Basics of Economics - Solon City Schools

... Whose buying habits does the CPI reflect? The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers. The all urban consumer group represents about 87 percent of the total U.S. population. It is based on the expenditures of a ...

... Whose buying habits does the CPI reflect? The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers. The all urban consumer group represents about 87 percent of the total U.S. population. It is based on the expenditures of a ...

The Interdependence of Markets

... achieving this it will have to lower them: lower interest rates will cause capital to flow out of Britain and this will cause the rate of exchange to depreciate. But there is a dilemma here. The government wants high interest rates to contain inflation but low interest rates to help exporters. But o ...

... achieving this it will have to lower them: lower interest rates will cause capital to flow out of Britain and this will cause the rate of exchange to depreciate. But there is a dilemma here. The government wants high interest rates to contain inflation but low interest rates to help exporters. But o ...

Economics Worksheet: Monetary Policy and the Federal Reserve

... The interest rate the federal reserve charges its member banks. ...

... The interest rate the federal reserve charges its member banks. ...

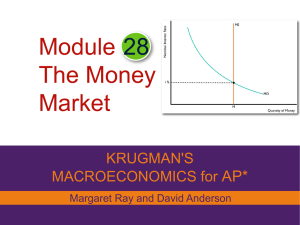

Macro_Module_28 money market

... Module 28 The Money Market KRUGMAN'S MACROECONOMICS for AP* Margaret Ray and David Anderson ...

... Module 28 The Money Market KRUGMAN'S MACROECONOMICS for AP* Margaret Ray and David Anderson ...

Monetary-Policy

... • Disincentive to save – (savings needed to finance investment, education, etc) • Retirees may see incomes fall • Credit boom may fuel rising inflation • Currency may fall ...

... • Disincentive to save – (savings needed to finance investment, education, etc) • Retirees may see incomes fall • Credit boom may fuel rising inflation • Currency may fall ...

module 31 review

... 2. Now assume that the Fed is following a policy of targeting the federal funds rate. What will the Fed do in the situation described in question 1 to keep the federal funds rate unchanged? Illustrate with a diagram. ...

... 2. Now assume that the Fed is following a policy of targeting the federal funds rate. What will the Fed do in the situation described in question 1 to keep the federal funds rate unchanged? Illustrate with a diagram. ...

Ch 2.2 GB economic conditions change

... • USA has not had a depression in 70 years • During the Great Depression between 1930-1940, unemployment was ...

... • USA has not had a depression in 70 years • During the Great Depression between 1930-1940, unemployment was ...

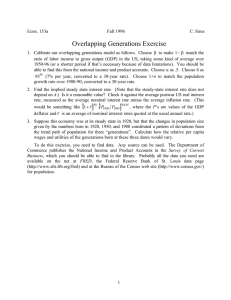

ogex.pdf

... 2. Find the implied steady state interest rate. (Note that the steady-state interest rate does not depend on A.) Is it a reasonable value? Check it against the average postwar US real interest rate, measured as the average nominal interest rate minus the average inflation rate. (This ...

... 2. Find the implied steady state interest rate. (Note that the steady-state interest rate does not depend on A.) Is it a reasonable value? Check it against the average postwar US real interest rate, measured as the average nominal interest rate minus the average inflation rate. (This ...

MULTIPLE CHOICE: Please select the best answer for the following

... According to Keynesian economics, the government could prevent, or reduce the severity of, inflation by a. increasing transfer payments. b. applying an expansionary fiscal policy. c. increasing federal spending. d. applying a contractionary fiscal policy. ...

... According to Keynesian economics, the government could prevent, or reduce the severity of, inflation by a. increasing transfer payments. b. applying an expansionary fiscal policy. c. increasing federal spending. d. applying a contractionary fiscal policy. ...

Nominal and Real Interest Rates

... the lender for foregoing other useful investments that could have been made with the loaned money ...

... the lender for foregoing other useful investments that could have been made with the loaned money ...

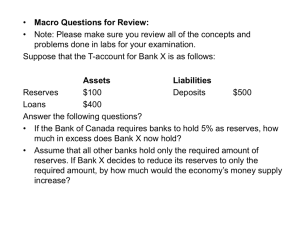

Chapter 16

... 3. A(n) policy increases the money supply. 5. Actions the Fed takes to influence the real GDP and the inflation rate are called policy. 6. Funds over and above Fed requirements make up a bank’s ...

... 3. A(n) policy increases the money supply. 5. Actions the Fed takes to influence the real GDP and the inflation rate are called policy. 6. Funds over and above Fed requirements make up a bank’s ...

Why is this true? In an open economy, net exports being negative

... In an open economy, net exports being negative causes fiscal stimulus to be weaker for the following reason. Recall that net exports being negative means that the country is importing more than it is exporting. In this situation, the government spending multiplier will be smaller because some of the ...

... In an open economy, net exports being negative causes fiscal stimulus to be weaker for the following reason. Recall that net exports being negative means that the country is importing more than it is exporting. In this situation, the government spending multiplier will be smaller because some of the ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.