Risks+to+the+Expansion++(White+House+Conf+April+2000).

... Such an inflation scare is not the only risk. • A stock market crash, a sudden drop in confidence, and even an oil price shock could do damage. • But unless there are inflationary pressures forcing interest rates up at the same time, or at least preventing easing by the Fed, these will be enough on ...

... Such an inflation scare is not the only risk. • A stock market crash, a sudden drop in confidence, and even an oil price shock could do damage. • But unless there are inflationary pressures forcing interest rates up at the same time, or at least preventing easing by the Fed, these will be enough on ...

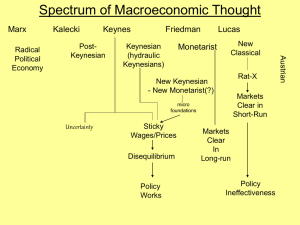

Macro Spectrum

... agents make errors…[A]gents temporarily mistake a general increase in all absolute prices as an increase in the relative price of the good they are selling, leading them to increase their supply of that good…Since everyone is, on average, making the same mistake, aggregate output will rise… • While ...

... agents make errors…[A]gents temporarily mistake a general increase in all absolute prices as an increase in the relative price of the good they are selling, leading them to increase their supply of that good…Since everyone is, on average, making the same mistake, aggregate output will rise… • While ...

Dominican_Republic_en.pdf

... from the resumption of ferronickel mining) and tourism (where the declining number of European tourists was offset by increased tourist arrivals from the United States and South America). Growth in private consumption slowed from 7.2% to 4.4% in the first six months of 2011 owing to a relative deter ...

... from the resumption of ferronickel mining) and tourism (where the declining number of European tourists was offset by increased tourist arrivals from the United States and South America). Growth in private consumption slowed from 7.2% to 4.4% in the first six months of 2011 owing to a relative deter ...

PROBLEM SET 2 14.02 Macroeconomics March 1, 2006 Due March 6, 2006

... I. Answer each as True, False, or Uncertain, and explain your choice. 1. The IS relation is a behavioral relation, telling us how the suppliers of output respond to changes in the interest rate. 2. In an expansionary open market operation, the central bank sells bonds so as to make consumers wealthi ...

... I. Answer each as True, False, or Uncertain, and explain your choice. 1. The IS relation is a behavioral relation, telling us how the suppliers of output respond to changes in the interest rate. 2. In an expansionary open market operation, the central bank sells bonds so as to make consumers wealthi ...

Assignment #1 - Computing Science

... Consider the factorial(n) program of figure 3.5 in the Study Guide. Implement this function and test it on both small and large positive values of ‘n’. Notice how the size of the output grows very quickly as n increases. 2. While loops vs. For loops Figure 3.5 implements the factorial(n) program usi ...

... Consider the factorial(n) program of figure 3.5 in the Study Guide. Implement this function and test it on both small and large positive values of ‘n’. Notice how the size of the output grows very quickly as n increases. 2. While loops vs. For loops Figure 3.5 implements the factorial(n) program usi ...

illinois economics challenge - UIC Center for Economic Education

... B. begin saving because they fear the good times will not last. C. spend money and use credit because they fear that inflation will soon be high. D. spend money and use credit because they are more secure and confident about their economic situation. E. pay-off past debts and avoid new debt. 27. Who ...

... B. begin saving because they fear the good times will not last. C. spend money and use credit because they fear that inflation will soon be high. D. spend money and use credit because they are more secure and confident about their economic situation. E. pay-off past debts and avoid new debt. 27. Who ...

14.02 Principles of Macroeconomics Spring 06 Quiz 3

... of output. Taxes, current and expected, are constant, and equal to government spending. Now suppose that a major technological discovery is made, which leads people and firms to expect a higher natural level for output in the future: Yn0 increases, and so does Y 0e . Assume r0e = rn0 is unchanged, a ...

... of output. Taxes, current and expected, are constant, and equal to government spending. Now suppose that a major technological discovery is made, which leads people and firms to expect a higher natural level for output in the future: Yn0 increases, and so does Y 0e . Assume r0e = rn0 is unchanged, a ...

ppt

... – Regulation Q broke down • Banks were freed to pay market interest rates in 1980 for S&Ls ...

... – Regulation Q broke down • Banks were freed to pay market interest rates in 1980 for S&Ls ...

Jamaica_en.pdf

... services sector is expected to be broad-based. In the crucial hotel and restaurant sector, growth of no more than 2.6% is expected, as arrivals from the United States and Europe, the country’s two largest source markets, declined by 1.5% and 3.7%, respectively, between January and May 2011. Meanwhil ...

... services sector is expected to be broad-based. In the crucial hotel and restaurant sector, growth of no more than 2.6% is expected, as arrivals from the United States and Europe, the country’s two largest source markets, declined by 1.5% and 3.7%, respectively, between January and May 2011. Meanwhil ...

THE SNAKE THAT ATE ITSELF L ONCE THE BREADBASKET OF AFRICA, ZIMBABWE IS

... illusion of infallibility and deny accountability to protect its position of power. Concern remains about what it might do to cling to power. However, it now suffers from a huge economic credibility gap. It absolved itself of any culpability and entirely blamed western sanctions for the economy’s co ...

... illusion of infallibility and deny accountability to protect its position of power. Concern remains about what it might do to cling to power. However, it now suffers from a huge economic credibility gap. It absolved itself of any culpability and entirely blamed western sanctions for the economy’s co ...

Unit 1 chapter 7

... would an increase in interest rates The impact of higher rates will be: • Highly geared business cash flow will be highly effected by high interest rates • Business would most likely borrow less due to high interest rates ...

... would an increase in interest rates The impact of higher rates will be: • Highly geared business cash flow will be highly effected by high interest rates • Business would most likely borrow less due to high interest rates ...

Ch 4:Determining Interest Rates

... • Diversification divides wealth among less than perfectly positively correlated assets to reduce or eliminate idiosyncratic or asset specific or unsystematic risk. Systematic or market risk, common to all assets in an economy, cannot be diversified. • Some economists see the financial crisis as a b ...

... • Diversification divides wealth among less than perfectly positively correlated assets to reduce or eliminate idiosyncratic or asset specific or unsystematic risk. Systematic or market risk, common to all assets in an economy, cannot be diversified. • Some economists see the financial crisis as a b ...

Exam 3 Sample Questions

... 5. The experience of Ireland during the last several decades indicates that high rates of economic growth are unlikely to be achieved and sustained unless a. tariffs and other trade barriers restrain the inflow of goods from low-wage countries. b. sound policies including those supportive of rule of ...

... 5. The experience of Ireland during the last several decades indicates that high rates of economic growth are unlikely to be achieved and sustained unless a. tariffs and other trade barriers restrain the inflow of goods from low-wage countries. b. sound policies including those supportive of rule of ...

g - University of Ottawa

... rate of accumulation now depends on transitional dynamics, which cannot be ignored: short-run events have a qualitative impact on long-run equilibria. It is common to speak of ‘path-dependence’ for such a characteristic. It is possible to show that this kind of model displays hysteresis in the sense ...

... rate of accumulation now depends on transitional dynamics, which cannot be ignored: short-run events have a qualitative impact on long-run equilibria. It is common to speak of ‘path-dependence’ for such a characteristic. It is possible to show that this kind of model displays hysteresis in the sense ...

Classical – Neoclassical Economics

... Prices (and wages) rise Profit expectations Demand for Credit Up Monetary equilibrium requires i = r. Role for Central Bank to manage i. ...

... Prices (and wages) rise Profit expectations Demand for Credit Up Monetary equilibrium requires i = r. Role for Central Bank to manage i. ...

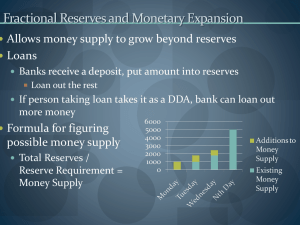

Money and Banking

... Tight Money Policy Restricts growth Increases interest rates Slows economic growth ...

... Tight Money Policy Restricts growth Increases interest rates Slows economic growth ...

Homework 2, Due in class Monday August 27 at 12:10 - uc

... year each year, the money stock grows by 9% per year, and the nominal interest rate is 7%. a. Using the quantity theory of money and the Fisher relation, what should be the inflation rate and the real interest rate in Taiwan? b. Suppose the central bank of Taiwan decides to lower inflation by loweri ...

... year each year, the money stock grows by 9% per year, and the nominal interest rate is 7%. a. Using the quantity theory of money and the Fisher relation, what should be the inflation rate and the real interest rate in Taiwan? b. Suppose the central bank of Taiwan decides to lower inflation by loweri ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.