projected numbers of higher rate tax payers

... Projections for the public finances are based on the assumption that tax allowances and thresholds are indexed in line with retail price inflation. But earnings typically rise by more than inflation, which means that over time a higher proportion of people’s earnings fall into the higher tax bracket ...

... Projections for the public finances are based on the assumption that tax allowances and thresholds are indexed in line with retail price inflation. But earnings typically rise by more than inflation, which means that over time a higher proportion of people’s earnings fall into the higher tax bracket ...

2017-04-17 Econ 115 S 2017 PS 2 #TCEH.pages

... interest rate they control—the i, the short-term safe nominal interest rate—from its 2007 value of 5% as far as they could. But in general central bank reductions in the short-term safe nominal interest rate i induce only half as large a reduction in the real interest rate r: financiers and others b ...

... interest rate they control—the i, the short-term safe nominal interest rate—from its 2007 value of 5% as far as they could. But in general central bank reductions in the short-term safe nominal interest rate i induce only half as large a reduction in the real interest rate r: financiers and others b ...

REISA 2009 convention presentation slides

... The collapse of the housing market bubble and credit markets has provided government with the cover it needs to intrude into our lives and businesses with a historically unprecedented trillion + dollars in “stimulus spending.” ...

... The collapse of the housing market bubble and credit markets has provided government with the cover it needs to intrude into our lives and businesses with a historically unprecedented trillion + dollars in “stimulus spending.” ...

14.02 Principles of Macroeconomics Fall 2004 Quiz 1 Thursday, October 7, 2004

... A) The IS curve is a vertical line and monetary policy is very effective in raising output. B) The IS curve is a horizontal line and monetary policy is very effective in raising output. C) The IS curve is a vertical line and monetary policy does not affect output in the IS-LM model. D) The IS curve ...

... A) The IS curve is a vertical line and monetary policy is very effective in raising output. B) The IS curve is a horizontal line and monetary policy is very effective in raising output. C) The IS curve is a vertical line and monetary policy does not affect output in the IS-LM model. D) The IS curve ...

MACRO Study Guide Before AP 2009

... This is a nominal interest rate (really the federal funds rate). Money Demand is based on speculative demand, precautionary demand & price level. So we hold more money when consumers get ‘scared”. You rarely shift MD on AP tests—but sometimes they do require it! ...

... This is a nominal interest rate (really the federal funds rate). Money Demand is based on speculative demand, precautionary demand & price level. So we hold more money when consumers get ‘scared”. You rarely shift MD on AP tests—but sometimes they do require it! ...

Final Exam - Whitman People

... Write your answers in your blue book. Show all of your work. The exam ends at 4:30. ...

... Write your answers in your blue book. Show all of your work. The exam ends at 4:30. ...

Peru_en.pdf

... domestic demand drove a 23.8% surge in imports over this period. In contrast to the other components of aggregate demand, goods and services exports grew more vigorously in 2011 and were up by 8.5% in the first three quarters. The 12-month inflation rate to October 2011 was 4.2% (6.4% for food and b ...

... domestic demand drove a 23.8% surge in imports over this period. In contrast to the other components of aggregate demand, goods and services exports grew more vigorously in 2011 and were up by 8.5% in the first three quarters. The 12-month inflation rate to October 2011 was 4.2% (6.4% for food and b ...

Financial statements

... changes in interest rates. Increases in interest rates cause bond prices to ... fall. Decreases in interest rates cause ... bond prices to rise. In other words, the market value of a bond rises if it pays a ... higher fixed interest rate than the current interest rate. Bondholders face another eleme ...

... changes in interest rates. Increases in interest rates cause bond prices to ... fall. Decreases in interest rates cause ... bond prices to rise. In other words, the market value of a bond rises if it pays a ... higher fixed interest rate than the current interest rate. Bondholders face another eleme ...

Answers to Test Your Understanding Questions

... increase by $100. Although the money supply is not immediately affected by the switch, the bank will find itself over-reserved by 90 (increased actual reserves of 100 minus increased target reserves of 10% x 100 = 10). Loaning out these excess reserves will result in an increase in demand deposits, ...

... increase by $100. Although the money supply is not immediately affected by the switch, the bank will find itself over-reserved by 90 (increased actual reserves of 100 minus increased target reserves of 10% x 100 = 10). Loaning out these excess reserves will result in an increase in demand deposits, ...

The Details In The Dollar

... in the world and is dominated by non-profit motivated buyers and sellers (travelers, corporations hedging risk, central banks), which makes it very inefficient. There are many factors that impact currency exchange rates between two countries, but three of the most important factors are interest rate ...

... in the world and is dominated by non-profit motivated buyers and sellers (travelers, corporations hedging risk, central banks), which makes it very inefficient. There are many factors that impact currency exchange rates between two countries, but three of the most important factors are interest rate ...

Homework 1

... a. What was the annual rate of inflation in 1979? b. What was the real interest rate in 1979? 3.) In 1998 the GDP deflator rose at an annual rate of 2.6%, and the short-term interest rate on three-month Treasury bills averaged 4.8% a. What was the (short-term) nominal interest rate in 1998? b. What ...

... a. What was the annual rate of inflation in 1979? b. What was the real interest rate in 1979? 3.) In 1998 the GDP deflator rose at an annual rate of 2.6%, and the short-term interest rate on three-month Treasury bills averaged 4.8% a. What was the (short-term) nominal interest rate in 1998? b. What ...

Macroeconomic Theory

... One can treat the 27% tariff proposal as if it were the imposition of a quota. In the graph below, NX would initially shift to the right, and, as a result, S – I would rise. The real exchange rate, however, would not remain the same. It would begin to rise as U.S. demand for imports fell. As a resul ...

... One can treat the 27% tariff proposal as if it were the imposition of a quota. In the graph below, NX would initially shift to the right, and, as a result, S – I would rise. The real exchange rate, however, would not remain the same. It would begin to rise as U.S. demand for imports fell. As a resul ...

Presentation

... (a) Macro-Policy : If real appreciation is required either permanently higher inflation or appreciating exchange rates & price stability. ...

... (a) Macro-Policy : If real appreciation is required either permanently higher inflation or appreciating exchange rates & price stability. ...

Final Exam - Brad DeLong

... aspects of the economic environment constant). An increase in foreigners' taste for home-produced goods (holding all other aspects of the economic environment constant). Smaller budget deficits in foreign countries (holding all other aspects of the economic environment constant). An increase in dome ...

... aspects of the economic environment constant). An increase in foreigners' taste for home-produced goods (holding all other aspects of the economic environment constant). Smaller budget deficits in foreign countries (holding all other aspects of the economic environment constant). An increase in dome ...

1 - BrainMass

... Suppose that, initially, the nominal interest rate is 6 percent and the expected inflation rate is 3 percent. If the expected inflation rate increases to 6 percent, what will be the new nominal interest rate? a. b. c. d. ...

... Suppose that, initially, the nominal interest rate is 6 percent and the expected inflation rate is 3 percent. If the expected inflation rate increases to 6 percent, what will be the new nominal interest rate? a. b. c. d. ...

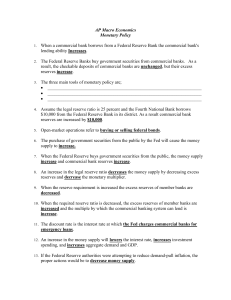

AP Macro Economics Monetary Policy When a commercial bank

... The three main tools of monetary policy are; ____________________________________________________________________ ____________________________________________________________________ ____________________________________________________________________ ...

... The three main tools of monetary policy are; ____________________________________________________________________ ____________________________________________________________________ ____________________________________________________________________ ...

SIMON FRASER UNIVERSITY Department of Economics Econ 345 Prof. Kasa

... 1. A depreciation of the (real) exchange rate increases net exports. 2. Equilibrium in the foreign exchange market predicts that interest rates and exchange rates (defined as the price of foreign currency) are negatively correlated. 3. According to the Balassa-Samuelson theory of real exchange rates, ...

... 1. A depreciation of the (real) exchange rate increases net exports. 2. Equilibrium in the foreign exchange market predicts that interest rates and exchange rates (defined as the price of foreign currency) are negatively correlated. 3. According to the Balassa-Samuelson theory of real exchange rates, ...

PowerPoint

... • Real estate prices fell • Stock-market based financing backfired • Japan in 2001 is back in recession, with only one year of good ...

... • Real estate prices fell • Stock-market based financing backfired • Japan in 2001 is back in recession, with only one year of good ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.