Monetary policy operating procedures in Saudi Arabia

... openness of the economy, with the riyal effectively pegged to the US dollar since the suspension of the SDR/riyal link in May 1981. In practice, this has resulted in riyal interest rates closely tracking dollar rates, often with a small premium, since the mid-1980s. It was argued in the past that do ...

... openness of the economy, with the riyal effectively pegged to the US dollar since the suspension of the SDR/riyal link in May 1981. In practice, this has resulted in riyal interest rates closely tracking dollar rates, often with a small premium, since the mid-1980s. It was argued in the past that do ...

Principles of Macroeconomics

... L. Demand for money: money as medium of exchange or means of payment vs. money as an asset;; interest rate as return to not hoarding or as cost of loan; Fed accommodation, Fed intervention, and asymmetric influence of contractionary vs. expansionary monetary policy, historical conditions that have c ...

... L. Demand for money: money as medium of exchange or means of payment vs. money as an asset;; interest rate as return to not hoarding or as cost of loan; Fed accommodation, Fed intervention, and asymmetric influence of contractionary vs. expansionary monetary policy, historical conditions that have c ...

Regional Monetary Arrangements

... forward hedge, because of the huge flow of short-term dollar payments coming due, it is too risky to let the exchange rate move randomly. For most EMCs the IMF advocates more flexible exchange rate regimes or at least advocates to choose an exit strategy if they have adopted an intermediate regime. ...

... forward hedge, because of the huge flow of short-term dollar payments coming due, it is too risky to let the exchange rate move randomly. For most EMCs the IMF advocates more flexible exchange rate regimes or at least advocates to choose an exit strategy if they have adopted an intermediate regime. ...

Final Exam Study Questions

... the level of inflation consistent with output in a recessionary gap. the level of inflation consistent with output in an expansionary gap. a sudden change in the normal behavior of inflation, unrelated to the nation's output gap. a change in the inflation rate generated by excessive aggregate spendi ...

... the level of inflation consistent with output in a recessionary gap. the level of inflation consistent with output in an expansionary gap. a sudden change in the normal behavior of inflation, unrelated to the nation's output gap. a change in the inflation rate generated by excessive aggregate spendi ...

PDF

... value of home goods by 2.6 per cent, compared to 0.6 per cent resulting from a rise in the price of non-agricultural exportables. This was to be expected, as the former are partly consumed in the domestic market while the latter are practically all exported. As part of an industrialisation strategy ...

... value of home goods by 2.6 per cent, compared to 0.6 per cent resulting from a rise in the price of non-agricultural exportables. This was to be expected, as the former are partly consumed in the domestic market while the latter are practically all exported. As part of an industrialisation strategy ...

Exchange rate strategies for small open developed Economics Department, RBNZ

... understanding of exchange rate exposure, they are not in a position to put into place a good hedging strategy. There are also reasons of imperfect competition that might be relevant. Hedging could leave a firm significantly worse off if it prevents them from benefiting from an unexpected but favoura ...

... understanding of exchange rate exposure, they are not in a position to put into place a good hedging strategy. There are also reasons of imperfect competition that might be relevant. Hedging could leave a firm significantly worse off if it prevents them from benefiting from an unexpected but favoura ...

Exchange Rate Policy in Chile

... between the targets set for inflation and the commitment with respect to the nominal exchange rate contemplated in the exchange rate policy (a crawling band adjusted with respect to past inflation). Although the inflation target always prevailed in case of conflict, in 1999 the Board decided finally ...

... between the targets set for inflation and the commitment with respect to the nominal exchange rate contemplated in the exchange rate policy (a crawling band adjusted with respect to past inflation). Although the inflation target always prevailed in case of conflict, in 1999 the Board decided finally ...

Homework 1

... 1.) Mark whether or not and why the following items are included in the calculation of GDP: A. Increases in business inventories B. Sales of existing homes C. The fees earned by real estate agents on selling existing homes D. Income earned by Americans living and working abroad E. Purchases of IBM s ...

... 1.) Mark whether or not and why the following items are included in the calculation of GDP: A. Increases in business inventories B. Sales of existing homes C. The fees earned by real estate agents on selling existing homes D. Income earned by Americans living and working abroad E. Purchases of IBM s ...

Lahore School of Economics

... C. the price of currency relative to another currency D. the currency of another currency used for trading E. the dollars that the United States uses to buy goods from other countries 8. One explanation of why the aggregate demand curve is downward sloping is that A. as prices fall, nominal income r ...

... C. the price of currency relative to another currency D. the currency of another currency used for trading E. the dollars that the United States uses to buy goods from other countries 8. One explanation of why the aggregate demand curve is downward sloping is that A. as prices fall, nominal income r ...

Macro Semester Topics

... 24. The expenditure approach of C + Ig + G + Xn must be memorized. 25. The expenditure approach is equal to AD. 26. The expenditure approach is also equal to GDP. 27. C is the most significant in the US, G has no savings leak, Ig is affected by interest rates (in an inverse way for the domestic mark ...

... 24. The expenditure approach of C + Ig + G + Xn must be memorized. 25. The expenditure approach is equal to AD. 26. The expenditure approach is also equal to GDP. 27. C is the most significant in the US, G has no savings leak, Ig is affected by interest rates (in an inverse way for the domestic mark ...

Three Lectures in Economics by Kenneth Creamer

... Two complications with using GDP to measure economic performance Complication 1: The value of money changes due to inflation (nominal vs real GDP) ...

... Two complications with using GDP to measure economic performance Complication 1: The value of money changes due to inflation (nominal vs real GDP) ...

The Currency Hierarchy and the Center-Periphery - LaI FU

... with the decline of this school of thought. Although structuralism must not be confused with the ISI, this model of development has become commonplace among several of its leading scholars and a reference point for many of its critics (Saad-Filho, 2005). Although the second half of the twentieth cen ...

... with the decline of this school of thought. Although structuralism must not be confused with the ISI, this model of development has become commonplace among several of its leading scholars and a reference point for many of its critics (Saad-Filho, 2005). Although the second half of the twentieth cen ...

202 course paper: 2001

... You can liven up the theoretical aspects of this course by referring to current policy issues. A lot of information is now available on the internet and I would strongly recommend you to get acquainted with two sites which produce some very interesting material for this course. Some of you will alre ...

... You can liven up the theoretical aspects of this course by referring to current policy issues. A lot of information is now available on the internet and I would strongly recommend you to get acquainted with two sites which produce some very interesting material for this course. Some of you will alre ...

Here - Queen`s Economics Department

... Equivalence holds. If they believe that people will perfectly forecast the future tax increase needed to finance the deficit generated today then they will not adjust their consumption decision today. Desired Savings and the current account deficit will remain unchanged. If people to not foresee the ...

... Equivalence holds. If they believe that people will perfectly forecast the future tax increase needed to finance the deficit generated today then they will not adjust their consumption decision today. Desired Savings and the current account deficit will remain unchanged. If people to not foresee the ...

Making Sense Of A New Currency: An Exploration Of Ghanaian

... 7. Confusion about the Value of Money: “I never know how much money to take (out of an ATM), and for a while, it felt as if I did not have enough money on me: you know: it felt light, but then the money that I would put in my wallet seemed small.” The stated difficulties reported by the interviewees ...

... 7. Confusion about the Value of Money: “I never know how much money to take (out of an ATM), and for a while, it felt as if I did not have enough money on me: you know: it felt light, but then the money that I would put in my wallet seemed small.” The stated difficulties reported by the interviewees ...

Emerging Markets Local Currency

... company formed on June 1, 2001 and began managing assets on December 1, 2001. The firm definition was revised February 1, 2016 to better reflect AUIM’s relationship in the broader Aegon Asset Management organization. The Emerging Markets Local Currency composite includes institutional fully discreti ...

... company formed on June 1, 2001 and began managing assets on December 1, 2001. The firm definition was revised February 1, 2016 to better reflect AUIM’s relationship in the broader Aegon Asset Management organization. The Emerging Markets Local Currency composite includes institutional fully discreti ...

ecn211-team-assessment-fall-2011-students

... a. Buy treasury securities, increase discount rate, decrease required reserve ratio b. Sell treasury securities, increase discount rate, increase required reserve ratio c. Buy treasury securities, decrease discount rate, decrease required reserve ratio d. Buy treasury securities, increase discount r ...

... a. Buy treasury securities, increase discount rate, decrease required reserve ratio b. Sell treasury securities, increase discount rate, increase required reserve ratio c. Buy treasury securities, decrease discount rate, decrease required reserve ratio d. Buy treasury securities, increase discount r ...

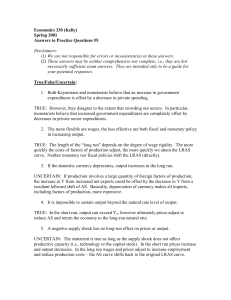

Economics 330 (Kelly)

... 7. Changes in the money supply cause changes in output. UNCERTAIN: First, this depends on your view of money demand. Generally, though, changes in money supply do affect Y. However, the direction of causation in practice is not at all obvious. One can justify that output growth leads money supply gr ...

... 7. Changes in the money supply cause changes in output. UNCERTAIN: First, this depends on your view of money demand. Generally, though, changes in money supply do affect Y. However, the direction of causation in practice is not at all obvious. One can justify that output growth leads money supply gr ...

Antonio J. ALVES, Jr. - Instituto de Economia

... financial budget deficits – and the attempt to maintain a fixed exchange rate, once the government is assumed to use a limited stock of reserves to peg its exchange rate. As this policy reveals to be unsustainable, the attempt of investors to anticipate the inevitable collapse would generate a specu ...

... financial budget deficits – and the attempt to maintain a fixed exchange rate, once the government is assumed to use a limited stock of reserves to peg its exchange rate. As this policy reveals to be unsustainable, the attempt of investors to anticipate the inevitable collapse would generate a specu ...

GLOBAL MARKETING MANAGEMENT by MASAAKI KOTABE

... 3. Fixed Versus Floating Exchange Rates 4. Foreign Exchange and Foreign Exchange Rates 5. Balance of Payments 6. Economic and Financial Turmoil Around the ...

... 3. Fixed Versus Floating Exchange Rates 4. Foreign Exchange and Foreign Exchange Rates 5. Balance of Payments 6. Economic and Financial Turmoil Around the ...

NBER WORKING PAPER SERIES INTERNATIONAL CAPITAL PERSPECTIVES

... relationship between the level of the real exthange rate that clears the balance of payments at a particular point in time and the magnitude of the current account when that real exchange rate is at that same level at some other point in time. ...

... relationship between the level of the real exthange rate that clears the balance of payments at a particular point in time and the magnitude of the current account when that real exchange rate is at that same level at some other point in time. ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.