Chapter 7 Power Point Presentation

... Since the collapse of the Bretton Woods system in the early 1970s, debate has never ended on whether fixed or floating exchange rates are better. Fixed exchange rates: 1. Impose monetary discipline be preventing governments from engaging in inflationary monetary policies (printing more money). 2. Re ...

... Since the collapse of the Bretton Woods system in the early 1970s, debate has never ended on whether fixed or floating exchange rates are better. Fixed exchange rates: 1. Impose monetary discipline be preventing governments from engaging in inflationary monetary policies (printing more money). 2. Re ...

EXAMINATION OF THE EFFECTS OF FLUCTUATIONS OF EXCHANGE RATES

... ON WAGES AND EMPLOYMENT IN THE EIGHTEEN DIFFERENT MANUFACTURING INDUSTRIES IN THE UNITED STATES: AN ERROR CORRECTION MODEL APPROACH ...

... ON WAGES AND EMPLOYMENT IN THE EIGHTEEN DIFFERENT MANUFACTURING INDUSTRIES IN THE UNITED STATES: AN ERROR CORRECTION MODEL APPROACH ...

Dollarization

... For example Ecuador's adoption of the US dollar as their own currency. Dollarization does not only occur with the US dollar. Other foreign currencies can be use by other countries for official dollarization. ...

... For example Ecuador's adoption of the US dollar as their own currency. Dollarization does not only occur with the US dollar. Other foreign currencies can be use by other countries for official dollarization. ...

Floating exchange rates

... • In an adjustable peg regime, exchange rates are normally fixed, but countries are occasionally allowed to alter their exchange rate. • Under the Bretton Woods system, each country announced a par value for their currency in terms of US dollars – the dollar standard. ...

... • In an adjustable peg regime, exchange rates are normally fixed, but countries are occasionally allowed to alter their exchange rate. • Under the Bretton Woods system, each country announced a par value for their currency in terms of US dollars – the dollar standard. ...

Foreign Exchange and the International Monetary System

... Sell abroad, and you may receive payment in foreign currency Buy abroad, and you may have to pay in foreign currency Travel abroad, you must spend foreign currency A foreign direct investment will have to pay expenses in foreign currency ...

... Sell abroad, and you may receive payment in foreign currency Buy abroad, and you may have to pay in foreign currency Travel abroad, you must spend foreign currency A foreign direct investment will have to pay expenses in foreign currency ...

The Determination of Exchange Rate

... Equation: A+B = C+D BOP Account must balance Copyright © 2015 Pearson Education, Inc. ...

... Equation: A+B = C+D BOP Account must balance Copyright © 2015 Pearson Education, Inc. ...

Presentation

... (a) Macro-Policy : If real appreciation is required either permanently higher inflation or appreciating exchange rates & price stability. ...

... (a) Macro-Policy : If real appreciation is required either permanently higher inflation or appreciating exchange rates & price stability. ...

MGT 4240: Organizations: Theory and Behavior

... independence from from the government completely insolvent Current ...

... independence from from the government completely insolvent Current ...

Dr. Mitchell - people.vcu.edu

... As international investors become aware that the central bank is running low on foreign exchange, they realize that there is a good chance the country won’t be able to “defend” its current exchange rate. They conclude that the value of the currency is likely to drop. Therefore they begin selling it ...

... As international investors become aware that the central bank is running low on foreign exchange, they realize that there is a good chance the country won’t be able to “defend” its current exchange rate. They conclude that the value of the currency is likely to drop. Therefore they begin selling it ...

Tension and new alliances - the currency wars

... current juncture. Indeed, in the past months, a number of countries have engaged in direct interventions in the foreign exchange markets or adopted some forms of capital controls. Let me offer a few thoughts on these issues. If we look back at the developments in the international monetary system ov ...

... current juncture. Indeed, in the past months, a number of countries have engaged in direct interventions in the foreign exchange markets or adopted some forms of capital controls. Let me offer a few thoughts on these issues. If we look back at the developments in the international monetary system ov ...

InternationalFinanance

... There is a huge market in foreign currency that is worldwide. Daily changes in demand for and supply of each currency are immediately incorporated into the foreign exchange market. ...

... There is a huge market in foreign currency that is worldwide. Daily changes in demand for and supply of each currency are immediately incorporated into the foreign exchange market. ...

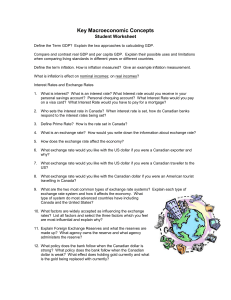

2-1-2 Key Macroeconomic Concepts - Student

... 7. What exchange rate would you like with the US dollar if you were a Canadian traveller to the US? 8. What exchange rate would you like with the Canadian dollar if you were an American tourist travelling in Canada? 9. What are the two most common types of exchange rate systems? Explain each type of ...

... 7. What exchange rate would you like with the US dollar if you were a Canadian traveller to the US? 8. What exchange rate would you like with the Canadian dollar if you were an American tourist travelling in Canada? 9. What are the two most common types of exchange rate systems? Explain each type of ...

International Trade & Finance

... nation’s economy. This is especially true for nations whose exports and imports are a substantial part of their GDPs. Fixed Exchange Rate If the government offers to buy and sell its currencies at a set price, it is imposing a fixed exchange rate. A nation’s reserves are used to alleviate imbalance ...

... nation’s economy. This is especially true for nations whose exports and imports are a substantial part of their GDPs. Fixed Exchange Rate If the government offers to buy and sell its currencies at a set price, it is imposing a fixed exchange rate. A nation’s reserves are used to alleviate imbalance ...

10 THE EXCHANGE RATE AND THE BALANCE OF PAYMENTS**

... Net exports equals the private sector balance (−£19 billion) plus the government sector balance (−£13 billion), or −£32 billion. The U.K. had a net export deficit of £32 billion. The government sector balance plus the private sector balance equals net exports. If the government sector balance change ...

... Net exports equals the private sector balance (−£19 billion) plus the government sector balance (−£13 billion), or −£32 billion. The U.K. had a net export deficit of £32 billion. The government sector balance plus the private sector balance equals net exports. If the government sector balance change ...

Linear Regression 1

... absolutely required in order to have a global economy? – 1. Inexpensive transportation & communication – 2. International financial (money) system – 3. Countries that are willing to participate • Removal of legal or regulatory “barriers” ...

... absolutely required in order to have a global economy? – 1. Inexpensive transportation & communication – 2. International financial (money) system – 3. Countries that are willing to participate • Removal of legal or regulatory “barriers” ...

class12

... PPP exchange rate rises to offset the dollar’s lower purchasing power. The exchange rate may change in nominal terms, but the real value of goods purchased is the same. ...

... PPP exchange rate rises to offset the dollar’s lower purchasing power. The exchange rate may change in nominal terms, but the real value of goods purchased is the same. ...

Sample

... 6) If it used to take $2 to buy a Swiss franc and now it takes $1.50 to buy a Swiss franc, then A) the dollar must have appreciated. B) the franc must have appreciated. C) the fed must have intervened in the exchange markets. D) the value of Swiss francs must have increased. Answer: A 7) An interna ...

... 6) If it used to take $2 to buy a Swiss franc and now it takes $1.50 to buy a Swiss franc, then A) the dollar must have appreciated. B) the franc must have appreciated. C) the fed must have intervened in the exchange markets. D) the value of Swiss francs must have increased. Answer: A 7) An interna ...

Class 7: Economic Globalization

... • Unlike the dollar, the euro or the yen, whose values fluctuate freely, China’s currency is pegged by official policy at about 6.8 yuan to the dollar. At this exchange rate, Chinese manufacturing has a large cost advantage over its rivals, leading to huge trade surpluses. • Under normal circumstanc ...

... • Unlike the dollar, the euro or the yen, whose values fluctuate freely, China’s currency is pegged by official policy at about 6.8 yuan to the dollar. At this exchange rate, Chinese manufacturing has a large cost advantage over its rivals, leading to huge trade surpluses. • Under normal circumstanc ...

Trade and the Exchange Rate

... NZ exchange rate in terms of the $US goes from 0.5 to 1.0. (US$1 originally cost us $2 NZ (1÷0.5), to $1(1÷1.0)). A good that costs US$10 originally cost ...

... NZ exchange rate in terms of the $US goes from 0.5 to 1.0. (US$1 originally cost us $2 NZ (1÷0.5), to $1(1÷1.0)). A good that costs US$10 originally cost ...

Trade and the Exchange Rate

... NZ exchange rate in terms of the $US goes from 0.5 to 1.0. (US$1 originally cost us $2 NZ (1÷0.5), to $1(1÷1.0)). A good that costs US$10 originally cost ...

... NZ exchange rate in terms of the $US goes from 0.5 to 1.0. (US$1 originally cost us $2 NZ (1÷0.5), to $1(1÷1.0)). A good that costs US$10 originally cost ...

Economics considerations for new and existing businesses

... Pushes costs up , particularly buying new machinery If UK inflation is rising faster than other countries business will find it difficult to compete. ...

... Pushes costs up , particularly buying new machinery If UK inflation is rising faster than other countries business will find it difficult to compete. ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.