Foreign Exchange Rate Forecasting

... *Uncovered interest arbitrage caused by exceptionally low borrowing interest rates in Japan coupled with high real interest rates in the United States was a problem for much of the 1990s. *Borrowing yen to invest in safe U.S. government ...

... *Uncovered interest arbitrage caused by exceptionally low borrowing interest rates in Japan coupled with high real interest rates in the United States was a problem for much of the 1990s. *Borrowing yen to invest in safe U.S. government ...

3250 Lecture - Monetary Relations

... 1) Central role of US dollar: versus “confidence” – “Triffin Dilemma” – one currency can’t do both System required US to run capital account deficits “Liquidity” ...

... 1) Central role of US dollar: versus “confidence” – “Triffin Dilemma” – one currency can’t do both System required US to run capital account deficits “Liquidity” ...

Brazil`s 1998-1999 BOP Crisis

... 1994-Real is introduced. Was intended to go up against the dollar. It was set up in the way that it could depreciate at controlled rate against the dollar. High interest rates were created and were intended to fight the high inflation by reducing an incentive to hold money. ...

... 1994-Real is introduced. Was intended to go up against the dollar. It was set up in the way that it could depreciate at controlled rate against the dollar. High interest rates were created and were intended to fight the high inflation by reducing an incentive to hold money. ...

Presentation

... tradable services sector is counted as nontradable. Biased against this explanation. Import reforms improperly measured by import unit values: “Higher per capita incomes” not same as increasing share of services. ...

... tradable services sector is counted as nontradable. Biased against this explanation. Import reforms improperly measured by import unit values: “Higher per capita incomes” not same as increasing share of services. ...

Chapter 33: International Finance

... higher, the quantity of U.S. assets demanded will rise, and thus the demand for dollars and the price of dollars will increase. c. Since the market will likely already have responded to the higher expected interest rates, the rise will likely have the same effect as a fall in interest rates. Thus, w ...

... higher, the quantity of U.S. assets demanded will rise, and thus the demand for dollars and the price of dollars will increase. c. Since the market will likely already have responded to the higher expected interest rates, the rise will likely have the same effect as a fall in interest rates. Thus, w ...

Chapter 33: International Finance

... higher, the quantity of U.S. assets demanded will rise, and thus the demand for dollars and the price of dollars will increase. c. Since the market will likely already have responded to the higher expected interest rates, the rise will likely have the same effect as a fall in interest rates. Thus, w ...

... higher, the quantity of U.S. assets demanded will rise, and thus the demand for dollars and the price of dollars will increase. c. Since the market will likely already have responded to the higher expected interest rates, the rise will likely have the same effect as a fall in interest rates. Thus, w ...

AP Macroeconomics Section 8 Practice Test 1. An open economy is

... A. The euro depreciated and the dollar appreciated during this period of time. B. The dollar depreciated and the euro appreciated during this period of time. C. The euro depreciated and there is insufficient information about the dollar's value during this period of time. D. The euro appreciated and ...

... A. The euro depreciated and the dollar appreciated during this period of time. B. The dollar depreciated and the euro appreciated during this period of time. C. The euro depreciated and there is insufficient information about the dollar's value during this period of time. D. The euro appreciated and ...

Mexican Financial Crisis - Department of Biological Sciences

... Peso devaluation Large amounts of credit flow domestic and foreign Liberalization of the then privatized financial sector ...

... Peso devaluation Large amounts of credit flow domestic and foreign Liberalization of the then privatized financial sector ...

Exchange Rate Systems - Optimal Resume at KAPLAN UNIVERSITY

... exchange rate to the US since they are the largest supplier of Baseballs, then it will not need to raise the dollar price to export the baseballs, so their planning for exports can be easily forecasted using a fixed exchange rate since they won’t need to take the additional cost into account. Floati ...

... exchange rate to the US since they are the largest supplier of Baseballs, then it will not need to raise the dollar price to export the baseballs, so their planning for exports can be easily forecasted using a fixed exchange rate since they won’t need to take the additional cost into account. Floati ...

Слайд 1 - English Studies

... PPP is an economic theory and a technique used to determine the relative value of currencies, estimating the amount of adjustment needed on the exchange rate between countries in order for the exchange to be equivalent to (or on par with) each currency's purchasing power. It asks how much money woul ...

... PPP is an economic theory and a technique used to determine the relative value of currencies, estimating the amount of adjustment needed on the exchange rate between countries in order for the exchange to be equivalent to (or on par with) each currency's purchasing power. It asks how much money woul ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... This report indicates the changes in prices of various products. When compared with nation’s exports this report can indicate if nation is making profit or loss on its product and services. Traders usually see this report to judge the strength of the currency when compared to its exports. In selecti ...

... This report indicates the changes in prices of various products. When compared with nation’s exports this report can indicate if nation is making profit or loss on its product and services. Traders usually see this report to judge the strength of the currency when compared to its exports. In selecti ...

Chapter 29

... 6. What is purchasing power parity? Why might exchange rates deviate from purchasing power parity? 7. Suppose the purchasing power parity exchange rate between the dollar and the pound is $1.50 per pound but the actual exchange rate is $2 per pound. Explain how a trader could profit by buying a bask ...

... 6. What is purchasing power parity? Why might exchange rates deviate from purchasing power parity? 7. Suppose the purchasing power parity exchange rate between the dollar and the pound is $1.50 per pound but the actual exchange rate is $2 per pound. Explain how a trader could profit by buying a bask ...

一、 解釋名詞,任選三小題作答

... Using the principles of double--entry bookkeeping, indicate how the following transactions are recorded in the balance of payments. Be sure to indicate whether a particular transaction enters as a credit or debit and identify the particular sub-account in which it is entered. a) An American buys a s ...

... Using the principles of double--entry bookkeeping, indicate how the following transactions are recorded in the balance of payments. Be sure to indicate whether a particular transaction enters as a credit or debit and identify the particular sub-account in which it is entered. a) An American buys a s ...

Financial crisis in Latin America

... A crawling peg type of exchange rate regime was used to bring inflation down gradually, but the system was operated flexibly to avoid extreme real appreciation. The Chilean central bank was made independent of the fiscal authorities in 1990. That action further solidified the commitment not to m ...

... A crawling peg type of exchange rate regime was used to bring inflation down gradually, but the system was operated flexibly to avoid extreme real appreciation. The Chilean central bank was made independent of the fiscal authorities in 1990. That action further solidified the commitment not to m ...

Introduction

... Exchange Rate Responses • Short-run wage stickiness causes the aggregate price level to adjust less completely to changes in aggregate demand than it would otherwise. • This has an important consequence for the response of the exchange rate to policy actions that affect aggregate demand. • Exchange ...

... Exchange Rate Responses • Short-run wage stickiness causes the aggregate price level to adjust less completely to changes in aggregate demand than it would otherwise. • This has an important consequence for the response of the exchange rate to policy actions that affect aggregate demand. • Exchange ...

Chapter 17

... ◦ Corruption and crime became growing problems. ◦ Because of a lack of tax revenue, the government financed ...

... ◦ Corruption and crime became growing problems. ◦ Because of a lack of tax revenue, the government financed ...

New Keynesian Economics

... The demand for money L = kPYe-αi, where P = the domestic price level, Y = real output i = the nominal interest rate, α = the interest elasticity of money demand, and k is a constant = 1/V, V = money velocity The assumption of a constant money velocity is a keystone to monetarism ...

... The demand for money L = kPYe-αi, where P = the domestic price level, Y = real output i = the nominal interest rate, α = the interest elasticity of money demand, and k is a constant = 1/V, V = money velocity The assumption of a constant money velocity is a keystone to monetarism ...

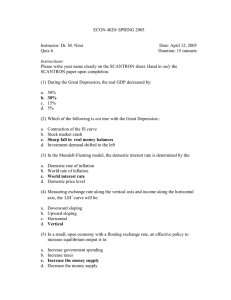

Quiz 6

... (7) Under the fixed-exchange rate system, the central bank of a small open economy must: a. Have a reserve of its own currency, which it must have accumulated in past transactions b. Have a reserve of foreign currency, which it can print c. Allow the money supply to adjust to whatever level will ens ...

... (7) Under the fixed-exchange rate system, the central bank of a small open economy must: a. Have a reserve of its own currency, which it must have accumulated in past transactions b. Have a reserve of foreign currency, which it can print c. Allow the money supply to adjust to whatever level will ens ...

An analysis of Exchange Rate Volatility on Sectoral Turkish Exports

... An analysis of Exchange Rate Volatility on Sectoral Turkish Exports by Panel Quantile Regression ...

... An analysis of Exchange Rate Volatility on Sectoral Turkish Exports by Panel Quantile Regression ...

Kenya and Bolivia: The differences between winners and losers

... to be feared, forcing the authorities to act. This would mean letting the currency fluctuate more or less freely against the greenback. Second scenario: Kenya, a country with a more mature financial market and a better diversified economy (finance, telecommunications, etc.); a country with firm dom ...

... to be feared, forcing the authorities to act. This would mean letting the currency fluctuate more or less freely against the greenback. Second scenario: Kenya, a country with a more mature financial market and a better diversified economy (finance, telecommunications, etc.); a country with firm dom ...

Workshop in economic terms

... • A general rise in the price level. When inflation is present, a dollar today can buy more than a dollar in the future. • Although the causes of inflation are diverse, a frequent source of inflationary pressures is the excess demand for good and services which pulls product prices upward – demand-p ...

... • A general rise in the price level. When inflation is present, a dollar today can buy more than a dollar in the future. • Although the causes of inflation are diverse, a frequent source of inflationary pressures is the excess demand for good and services which pulls product prices upward – demand-p ...

Lecture 7

... Basics: Goods Markets • Trends and U.S. trade deficit - Figure 18.1 • New decision: – whether to buy domestic or foreign goods ...

... Basics: Goods Markets • Trends and U.S. trade deficit - Figure 18.1 • New decision: – whether to buy domestic or foreign goods ...

dl1.cuni.cz

... - through open market operations involving the purchase and sale of U.S. Treasury securities - by setting the Discounte rate - interest rate that banks pay on short-term loans from Fed (cost of credit) - by setting Reserve Requirements - amount of physical funds that depository institutions are requ ...

... - through open market operations involving the purchase and sale of U.S. Treasury securities - by setting the Discounte rate - interest rate that banks pay on short-term loans from Fed (cost of credit) - by setting Reserve Requirements - amount of physical funds that depository institutions are requ ...

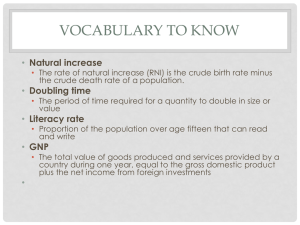

Demography Vocabulary

... • An economic theory that estimates the amount of adjustment needed on the exchange rate between countries in order for the exchange to be equivalent to each currency's purchasing power. ...

... • An economic theory that estimates the amount of adjustment needed on the exchange rate between countries in order for the exchange to be equivalent to each currency's purchasing power. ...