AP JEOPARDY!

... ________ account flows describe payments that cross borders to pay for financial assets such as bank accounts, bonds, and stock. ...

... ________ account flows describe payments that cross borders to pay for financial assets such as bank accounts, bonds, and stock. ...

1. Efficiency of the international monetary system means that the

... has depreciated by nearly 50 per cent vis-à-vis the euro in the last years in nominal terms. Such changes of the nominal exchange rate affect the allocation of resources, sectorial structure and imply adjustment costs. Overshooting is due to the fact that the demand for and supply of currencies is n ...

... has depreciated by nearly 50 per cent vis-à-vis the euro in the last years in nominal terms. Such changes of the nominal exchange rate affect the allocation of resources, sectorial structure and imply adjustment costs. Overshooting is due to the fact that the demand for and supply of currencies is n ...

Russia

... Increase in price of imports fueled Russia’s domestic production of everything. Every sector of the economy began to see improvement. By 1999 and 2000 crude oil prices rose just as rapidly as they fell. Giving Russia a needed trade surplus Sales of crude oil went from 0% to 9.8% of the GDP by la ...

... Increase in price of imports fueled Russia’s domestic production of everything. Every sector of the economy began to see improvement. By 1999 and 2000 crude oil prices rose just as rapidly as they fell. Giving Russia a needed trade surplus Sales of crude oil went from 0% to 9.8% of the GDP by la ...

Downlaod File

... ANSWER: The Euro's value changes because of the flow of funds between the countries and USA using the Euro or their currency. The pound's value changes because of the flow of funds between the U.S. and the United Kingdom. As the UK economy is different from the euro economy, economic events will hav ...

... ANSWER: The Euro's value changes because of the flow of funds between the countries and USA using the Euro or their currency. The pound's value changes because of the flow of funds between the U.S. and the United Kingdom. As the UK economy is different from the euro economy, economic events will hav ...

Monetary Policy - Economics of Agricultural Development

... Exchange rates in developed countries determined in international currency markets Exchange rates in developing countries often set by government and “pegged” to currency of a major developed country ...

... Exchange rates in developed countries determined in international currency markets Exchange rates in developing countries often set by government and “pegged” to currency of a major developed country ...

Long-Run Determinants of Exchange Rate Regimes: A Simple

... Share of trade with the Exports to the largest trading partner as a share of largest trading partner total exports, from the IMF’s Direction of Trade ...

... Share of trade with the Exports to the largest trading partner as a share of largest trading partner total exports, from the IMF’s Direction of Trade ...

Homework assignment 7

... 3) If inflation in the United States is at an annual rate of 2% and inflation in Brazil is at 8%, then the PPP theory suggests that in the long run the dollar price of one Brazilian real will: a. Increase at an annual rate of 8% b. Decrease at an annual rate of 6% c. Increase at an annual rate of 6% ...

... 3) If inflation in the United States is at an annual rate of 2% and inflation in Brazil is at 8%, then the PPP theory suggests that in the long run the dollar price of one Brazilian real will: a. Increase at an annual rate of 8% b. Decrease at an annual rate of 6% c. Increase at an annual rate of 6% ...

Fixed Exchange Rate

... influence the prevailing exchange rate), a government must have foreign exchange reserves. It is not likely to have enough reserves to defend against a massive and sustained attack on the currency. What is an attack on a country’s currency? (Answer: Massive “selling off” of a currency expected to be ...

... influence the prevailing exchange rate), a government must have foreign exchange reserves. It is not likely to have enough reserves to defend against a massive and sustained attack on the currency. What is an attack on a country’s currency? (Answer: Massive “selling off” of a currency expected to be ...

Coping with Asia`s Large Capital Inflows in a Multi

... General principle: to attain both policy targets, a country needs to use 2 policy instruments. ...

... General principle: to attain both policy targets, a country needs to use 2 policy instruments. ...

chapter 33 (18)

... exchange traders to determine the long-run exchange rate of the Neverback. This combination approach can be justified only by the “that’s all we have to go on” defense. Since no one really knows what the long-run equilibrium exchange rate is, and since that exchange rate can be significantly influen ...

... exchange traders to determine the long-run exchange rate of the Neverback. This combination approach can be justified only by the “that’s all we have to go on” defense. Since no one really knows what the long-run equilibrium exchange rate is, and since that exchange rate can be significantly influen ...

EXAMINATION OF THE EFFECTS OF FLUCTUATIONS OF EXCHANGE RATES

... ON WAGES AND EMPLOYMENT IN THE EIGHTEEN DIFFERENT MANUFACTURING INDUSTRIES IN THE UNITED STATES: AN ERROR CORRECTION MODEL APPROACH ...

... ON WAGES AND EMPLOYMENT IN THE EIGHTEEN DIFFERENT MANUFACTURING INDUSTRIES IN THE UNITED STATES: AN ERROR CORRECTION MODEL APPROACH ...

fullani_presentation

... Expand the range of collateral: from TBiIls with up to 1 year maturity to securities with days to maturity up to one year; ...

... Expand the range of collateral: from TBiIls with up to 1 year maturity to securities with days to maturity up to one year; ...

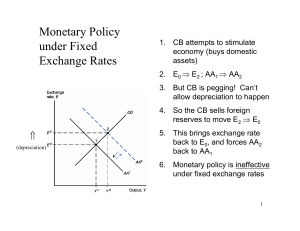

Due Date: Thursday, September 8th (at the beginning of class)

... economy under fixed exchange rates will have no effect on real income. A monetary contraction shifts the LM* curve to the left, putting downward pressure on the exchange rate. However, the central bank is committed to the original rate – people will then sell the central bank foreign currency and bu ...

... economy under fixed exchange rates will have no effect on real income. A monetary contraction shifts the LM* curve to the left, putting downward pressure on the exchange rate. However, the central bank is committed to the original rate – people will then sell the central bank foreign currency and bu ...

April 4/6

... Notice that the first term on the RHS is not affected by changes in E, it is only the second term. Thus a 10% increase in E changes q only by 0.2* 10 = 2%. ...

... Notice that the first term on the RHS is not affected by changes in E, it is only the second term. Thus a 10% increase in E changes q only by 0.2* 10 = 2%. ...

Fixed Exchange Rates and Macroeconomic Policy

... Disadvantages of Fixed Exchange Rates • With a fixed exchange rate you give up on an independent monetary policy • So you cannot use monetary policy to target domestic inflation or to try to smooth out the domestic business cycle • The only hope for independent monetary policy is exchange controls ...

... Disadvantages of Fixed Exchange Rates • With a fixed exchange rate you give up on an independent monetary policy • So you cannot use monetary policy to target domestic inflation or to try to smooth out the domestic business cycle • The only hope for independent monetary policy is exchange controls ...

Open economy macroeconomics

... supply to keep the exchange rate constant. – The interest rate will return to the original value. In the meantime the output will increase and a short-term economic boom will be experienced. ...

... supply to keep the exchange rate constant. – The interest rate will return to the original value. In the meantime the output will increase and a short-term economic boom will be experienced. ...

Chapter 12

... encourage the Monetary Policy Committee to lower the rate of interest. If this happened, it could neutralise the balance of payments effect of the ECB’s interest rate cut. In fact, if rates of interest in the UK fell by the same amount as in the euro-zone, the UK’s balance of trade would probably im ...

... encourage the Monetary Policy Committee to lower the rate of interest. If this happened, it could neutralise the balance of payments effect of the ECB’s interest rate cut. In fact, if rates of interest in the UK fell by the same amount as in the euro-zone, the UK’s balance of trade would probably im ...

Module 5

... instruments either for a commission or on a spread. Brokers are agents working on commission and not principals or agents acting on their own account. In the foreign exchange market brokers tend to act as intermediaries between banks bringing buyers and sellers together for a commission paid by the ...

... instruments either for a commission or on a spread. Brokers are agents working on commission and not principals or agents acting on their own account. In the foreign exchange market brokers tend to act as intermediaries between banks bringing buyers and sellers together for a commission paid by the ...

Singapore`s Exchange Rate

... Since 1981, monetary policy in Singapore has been centred on the management of the exchange rate. The primary objective has been to promote price stability as a sound basis for sustainable economic growth. The exchange rate represents an ideal intermediate target of monetary policy in the context of ...

... Since 1981, monetary policy in Singapore has been centred on the management of the exchange rate. The primary objective has been to promote price stability as a sound basis for sustainable economic growth. The exchange rate represents an ideal intermediate target of monetary policy in the context of ...

Presentation

... Expand the range of collateral: from TBiIls with up to 1 year maturity to securities with days to maturity up to one year; ...

... Expand the range of collateral: from TBiIls with up to 1 year maturity to securities with days to maturity up to one year; ...

2-1-2 Key Macroeconomic Concepts - Student

... 7. What exchange rate would you like with the US dollar if you were a Canadian traveller to the US? 8. What exchange rate would you like with the Canadian dollar if you were an American tourist travelling in Canada? 9. What are the two most common types of exchange rate systems? Explain each type of ...

... 7. What exchange rate would you like with the US dollar if you were a Canadian traveller to the US? 8. What exchange rate would you like with the Canadian dollar if you were an American tourist travelling in Canada? 9. What are the two most common types of exchange rate systems? Explain each type of ...

Рисков профил на Уникредит Булбанк АД за периода 01

... terms of governance, fiscal stance, structural reforms and consistency of their macroeconomic policies. If you take Bulgaria as an example, you will see that for more than 12 years three consecutive governments have followed very consistent and stability oriented fiscal and structural policies. Sinc ...

... terms of governance, fiscal stance, structural reforms and consistency of their macroeconomic policies. If you take Bulgaria as an example, you will see that for more than 12 years three consecutive governments have followed very consistent and stability oriented fiscal and structural policies. Sinc ...

Venezuela_en.pdf

... and whose imports fall within priority categories. Individuals can also participate in these auctions in order to obtain currency for specific needs. However, this mechanism is not meeting the demand for foreign exchange, which is eight times greater than supply. The bolívar remains overvalued, sinc ...

... and whose imports fall within priority categories. Individuals can also participate in these auctions in order to obtain currency for specific needs. However, this mechanism is not meeting the demand for foreign exchange, which is eight times greater than supply. The bolívar remains overvalued, sinc ...