fixed exchange rates will have no effect on real income. A monetary contraction shifts the LM* curve to the left, putting downward pressure on the exchange rate. However, the central bank is committed to the original rate – people will then sell the central bank foreign currency and bu ...

... economy under fixed exchange rates will have no effect on real income. A monetary contraction shifts the LM* curve to the left, putting downward pressure on the exchange rate. However, the central bank is committed to the original rate – people will then sell the central bank foreign currency and bu ...

The European Union (EU) - Lisa Williams Social Studies

... members of the EU have by sharing the same currency? ...

... members of the EU have by sharing the same currency? ...

EC827_B5

... Fixed Exchange Rates = Governments must intervene in exchange markets to maintain a set price (or range of prices) for their currency. E.g. if the $ falls, we buy $ and sell Yen, DM etc. to pull the $ back up. ...

... Fixed Exchange Rates = Governments must intervene in exchange markets to maintain a set price (or range of prices) for their currency. E.g. if the $ falls, we buy $ and sell Yen, DM etc. to pull the $ back up. ...

Practice e answers for final

... from speculative attacks on their currencies. Before the crisis, Korea had its currency (the won) pegged to the U.S. dollar. Except for Malaysia, these countries have since moved to floating exchange rates, and are in the process of recovering from recessions. The price of 100 won fell from $0.11 in ...

... from speculative attacks on their currencies. Before the crisis, Korea had its currency (the won) pegged to the U.S. dollar. Except for Malaysia, these countries have since moved to floating exchange rates, and are in the process of recovering from recessions. The price of 100 won fell from $0.11 in ...

Chapter 16

... U.S. and foreign currencies must be translated to U.S. dollars. Generally, the accounting standards must first be brought into agreement and then the translation into U.S. dollars takes place. The currency of the primary operating environment in which a foreign unit spends and receives cash is refer ...

... U.S. and foreign currencies must be translated to U.S. dollars. Generally, the accounting standards must first be brought into agreement and then the translation into U.S. dollars takes place. The currency of the primary operating environment in which a foreign unit spends and receives cash is refer ...

Tema 15

... • growth of the prices of the real estates • decline of the interest rates will reduce the deposit yields • savings will be converted from SKK to EURO by conversion exchange rate at the day convergence - savings depreciation ...

... • growth of the prices of the real estates • decline of the interest rates will reduce the deposit yields • savings will be converted from SKK to EURO by conversion exchange rate at the day convergence - savings depreciation ...

Document

... • The official settlements balance, sometimes referred to as the overall balance, is the total balance on the current account plus the balance on all NONOFFICIAL reserve transactions. • It must be exactly offset by the balance on official reserves transactions ...

... • The official settlements balance, sometimes referred to as the overall balance, is the total balance on the current account plus the balance on all NONOFFICIAL reserve transactions. • It must be exactly offset by the balance on official reserves transactions ...

PowerPoint presentation

... in terms of another (1 dollar = 30 roubles , 1 dollar = 0.85 euros) The currency appreciates when the number of units of foreign currency required to purchase it increases (1 dollar = 36 roubles would be an example of a 20% appreciation in the value of the dollar). Depreciation is just the opposite ...

... in terms of another (1 dollar = 30 roubles , 1 dollar = 0.85 euros) The currency appreciates when the number of units of foreign currency required to purchase it increases (1 dollar = 36 roubles would be an example of a 20% appreciation in the value of the dollar). Depreciation is just the opposite ...

chapter 2 international monetary system

... by Prime Minister Tony Blair appears to be in favor of joining the euro club, it is not clear at the moment if that will actually happen. The opposition Tory party is not in favor of adopting the euro and thus giving up monetary sovereignty of the country. The public opinion is also divided on the i ...

... by Prime Minister Tony Blair appears to be in favor of joining the euro club, it is not clear at the moment if that will actually happen. The opposition Tory party is not in favor of adopting the euro and thus giving up monetary sovereignty of the country. The public opinion is also divided on the i ...

LCQ19: Linked Exchange Rate (7

... currency collapse. It provides Hong Kong with a firm monetary anchor which, among other things, reduces the foreign exchange risk faced by importers, exporters and international investors. The disadvantages of the Link are that it ties Hong Kong to US monetary policy at times when the economic cycle ...

... currency collapse. It provides Hong Kong with a firm monetary anchor which, among other things, reduces the foreign exchange risk faced by importers, exporters and international investors. The disadvantages of the Link are that it ties Hong Kong to US monetary policy at times when the economic cycle ...

The Open Economy: International Trade and Finance

... • Balance of payments on goods and services plus net international transfer payments and factor income ...

... • Balance of payments on goods and services plus net international transfer payments and factor income ...

ch 20 end of chapter answers

... 9. a. This is an enormous change. In order to bring it about, the Never-Never government would have to run an enormously expansionary monetary policy, reducing the real interest rate possibly to negative amounts and probably generating significant inflation. As far as trade policies are concerned, t ...

... 9. a. This is an enormous change. In order to bring it about, the Never-Never government would have to run an enormously expansionary monetary policy, reducing the real interest rate possibly to negative amounts and probably generating significant inflation. As far as trade policies are concerned, t ...

Syllabus

... This course introduces students to the international aspects of corporate finance. Topics include, but are not limited to, foreign exchange rate systems, balance of payments, international parity conditions, international monetary organizations, currency derivatives, exchange rate risk management, i ...

... This course introduces students to the international aspects of corporate finance. Topics include, but are not limited to, foreign exchange rate systems, balance of payments, international parity conditions, international monetary organizations, currency derivatives, exchange rate risk management, i ...

Exchange Rate Regimes

... However, many critics have been moved to the IMF – 1) High interest rates were not effective in slowing down currency depreciation, but rather worsened the extent of the crisis by leading widespread banking and corporate bankruptcies. – 2) Fiscal policy requirements were unnecessarily and harmfully ...

... However, many critics have been moved to the IMF – 1) High interest rates were not effective in slowing down currency depreciation, but rather worsened the extent of the crisis by leading widespread banking and corporate bankruptcies. – 2) Fiscal policy requirements were unnecessarily and harmfully ...

Homework 3

... a. Calculate, the profit maximizing level of capital when the tax wedge is zero and the level of output that could be produced with that amount of capital. Calculate the level of profit (Hint: The profit is the level of output minus costs. Costs are equal to the product of the cost of capital and th ...

... a. Calculate, the profit maximizing level of capital when the tax wedge is zero and the level of output that could be produced with that amount of capital. Calculate the level of profit (Hint: The profit is the level of output minus costs. Costs are equal to the product of the cost of capital and th ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.