Exchange Rates Teacher

... • An appreciation of a currency takes place when its value rises against other currencies, whereas a depreciation occurs when a currencies’ value falls against other currencies. ...

... • An appreciation of a currency takes place when its value rises against other currencies, whereas a depreciation occurs when a currencies’ value falls against other currencies. ...

ECON 409 October 31, 2012 International Monetary Order until the 1980s

... into gold at a fixed rate. (35 $ per ounce). If a country faces a serious balance of payment difficulty (i.e. trade deficit) then it is given an option of adjusting its rate at which its currency is pegged to dollar. In other words, if these countries face growing trade deficits, then they can subst ...

... into gold at a fixed rate. (35 $ per ounce). If a country faces a serious balance of payment difficulty (i.e. trade deficit) then it is given an option of adjusting its rate at which its currency is pegged to dollar. In other words, if these countries face growing trade deficits, then they can subst ...

Federal Reserve System Federal Reserve System

... An unsterilized intervention in which domestic currency is sold to purchase foreign assets leads to a gain in international reserves, an increase in the money supply, and a depreciation of the domestic currency ...

... An unsterilized intervention in which domestic currency is sold to purchase foreign assets leads to a gain in international reserves, an increase in the money supply, and a depreciation of the domestic currency ...

US$ Depreciation

... B. How Do Americans Purchase German Goods? 1. Foreign Currency Demand: • derived from the demand for foreign country’s goods, services, and financial assets. ...

... B. How Do Americans Purchase German Goods? 1. Foreign Currency Demand: • derived from the demand for foreign country’s goods, services, and financial assets. ...

Key Concepts: Graphs and Formulas to KNOW: *Production

... 11) current account deficit: Situation that occurs when spending for goods and services that flows out of the country exceeds spending that flows in. 12) current account surplus: Situation that occurs when spending flowing in for the purchase of goods and services exceeds spending that flows out. 13 ...

... 11) current account deficit: Situation that occurs when spending for goods and services that flows out of the country exceeds spending that flows in. 12) current account surplus: Situation that occurs when spending flowing in for the purchase of goods and services exceeds spending that flows out. 13 ...

lecture 5.slides - Lancaster University

... • world’s economies increasingly inter-dependent • steadily increasing world trade - dependent on each other’s demand for exports • vast increase in financial flows due to liberalisation of financial markets - abolition of controls on currency movements - financial markets affect each other (instant ...

... • world’s economies increasingly inter-dependent • steadily increasing world trade - dependent on each other’s demand for exports • vast increase in financial flows due to liberalisation of financial markets - abolition of controls on currency movements - financial markets affect each other (instant ...

File

... a. Using a correctly labeled graph of the loanable funds market, show the effect of the increase in Country A’s budget deficit on the real interest rate. b. Given your answer in (a), what is the effect on business investment in Country A? c. The exchange rate between Country A’s dollar and Country B ...

... a. Using a correctly labeled graph of the loanable funds market, show the effect of the increase in Country A’s budget deficit on the real interest rate. b. Given your answer in (a), what is the effect on business investment in Country A? c. The exchange rate between Country A’s dollar and Country B ...

Fixed Exchange Rate

... To buy or sell foreign currencies (in order to influence the prevailing exchange rate), a government must have foreign exchange reserves. It is not likely to have enough reserves to defend against a massive and sustained attack on the currency. What is an attack on a country’s currency? (Answer: Mas ...

... To buy or sell foreign currencies (in order to influence the prevailing exchange rate), a government must have foreign exchange reserves. It is not likely to have enough reserves to defend against a massive and sustained attack on the currency. What is an attack on a country’s currency? (Answer: Mas ...

international assets advisory, llc (“iaa”) “pure” foreign currency

... you, say, some Euros and put them on deposit in a money market account, right? Unfortunately, no. Generally, to be in the “spot” market you need to be a big corporation or financial institution with huge amounts of capital. That is, until now. Recently, a financial product has come along that allows ...

... you, say, some Euros and put them on deposit in a money market account, right? Unfortunately, no. Generally, to be in the “spot” market you need to be a big corporation or financial institution with huge amounts of capital. That is, until now. Recently, a financial product has come along that allows ...

Unit Four

... Countries, which decides the price and amount of oil produced each year in Iraq, Iran, Saudi Arabia, Kuwait, Venezuela, and other countries. ...

... Countries, which decides the price and amount of oil produced each year in Iraq, Iran, Saudi Arabia, Kuwait, Venezuela, and other countries. ...

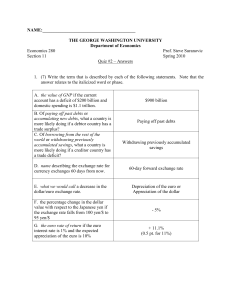

THE GEORGE WASHINGTON UNIVERSITY

... 1. (7) Write the term that is described by each of the following statements. Note that the answer relates to the italicized word or phase. A. the value of GNP if the current account has a deficit of $200 billion and domestic spending is $1.1 trillion. ...

... 1. (7) Write the term that is described by each of the following statements. Note that the answer relates to the italicized word or phase. A. the value of GNP if the current account has a deficit of $200 billion and domestic spending is $1.1 trillion. ...

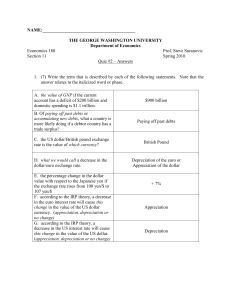

THE GEORGE WASHINGTON UNIVERSITY

... 3. (4) The current dollar/euro exchange rate is 1.35. Suppose you plan to invest $1000 in a simple interest one-year European CD paying an interest rate of 2% per year. A. (3) Calculate the rate of return on this investment if you expect the dollar/euro exchange rate to be 1.25 in one year. Show yo ...

... 3. (4) The current dollar/euro exchange rate is 1.35. Suppose you plan to invest $1000 in a simple interest one-year European CD paying an interest rate of 2% per year. A. (3) Calculate the rate of return on this investment if you expect the dollar/euro exchange rate to be 1.25 in one year. Show yo ...

chapte r 4

... How exchange rates reach equilibrium? 1. Demand for a Currency a. derived from the local buyers who are willing and able to purchase foreign goods but who must convert their local currencies. b. An indirect relationship exists between the cost of foreign currency and amount demanded. c. Graphically, ...

... How exchange rates reach equilibrium? 1. Demand for a Currency a. derived from the local buyers who are willing and able to purchase foreign goods but who must convert their local currencies. b. An indirect relationship exists between the cost of foreign currency and amount demanded. c. Graphically, ...

chapter 29 - exchange rates

... purchasing power parity. Traders would buy Country A’s currency in order to buy its goods for resale in Country B. Country A’s currency will appreciate relative to Country B’s (alternately stated: Country B’s currency will depreciate relative to Country A’s). Since the trade deficit at point B equal ...

... purchasing power parity. Traders would buy Country A’s currency in order to buy its goods for resale in Country B. Country A’s currency will appreciate relative to Country B’s (alternately stated: Country B’s currency will depreciate relative to Country A’s). Since the trade deficit at point B equal ...

AP MACRO UNIT 8 MR. LIPMAN

... 2. Mexico buys tractors from Canada 3. Canada sells syrup to the U.S. For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency for that of the sellers (exporter). ...

... 2. Mexico buys tractors from Canada 3. Canada sells syrup to the U.S. For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency for that of the sellers (exporter). ...

Monetary & Fiscal Policy in a Global Economy

... interest rate in the short run. Expansionary fiscal policy increases interest rates. ...

... interest rate in the short run. Expansionary fiscal policy increases interest rates. ...

The United Kingdom & the EU (the Single Currency)

... other things being equal, be equivalent to a loss of competitiveness among the countries outside. Then, it will lead to : • Higher risk premium on interest rates • Greater exchange rate volatility Lower rates of investment and growth Higher unemployment and strains on government finances. ...

... other things being equal, be equivalent to a loss of competitiveness among the countries outside. Then, it will lead to : • Higher risk premium on interest rates • Greater exchange rate volatility Lower rates of investment and growth Higher unemployment and strains on government finances. ...

Power Point Unit Eight - Long Branch Public Schools

... 2. Mexico buys tractors from Canada 3. Canada sells syrup to the U.S. For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency for that of the sellers (exporter). ...

... 2. Mexico buys tractors from Canada 3. Canada sells syrup to the U.S. For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency for that of the sellers (exporter). ...

Theme 3

... • the exchange rates of three currencies don't match all ratios, and there is a gap between expectation and reality • the process of converting one currency to another, converting it again to a third currency and, finally, converting it back to the original currency within a short ...

... • the exchange rates of three currencies don't match all ratios, and there is a gap between expectation and reality • the process of converting one currency to another, converting it again to a third currency and, finally, converting it back to the original currency within a short ...

forwards

... 1. Currencies: The currencies that have forward contracts available are the Canadian dollar (C$), Japanese yen (¥), Swiss franc (SF), and the UK pound (£). Within each of these currencies, there are 1 month, 3 month, and 6 month forwards available. That is, the currency delivery date is one month (o ...

... 1. Currencies: The currencies that have forward contracts available are the Canadian dollar (C$), Japanese yen (¥), Swiss franc (SF), and the UK pound (£). Within each of these currencies, there are 1 month, 3 month, and 6 month forwards available. That is, the currency delivery date is one month (o ...

Module 5

... million) dollars-worth of foreign exchange is traded globally every day, making forex larger than all bond markets put together. Currency markets exist in the form of spot, forward, futures and options markets. Foreign exchange transactions are made up of: Trade flows Only 5% to 10% of total forex t ...

... million) dollars-worth of foreign exchange is traded globally every day, making forex larger than all bond markets put together. Currency markets exist in the form of spot, forward, futures and options markets. Foreign exchange transactions are made up of: Trade flows Only 5% to 10% of total forex t ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.