download

... Before the financial statements of a foreign subsidiary can be translated into dollars for consolidation purposes, the financials must be in conformity with US GAAP. True False ...

... Before the financial statements of a foreign subsidiary can be translated into dollars for consolidation purposes, the financials must be in conformity with US GAAP. True False ...

Eco120Int_Lecture13

... • A closed economy is one that does not interact with other economies in the world. – There are no exports, no imports, and no ...

... • A closed economy is one that does not interact with other economies in the world. – There are no exports, no imports, and no ...

Economics considerations for new and existing businesses

... Inflation makes the business appear that it has increased profitability. Firms with large loans benefit from inflation ...

... Inflation makes the business appear that it has increased profitability. Firms with large loans benefit from inflation ...

The Details In The Dollar

... I discuss the potential global impact of this surprise announcement, I feel a brief economics review of currency markets necessary, yet quite boring. Currency investing has always been a fascinating subject to me. I routinely discuss that nondollar denominated assets generally have two return compon ...

... I discuss the potential global impact of this surprise announcement, I feel a brief economics review of currency markets necessary, yet quite boring. Currency investing has always been a fascinating subject to me. I routinely discuss that nondollar denominated assets generally have two return compon ...

Unit 1.12 - Economic Threats

... economy – It could subsidize local businesses to reduce costs of production – Could pursue “supply-side policies” that improve the productive capacity of the economy (investment in health care/education ...

... economy – It could subsidize local businesses to reduce costs of production – Could pursue “supply-side policies” that improve the productive capacity of the economy (investment in health care/education ...

open economy - Department of Economics

... • Exchange rates are the monetary link among countries. • In the open economy, the tail wags the dog (tail = financial flows; dog = trade balance). • US has a chronic trade surplus because people love to put their money here (central banks and investors). • Countries face a trilemma among fixed exch ...

... • Exchange rates are the monetary link among countries. • In the open economy, the tail wags the dog (tail = financial flows; dog = trade balance). • US has a chronic trade surplus because people love to put their money here (central banks and investors). • Countries face a trilemma among fixed exch ...

Slide 1

... These payment flows are measured in a Balance of Payment “BOP”. If the amount of currency flowing into a country is MORE than the currency flowing out than the country has positive BOP If the currency flowing into a country is LESS than the currency flowing out, than the country has negative BOP. A ...

... These payment flows are measured in a Balance of Payment “BOP”. If the amount of currency flowing into a country is MORE than the currency flowing out than the country has positive BOP If the currency flowing into a country is LESS than the currency flowing out, than the country has negative BOP. A ...

Unit Four

... • The Organization of Petroleum Exporting Countries, which decides the price and amount of oil produced each year in Iraq, Iran, Saudi Arabia, Kuwait, Venezuela, and other countries. ...

... • The Organization of Petroleum Exporting Countries, which decides the price and amount of oil produced each year in Iraq, Iran, Saudi Arabia, Kuwait, Venezuela, and other countries. ...

Ch 18 Milton Friedman

... Great Depression was probably caused by a sharp reduction in money supply by the US central bank, the Fed. • In the long run, however, the quantity of money affects the price level alone ...

... Great Depression was probably caused by a sharp reduction in money supply by the US central bank, the Fed. • In the long run, however, the quantity of money affects the price level alone ...

Power Point Unit Eight - Long Branch Public Schools

... - U.S. citizens have more disposable income - Americans import more - Net exports (Xn) decrease The current account balance decreases and moves toward a deficit. 2. If the U.S. dollar depreciates relative to other countries does the BOP move to a deficit or a surplus? - US exports are desirable - Am ...

... - U.S. citizens have more disposable income - Americans import more - Net exports (Xn) decrease The current account balance decreases and moves toward a deficit. 2. If the U.S. dollar depreciates relative to other countries does the BOP move to a deficit or a surplus? - US exports are desirable - Am ...

Unit 1 chapter 7

... • Business strategy may have to adapt to the country remaining outside the common currency. So we could say that in order to avoid the currency costs and risks, the UK businesses that trade extensively in Europe may decide to relocate into a Eurozone country. ...

... • Business strategy may have to adapt to the country remaining outside the common currency. So we could say that in order to avoid the currency costs and risks, the UK businesses that trade extensively in Europe may decide to relocate into a Eurozone country. ...

doc

... c. rise until reaching a plateau, where it is unaffected by further per capita income growth d. first rise, then level off, and finally decline slightly 20. When there are substantial economies of scale in an industry, manufacturing in a small, low-income country can be viable and efficient only if ...

... c. rise until reaching a plateau, where it is unaffected by further per capita income growth d. first rise, then level off, and finally decline slightly 20. When there are substantial economies of scale in an industry, manufacturing in a small, low-income country can be viable and efficient only if ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... Remarkably high real rates have been a feature of stabilization programs in most Latin American countries, and one must ask how financial rates can move so far out of line with any reasonable expectation of the productivity of capital. One cause might be a sharply contractionary monetary policy. But ...

... Remarkably high real rates have been a feature of stabilization programs in most Latin American countries, and one must ask how financial rates can move so far out of line with any reasonable expectation of the productivity of capital. One cause might be a sharply contractionary monetary policy. But ...

Exchange Rate Economics

... An interesting result is that given change in RER may have differential effect on growth if it is an equilibrium phenomenon or a misalignment. Why? Perhaps because of different judgments of the private sector on the permanence of change. RER decrease increases profitability of investing in nontrada ...

... An interesting result is that given change in RER may have differential effect on growth if it is an equilibrium phenomenon or a misalignment. Why? Perhaps because of different judgments of the private sector on the permanence of change. RER decrease increases profitability of investing in nontrada ...

The Determination of Exchange Rate

... established a par value, or benchmark value, for each currency initially quoted in terms of gold and the U.S. dollar The dollar became the world benchmark for trading currencies and continues in that role today Copyright © 2015 Pearson Education, Inc. ...

... established a par value, or benchmark value, for each currency initially quoted in terms of gold and the U.S. dollar The dollar became the world benchmark for trading currencies and continues in that role today Copyright © 2015 Pearson Education, Inc. ...

fixed exchange rates

... However, a fixed exchange rate can’t stay fixed all on its own! Governments/Central Banks have to be ready to intervene maintain its fixed rate. Assume that Azoraxia has ‘pegged’ its currency, the AZO to the US$ at a rate of 1 AZO = 2 US$, with the demand and supply given by D1 and S1 below. As long ...

... However, a fixed exchange rate can’t stay fixed all on its own! Governments/Central Banks have to be ready to intervene maintain its fixed rate. Assume that Azoraxia has ‘pegged’ its currency, the AZO to the US$ at a rate of 1 AZO = 2 US$, with the demand and supply given by D1 and S1 below. As long ...

ECON 4423-001 International Finance

... understanding of recent events and current policy issues. The theory presented in this course covers a broad range of topics including exchange rate determination, monetary and fiscal policy in an open economy, balance of payments crises, the choice of exchange rate systems, and international debt. ...

... understanding of recent events and current policy issues. The theory presented in this course covers a broad range of topics including exchange rate determination, monetary and fiscal policy in an open economy, balance of payments crises, the choice of exchange rate systems, and international debt. ...

Really Fun Worksheet

... exists, and where would you buy and where would you sell? 4. How much profit could you expect on a six-pack? Question 8 If we know the exchange rate between Country A’s currency and Country B’s currency, and we know the exchange rate between Country B’s currency and Country C’s currency, then we can ...

... exists, and where would you buy and where would you sell? 4. How much profit could you expect on a six-pack? Question 8 If we know the exchange rate between Country A’s currency and Country B’s currency, and we know the exchange rate between Country B’s currency and Country C’s currency, then we can ...

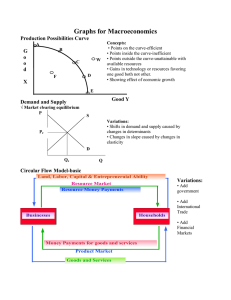

Graphs for Macroeconomics Production Possibilities Curve G o

... Applications: • As new demand and supply factors impact this market, changes in interest rate causes changes in investment and interest rate-driven consumption, which affects AD, ASsr, ASlr PL and Real GDP. • When government financing deficit spending, the impact of borrowing increases the demand cu ...

... Applications: • As new demand and supply factors impact this market, changes in interest rate causes changes in investment and interest rate-driven consumption, which affects AD, ASsr, ASlr PL and Real GDP. • When government financing deficit spending, the impact of borrowing increases the demand cu ...

Chapter 15: Financial Markets and Expectations

... Courtiers must conform to rules regarding exchange rate stability, inflation, interest rates, government budget deficits, and government debt. These are called convergence indicators or convergence criteria. They measure whether the economies follow policies similar-or convergent- enough to ma ...

... Courtiers must conform to rules regarding exchange rate stability, inflation, interest rates, government budget deficits, and government debt. These are called convergence indicators or convergence criteria. They measure whether the economies follow policies similar-or convergent- enough to ma ...

Suriname_en.pdf

... expenditures narrowed owing to restrained public sector spending combined with strong revenues dominated by transfers from the mineral sector, especially oil and gold receipts. The high price for gold will push revenues up to 25.6% of GDP in 2011, while expenditures are expected to be about 27.8% of ...

... expenditures narrowed owing to restrained public sector spending combined with strong revenues dominated by transfers from the mineral sector, especially oil and gold receipts. The high price for gold will push revenues up to 25.6% of GDP in 2011, while expenditures are expected to be about 27.8% of ...

Slide 1

... Activity indicators for Q2, especially the PMI surveys, suggested that the rate of contraction in the global and UK economies had slowed, and there were signs of improving business confidence. There had also been signs that the second-quarter decline in consumption would be smaller than the Committe ...

... Activity indicators for Q2, especially the PMI surveys, suggested that the rate of contraction in the global and UK economies had slowed, and there were signs of improving business confidence. There had also been signs that the second-quarter decline in consumption would be smaller than the Committe ...

Globalization Globalization – Principle and Practice - Rose

... Focus on distribution of gains from economic activity ...

... Focus on distribution of gains from economic activity ...

14.02, Spring 2003 Problem Set 4: Open economy IS-LM

... (b) In an open economy IS-LM model with flexible exchange rates, a cut in taxes always leads to an increase in Y, an appreciation of the exchange rate and an increase in investment. (c) If the IS curve is very flat, an increase in the domestic money supply causes a small depreciation of the exchange ...

... (b) In an open economy IS-LM model with flexible exchange rates, a cut in taxes always leads to an increase in Y, an appreciation of the exchange rate and an increase in investment. (c) If the IS curve is very flat, an increase in the domestic money supply causes a small depreciation of the exchange ...