Daniels/VanHoose International Monetary and Financial

... foreign interest rate, R*1 in panel (b), which is determined by IS–LM equilibrium for the foreign nation. This is point A in panel (b), at which the equilibrium level of foreign real income is equal to y*1. ...

... foreign interest rate, R*1 in panel (b), which is determined by IS–LM equilibrium for the foreign nation. This is point A in panel (b), at which the equilibrium level of foreign real income is equal to y*1. ...

Review Questions Chapter 16

... price level next year if the Fed keeps the money supply constant? c. What money supply should the Fed set next year if it wants to keep the price level stable? d. What money supply should the Fed set next year if it wants inflation of ...

... price level next year if the Fed keeps the money supply constant? c. What money supply should the Fed set next year if it wants to keep the price level stable? d. What money supply should the Fed set next year if it wants inflation of ...

WES Questionnaire (PDF, 25 KB)

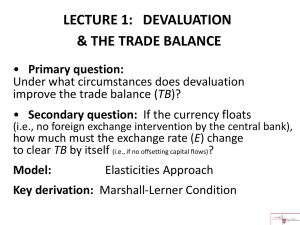

... (a) increasing surplus or decreasing deficit (b) decreasing surplus or increasing deficit ...

... (a) increasing surplus or decreasing deficit (b) decreasing surplus or increasing deficit ...

Interest Rate Spreads and Deviations from Purchasing Power Parity

... There have been a number of tests of PPP in economic literature, both formal and informal. A well known informal test is The Economist magazine's Big Mac Index. This tests whether the cost of McDonald's Big Macs, available in many countries, reflect exchange rates on a PPP basis. With this index, Th ...

... There have been a number of tests of PPP in economic literature, both formal and informal. A well known informal test is The Economist magazine's Big Mac Index. This tests whether the cost of McDonald's Big Macs, available in many countries, reflect exchange rates on a PPP basis. With this index, Th ...

Session 5.3

... 1. External shocks – though the evidence is contradictory – it may have been worse in EA 2. Overborrowing in LA – important but contradictory evidence – significant borrowing occurred in EA too – the key is in the way in which it was managed a. Examples: Korea and Thailand had larger current account ...

... 1. External shocks – though the evidence is contradictory – it may have been worse in EA 2. Overborrowing in LA – important but contradictory evidence – significant borrowing occurred in EA too – the key is in the way in which it was managed a. Examples: Korea and Thailand had larger current account ...

File

... 2) Assume that an increase in government spending increases the budget deficit in Country A. a. Using a correctly labeled graph of the loanable funds market, show the effect of the increase in Country A’s budget deficit on the real interest rate. b. Given your answer in (a), what is the effect on bu ...

... 2) Assume that an increase in government spending increases the budget deficit in Country A. a. Using a correctly labeled graph of the loanable funds market, show the effect of the increase in Country A’s budget deficit on the real interest rate. b. Given your answer in (a), what is the effect on bu ...

Macroeconomic Policy in an Open Economy

... monetary policy – central bank changes money supply and this affects interest rates which in turn affect investment and consumption spending In an open economy, the interest rate changes will affect the demand for currency ...

... monetary policy – central bank changes money supply and this affects interest rates which in turn affect investment and consumption spending In an open economy, the interest rate changes will affect the demand for currency ...

PowerPoint presentation

... that is priced at 300 roubles, then given the exchange rate of 1USD=30R, the US firm receives 10 dollars per unit sold, but what if during the time between shipping the product to Russia and actually selling it and converting the proceeds into dollars the value of the dollar changes to 1USD=40 R, th ...

... that is priced at 300 roubles, then given the exchange rate of 1USD=30R, the US firm receives 10 dollars per unit sold, but what if during the time between shipping the product to Russia and actually selling it and converting the proceeds into dollars the value of the dollar changes to 1USD=40 R, th ...

Simple Rules for Open Economies John B. Taylor Stanford University

... • Very low policy rate in US • Creates pressures on EM central banks to hold rates lower than they would be for domestic price and output stability – Also creates pressures to intervene in currency markets and impose capital controls ...

... • Very low policy rate in US • Creates pressures on EM central banks to hold rates lower than they would be for domestic price and output stability – Also creates pressures to intervene in currency markets and impose capital controls ...

Quiz 8 - International Business courses

... b. A theory that states if the exchange rates of two countries are in equilibrium, a product purchased in one will cost the same in the other, if expressed in the same currency. c. A theory that states if the exchange rates of two countries are not in equilibrium, a product purchased in one will co ...

... b. A theory that states if the exchange rates of two countries are in equilibrium, a product purchased in one will cost the same in the other, if expressed in the same currency. c. A theory that states if the exchange rates of two countries are not in equilibrium, a product purchased in one will co ...

Presentation - International Development Economics Associates

... equilibrium but may suffer from structural misalignment (Edwards) •even under flexible exchange rate regimes, the exchange rate may become misaligned, if its actual value exhibits a sustained departure from that rate which is compatible with the internal and external equilibrium. ...

... equilibrium but may suffer from structural misalignment (Edwards) •even under flexible exchange rate regimes, the exchange rate may become misaligned, if its actual value exhibits a sustained departure from that rate which is compatible with the internal and external equilibrium. ...

International Monetary System

... European Currency Unit (ECU): A basket of 12 currencies with fixed weights • Each of the 12 currencies had a fixed rate against the ECU • These fixed rates against the ECU determined a fixed cross rates between all 12 currencies • Each cross rate was allowed to fluctuate within a band of 2.25% aroun ...

... European Currency Unit (ECU): A basket of 12 currencies with fixed weights • Each of the 12 currencies had a fixed rate against the ECU • These fixed rates against the ECU determined a fixed cross rates between all 12 currencies • Each cross rate was allowed to fluctuate within a band of 2.25% aroun ...

Document

... of the adjustment/anti-inflationary process. • Aggregate fiscal adjustment can help mitigate the real exchange rate appreciation; sterilisation on the other hand complicates both the fiscal and the exchange rate problem. ...

... of the adjustment/anti-inflationary process. • Aggregate fiscal adjustment can help mitigate the real exchange rate appreciation; sterilisation on the other hand complicates both the fiscal and the exchange rate problem. ...

seminsar_Mar10_Bhanupong

... of benefit and long-term strategy Short-term gains divert us from ultimate goals (time inconsistency problem) Policy consistency and commitment are required for stable long-term growth path. Think in relative terms, compare with other countries, not just to our past. ...

... of benefit and long-term strategy Short-term gains divert us from ultimate goals (time inconsistency problem) Policy consistency and commitment are required for stable long-term growth path. Think in relative terms, compare with other countries, not just to our past. ...

Objectives today - Economics of Agricultural Development

... determined in international currency markets Exchange rates in developing countries often set by government and “pegged” to currency of a major developed country ...

... determined in international currency markets Exchange rates in developing countries often set by government and “pegged” to currency of a major developed country ...

This PDF is a selection from a published volume from... Volume Title: NBER International Seminar on Macroeconomics 2008

... almost entirely at the intensive margin, increased trade of existing products. The authors develop a stochastic general equilibrium model, featuring price stickiness and firm entry under uncertainty, to understand this result. Because both regimes tend to provide reliable exchange rate stability ove ...

... almost entirely at the intensive margin, increased trade of existing products. The authors develop a stochastic general equilibrium model, featuring price stickiness and firm entry under uncertainty, to understand this result. Because both regimes tend to provide reliable exchange rate stability ove ...

Background of European Union

... Set the convergence criteria for a country to qualify for participation in EMU ◦ Inflation within 1.5% of the best three of the European Union for at least a year ◦ Long-term interest rates must not be more than 2% points higher than the lowest inflation member states ◦ Being in the narrow band of t ...

... Set the convergence criteria for a country to qualify for participation in EMU ◦ Inflation within 1.5% of the best three of the European Union for at least a year ◦ Long-term interest rates must not be more than 2% points higher than the lowest inflation member states ◦ Being in the narrow band of t ...

PSFU NEWS PRIVATE SECTOR MEETS BANK OF UGANDA TO

... contracts (e.g. SWAPS, Forwards). These would help in planning since through these the exchange rate is fixed with the specific financial institutions. This however maybe taken with caution since the exchange rate may shoot up to the projected fixed rate. d) Trade with countries using their local cu ...

... contracts (e.g. SWAPS, Forwards). These would help in planning since through these the exchange rate is fixed with the specific financial institutions. This however maybe taken with caution since the exchange rate may shoot up to the projected fixed rate. d) Trade with countries using their local cu ...

Tenge Real Effective Exchange Rate Index (REER)

... turnover is at least 0.5%. At the same time, the sample of countries - major trade partners should cover at least 90% of the total turnover. It should be noted that for analytical purposes, the National Bank of the Republic of Kazakhstan calculates indexes of effective exchange rates also on the bas ...

... turnover is at least 0.5%. At the same time, the sample of countries - major trade partners should cover at least 90% of the total turnover. It should be noted that for analytical purposes, the National Bank of the Republic of Kazakhstan calculates indexes of effective exchange rates also on the bas ...

International Finance

... freely, and then “sterilizes” to prevent domestic inflation. Sterilization means that the central bank sells govt bonds to mop up the excess local currency. ...

... freely, and then “sterilizes” to prevent domestic inflation. Sterilization means that the central bank sells govt bonds to mop up the excess local currency. ...

MACROECONOMICS 1. A supply curve slopes upward - FBLA-PBL

... c. an increase in price gives producers an incentive to supply a larger quantity d. as more is produced, total cost of production falls 2. The aggregate demand curve, when plotted against price: a. slopes upwards because all governments subsidize the export of goods and services b. slopes downward b ...

... c. an increase in price gives producers an incentive to supply a larger quantity d. as more is produced, total cost of production falls 2. The aggregate demand curve, when plotted against price: a. slopes upwards because all governments subsidize the export of goods and services b. slopes downward b ...

Nominální efektivní kurz koruny

... the eurozone countries are identified as a single currency area. The number of eurozone countries corresponds to the actual state. In the first variant, the weights relate to the overall trade turnover, whereas in the second variant the weights relate only to the turnover in SITC groups 5–8. The tim ...

... the eurozone countries are identified as a single currency area. The number of eurozone countries corresponds to the actual state. In the first variant, the weights relate to the overall trade turnover, whereas in the second variant the weights relate only to the turnover in SITC groups 5–8. The tim ...