EXAM II

... will accelerate when the rate of growth in wages starts to exceed the growth in productivity of labor. The reverse will also hold, if the labor market is soft, there should be limited pressure on the prices, i.e. the unemployed do not bid up the housing, TV, … prices. The labor market is considered ...

... will accelerate when the rate of growth in wages starts to exceed the growth in productivity of labor. The reverse will also hold, if the labor market is soft, there should be limited pressure on the prices, i.e. the unemployed do not bid up the housing, TV, … prices. The labor market is considered ...

Macroeconomics * Problem Set 1

... It’s possible to relate the fluctuations of the Government Expenditures with other fluctuations of other series because they are all positively directly proportional. Regarding our series, Government Expenditures, we can relate with Investment, known as the crowding out effect, the increase of the G ...

... It’s possible to relate the fluctuations of the Government Expenditures with other fluctuations of other series because they are all positively directly proportional. Regarding our series, Government Expenditures, we can relate with Investment, known as the crowding out effect, the increase of the G ...

World Recession Set to Worsen* Prabhat Patnaik

... Harry Magdoff, had prevailed in the United States in the late 1930s, when the consumption goods sector’s output had recovered owing inter alia to larger government spending under Roosevelt, but the capital goods sector had remained saddled with massive unutilized capacity because of the capitalists’ ...

... Harry Magdoff, had prevailed in the United States in the late 1930s, when the consumption goods sector’s output had recovered owing inter alia to larger government spending under Roosevelt, but the capital goods sector had remained saddled with massive unutilized capacity because of the capitalists’ ...

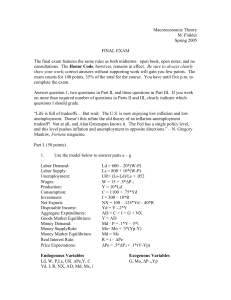

Endogenous Variables Exogenous Variables

... (vertical), or c) gradually upward sloping. For each curve, be sure to address the role played by in the labor market. ...

... (vertical), or c) gradually upward sloping. For each curve, be sure to address the role played by in the labor market. ...

The FRB St Louis New Economic Narrative and Negative Rates

... can happen in either regime. They are low probability events, but it’s more likely to happen in the low-growth rate regime. When recession risk increases, firms and households can reduce their expectations for future growth and incomes. This leads to lower investment and spending. This development b ...

... can happen in either regime. They are low probability events, but it’s more likely to happen in the low-growth rate regime. When recession risk increases, firms and households can reduce their expectations for future growth and incomes. This leads to lower investment and spending. This development b ...

mb-medalla-presentation

... stuck in what Keynes called a .“liquidity trap.”? ….Far from being powerless,the Bank of Japan could achieve a great deal if it were willing to abandon its excessive caution … The argument that current monetary policy in Japan is in fact quite accommodative rests largely on the observation that inte ...

... stuck in what Keynes called a .“liquidity trap.”? ….Far from being powerless,the Bank of Japan could achieve a great deal if it were willing to abandon its excessive caution … The argument that current monetary policy in Japan is in fact quite accommodative rests largely on the observation that inte ...

ECONOMIC ENVIRO NMENT MAY 2011 SOLUTIONS

... Accommodation: central bank lending to commercial banks whereby the latter are short of liquidity ...

... Accommodation: central bank lending to commercial banks whereby the latter are short of liquidity ...

2007 Macro FRQ

... in part (b) on the nominal interest rate. Answer: Buying bonds would increase the MS and lower nominal Interest rates. (e) Assume that the Fed’s action results in some inflation. What would be the impact of the open-market operation on the real rate of interest? Explain. Answer: The real interest ra ...

... in part (b) on the nominal interest rate. Answer: Buying bonds would increase the MS and lower nominal Interest rates. (e) Assume that the Fed’s action results in some inflation. What would be the impact of the open-market operation on the real rate of interest? Explain. Answer: The real interest ra ...

Economics 312/702 Macroeconomics Noah Williams Problem Set 3

... Due in class on March 29. 1. This problem considers the qualitative effects of different types of shocks as potential sources of business cycle fluctuations. For each part use the two period dynamic general equilibrium model (with output supply and demand, labor supply and demand) to analyze the eff ...

... Due in class on March 29. 1. This problem considers the qualitative effects of different types of shocks as potential sources of business cycle fluctuations. For each part use the two period dynamic general equilibrium model (with output supply and demand, labor supply and demand) to analyze the eff ...

FRQ #9 Review Powerpoint

... Instead of the monetary policy change indicated earlier, the government decides to utilize fiscal policy to correct the problem. What is this policy called? What are the government’s options? Draw an AD/AS graph showing how this affects P and GDP. ...

... Instead of the monetary policy change indicated earlier, the government decides to utilize fiscal policy to correct the problem. What is this policy called? What are the government’s options? Draw an AD/AS graph showing how this affects P and GDP. ...

Section 1.02 Power Point

... of the labor force that are not working, but are willing to work, are looking for work, but can’t find a job. • Productivity means …The production output in relation to a unit of input (by a worker.) Gains in Productivity Result in Record Output – What can contribute to employees increasing their pr ...

... of the labor force that are not working, but are willing to work, are looking for work, but can’t find a job. • Productivity means …The production output in relation to a unit of input (by a worker.) Gains in Productivity Result in Record Output – What can contribute to employees increasing their pr ...

FedViews

... The continuing European debt crisis has flared up in the past few months as European policymakers struggle to deal with issues related to Greek debt, the recapitalization of European banks, and funding for the European Financial Stability Facility, the euro zone vehicle for making loans to ...

... The continuing European debt crisis has flared up in the past few months as European policymakers struggle to deal with issues related to Greek debt, the recapitalization of European banks, and funding for the European Financial Stability Facility, the euro zone vehicle for making loans to ...

An Overview of the Great Depression

... • Bank depositors lost confidence bank runs • Banks lost gold, currency and other reserve assets • Loss of reserves caused banks to reduce loans and deposits (causing money stock to fall) ...

... • Bank depositors lost confidence bank runs • Banks lost gold, currency and other reserve assets • Loss of reserves caused banks to reduce loans and deposits (causing money stock to fall) ...

How to calculate purchasing power of income

... c) How Indirect Taxes affects poor and rich people? d) How indirect taxes affect the confidence of people over government? e) In your opinion what should government do to raise the level of tax revenue in Pakistan? Give at least five suggestions. Instructor: Rizwan Ahmad Some examples of Real and No ...

... c) How Indirect Taxes affects poor and rich people? d) How indirect taxes affect the confidence of people over government? e) In your opinion what should government do to raise the level of tax revenue in Pakistan? Give at least five suggestions. Instructor: Rizwan Ahmad Some examples of Real and No ...

Chapter 9 Study Guide Public Policy labor union single

... 4. ____________________ A type of interest group that works for the public good 5. ____________________ The means by which group pressures are brought to bear on all aspects of the policy-making process. 6. ____________________ Of or form the common people, the average voters. ...

... 4. ____________________ A type of interest group that works for the public good 5. ____________________ The means by which group pressures are brought to bear on all aspects of the policy-making process. 6. ____________________ Of or form the common people, the average voters. ...

Jamaica_en.pdf

... The Jamaican economy posted growth rates of 1.6% in the January to March quarter and 1.2% in the April to June quarter. It is anticipated that this growth will continue to build gradually, with the International Monetary Fund (IMF) Extended Fund Facility (EFF) in place and growing confidence in the ...

... The Jamaican economy posted growth rates of 1.6% in the January to March quarter and 1.2% in the April to June quarter. It is anticipated that this growth will continue to build gradually, with the International Monetary Fund (IMF) Extended Fund Facility (EFF) in place and growing confidence in the ...

File - Critical Thinking is Required

... Less than $12.4 million = none. $12.4-$79.5 million = 1/3:1 (3%). Over $79.5 million = 10:1. ...

... Less than $12.4 million = none. $12.4-$79.5 million = 1/3:1 (3%). Over $79.5 million = 10:1. ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.