NBER WORKING PAPER SERIES INTERNATIONAL CAPITAL PERSPECTIVES

... relationship between the level of the real exthange rate that clears the balance of payments at a particular point in time and the magnitude of the current account when that real exchange rate is at that same level at some other point in time. ...

... relationship between the level of the real exthange rate that clears the balance of payments at a particular point in time and the magnitude of the current account when that real exchange rate is at that same level at some other point in time. ...

DISINFLATION PROGRAM FOR THE YEAR 2000: GAZ ERÇEL

... 24.The exchange rate basket has consisted of 1 US Dollar + 0,77 EURO till now. This basket will be valid during this program. 25.Before explaining the depreciation rate of basket, as all of you may be anxious to learn it, I want to mention through which channels the exchange rate policy will affect ...

... 24.The exchange rate basket has consisted of 1 US Dollar + 0,77 EURO till now. This basket will be valid during this program. 25.Before explaining the depreciation rate of basket, as all of you may be anxious to learn it, I want to mention through which channels the exchange rate policy will affect ...

Money in the Economy

... Monetary Policy, Exchange Rates and GDP • Let the Fed decrease short-term interest rates – As interest rates decrease, exchange rates decrease, causing net exports (X - M) and GDP to rise. • GDP = C + I + G + (X - M) – As the value of the dollar decreases, we export more goods and import fewer. ...

... Monetary Policy, Exchange Rates and GDP • Let the Fed decrease short-term interest rates – As interest rates decrease, exchange rates decrease, causing net exports (X - M) and GDP to rise. • GDP = C + I + G + (X - M) – As the value of the dollar decreases, we export more goods and import fewer. ...

Economy (available only in English)

... Income, calculated in national currency, is usually converted to US dollars at official exchange rates for comparisons across economies, although an alternative rate is used when the official exchange rate is judged to diverge by an exceptionally large margin from the rate actually applied in intern ...

... Income, calculated in national currency, is usually converted to US dollars at official exchange rates for comparisons across economies, although an alternative rate is used when the official exchange rate is judged to diverge by an exceptionally large margin from the rate actually applied in intern ...

Going Global Why understanding currency diversification within a

... The term “globalization” has been tossed about in fields from politics to agriculture. But globalization is not just a catchy word; it is a real phenomenon, with significant impact on the world of investing.We believe that the changing global environment demands a different approach to investing to ...

... The term “globalization” has been tossed about in fields from politics to agriculture. But globalization is not just a catchy word; it is a real phenomenon, with significant impact on the world of investing.We believe that the changing global environment demands a different approach to investing to ...

is it time for a common nafta currency?

... Mexican economy relative to that of the U.S. economy. As long as this relative size remained constant, the problems caused by a change in the peso-dollar rate would be small compared to fluctuations experienced in Europe (Eichengreen, 1997). He concluded the economic integration caused by NAFTA woul ...

... Mexican economy relative to that of the U.S. economy. As long as this relative size remained constant, the problems caused by a change in the peso-dollar rate would be small compared to fluctuations experienced in Europe (Eichengreen, 1997). He concluded the economic integration caused by NAFTA woul ...

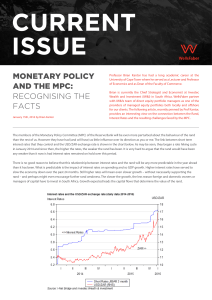

Monetary policy and the Mpc: Recognising the facts

... The sooner the members of the MPC fully recognise these facts of SA economic life, the less likely they are to damage the growth prospects of the economy. The exchange value of the rand and so the inflation rate and the expectation of inflation (that take their cue from the exchange rate, for good ...

... The sooner the members of the MPC fully recognise these facts of SA economic life, the less likely they are to damage the growth prospects of the economy. The exchange value of the rand and so the inflation rate and the expectation of inflation (that take their cue from the exchange rate, for good ...

Uri Dadush Bennett Stancil 9 May 2011, VOX.EU

... lower the costs of debt service; for countries with reserves well in excess of benchmarks, such as China and Malaysia, the cost may be as high as 2% of GDP. 4 Reinhart and Rogoff (2008) find that financial crises, on average, reduce per capita GDP by ...

... lower the costs of debt service; for countries with reserves well in excess of benchmarks, such as China and Malaysia, the cost may be as high as 2% of GDP. 4 Reinhart and Rogoff (2008) find that financial crises, on average, reduce per capita GDP by ...

Currency crises, speculative attacks and financial

... to the fact that people, in the past, expected it would be depreciated at any time and/or because economic agents now expect it will be depreciated in the future. Thus, the logic of a crisis arises from the fact that defending a parity is more expensive (i.e., it requires higher interest rates) if t ...

... to the fact that people, in the past, expected it would be depreciated at any time and/or because economic agents now expect it will be depreciated in the future. Thus, the logic of a crisis arises from the fact that defending a parity is more expensive (i.e., it requires higher interest rates) if t ...

Solutions to Problems

... not fully employed. Unemployment exceeds the natural rate. 9c. Eventually, the real GDP will increase and full employment will be restored. The price level will fall. With unemployment exceeding the natural rate of unemployment, the money wage rate will eventually fall. The SAS curve will shift righ ...

... not fully employed. Unemployment exceeds the natural rate. 9c. Eventually, the real GDP will increase and full employment will be restored. The price level will fall. With unemployment exceeding the natural rate of unemployment, the money wage rate will eventually fall. The SAS curve will shift righ ...

Supporting - System Dynamics Society

... its liquidity level. Reserves, which include currency on the correspondent accounts in National Bank of Ukraine, are the most liquid assets. Bonds can be purchased or sold in the short period. Total loans are the least liquid assets as it takes time for loans to be repaid. Managing their assets bank ...

... its liquidity level. Reserves, which include currency on the correspondent accounts in National Bank of Ukraine, are the most liquid assets. Bonds can be purchased or sold in the short period. Total loans are the least liquid assets as it takes time for loans to be repaid. Managing their assets bank ...

The Asian Financial Crisis 1997-1998 and Malaysian Response: An

... the non-performing loans began the era of banking crisis as banks’ balance sheet had been deteriorated. In international trade, Thailand had become less competitive in the existence of an emerging trader like China together with a constantly increasing trend of dollar currency (i.e. an appreciation ...

... the non-performing loans began the era of banking crisis as banks’ balance sheet had been deteriorated. In international trade, Thailand had become less competitive in the existence of an emerging trader like China together with a constantly increasing trend of dollar currency (i.e. an appreciation ...

5-Open Economy

... 3. dirty float with "sterilization". An expansionary monetary policy will raise the level of income to Y1; now, however, the deficit (ab) will be larger than the case of zero capital immobility (cb) because with lower interest rates there are also outflows of capital. ...

... 3. dirty float with "sterilization". An expansionary monetary policy will raise the level of income to Y1; now, however, the deficit (ab) will be larger than the case of zero capital immobility (cb) because with lower interest rates there are also outflows of capital. ...

Homework 1

... C. The fees earned by real estate agents on selling existing homes D. Income earned by Americans living and working abroad E. Purchases of IBM stock by your brother F. Purchase of a new tank by the Department of Defense G. Rent that you pay to your landlord ...

... C. The fees earned by real estate agents on selling existing homes D. Income earned by Americans living and working abroad E. Purchases of IBM stock by your brother F. Purchase of a new tank by the Department of Defense G. Rent that you pay to your landlord ...

Gold standard tutorial for Econ 105, test #3 Congratulations! You

... is going to do to the money supply. Remember that under a gold standard, the U.S. can’t have any dollars that aren’t backed by gold. Well, if the amount of gold in the U.S. decreases, then the supply of money decreases, which hurts the economy. Think about it this way; what does a decrease in the mo ...

... is going to do to the money supply. Remember that under a gold standard, the U.S. can’t have any dollars that aren’t backed by gold. Well, if the amount of gold in the U.S. decreases, then the supply of money decreases, which hurts the economy. Think about it this way; what does a decrease in the mo ...

EXCHANGE RATE ECONOMICS: 1986 NATIONAL BUREAU OF ECONOMIC RESEARCH Cambridge, MA 02138

... its strong and unambiguous predictions. First, the absence of any effects, dynamic or otherwise, associated with the current account. Second, that home and foreign assets are perfect substitutes. Third, that there are only two classes of assets, money and bonds, and no real assets. We consider now w ...

... its strong and unambiguous predictions. First, the absence of any effects, dynamic or otherwise, associated with the current account. Second, that home and foreign assets are perfect substitutes. Third, that there are only two classes of assets, money and bonds, and no real assets. We consider now w ...

2016 Mexico Individual Attorney Billing Rate Report Brochure

... Brochure More information from http://www.researchandmarkets.com/reports/3627466/ ...

... Brochure More information from http://www.researchandmarkets.com/reports/3627466/ ...

Suggested Solutions for Problem Set #1

... accounting. Your choices are C, I, G, GX (exports), IM (Imports), and NR (not recorded). Give a brief explanation for each answer; one sentence should suffice. a. A family from Sweden, visiting Berkeley, buys jewelry from a vendor on Telegraph Avenue. EX. Export of a good (jewelry) that was produced ...

... accounting. Your choices are C, I, G, GX (exports), IM (Imports), and NR (not recorded). Give a brief explanation for each answer; one sentence should suffice. a. A family from Sweden, visiting Berkeley, buys jewelry from a vendor on Telegraph Avenue. EX. Export of a good (jewelry) that was produced ...

Global monetary and financial disorder

... into that debate before this audience) is wildly inappropriate for China and indeed ...

... into that debate before this audience) is wildly inappropriate for China and indeed ...

Chapter 15: Financial Markets and Expectations

... Operated from about 1880 to the outbreak of the WW I. After the war, there was an attempt to reestablish the gold standard but this failed in 1931. It is also unlikely that it will be reestablished in the future. But it is important to understand its advantages and disadvantages. ...

... Operated from about 1880 to the outbreak of the WW I. After the war, there was an attempt to reestablish the gold standard but this failed in 1931. It is also unlikely that it will be reestablished in the future. But it is important to understand its advantages and disadvantages. ...

CCIWA Student Economic Forum Cartoon Scenarios August 2011

... If the Chinese Reminbi was allowed to float to a market-clearing level (which would be an appreciation relative to the USD), would mean that Chinese exports would become relatively more expensive for US consumers, leading to a decline in US imports. On the flip-side, US exports would become relative ...

... If the Chinese Reminbi was allowed to float to a market-clearing level (which would be an appreciation relative to the USD), would mean that Chinese exports would become relatively more expensive for US consumers, leading to a decline in US imports. On the flip-side, US exports would become relative ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.