AP Macro 5-3 Foreign Exchange

... A. For all these transactions, there are different national currencies. B. Each country must be paid in their own currency C. The buyer (importer) must exchange their currency for that of the sellers (exporter). ...

... A. For all these transactions, there are different national currencies. B. Each country must be paid in their own currency C. The buyer (importer) must exchange their currency for that of the sellers (exporter). ...

UNCTAD N° 5, December 2008

... As the financial crisis becomes increasingly global, the world economy is caught in a loop of weaknesses and seems headed for a deep and synchronized downturn. Some developing and emerging economies will be particularly affected because of their vulnerability to declining exports, falling commodity ...

... As the financial crisis becomes increasingly global, the world economy is caught in a loop of weaknesses and seems headed for a deep and synchronized downturn. Some developing and emerging economies will be particularly affected because of their vulnerability to declining exports, falling commodity ...

Slide 1

... there were signs of improving business confidence. There had also been signs that the second-quarter decline in consumption would be smaller than the Committee had previously anticipated. ...

... there were signs of improving business confidence. There had also been signs that the second-quarter decline in consumption would be smaller than the Committee had previously anticipated. ...

Venezuela_en.pdf

... The government continued to supply oil to a number of countries within the framework of the Bolivarian Alternative for Latin America and the Caribbean, the Petrocaribe energy cooperation agreement, Petrosur, and bilateral agreements signed with a number of countries. In April 2008, legislation was a ...

... The government continued to supply oil to a number of countries within the framework of the Bolivarian Alternative for Latin America and the Caribbean, the Petrocaribe energy cooperation agreement, Petrosur, and bilateral agreements signed with a number of countries. In April 2008, legislation was a ...

opportunity cost

... – Central banks were allowed to intervene in the exchange rate markets to iron out unwarranted volatilities. Gold was abandoned as an international reserve asset. Non-oil-exporting countries and less-developed countries were given greater access to IMF funds. ...

... – Central banks were allowed to intervene in the exchange rate markets to iron out unwarranted volatilities. Gold was abandoned as an international reserve asset. Non-oil-exporting countries and less-developed countries were given greater access to IMF funds. ...

Exchange Rates and Business Cycles

... effects depend on which effect is stronger (i.e. does a weaker exchange rate sell more goods or does it just increase the cost of goods). ...

... effects depend on which effect is stronger (i.e. does a weaker exchange rate sell more goods or does it just increase the cost of goods). ...

Foreign exchange rate

... • Increase in expected investment returns relative to rest of world. • Increase in U.S. inflation relative to rest of world. • Expected increase in value of $ in future. ...

... • Increase in expected investment returns relative to rest of world. • Increase in U.S. inflation relative to rest of world. • Expected increase in value of $ in future. ...

Balance of Payments

... 2. Mexico buys tractors from Canada 3. Canada sells syrup to the U.S. 4. Japan buys Fireworks from Mexico For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency for that of the sellers (ex ...

... 2. Mexico buys tractors from Canada 3. Canada sells syrup to the U.S. 4. Japan buys Fireworks from Mexico For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency for that of the sellers (ex ...

Low consumption

... The exchange rate is a relative price But relative price of what? Domestic and foreign moneys? Yes, the nominal exchange rate is a monetary phenomenon, but exchange rate regimes are not, they are “real” Exchange rate regimes have real effects ...

... The exchange rate is a relative price But relative price of what? Domestic and foreign moneys? Yes, the nominal exchange rate is a monetary phenomenon, but exchange rate regimes are not, they are “real” Exchange rate regimes have real effects ...

Europe and the Crisis Rainer Kattel Tallinn University of Technology Estonia

... • Lagging productivity due to specialization into low value added production activities – Low domestic linkages – Weak knowledge production ...

... • Lagging productivity due to specialization into low value added production activities – Low domestic linkages – Weak knowledge production ...

International Monetary System

... Flexible exchange rates were declared acceptable to the IMF members. ...

... Flexible exchange rates were declared acceptable to the IMF members. ...

companies step up fx hedging after big moves in

... which can wreak havoc with budget plans and eat into corporate profits, say business is up.” But what does this really mean? In today’s global economy, almost every company is exposed to foreign exchange (FX) rates, be they cash flows from an overseas subsidiary or the impact of exporting sales or i ...

... which can wreak havoc with budget plans and eat into corporate profits, say business is up.” But what does this really mean? In today’s global economy, almost every company is exposed to foreign exchange (FX) rates, be they cash flows from an overseas subsidiary or the impact of exporting sales or i ...

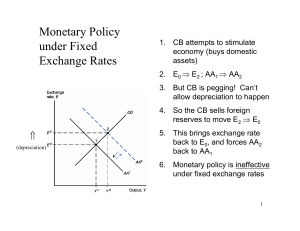

Fixed Exchange Rates and Macroeconomic Policy

... domestic inflation or to try to smooth out the domestic business cycle • The only hope for independent monetary policy is exchange controls to prevent traders buying or selling domestic currency • But exchange controls reduce trade and foreign direct investment, and present opportunities for corrupt ...

... domestic inflation or to try to smooth out the domestic business cycle • The only hope for independent monetary policy is exchange controls to prevent traders buying or selling domestic currency • But exchange controls reduce trade and foreign direct investment, and present opportunities for corrupt ...

BM 2.07 Notes

... supply. It will become less valuable whenever demand is less than available supply (this does not mean people no longer want money, it just means they prefer holding their wealth in some other form, possibly another currency). • A currency will tend to lose value, relative to other currencies, if th ...

... supply. It will become less valuable whenever demand is less than available supply (this does not mean people no longer want money, it just means they prefer holding their wealth in some other form, possibly another currency). • A currency will tend to lose value, relative to other currencies, if th ...

THE SNAKE THAT ATE ITSELF L ONCE THE BREADBASKET OF AFRICA, ZIMBABWE IS

... eventually approaching 100% a day. The Zim dollar had, in effect, become two currencies with, at one point, a ‘cash’ dollar worth 250bn ‘bank’ dollars. International Financial Reporting Standards presuppose some basic conditions including a logical relationship between inflation rates, exchange rate ...

... eventually approaching 100% a day. The Zim dollar had, in effect, become two currencies with, at one point, a ‘cash’ dollar worth 250bn ‘bank’ dollars. International Financial Reporting Standards presuppose some basic conditions including a logical relationship between inflation rates, exchange rate ...

Course # and Course Name

... The history of XRs in the U.S. The different types of XR regimes What the Federal Reserve is What the Euro is How the FX market operates ...

... The history of XRs in the U.S. The different types of XR regimes What the Federal Reserve is What the Euro is How the FX market operates ...

solution

... A rise in the foreign price level leads to a real domestic currency depreciation for a given domestic price level and nominal exchange rate; thus, as shown in the following diagram, the output market curve shifts from DD to DD moving the equilibrium from point 0 to point 1. This shift causes an ap ...

... A rise in the foreign price level leads to a real domestic currency depreciation for a given domestic price level and nominal exchange rate; thus, as shown in the following diagram, the output market curve shifts from DD to DD moving the equilibrium from point 0 to point 1. This shift causes an ap ...

MM 6.03 Slide Show/Notes

... Exchange-rate quotation - exchange rate quotation is given by stating the number of units of a price currency that can be bought in terms of 1 unit currency. For example, in a quotation that says the EUR-USD exchange rate is 1.2 USD per EUR, the price currency is USD and the unit currency is EUR. ht ...

... Exchange-rate quotation - exchange rate quotation is given by stating the number of units of a price currency that can be bought in terms of 1 unit currency. For example, in a quotation that says the EUR-USD exchange rate is 1.2 USD per EUR, the price currency is USD and the unit currency is EUR. ht ...

Industrial countries other than the United States

... Exchange Rate Markets: Brief Introduction • A spot contract is a binding commitment for an exchange of funds, with normal settlement and delivery of bank balances following in two business days (one day in the case of North American currencies). • A forward contract, or outright forward, is an agre ...

... Exchange Rate Markets: Brief Introduction • A spot contract is a binding commitment for an exchange of funds, with normal settlement and delivery of bank balances following in two business days (one day in the case of North American currencies). • A forward contract, or outright forward, is an agre ...

Daniels/VanHoose International Monetary and Financial

... foreign interest rate, R*1 in panel (b), which is determined by IS–LM equilibrium for the foreign nation. This is point A in panel (b), at which the equilibrium level of foreign real income is equal to y*1. ...

... foreign interest rate, R*1 in panel (b), which is determined by IS–LM equilibrium for the foreign nation. This is point A in panel (b), at which the equilibrium level of foreign real income is equal to y*1. ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.