Unit 1 Vocabulary - Course

... Circular flow model – an interrelated web of decision making and economic activity involving businesses and households Market – an institution or mechanism that brings together buyers (demanders) and sellers (suppliers) of particular goods, services, or resources Demand – a schedule or a curve that ...

... Circular flow model – an interrelated web of decision making and economic activity involving businesses and households Market – an institution or mechanism that brings together buyers (demanders) and sellers (suppliers) of particular goods, services, or resources Demand – a schedule or a curve that ...

IOSR Journal Of Humanities And Social Science (IOSR-JHSS)

... as to compete with the rest of the world. The policy focused in ensuring efficiency in resource utilization; avoid wastage in economic management, removal of continued misalignment in the foreign and domestic sectors, which led to persistent balance of payment deficit and to channel a path of econom ...

... as to compete with the rest of the world. The policy focused in ensuring efficiency in resource utilization; avoid wastage in economic management, removal of continued misalignment in the foreign and domestic sectors, which led to persistent balance of payment deficit and to channel a path of econom ...

EFFECTS OF EXCHANGE RATE VOLATILITY ON OUTPUTS IN

... has been established by the co-integration tests. Following the Baak (2008) approach, each explanatory variables where regressed at different lag and each lag variable that is found not significant will be omitted from the regression as shown on Table 3. The results suggest for the long-run equilibr ...

... has been established by the co-integration tests. Following the Baak (2008) approach, each explanatory variables where regressed at different lag and each lag variable that is found not significant will be omitted from the regression as shown on Table 3. The results suggest for the long-run equilibr ...

The Macroeconomic Environment

... Income mostly and not interest rates. Money supply affects spending directly: MS – Excess MS - AD - PQ in short run ...

... Income mostly and not interest rates. Money supply affects spending directly: MS – Excess MS - AD - PQ in short run ...

Chapter 13 Exchange Rates, Business Cycles, and Macroeconomic

... According to the “beachhead effect,” in order to undo the effects of a strong-dollar period, the real value of the dollar (a) must fall to at least half of its value before appreciation of the dollar began. (b) must fall to the value it had before appreciation of the dollar began. (c) must fall to a ...

... According to the “beachhead effect,” in order to undo the effects of a strong-dollar period, the real value of the dollar (a) must fall to at least half of its value before appreciation of the dollar began. (b) must fall to the value it had before appreciation of the dollar began. (c) must fall to a ...

NBER WORKING PAPER SERIES FIXED EXCHANGE RATES, INFLATION AND MACROECONOMIC DISCIPLINE Sebastian Edwards

... exchange regime worked relatively well until the mid-1970s. In ct, the evidence provides some support to the view that fixed exchange rates acted for long periods of ...

... exchange regime worked relatively well until the mid-1970s. In ct, the evidence provides some support to the view that fixed exchange rates acted for long periods of ...

Macroeconomics

... there is a lag in recognizing the phase of the business cycle to determine when the government might want to provide help. Second, there is an administrative lag in decision-making that involves deciding which specific policies should be adopted. Third, there is an operational lag because the adopti ...

... there is a lag in recognizing the phase of the business cycle to determine when the government might want to provide help. Second, there is an administrative lag in decision-making that involves deciding which specific policies should be adopted. Third, there is an operational lag because the adopti ...

Key Terms (SSEF1a) A. Economics: is the study of how individuals

... 1. Fixed costs: a cost that does not change, regardless of how much of a good is produced. Ex. rent and salaries 2. Variable costs: are costs that rise or fall depending on how much is produced. Ex. costs of materials, some labor costs. 3. Total cost: equals fixed costs plus variable costs ...

... 1. Fixed costs: a cost that does not change, regardless of how much of a good is produced. Ex. rent and salaries 2. Variable costs: are costs that rise or fall depending on how much is produced. Ex. costs of materials, some labor costs. 3. Total cost: equals fixed costs plus variable costs ...

Economics Summary Packet - Troup County School System

... 1. Fixed costs: a cost that does not change, regardless of how much of a good is produced. Ex. rent and salaries 2. Variable costs: are costs that rise or fall depending on how much is produced. Ex. costs of materials, some labor costs. 3. Total cost: equals fixed costs plus variable costs ...

... 1. Fixed costs: a cost that does not change, regardless of how much of a good is produced. Ex. rent and salaries 2. Variable costs: are costs that rise or fall depending on how much is produced. Ex. costs of materials, some labor costs. 3. Total cost: equals fixed costs plus variable costs ...

lower relative inflation

... • C If a country is more productively efficient it can produce at lower average cost per unit. • C A country with consistently higher productivity will tend to have lower relative inflation. • C As a result it is better placed to sell its goods abroad and reduce its imports. • C Productivity also go ...

... • C If a country is more productively efficient it can produce at lower average cost per unit. • C A country with consistently higher productivity will tend to have lower relative inflation. • C As a result it is better placed to sell its goods abroad and reduce its imports. • C Productivity also go ...

How to calculate purchasing power of income

... Suppose in 1990, in an economy, price of bread was Rs. 2 and quantity produced during the period was 150. While Price of pencils was Rs. 1 and quantity produced was 500 What was the value of GDP in the economy? Suppose in year 1991, same quantity was produced for two goods, but prices due to some re ...

... Suppose in 1990, in an economy, price of bread was Rs. 2 and quantity produced during the period was 150. While Price of pencils was Rs. 1 and quantity produced was 500 What was the value of GDP in the economy? Suppose in year 1991, same quantity was produced for two goods, but prices due to some re ...

The Relationship between Commodities and Pakistani Currency

... currencies. They stated that at the time there was need to fix the exchange rate for world investors to invest in commodities market who ever there were effects of monetary responses to the strong currency could distract attention from reforms to Canadian tax, industrial and regional policies and al ...

... currencies. They stated that at the time there was need to fix the exchange rate for world investors to invest in commodities market who ever there were effects of monetary responses to the strong currency could distract attention from reforms to Canadian tax, industrial and regional policies and al ...

The Realities of Modern Hyperinflation

... Note: t refers to the hyperinflation years (in parentheses). n.a. denotes not available. inflation began. Although deposits 1Nonfinancial public sector or general government. Excludes quasi-fiscal losses. and monetary aggregates do recover after hyperinflation ends, intermediaLingering effects tion ...

... Note: t refers to the hyperinflation years (in parentheses). n.a. denotes not available. inflation began. Although deposits 1Nonfinancial public sector or general government. Excludes quasi-fiscal losses. and monetary aggregates do recover after hyperinflation ends, intermediaLingering effects tion ...

$doc.title

... suppliers must be found to be pricing at “less than fair value” (LTFV). This latter criterion can be determined in either of two ways: (1) by showing that the price charged in the domestic market by the foreign suppliers is below the price charged for the same product in other markets (i.e., the “pr ...

... suppliers must be found to be pricing at “less than fair value” (LTFV). This latter criterion can be determined in either of two ways: (1) by showing that the price charged in the domestic market by the foreign suppliers is below the price charged for the same product in other markets (i.e., the “pr ...

bank of Mau PDF - Bank of Mauritius

... The nominal exchange rate (s t ) used is the indicative Rs/US$ exchange rate because banks in Mauritius first adjust the rupee against the US dollar, taking into account daily movements in the US dollar on the international market and the liquidity situation of the domestic foreign exchange market, ...

... The nominal exchange rate (s t ) used is the indicative Rs/US$ exchange rate because banks in Mauritius first adjust the rupee against the US dollar, taking into account daily movements in the US dollar on the international market and the liquidity situation of the domestic foreign exchange market, ...

7.1 rise in investment demand when saving depends on interest rate

... economy over a period of time. The term "inflation" is also defined as the increases in the money supply (monetary inflation) which causes increases in the price level. Inflation can also be described as a decline in the real value of money i-e a loss of purchasing power in the medium of exchange wh ...

... economy over a period of time. The term "inflation" is also defined as the increases in the money supply (monetary inflation) which causes increases in the price level. Inflation can also be described as a decline in the real value of money i-e a loss of purchasing power in the medium of exchange wh ...

The Stock Exchange Corner

... size and liquidity of the issue. In other markets good quality corporate bonds can have an interest rate about one percent more than a government bond (meaning that if the Government is borrowing at 5%, a good corporate issuer may borrow at 6%) Shares – which represent part ownership of a company – ...

... size and liquidity of the issue. In other markets good quality corporate bonds can have an interest rate about one percent more than a government bond (meaning that if the Government is borrowing at 5%, a good corporate issuer may borrow at 6%) Shares – which represent part ownership of a company – ...

Forecasting - Rajeev Dhawan

... two consecutive quarters of decline in real GDP. How does that relate to the NBER's recession dating procedure? – Most of the recessions identified by our procedures consist of two or more quarters of declining real GDP, but not all of them – We consider the depth as well as the duration of the decl ...

... two consecutive quarters of decline in real GDP. How does that relate to the NBER's recession dating procedure? – Most of the recessions identified by our procedures consist of two or more quarters of declining real GDP, but not all of them – We consider the depth as well as the duration of the decl ...

Chapter 7

... • From 1944 to 1973, central banks throughout the world fixed the value of their currencies relative to the U.S. dollar by buying or selling domestic assets in exchange for dollar denominated assets. • Arbitrage ensured that exchange rates between any two currencies remained fixed. – Suppose Bank of ...

... • From 1944 to 1973, central banks throughout the world fixed the value of their currencies relative to the U.S. dollar by buying or selling domestic assets in exchange for dollar denominated assets. • Arbitrage ensured that exchange rates between any two currencies remained fixed. – Suppose Bank of ...

Chapter 2

... (via Internet etc.) between firms in different countries. Inefficient firms are adversely affected if they have to face tougher competition from foreign firms as a result of a reduction in trade restrictions. 8. Effects of the Euro. Explain how the existence of the euro may affect U.S. international ...

... (via Internet etc.) between firms in different countries. Inefficient firms are adversely affected if they have to face tougher competition from foreign firms as a result of a reduction in trade restrictions. 8. Effects of the Euro. Explain how the existence of the euro may affect U.S. international ...

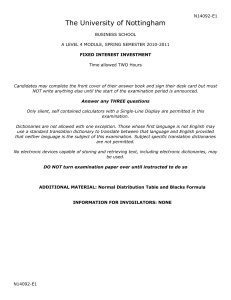

1a)Define redemption yield, spot rate and forward rate

... exchange rate is $0.95 per euro. What will be the swap rate on an agreement to exchange currency over a 3-year period? The swap will call for the exchange of 1 million euros for a given number of dollars in each year [30 marks] ...

... exchange rate is $0.95 per euro. What will be the swap rate on an agreement to exchange currency over a 3-year period? The swap will call for the exchange of 1 million euros for a given number of dollars in each year [30 marks] ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.