Macroeconomic Analysis ECON 6022A Fall 2011 Problem Set 4

... 7. When the nominal money supply increases, without changes in prices in the short-run, the new equilibrium interest rate i∗∗ would be lower than i∗ . The return on non-monetary asset has to be lower, so that households would hold more money in their portfolio. The mechanism is that households try t ...

... 7. When the nominal money supply increases, without changes in prices in the short-run, the new equilibrium interest rate i∗∗ would be lower than i∗ . The return on non-monetary asset has to be lower, so that households would hold more money in their portfolio. The mechanism is that households try t ...

Homework 1

... 6.) In 1992 both nominal GDP and real GDP measured in 1992 dollars were $6.244 trillion. By 1997 nominal GDP had risen to $8.111 trillion, and the implicit GDP deflator had risen to 111.57. a. What was real GDP in 1997? b. What was the average rate of real GDP growth between 1992 and 1997? ...

... 6.) In 1992 both nominal GDP and real GDP measured in 1992 dollars were $6.244 trillion. By 1997 nominal GDP had risen to $8.111 trillion, and the implicit GDP deflator had risen to 111.57. a. What was real GDP in 1997? b. What was the average rate of real GDP growth between 1992 and 1997? ...

ch25 - Index of

... The main components of spending that depend on the real interest rate are spending by households on durable goods and investment – When these components of spending are sensitive to the interest rate, then the Fed can influence the economy through small variations in its target federal funds rate ...

... The main components of spending that depend on the real interest rate are spending by households on durable goods and investment – When these components of spending are sensitive to the interest rate, then the Fed can influence the economy through small variations in its target federal funds rate ...

PDF

... three months the NBRM intervened with substantial amount on the currency market with intention to defend the fixed exchange rate regime. When the country makes the decision which sources (taxes or borrowing) to use in financing the expansive fiscal policy, usually the more suitable is public debt. I ...

... three months the NBRM intervened with substantial amount on the currency market with intention to defend the fixed exchange rate regime. When the country makes the decision which sources (taxes or borrowing) to use in financing the expansive fiscal policy, usually the more suitable is public debt. I ...

Unit 7 Government and the Economy

... 12. The 16th amendment to the U.S. Constitution ____ A. gave Congress the power to tax personal and business income. B. gave Freedom to slaves C. authorized gun control D. gave women the right to vote ...

... 12. The 16th amendment to the U.S. Constitution ____ A. gave Congress the power to tax personal and business income. B. gave Freedom to slaves C. authorized gun control D. gave women the right to vote ...

Topic 5: Using Monetary and Fiscal Policy

... Trade off – The Philips Curve Graph the Philips Curve – In class Vertical axis for inflation, horizontal axis for unemployment How to incorporate Natural Rate of Unemployment? How to incorporate Inflationary Expectations? ...

... Trade off – The Philips Curve Graph the Philips Curve – In class Vertical axis for inflation, horizontal axis for unemployment How to incorporate Natural Rate of Unemployment? How to incorporate Inflationary Expectations? ...

Chapter 1

... and assets of the corporation • Issuing stock and selling it to the public is a way for corporations to raise funds to finance their activities • Stock Market is a place where people can get rich—or poor—quickly. ...

... and assets of the corporation • Issuing stock and selling it to the public is a way for corporations to raise funds to finance their activities • Stock Market is a place where people can get rich—or poor—quickly. ...

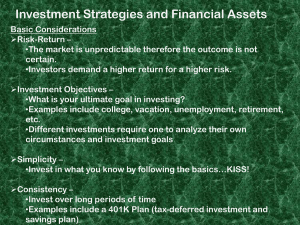

Investment Strategies and Financial Assets

... •Examples include college, vacation, unemployment, retirement, etc. •Different investments require one to analyze their own circumstances and investment goals Simplicity – •Invest in what you know by following the basics…KISS! Consistency – •Invest over long periods of time •Examples include a 401 ...

... •Examples include college, vacation, unemployment, retirement, etc. •Different investments require one to analyze their own circumstances and investment goals Simplicity – •Invest in what you know by following the basics…KISS! Consistency – •Invest over long periods of time •Examples include a 401 ...

Lecture 9 & 10 - National University of Ireland, Galway

... Interest rates in the euro area set by the European Central Bank (ECB) ...

... Interest rates in the euro area set by the European Central Bank (ECB) ...

Review Questions for Midterm #1

... b) Using the GDP deflator, what is the inflation rate for the year? 3) Given the following information about the macro-economy, find the equilibrium level of output Y*. If government spending falls by $50, how does Y* change? Show on a graph of the expenditure function with the equilibrium condition ...

... b) Using the GDP deflator, what is the inflation rate for the year? 3) Given the following information about the macro-economy, find the equilibrium level of output Y*. If government spending falls by $50, how does Y* change? Show on a graph of the expenditure function with the equilibrium condition ...

Economics 215

... b. Assume that rp = 0. Let forex markets believe that the exchange rate loses credibility and the fundamental exchange rate changes to eLR = 1.2.. Solve for equilibrium output, interest rate, consumption, investment and net exports if the central bank maintains a fixed exchange rate et = eFIX = 1. S ...

... b. Assume that rp = 0. Let forex markets believe that the exchange rate loses credibility and the fundamental exchange rate changes to eLR = 1.2.. Solve for equilibrium output, interest rate, consumption, investment and net exports if the central bank maintains a fixed exchange rate et = eFIX = 1. S ...

Fiscal policy is carried out primarily by:

... 13. In which of the following situations is it certain that the quantity of money demanded by the public will decrease? A) nominal GDP decreases and the interest rate decreases B) nominal GDP increases and the interest rate decreases C) nominal GDP decreases and the interest rate increases D) nomina ...

... 13. In which of the following situations is it certain that the quantity of money demanded by the public will decrease? A) nominal GDP decreases and the interest rate decreases B) nominal GDP increases and the interest rate decreases C) nominal GDP decreases and the interest rate increases D) nomina ...

Chile_en.pdf

... (the main driver of growth in previous years), and a sharp fall-off in construction and machinery investment. Both factors are connected to the downgrading of expectations that began in the first quarter of 2013 as a result of rising uncertainty about future growth in the world economy and, in parti ...

... (the main driver of growth in previous years), and a sharp fall-off in construction and machinery investment. Both factors are connected to the downgrading of expectations that began in the first quarter of 2013 as a result of rising uncertainty about future growth in the world economy and, in parti ...

PROBLEM SET 6 14.02 Principles of Macroeconomics April 20, 2005

... April 20, 2005 Due April 27, 2005 I. Answer each as True, False, or Uncertain, providing some explanation for your choice. 1. If consumers and investors are forward-looking, a one-time increase in the level of the nominal money stock only shifts the LM curve. 2. Increases in current and expected fut ...

... April 20, 2005 Due April 27, 2005 I. Answer each as True, False, or Uncertain, providing some explanation for your choice. 1. If consumers and investors are forward-looking, a one-time increase in the level of the nominal money stock only shifts the LM curve. 2. Increases in current and expected fut ...

Document

... B.implies that the NX falls at a given exchange rate. Output does not change, while the exchange rate depreciates. The trade balance does not change, despite that the exchange rate has depreciates. We know this since NX=S-I, and both saving and investment remain unchanged. C.An increase in money sup ...

... B.implies that the NX falls at a given exchange rate. Output does not change, while the exchange rate depreciates. The trade balance does not change, despite that the exchange rate has depreciates. We know this since NX=S-I, and both saving and investment remain unchanged. C.An increase in money sup ...

Colombia_en.pdf

... lowest point in almost 50 years. Up to October, year-onyear inflation stood at 2.7% (2.0% from December 2008 to October 2009) following a reduction in international prices for food and fuels, a slight increase in demand, the appreciation in the peso and a downward trend in costs. The El Niño phenome ...

... lowest point in almost 50 years. Up to October, year-onyear inflation stood at 2.7% (2.0% from December 2008 to October 2009) following a reduction in international prices for food and fuels, a slight increase in demand, the appreciation in the peso and a downward trend in costs. The El Niño phenome ...

AP Economics Final Exam

... Money has 3 basic functions – medium of exchange, unit of account, store of value M1 = Currency in circulation M2 = Savings deposits, including money markets, and money markets Understand that the demand for money has an indirect relationship with interest rates ...

... Money has 3 basic functions – medium of exchange, unit of account, store of value M1 = Currency in circulation M2 = Savings deposits, including money markets, and money markets Understand that the demand for money has an indirect relationship with interest rates ...

Supply and Demand Models of Financial Markets

... • Consider the financial market at its broadest and most abstract. – an amalgamation of the bond market and the lending market (banks, etc.) ...

... • Consider the financial market at its broadest and most abstract. – an amalgamation of the bond market and the lending market (banks, etc.) ...

deflation/disinflation

... We have already seen that interest rates are affected by inflation expectations. What about deflation? Nominal rate = real rate + expected inflation Suppose the rr=2% and expected inflation = 3%, then the nominal rate = 5% (Draw example of Fisher Effect in Loanable Funds market) But what if there ...

... We have already seen that interest rates are affected by inflation expectations. What about deflation? Nominal rate = real rate + expected inflation Suppose the rr=2% and expected inflation = 3%, then the nominal rate = 5% (Draw example of Fisher Effect in Loanable Funds market) But what if there ...

14.02 Principles of Macroeconomics Problem Set 5 Fall 2005

... 3) In the medium run equilibrium, the current account has to be balanced. 4) If the uncovered interest parity does not hold, it surely means that there is an arbitrage opportunity. 5) The higher the degree of openness of an economy, the less of an effect a domestic expansionary fiscal policy has on ...

... 3) In the medium run equilibrium, the current account has to be balanced. 4) If the uncovered interest parity does not hold, it surely means that there is an arbitrage opportunity. 5) The higher the degree of openness of an economy, the less of an effect a domestic expansionary fiscal policy has on ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.